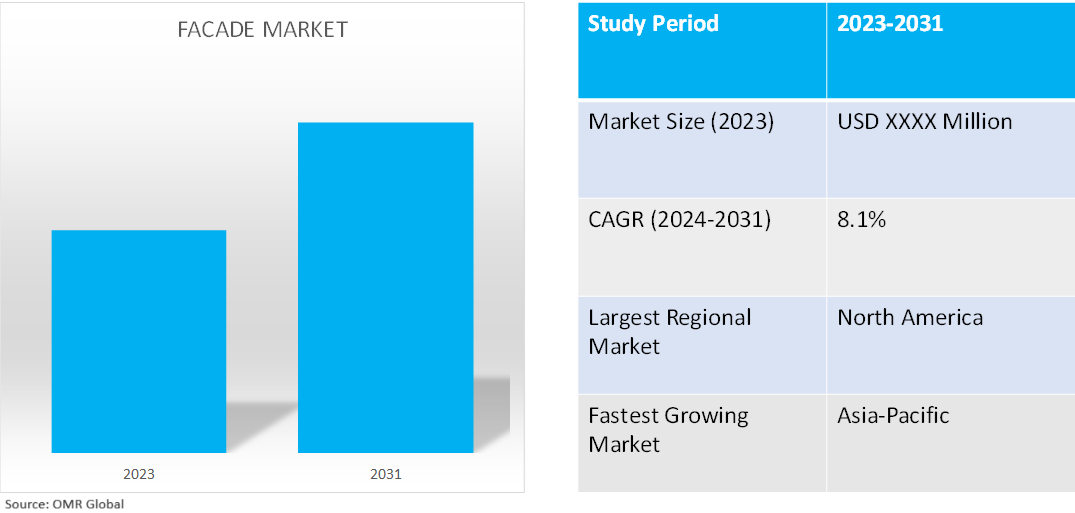

Facade Market

Facade Market Size, Share & Trends Analysis Report by Raw Material (Glass, Wood, Metal, Ceramic, Polyvinyl Chloride (PVC), Stone, Concrete, and Others), and by Facade Type (Ventilated and Non-Ventilated), and by End-User Industry (Commercial, Residential and Industrial) Forecast Period (2024-2031)

Facade market is anticipated to grow at a significant CAGR of 8.1% during the forecast period (2024-2031). The industry growth is attributed to pivotal factors such as rising industrial, commercial, and residential construction activities, increasing concern towards energy efficiency, and external beautification aspects. It helps in the temperature management of the buildings due to which the facade market players are developing weather-specific facades. The facades are primarily used in high-rise buildings and offices, including storefronts and residences. The role of the facade has increased in the construction sector, majorly due to the changing perception of consumers and the increasing deployment of facades in the exterior appearance of a building.

Market Dynamics

Rising Industrial, Commercial, and Residential Construction Activities

The market is witnessing rapid growth due to rising industrial, commercial, and residential construction activities. Protection is not the only role that the facade plays in architecture. These crucial exterior elements serve quite a few functions such as protecting against the elements, ensuring ventilation, increasing acoustic insulation, adding structural support, and more. In recent years facade adoption has increased in industrial, commercial, and residential construction due to these benefits. Construction spending in the US during May 2024 was estimated at an adjusted annual rate of $2,139.8 billion. The May figure is 6.4 % above the May 2023 estimate of $2,011.8 billion. During the first five months of 2024, construction spending amounted to $836.3 billion, 8.8% above the $768.6 billion for the same period in 2023.

High Demand for Energy-Efficient Buildings

Architects and designers are increasingly resorting to modern facade designs that not only improve visual appeal but also significantly boost energy efficiency in their search for more environmentally friendly and sustainable structures. House facades can be transformed into solar power plants. Particularly in winter, solar plants on house facades can deliver more power due to the sun's low position. Investments for a suspended solar facade are certainly higher than those for a suspended glass facade. But the solar facade supplies power and, as a result, it provides a return on investment.

Market Segmentation

- Based on the raw material, the market is segmented into glass, wood, metal, ceramic, polyvinyl chloride (PVC), stone, concrete, and others (Bio-Based and Terracotta).

- Based on the facade type, the market is segmented into ventilated and non-ventilated.

- Based on the end-user industry, the market is segmented into commercial, residential, and industrial.

Ventilated Facade to Hold Prominent Shares in the Global Facade Market

Among the facade types, the ventilated segment is estimated to hold a prominent market share in the global facade market. This is mainly owing to its benefits over non-ventilated facades such as energy-saving and providing rich aesthetics. This has increased the demand for ventilated façades for most buildings, and future construction. The market players are also focusing on the segment prominently by launching new innovative ventilated facade ideas and designs to gain an edge in the ongoing competition. For instance, in June 2021, Paroc published a well-insulated ventilated façade design, which offers guidelines for designing the ventilation of facades of diverse heights and for selecting the right windshield and thermal insulation products.

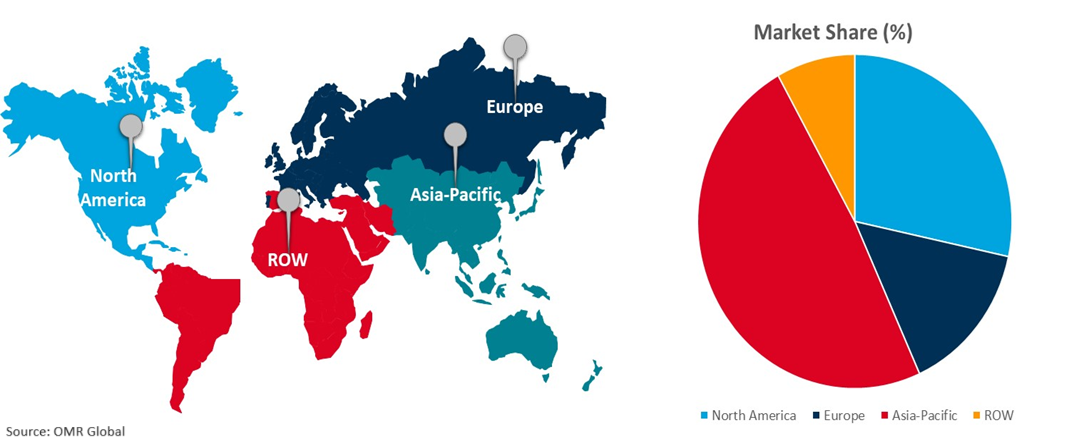

Regional Outlook

Global facade market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Exhibit Significant Market Growth

The increasing construction of new commercial and industrial buildings in countries, including China, India, and Southeast Asia is making a significant contribution to the regional market growth. China is the largest contributor to the regional market growth owing to the advancements in facade installation techniques, availability of labor, cost-effective materials, and rising investments in the construction industry. In addition, rapid urbanization in developing countries such as India, Japan, China, and South Korea is further driving the demand for facade installations in the region. For instance, in August 2022, Architecture studio Aedas unveiled its Dance of Light office skyscraper in Chongqing, China, with a twisted facade informed by the shape of the northern lights. The 180-meter-tall tower, which is situated on Xingfu Plaza in Chongqing's Jiangbei District, has two double-curved facades that give the structure the appearance of being twisted.

Global Facade Market Growth by Region 2024-2031

North America Holds Significant Market Share

Among all the regions, North America holds a significant share owing to the constant growth of the construction sector and increasing demand for solar facades. Urban spread continued in Canada’s urban centers as the population growth of many suburban cities outpaced the growth occurring elsewhere. Activity in the non-residential sector is projected to remain strong across the forecast period, given the high volume of large projects planned and underway in most regions of the country. Construction is a key contributor to Canada’s GDP. In 2022, there were 252 large infrastructure projects in Canada under development, which were valued at over $33.8 million. As of now, Canada has many projects in the works. Projects such as Industrial: Anthony Henday Business Park, Retail: The Mills (Halifax), and TD Terrace will further boost the facade market growth in the region. On the other hand, construction is also the main driver of the US economy. In the US, there were around 919,000 construction establishments during the first quarter of 2023. An estimated $2.1 trillion worth of structures are made annually by the construction industry, which employs 8.0 million people.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global facade market include Empire Facades Pvt. Ltd., Etherington Group Ltd, Saint-Gobain, Kingdom Facades, and Walters and Wolf among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, Enclos acquired PFEIFER Structures America, expanding its offerings to include custom tensile membrane structures, structural glass systems, and kinetic structures. The acquisition of PFEIFER Structures America fits Enclos’ strategy to provide the most comprehensive custom building envelope solutions to owners, architects, engineers, and general contractors.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the facade market. Based on the availability of data, information related to new service deployment, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Walters & Wolf

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Saint Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. AXIS Facades

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Empire Facades Pvt. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Facade Market by Raw Material

4.1.1. Glass

4.1.2. Wood

4.1.3. Metal

4.1.3.1. Aluminum

4.1.3.2. Copper

4.1.3.3. Brass

4.1.3.4. Stainless Steel

4.1.3.5. Bronze

4.1.4. Ceramic

4.1.5. Polyvinyl Chloride (PVC)

4.1.6. Stone

4.1.7. Concrete

4.1.8. Others (Bio-Based and Terracotta)

4.2. Global Facade Market by Facade Type

4.2.1. Ventilated

4.2.1.1. Curtain Walls

4.2.1.2. Others (Porcelain)

4.2.2. Non-Ventilated

4.3. Global Facade Market by End-User Industry

4.3.1. Commercial

4.3.2. Residential

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Al Abbar Group

6.2. Alucobond

6.3. Alumicor Ltd.

6.4. Alumil

6.5. Argo Facades

6.6. Auzmet Architectural Cladding & Signage

6.7. Branoz Pte Ltd.

6.8. Eltherington Group Ltd

6.9. Enclos

6.10. Facade Master

6.11. Foshan Alumideas Co., Ltd.

6.12. Kingdom Facades

6.13. LOPO International Ltd.

6.14. Qingdao REXI Industries Co., Ltd

6.15. Reynaers Group

1. Global Facade Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

2. Global Glass Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Wood Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Metal Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Ceramic Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global PVC Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Stone Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Concrete Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Other Raw Material-Based Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Facade Market Research And Analysis By Facade Type, 2023-2031 ($ Million)

11. Global Ventilated Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Non-Ventilated Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Facade Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

14. Global Commercial Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Residential Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Industrial Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Facade Market Research And Analysis By Region, 2022-2030 ($ Million)

18. North American Facade Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Facade Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

20. North American Facade Market Research And Analysis By Facade Type, 2023-2031 ($ Million)

21. North American Facade Market Research And Analysis By End-User, 2023-2031 ($ Million)

22. European Facade Market Research And Analysis By Country, 2023-2031 ($ Million)

23. European Facade Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

24. European Facade Market Research And Analysis By Facade Type, 2023-2031 ($ Million)

25. European Facade Market Research And Analysis By End-User, 2023-2031 ($ Million)

26. Asia-Pacific Facade Market Research And Analysis By Country, 2023-2031 ($ Million)

27. Asia-Pacific Facade Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

28. Asia-Pacific Facade Market Research And Analysis By Facade Type, 2023-2031 ($ Million)

29. Asia-Pacific Facade Market Research And Analysis By End-User, 2023-2031 ($ Million)

30. Rest Of The World Facade Market Research And Analysis By Region, 2023-2031 ($ Million)

31. Rest Of The World Facade Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

32. Rest Of The World Facade Market Research And Analysis By Facade Type, 2023-2031 ($ Million)

33. Rest Of The World Facade Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Facade Market Share By Raw Material, 2023 Vs 2031 (%)

2. Global Glass Facade Market Share By Region, 2023 Vs 2031 (%)

3. Global Wood Facade Market Share By Region, 2023 Vs 2031 (%)

4. Global Metal Facade Market Share By Region, 2023 Vs 2031 (%)

5. Global Ceramic Facade Market Share By Region, 2023 Vs 2031 (%)

6. Global PVC Facade Market Share By Region, 2023 Vs 2031 (%)

7. Global Stone Facade Market Share By Region, 2023 Vs 2031 (%)

8. Global Concrete Facade Market Share By Region, 2023 Vs 2031 (%)

9. Global Facade Market Share By Facade Type, 2023 Vs 2031 (%)

10. Global Ventilated Facade Market Share By Region, 2023 Vs 2031 (%)

11. Global Non-Ventilated Facade Market Share By Region, 2023 Vs 2031 (%)

12. Global Facade Market Share By End-User, 2023 Vs 2031 (%)

13. Global Commercial Facade Market Share By Region, 2023 Vs 2031 (%)

14. Global Residential Facade Market Share By Region, 2023 Vs 2031 (%)

15. Global Industrial Facade Market Share By Region, 2023 Vs 2031 (%)

16. Global Facade Market Share By Region, 2023 Vs 2031 (%)

17. US Facade Market Size, 2023-2031 ($ Million)

18. Canada Facade Market Size, 2023-2031 ($ Million)

19. UK Facade Market Size, 2023-2031 ($ Million)

20. France Facade Market Size, 2023-2031 ($ Million)

21. Germany Facade Market Size, 2023-2031 ($ Million)

22. Italy Facade Market Size, 2023-2031 ($ Million)

23. Spain Facade Market Size, 2023-2031 ($ Million)

24. Rest Of Europe Facade Market Size, 2023-2031 ($ Million)

25. India Facade Market Size, 2023-2031 ($ Million)

26. China Facade Market Size, 2023-2031 ($ Million)

27. Japan Facade Market Size, 2023-2031 ($ Million)

28. South Korea Facade Market Size, 2023-2031 ($ Million)

29. Rest Of Asia-Pacific Facade Market Size, 2023-2031 ($ Million)

30. Latin America Facade Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Facade Market Size, 2023-2031 ($ Million)