Feed Carotenoids Market

Global Feed Carotenoids Market Size, Share & Trends Analysis Report by Type (Beta-Carotene, Lycopene, Lutein, Astaxanthin, and Canthaxanthin), By Animal Type (Ruminant, Poultry, Swine, Aquaculture, and Other Animal Types) Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global market for feed carotenoids is projected to have a considerable CAGR of around 3.6% during the forecast period. Feed carotenoids are in the form of pigments that are naturally sourced from photosynthetic bacteria, algae, and plants. Carotenoids are responsible for the colour of animal skin and are essential for maintaining the health of animals. The growing prevalence of animal diseases has led to a surge in demand for carotenoids in the livestock industry. To provide healthy animal food products with biologically active food ingredients, producers have seen a considerable increase in demand for carotenoids around the world. Carotenoid production through chemical synthesis or extraction from plants is limited by low yields that result in high production costs will restrain the future growth of the feed carotenoids industry. Further, the restrictions on non-essential goods exports and imports imposed by temporary border closure conditions in some nations will also be limiting the growth of the market.

Impact of COVID-19 on Feed Carotenoids market

The COVID-19 pandemic has had a significant impact on the market. The intended industry faced challenges in managing the interrupted demand and supply of components. Unpredictable and disruptive supply chain activities, as well as a lack of human resources, hampered the growth of the global market for feed carotenoids.

Segmental Outlook

The global feed carotenoids market is segmented based on type, and animal type. Based on the type, the market is further classified into beta-carotene, lycopene, lutein, astaxanthin, and canthaxanthin. Based on animal type, the market is segregated into ruminant, poultry, swine, aquaculture, and other animal types.

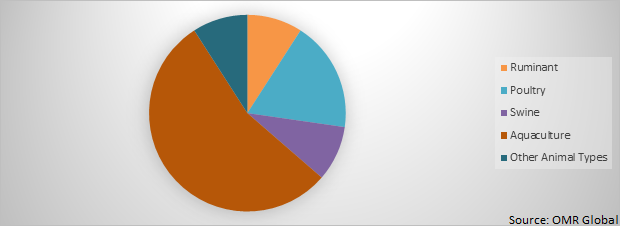

Global Feed Carotenoids Market Share by animal type, 2021(%)

The aquaculture segment is considered the dominating segment in the global feed carotenoids market.

Among animal types, the aquaculture segment is estimated as dominating segment during the forecast period. Carotenoids' various biological properties have led to an increase in their use as aquaculture feed additives. Carotenoids are widely used in shellfish, trout, salmon, red porgy feed, shrimp, and lobster. Carotenoids are critical during the larval stage of aquaculture species, and fish larvae increase their survival rate when reared on live feeds containing carotenoids. According to estimates, cultured aquaculture will account for over 20% of world fish and other aquaculture consumption by the end of 2021, as compared to the wild collection. This creates a massive opportunity for the aquaculture feed carotenoids market to grow. The growing awareness of aquaculture farmers about the importance of optimum nutrition in their farms is also projected to expand the aquaculture segment of the feed carotenoids market.

Regional Outlook

Geographically, the global Feed Carotenoids market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant CAGR in the feed carotenoids market. The United States is the largest producer of animal feed in the region owing to the growing trend of mass production of livestock. The rise in the animal population in the country has resulted in an increase in the production of animal feed for different species. According to Alltech, the country's feed output reached 214 million metric tonnes in 2019, with poultry feed accounting for 62.6 million metric tonnes, followed by beef and pig feed accounting for 61.09 million metric tonnes and 44.86 million metric tonnes, respectively.

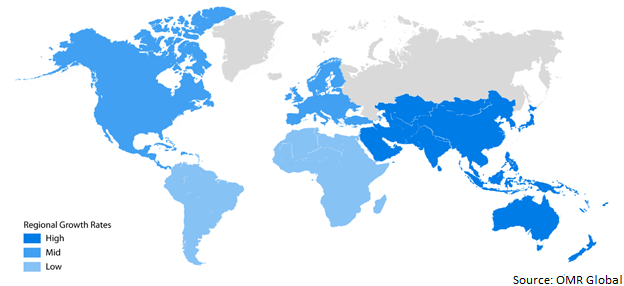

Global Feed Carotenoids Market Growth, by region 2022-2028

Asia-Pacific to hold a considerable CAGR in the global Feed Carotenoids market

Geographically, Asia-Pacific is projected to hold significant share in the global feed carotenoids market. The factors that are contributing to the growth of the market include increasing awareness among the animal rearers in the region about the importance of natural additives in the feed. Asia-Pacific is the largest market for aquaculture across the world, dominated by China. India and Vietnam markets are expected to expand the most in the future as a result of the growing adoption of new scientific farming technologies and increased meat and fish consumption.

Market Players Outlook

The key players in the Feed Carotenoids market contribute significantly by providing different types of products and increasing their geographical presence across the globe. BASF SE, Kemin Industries, DSM Animal Nutrition, Novus International Inc, Biochem Products B.V among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In August 2018, BASF Animal Nutrition launches its Lucantin NXT product line in the EU 28 market. The next generation of carotenoids is stabilized by propyl gallate (PG) and butylhydroxytoluene (BHT) or tocopherol. As per the extensive trials Lucantin NXT products deliver high homogeneity remarkable stability and long shelf life along with maintaining egg yolk and broiler skin coloring efficacy. Therefore, with proprietary Lucantin NXT products, BASF offers their customers novel formulations that comply with regulatory requirements while setting high-quality standards to address the growing global demand.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Feed Carotenoids market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Feed Carotenoids Industry

• Recovery Scenario of Global Feed Carotenoids Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Trade Analysis

2.4. Porters Analysis

2.5. Volume Analysis

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Feed Carotenoids Market by Type

5.1.1. Beta-Carotene

5.1.2. Lycopene

5.1.3. Lutein

5.1.4. Astaxanthin

5.1.5. Canthaxanthin

5.2. Global Feed Carotenoids Market by Animal Type

5.2.1. Ruminant

5.2.2. Poultry

5.2.3. Swine

5.2.4. Aquaculture

5.2.5. Other Animal Types

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allied Biotech Corporation

7.2. Avivagen

7.3. BASF SE

7.4. Biochem Products B.V

7.5. Biochem Products B.V.

7.6. Chr. Hansen Holding A/S

7.7. Cyanotech Corp

7.8. Divi's Laboratories Ltd

7.9. Fuji Chemical Industry Co Ltd.

7.10. Impextraco

7.11. Innovad SA

7.12. Kemin Industries

7.13. Koninklijke DSM N.V.

7.14. Lycored Ltd

7.15. Novus International Inc

7.16. Novus International Inc.

7.17. Nutrex NV

7.18. Synthite Industries Ltd.

7.19. Thoroughbred Remedies Manufacturing

7.20. Vitafor Belgium

1. GLOBAL FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL BETA-CAROTENE FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LYCOPENE FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LUTEIN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL ASTAXANTHIN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CANTHAXANTHIN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

8. GLOBAL FEED CAROTENOIDS IN RUMINANT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FEED CAROTENOIDS IN POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FEED CAROTENOIDS IN SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL FEED CAROTENOIDS IN AQUACULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL FEED CAROTENOIDS IN OTHER ANIMAL TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD FEED CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FEED CAROTENOIDS MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FEED CAROTENOIDS MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL FEED CAROTENOIDS MARKET, 2021-2028 (%)

4. GLOBAL FEED CAROTENOIDS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL FEED CAROTENOIDS MARKET SHARE BY ANIMAL TYPE, 2021 VS 2028 (%)

6. GLOBAL FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL BETA-CAROTENE FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL LYCOPENE FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL LUTEIN FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL ASTAXANTHIN FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL CANTHAXANTHIN FEED CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL FEED CAROTENOIDS FOR RUMINANT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL FEED CAROTENOIDS FOR POULTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL FEED CAROTENOIDS FOR SWINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL FEED CAROTENOIDS FOR AQUACULTURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL FEED CAROTENOIDS FOR OTHER ANIMAL TYPES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

19. UK FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

24. ROE FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

28. ASEAN FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD FEED CAROTENOIDS MARKET SIZE, 2021-2028 ($ MILLION)