Fault Passage Indicators Market

Fault Passage Indicators Market Size, Share & Trends Analysis Report by Product Type (Overhead Line Fault Passage Indicators, Underground Fault Passage Indicators, Panel Fault Passage Indicators, and Others), Voltage Level (Low Voltage (LV) Fault Passage Indicators, Medium Voltage (MV) Fault Passage Indicators and High Voltage (HV) Fault Passage Indicators), and by End-User (Utilities, Industrial, Commercial and Residential) Forecast Period (2024-2031)

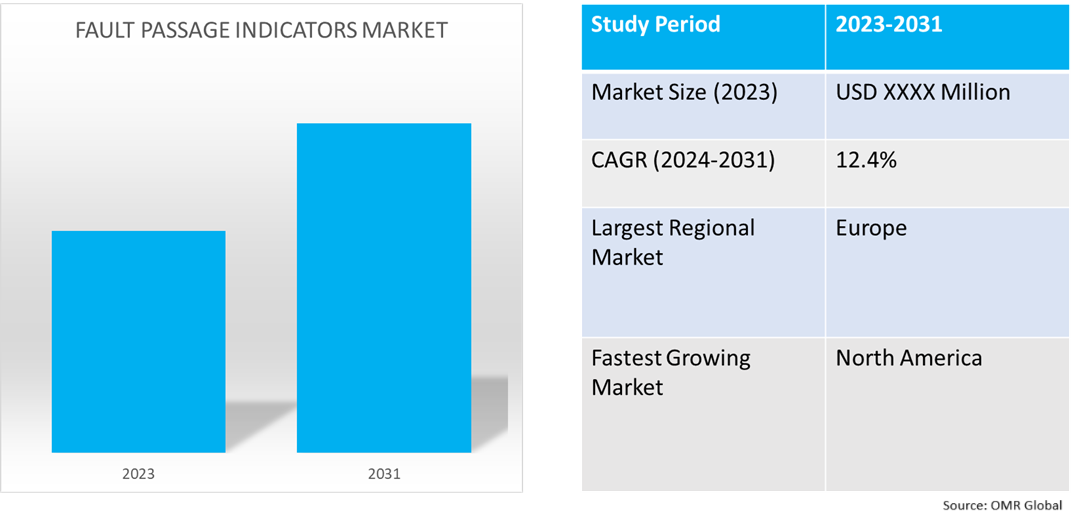

Fault passage indicators (FPIs) market is anticipated to grow at a significant CAGR of 12.4% during the forecast period (2024-2031). The market growth is attributed to pivotal factors such as increasing demand for quick response and restoration of power networks, regulatory push for grid modernization and energy efficiency, growing focus on reducing power outages and system downtime, and rising awareness about reducing maintenance costs for utilities. According to the International Energy Agency, in July 2024, Global electricity demand is forecast to grow by around 4.0% in 2024, up from 2.5% in 2023

Market Dynamics

Increasing Integration with Smart Grid Technologies

The growth of the fault passage indicators (FPI) market is driven by their integration with smart grid technologies. Smart grid technologies enhance the ability of utility companies to detect and isolate faults in real-time, thereby improving the reliability and efficiency of power distribution systems. Smart grids facilitate advanced communication and automation, enabling FPIs to provide critical data that aids in swift decision-making during outages. Additionally, the deployment of smart grid infrastructure supports predictive maintenance strategies, reducing downtime and operational costs. As utilities increasingly adopt digital solutions to enhance grid resilience, the demand for FPIs is expected to rise. The regulatory initiatives promoting energy efficiency and sustainability further bolster market growth. The integration of FPIs with smart grid technologies represents a pivotal advancement in modernizing electrical networks.

Growing Adoption of Enhanced Communication Capabilities

The fault passage indicators (FPI) market is influenced by enhanced communication capabilities. The advanced indicators facilitate real-time monitoring and swift identification of fault locations within electrical distribution networks. By leveraging modern communication technologies, FPIs provide utilities with immediate data transmission, allowing for faster response times and reduced outage durations. The integration of Internet of Things (IoT) solutions further enhances these capabilities, enabling seamless connectivity and data analysis. As utilities increasingly prioritize reliability and operational efficiency, the demand for FPIs is expected to rise.

Market Segmentation

- Based on the product type, the market is segmented into overhead line fault passage indicators, underground fault passage indicators, panel fault passage indicators, and others (specialized or hybrid fault passage indicators).

- Based on the voltage level, the market is segmented into low voltage (LV) fault passage indicators, medium voltage (MV) fault passage indicators, and high voltage (HV) fault passage indicators.

- Based on the end-user, the market is segmented into utilities, industrial, commercial, and residential.

Overhead Line Fault Passage Indicators Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth include the overhead line fault passage indicators enabling quicker fault detection and reducing outage times. The increasing aging grid infrastructure and the growing demand for reliable power distribution, utilities are increasingly adopting these indicators to enhance grid resilience. Technological advancements, including remote monitoring and wireless communication, further bolster market growth. Additionally, regulatory mandates promoting grid modernization contribute to the rising adoption of overhead line FPIs. Fault Passage Indicators (FPIs) enhance the reliability of medium voltage overhead and underground networks by utilizing fault current indicators to quickly identify and isolate faults, minimizing service interruptions and optimizing maintenance efforts. For instance, CAHORS Group offers overhead and underground fault passage indicator (FPI / FCI). The fault passage indicators quickly identify faulty network sections by providing information about permanent faults and a count of all events that have occurred. The company offers directional and Amperometric fault passage indicators or fault current indicators for medium voltage overhead and underground networks.

Utilities to Hold a Considerable Market Share

The factors supporting segment growth include the increasing demand for reliable and efficient power distribution, and utilities are investing in advanced monitoring technologies to enhance system reliability and minimize outage durations. Fault Passage Indicators provide quickly identifying faults within electrical networks, enabling rapid response and maintenance. The integration of smart grid technologies is propelling the adoption of FPIs, as these devices contribute to improved operational efficiency and reduced downtime. Additionally, regulatory mandates aimed at enhancing grid resilience further encourage utilities to implement such innovative solutions. For instance, Tesmec S.p.A. offers an outdoor directional fault passage indicator (RGDAT A-70), and the new integrated digital monitoring and protection device that provides high performance, low cost, and easy installation. It is suitable for all MV systems, from 8kV to 36 kV with any neutral maintenance.

Regional Outlook

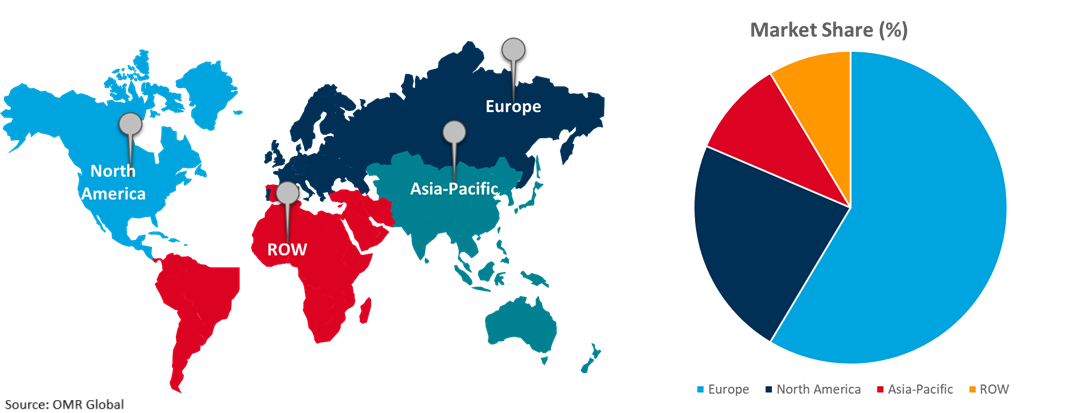

The global fault passage indicators market is further segmented based on region including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Fault Passage Indicators in North America

The regional growth is attributed to aging electrical infrastructure is prompting utilities to invest in advanced monitoring technologies, The increasing demand for smart grid technology integration is driving the FPIs market in the region, Additionally, innovations in FPI technology, such as wireless communication and IoT integration, are further fueling market growth. Government investments aimed at enhancing electric grid resilience and reliability across America are driving the adoption of advanced technologies such as fault passage indicators, improving grid monitoring and fault detection efficiency. For instance, in October 2023, the US Department of Energy announced $3.46 billion for 58 projects across 44 states to strengthen electric grid resilience and reliability across America. The project makes a comprehensive smart grid infrastructure update, through investments in battery storage, local microgrids, and grid reliability, as well as new transmission lines.

Global Fault Passage Indicators Market Growth by Region 2024-2031

Europe Holds Major Market Share

Europe holds a significant share owing to the presence of fault passage indicators offering companies such as ABB Ltd., General Electric Co., Schneider Electric SE, Siemens AG, and others. The market growth is attributed to the increased focus on grid reliability, investment in smart grid technologies, regulatory support, enhanced safety standards, and innovations in sensor technology and data analytics are improving the performance to drive the growth of the market. According to the European Investment Bank (EIB), in September 2024, The European Investment Bank (EIB) is lending Slovenian electricity company Elektro Ljubljana €50 million ($54.3 million) to expand and upgrade the power-distribution network in central and southeastern parts of the country. Market players offer fault passage indicators (FPIs) for the reliability of distribution networks by detecting short circuits, earth faults, and phase discontinuities, enabling quicker identification and isolation of faults. For instance, ABB Ltd. offers the fault indicator type SPEF 3A2 C is used in association with disconnect terminal units (DTUs) for the detection of short circuits, earth faults, and phase discontinuity in distribution networks.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the fault passage indicators market include ABB Ltd., Eaton Corp., General Electric Co. (GE Grid Solutions), Schneider Electric, and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In December 2024, DISTRIBUTECH announced fault passage indicators used in underground distribution grids. The integration of advanced fault passage indicators (FPIs) into underground distribution networks reduces the impact of unplanned fault events on the system average interruption duration index (SAIDI) and related indices.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fault passage indicators market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Advancements in Fault Detection and Monitoring

2.2.1.2. Automation and Digitization in Utilities

2.2.1.3. Investment in Smart Grids and Energy Infrastructure

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Eaton Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. General Electric Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schneider Electric SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fault Passage Indicators Market by Product Type

4.1.1. Overhead Line Fault Passage Indicators

4.1.2. Underground Fault Passage Indicators

4.1.3. Panel Fault Passage Indicators

4.1.4. Others (Specialized or Hybrid Fault Passage Indicators)

4.2. Global Fault Passage Indicators Market by Voltage Level

4.2.1. Low Voltage (LV) Fault Passage Indicators

4.2.2. Medium Voltage (MV) Fault Passage Indicators

4.2.3. High Voltage (HV) Fault Passage Indicators

4.3. Global Fault Passage Indicators Market by End-User

4.3.1. Utilities

4.3.2. Industrial

4.3.3. Commercial

4.3.4. Residential

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ATRIY ELECTRONIC APPLIANCES TRADING LLC.

6.2. C&S Electric Ltd.

6.3. CAHORS Group

6.4. EFACEC Power Solutions

6.5. Elektro-Mechanik EM GmbH

6.6. ELVAC a.s.

6.7. Ensto Oy

6.8. Float Power Systems & Controls

6.9. Horstmann GmbH

6.10. HV Power Measurements and Protection Ltd.

6.11. Kries-Energietechnik GmbH & Co. KG

6.12. NARI Group Corp.

6.13. ROMIND

6.14. Schweitzer Engineering Laboratories, Inc.

6.15. Southern States, LLC

6.16. Streamer Inc.

6.17. Tesmec S.p.A.

6.18. Texas Instruments Inc.

6.19. TransNet NZ Ltd.

6.20. Xiamen Andaxing Electric Group Co., Ltd.

6.21. ZIV Aplicaciones y Tecnología, S.L.U

1. Global Fault Passage Indicators Market Research And Analysis By Product Type, 2023-2031 ($ Million)

2. Global Overhead Line Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Underground Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Panel Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Other Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023-2031 ($ Million)

7. Global Low Voltage (LV) Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Medium Voltage (MV) Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global High Voltage (HV) Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Fault Passage Indicators Market Research And Analysis By End-User, 2023-2031 ($ Million)

11. Global Fault Passage Indicators For Utilities Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Fault Passage Indicators For Industrial Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Fault Passage Indicators For Commercial Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Fault Passage Indicators For Residential Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

16. North American Fault Passage Indicators Market Research And Analysis By Country, 2023-2031 ($ Million)

17. North American Fault Passage Indicators Market Research And Analysis By Product Type, 2023-2031 ($ Million)

18. North American Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023-2031 ($ Million)

19. North American Fault Passage Indicators Market Research And Analysis By End-User, 2023-2031 ($ Million)

20. European Fault Passage Indicators Market Research And Analysis By Country, 2023-2031 ($ Million)

21. European Fault Passage Indicators Market Research And Analysis By Product Type, 2023-2031 ($ Million)

22. European Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023-2031 ($ Million)

23. European Fault Passage Indicators Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. Asia-Pacific Fault Passage Indicators Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific Fault Passage Indicators Market Research And Analysis By Product Type, 2023-2031 ($ Million)

26. Asia-Pacific Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023-2031 ($ Million)

27. Asia-Pacific Fault Passage Indicators Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Rest Of The World Fault Passage Indicators Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World Fault Passage Indicators Market Research And Analysis By Product Type, 2023-2031 ($ Million)

30. Rest Of The World Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023-2031 ($ Million)

31. Rest Of The World Fault Passage Indicators Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Fault Passage Indicators Market Research And Analysis By Product Type, 2023 Vs 2031 (%)

2. Global Overhead Line Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

3. Global Underground Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

4. Global Panel Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

5. Global Other Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

6. Global Fault Passage Indicators Market Research And Analysis By Voltage Level, 2023 Vs 2031 (%)

7. Global Low Voltage (LV) Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

8. Global Medium Voltage (MV) Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

9. Global High Voltage (HV) Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

10. Global Fault Passage Indicators Market Research And Analysis By End-User, 2023 Vs 2031 (%)

11. Global Fault Passage Indicators For Utilities Market Share By Region, 2023 Vs 2031 (%)

12. Global Fault Passage Indicators For Industrial Market Share By Region, 2023 Vs 2031 (%)

13. Global Fault Passage Indicators For Commercial Market Share By Region, 2023 Vs 2031 (%)

14. Global Fault Passage Indicators For Residential Market Share By Region, 2023 Vs 2031 (%)

15. Global Fault Passage Indicators Market Share By Region, 2023 Vs 2031 (%)

16. US Fault Passage Indicators Market Size, 2023-2031 ($ Million)

17. Canada Fault Passage Indicators Market Size, 2023-2031 ($ Million)

18. UK Fault Passage Indicators Market Size, 2023-2031 ($ Million)

19. France Fault Passage Indicators Market Size, 2023-2031 ($ Million)

20. Germany Fault Passage Indicators Market Size, 2023-2031 ($ Million)

21. Italy Fault Passage Indicators Market Size, 2023-2031 ($ Million)

22. Spain Fault Passage Indicators Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Fault Passage Indicators Market Size, 2023-2031 ($ Million)

24. India Fault Passage Indicators Market Size, 2023-2031 ($ Million)

25. China Fault Passage Indicators Market Size, 2023-2031 ($ Million)

26. Japan Fault Passage Indicators Market Size, 2023-2031 ($ Million)

27. South Korea Fault Passage Indicators Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Fault Passage Indicators Market Size, 2023-2031 ($ Million)

29. Latin America Fault Passage Indicators Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Fault Passage Indicators Market Size, 2023-2031 ($ Million)