Explosive Detection Technology Market

Explosive Detection Technology Market Size, Share & Trends Analysis Report by Technology Type (Trace Detector, and Bulk Detector). by Function (Manual, Handheld, and Automated). and by End User (Airport, Critical Infrastructure, Ports and Borders, and Military and Defense). Forecast Period (2024-2031).

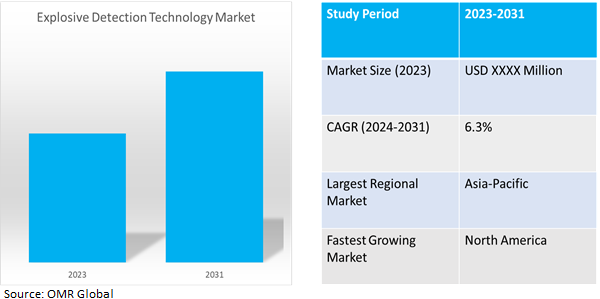

Explosive detection technology market is anticipated to grow at a CAGR of 6.3% during the forecast period (2024-2031). The explosive detection technology market is driven by increasing security concerns, stringent regulations, technological advancements, increasing air passenger traffic, military modernization programs, investments in R&D, emerging new threats, integration of AI and ML, growing demand for non-intrusive screening solutions, and public safety concerns. These factors drive the adoption of explosive detection technologies across sectors such as transportation, aviation, defense, law enforcement, and critical infrastructure protection. Advancements in sensor technologies, such as trace detection systems and X-ray scanners, improve detection accuracy and speed. The growing demand for non-intrusive screening solutions and public safety concerns further drive the adoption of explosive detection technologies.

Market Dynamics

Demand For Aviation Security Solutions

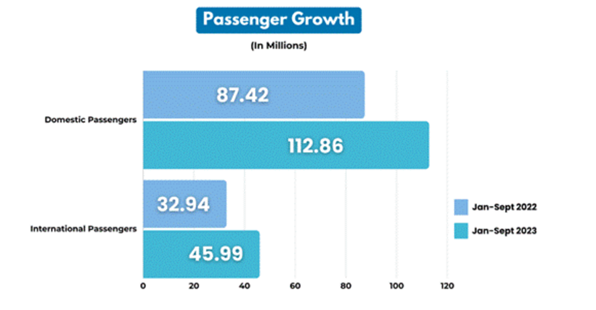

The increasing number of passengers and flights drives explosive detection technology market expansion owing to the increasing demand for aviation security solutions. According to the Government of India, in April 2023, the domestic airlines transported 112.9 million passengers in 2022 compared to 87.4 million in 2022, a 29.1% increase. Airlines carried 45.9 million international passengers between January and September 2023, a noteworthy 39.6% increase over the 32.9 million passengers carried over the same period in 2022.

Source: Government of India

Increased Concerns Regarding Security

The demand for advanced security measures, such as explosive detection systems, to identify and stop terrorist attacks is highlighted by the rise in terrorist fatalities considering an improvement in prevalence. According to the Global Terrorism Index 2024 (GTI), presently continues to be a significant risk of terrorism globally. In 2023, there were 8,352 total terrorist fetalities, which is a 22.0% increase from the previous year. This has been the largest number since 2017. Fetalities have gone up by 5.0% even if the attacks of October 7th were excluded. This is despite a 22.0% decline in terrorist incidents to 3,350, which led to a 56.0% rise in the average number of fatalities per assault. This rate represents the lowest in over a decade.

Market Segmentation

Our in-depth analysis of global explosive detection technology market includes the following segments by technology type, function, and end-user:

- Based on technology type, the market is segmented into trace detector and bulk detector.

- based on function, the market is segmented into manual, handheld, and automated.

- Based on end-users, the market is segmented into airports, critical infrastructure, ports and borders, and military and defense.

Trace Detector is Projected to Emerge as the Largest Segment

The tuberculosis segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the demand for explosive detection technology in transportation hubs has expanded owing to international trade and travel, to ensure the safety of passengers, cargo, and infrastructure. For instance, in April 2021, the Union Education Minister launched India's first microsensor-based explosive trace detector, NanoSniffer, to reduce dependence on imports. The affordable device, developed by NanoSniff Technologies, is marketed by Vehant Technologies.

Military and Defense Segment to Hold a Considerable Market Share

Governments across the globe have increased military spending in light of escalating conflicts and geopolitical tensions. This includes investing in advanced explosive detection technologies to enhance security infrastructure and mitigate potential risks from adversaries. According to the Stockholm International Peace Research Institute, in April 2023, global military expenditure reached a new high of $2240.0 billion in 2022, with Europe experiencing its steepest year-on-year increase in at least 30 years. The invasion of Ukraine and tensions in East Asia drove increased spending, with Europe experiencing the sharpest rise of 13.0%. Military aid to Ukraine and concerns about Russia's heightened threat influenced spending decisions. Central and Western European states' military expenditure reached $345.0 billion in 2022, a 30.0% increase from 2013 and the first time since 1989.

Regional Outlook

Global explosive detection technology market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

International Cross-Border Security In North America Region

The internationalization renders it essential to implement stronger safety measures at seaports, airports, and international borders. These protocols utilize use of innovative explosive detection technologies to guarantee supply chain security and reduce associated risks. For instance, in November 2022, Agilent Technologies installed Insight200M alarm resolution technology at London Heathrow Airport, enhancing security and efficiency. The ECAC 3 Type A & B certified system, along with Smiths Detection's HI-SCAN 6040 CTiX, improves passenger throughput and reduces false alarm rates.

Global Explosive Detection Technology Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Government initiatives to upgrade airport infrastructure and improve aviation security have led to increased investment in explosive detection technology. These efforts, which include public-private partnerships, funding allocations, and regulatory mandates, have facilitated the procurement and implementation of EDT solutions throughout India's aviation industry. According to the Financial Express, in September 2023, India's domestic airlines saw a significant increase in passenger numbers, with a 37.3% increase in passenger numbers annually and a 23.1% increase in monthly passenger numbers. Between January and August 2023, domestic airlines carried 1190.6 lakh passengers, with only 0.6% of flights canceled. This growth indicates the aviation industry's growing importance in India's economy.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving global explosive detection technology market include FLIR Detection, Inc., Honeywell International Inc., L3Harris Technologies, Inc., OSI Systems Inc., and Smiths Group plc, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. for instance, in March 2020, DRDO unveiled RaIDer-X, a new explosive detection device developed by HEMRL Pune and the Indian Institute of Science, aiming to further develop explosive detection devices.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global explosive detection technology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. FLIR Detection, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Honeywell International Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. L3Harris Technologies, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Explosive Detection Technology Market by Technology Type

4.1.1. Trace Detector

4.1.2. Bulk Detector

4.2. Global Explosive Detection Technology Market by Function

4.2.1. Manual

4.2.2. Handheld

4.2.3. Automated

4.3. Global Explosive Detection Technology Market by End-user

4.3.1. Airport

4.3.2. Critical Infrastructure

4.3.3. Ports and Borders

4.3.4. Military and Defense

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Analogic Corp.

6.2. Bruker Corp.

6.3. Chemring Group PLC

6.4. Cobham Ltd.

6.5. DetectaChem

6.6. Elbit Systems Ltd.

6.7. Emerson Electric Co.

6.8. Kromek Group plc

6.9. Leidos, Inc.

6.10. Matheson Tri-Gas, Inc.

6.11. MS Technologies Inc.

6.12. OSI Systems Inc.

6.13. Safran Group

6.14. Security Electronic Equipment Co., Ltd.

6.15. Scanna MSC Inc

6.16. Smiths Group plc

6.17. Thermo Fisher Scientific Inc.

6.18. Westminster Group Plc

1. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY BY TRACE DETECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY BY BULK DETECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY FUNCTION 2023-2031 ($ MILLION)

5. GLOBAL MANUAL EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL HANDHELD EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMATED EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN AIRPORT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN CRITICAL INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN PORTS AND BORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN MILITARY AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

18. EUROPEAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

21. EUROPEAN EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. REST OF THE WORLD EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD EXPLOSIVE DETECTION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY TECHNOLOGY TYPE, 2023 VS 2031 (%)

2. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY BY TRACE DETECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY BY BULK DETECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY FUNCTION, 2023 VS 2031 (%)

5. GLOBAL MANUAL EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL HANDHELD EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMATED EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN AIRPORT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN CRITICAL INFRASTRUCTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN PORTS AND BORDERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY IN MILITARY AND DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL EXPLOSIVE DETECTION TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

16. UK EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA EXPLOSIVE DETECTION TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)