Farnesene Market

Global Farnesene Market Size, Share & Trends Analysis Report by Application (Cosmetics & Personal Care, Flavor and fragrances, Performance materials, and fuel & Lubricants) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global farnesene market is anticipated to grow at a significant CAGR of 6.3% during the forecast period. Farnesene is a chemical compound known as ?-farnesene. In plants, farnesene is found as a natural coating on fruits and also a component of different essential oils. Farnesene is found in green apple skin and is also found in sandalwood, cedarwood, patchouli, hops, ginger, turmeric, potatoes, gardenias, ylang-ylang, grapefruit, and myrrh. The growing awareness of natural and organic cosmetic products and ingredients along with the growing demand for farnesenes during the forecast period is supporting the growth of the farnesene market globally.

Impact of COVID-19 Pandemic on Global Farnesene Market

During the COVID-19 pandemic period, people started focusing more on their health and switched to a healthy diet. The rising consumer awareness toward healthy diets due to the increasing number of diseases also led to the increased demand for natural and organic ingredients in the food & beverage industry. This supports boosting the growth and demand of farnesene in the flavors & fragrances industry during the forecast period. However, owing to the imposition of lockdown across the major cities, ports, and manufacturing units halted the supply chain globally, which has impacted the farnesene market negatively.

Segmental Outlook

The global farnesene market is segmented based on the application. Based on the application, the market is further segmented into cosmetics & personal care, flavor & fragrances, performance materials, and fuels & lubricants. The above-mentioned segments can be customized as per the requirements.

Global Farnesene Market Share by Application, 2021 (%)

The Flavor & Fragrance Segment is Anticipated to Hold a Considerable Share in the Global Farnesene Market

The cosmetics industry also uses farnesene in moisturizing creams, anti-aging creams, and various other cosmetic products. With the increasing awareness regarding personal appearance, lifestyle, and well-being, the demand for cosmetics is increasing rapidly. However, this increases the production and use of farnesene in the cosmetic industry. For instance, in August 2016, Amyris manufactured cellulose-derived farnesene for biofuels in partnership with Renmatix and Total New Energies USA. The process uses wood as the cellulosic feedstock to produce farnesene, which is used to make a range of products such as cosmetics, detergents, lubricants, and diesel.

Regional Outlooks

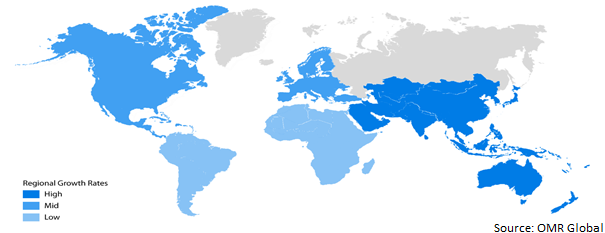

The global farnesene market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

Global Farnesene Market Growth, by Region 2022-2028

The Europe Region is Expected to Hold a Prominent Share in the Global Farnesene Market

The Europe region is expected to hold a prominent share in the global farnesene market due to the rapidly growing usage of chemicals in the personal care industry. A high standard of living in countries in Europe are more likely and inclined to use personal care products which leads to an increase in the demand for the production of the cosmetic & personal care products. Thus, further increasing the use of farnesene as it is also used as a fragrance in cosmetic and personal care products. For instance, in January 2021, Amyris, Inc. partnered with clean beauty platform SuperOrdinary to market Biossance skincare. Amyris is active in the clean health and beauty markets through its consumer brands and as a supplier of sustainable and natural ingredients.

Market Players Outlook

The major companies serving the global Farnesene market include Katyani Exports, Tate and Lyle Plc, Penta Manufacturing Co. LLC, Amyris, Inc., Precigen Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2021, DSM, a global science-based company in Nutrition, Health, and Sustainable Living acquires the flavor and fragrance segment and bio-based intermediates business of Amyris, Inc. Through this acquisition, DSM aims to extend its offerings in aroma ingredients with bio-based ingredients for the flavor and fragrance and cosmetics industries.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global farnesene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Farnesene Market

• Recovery Scenario of Global Farnesene Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Farnesene Market by Application

4.1.1. Cosmetics & Personal Care

4.1.2. Flavor and Fragrances

4.1.3. Performance materials

4.1.4. Fuels & Lubricants

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADL BIOPHARMA S.L.U.

6.2. Amyris, Inc.

6.3. Bedoukian Research, Inc.

6.4. Chromatin, Inc.

6.5. Intrexon Corp.

6.6. Katyani Exports

6.7. Merck KGaA

6.8. National Agency for the Automated Processing of Offenses (ANTAI)

6.9. Parchem fine & specialty chemicals

6.10. Penta Manufacturing Co. LLC

6.11. Precigen Inc.

6.12. Santa Cruz Biotechnology Inc.

6.13. Synerzine Inc.

6.14. Tate and Lyle PLC

6.15. Toronto Research Chemicals Inc.

6.16. Triveni Chemicals

1. GLOBAL FARNESENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

2. GLOBAL FARNESENE IN COSMETICS & PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FARNESENE IN FLAVOR AND FRAGRANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL FARNESENE IN PERFORMANCE MATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FARNESENE IN FUELS & LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

7. NORTH AMERICAN FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

8. NORTH AMERICAN FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

9. EUROPEAN FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. EUROPEAN FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

11. ASIA-PACIFIC FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. ASIA-PACIFIC FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. REST OF THE WORLD FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. REST OF THE WORLD FARNESENE MARKET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FARNESENE MARKET MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FARNESENE MARKET MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL FARNESENE MARKET MARKET, 2021-2028 (%)

4. GLOBAL FARNESENE MARKET MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL FARNESENE IN COSMETICS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL FARNESENE IN FLAVOR AND FRAGRANCES MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL FARNESENE IN PERFORMANCE MATERIALS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL FARNESENE IN LUBRICANTS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL FARNESENE MARKET MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. US FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

12. UK FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD FARNESENE MARKET MARKET SIZE, 2021-2028 ($ MILLION)