Feed management software Market

Feed management software Market Size, Share & Trends Analysis Report by Type (1 Feed Formulation Software, Animal Simulation Model, and Others), by Mode of Delivery (On Premise, and Cloud-Based), by Animal Type (Ruminants, Swine, Poultry, and Others), and by Application (Feed Formulation, Feed Management, Ration Balancing, Quality Control, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Feed management software market is anticipated to grow at a significant CAGR of 6.9% during the forecast period. Keeping track of feed inventory on-farm is a manual task that usually involves a different set of management challenges. Feed inventory allows farmers to accurately monitor and balance quantities of feed given to the animals against quantities of feed held on-farm. it enables automatic alerts to notify when stock levels reach a certain point, and in some cases, automatic re-ordering can be set up. One of the key benefits of using feed management technology is the ability to continually track and maximize Maximize income over feed cost figures. It includes the precise loading of individual ingredients and the subsequent Total mixed ration TMR mixing, tracking of feed intakes, management of feed costs, and others. The growing adoption of feed management software to maximize income over feed cost, progress reporting, and data-sharing, and flexibility and adaptability as per changing scenarios are primary factors driving the global feed management software. Also growing investment and expansion of key players in the feed management segment are anticipated to drive the global feed management software for the forecast period. For instance, in August 2022, International Flavors & Fragrances Inc. (IFF) invested $15.8 million inthree of its innovation centers in Brazil, Colombia, and Chile. The newfacilities will support product design and development, serving several industriesincluding animal nutrition and health. In February 2021, AgriWebb, announced its expansion in the US to help ranchers across the country leverage their data more effectively to increase on-ranch productivity, sustainability, and efficiency. The company helps the industry by replacing handwritten notebooks. Ranchers can input records into their mobile devices both online and offline, providing access to real-time insights. With all this data at their fingertips, AgriWebb allows ranchers to make better decisions around stocking rates, feed costs, gross margins, and more.

Segmental Outlook

The global feed management software market is segmented based on the type, mode of delivery, animal type, and application. Based on the type, the market is segmented into feed formulation software, animal simulation model, and others. Based on the mode of delivery, the market is sub-segmented into the on premise, and cloud-based. Based on the animal type, the market is sub-segmented into the ruminants, swine, poultry, and others. Based on the application, the market is sub-segmented into the feed formulation, feed management, ration balancing, quality control, and others. Among mode of delivery the cloud-based segment is anticipated for the dominant share in the market.

The Feed Management Segment is Expected to hold the Significant Share in the Global Feed management software Market during the Forecast Period.

Among applications, feed management is anticipated to register significant growth in The global feed management software. Feed management helps to maximize income over feed cost, progress reporting, data-sharing, and flexibility and adaptability. Moreover, access to the technology is provided to the farm’s third-party consultants, communication is improved, and adjustments to animal diets can be made in a more proactive and timely manner, without the need for consultants to be on-farm. All these benefits of feed management are factors driving the feed management segment for the forecast period.

Regional Outlooks

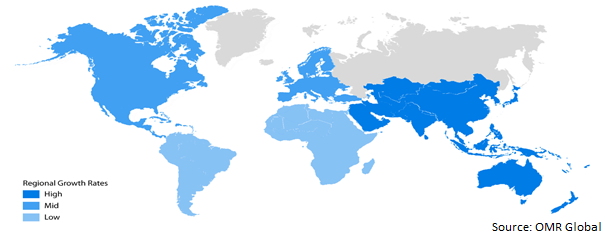

The global feed management software market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). Among regions, Asia pacific region accounted for the dominant growth in the market for the forecast period.

Global Feed Management Software Market Growth, by Region 2022-2028

The North Region Regionis Holds the dominant Share in the Global Feed management software Market

Among regions, the North American region accounted for the dominant share in the market, The presence of key players, well-developed digital infrastructure, and growing expansion of key players in the region are primary factors for the growth of the market in the North America region. For instance, in February 2022, Evonik plans to invest $176.5 million in a new methyl mercaptan plant at the US site in Theodore. The chemical is used to make MetAmino (DL-methionine), which is used in livestock feed. The investment is projected to reduce the carbon footprint of production by about 7%, with more than 25,000 t/y of CO2 equivalents being saved annually.

Market Players Outlook

The major companies serving the global feed management software market include Format Solutions, Inc., Adifo NV, Kemin Industries, Inc., Prairie Systems, Evonik Industries AG, Cultura Technologies LLC., Agentis Innovations Ltd. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in Decemer 2020, BASF and Adifo Software partner to launch a new digital solution for the animal agriculture value chain by integrating sustainability analytics powered by BASF’s AgBalance® Livestock project into Adifo’s BESTMIX® feed formulation software. The partnership will help the animal agriculture value chain to strategically manage and optimize feed formulation based on nutrition and cost while taking environmental sustainability aspects into account.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global feed management software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Key Strategy Analysis

4. Market Segmentation

4.1. Global Feed management software Market by Type

4.1.1. Feed Formulation Software

4.1.2. Animal Simulation Model

4.1.3. Others

4.2. Global Feed management software Market by Mode of Delivery

4.2.1. On Premise

4.2.2. Cloud Based

4.3. Global Feed management software Market by Animal Type

4.3.1. Ruminants

4.3.2. Swine

4.3.3. Poultry

4.3.4. Others

4.4. Global Feed management software Market by Application

4.4.1. Feed Formulation

4.4.2. Feed Management

4.4.3. Ration Balancing

4.4.4. Quality Control

4.4.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adifo NV

6.2. Adisseo France SAS

6.3. Agentis Innovations Ltd.

6.4. Alltech Inc.

6.5. Cultura Technologies LLC.

6.6. DHI – Provo

6.7. DHI Computing Service, Inc.

6.8. Evonik Industries AG

6.9. Format Solutions, Inc.

6.10. GLOBALVETLINK, L.C.

6.11. International Flavors & Fragrances Inc.(Danisco Animal Nutrition)

6.12. Kemin Industries, Inc.

6.13. Prairie Systems

1. GLOBAL FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL FEED FORMULATION SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ANIMAL SIMULATION MODEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHERS TYPE FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2021-2028 ($ MILLION)

6. GLOBAL ON PREMISE FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CLOUD-BASED FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

9. GLOBAL FEED MANAGEMENT SOFTWARE FOR RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FEED MANAGEMENT SOFTWARE FOR SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL FEED MANAGEMENT SOFTWARE FOR POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL FEED MANAGEMENT SOFTWARE FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

14. GLOBAL FEED MANAGEMENT SOFTWARE FOR FEED FORMULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL FEED MANAGEMENT SOFTWARE FOR FEED MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL FEED MANAGEMENT SOFTWARE FOR RATION BALANCING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL FEED MANAGEMENT SOFTWARE FOR QUALITY CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL FEED MANAGEMENT SOFTWARE FOR OTHERSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. NORTH AMERICAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. NORTH AMERICAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2021-2028 ($ MILLION)

23. NORTH AMERICAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

24. NORTH AMERICAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. EUROPEAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

27. EUROPEAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2021-2028 ($ MILLION)

28. EUROPEAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

29. EUROPEAN FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2021-2028 ($ MILLION)

33. ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

34. ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

35. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

36. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

37. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2021-2028 ($ MILLION)

38. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

39. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL FEED MANAGEMENT SOFTWARE MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL FEED FORMULATION SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ANIMAL SIMULATION MODEL MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL OTHERS TYPE FEED MANAGEMENT SOFTWARE FOR BY MARKET SHARE REGION, 2021 VS 2028 (%)

5. GLOBAL FEED MANAGEMENT SOFTWARE MARKET SHARE BY MODE OF DELIVERY, 2021 VS 2028 (%)

6. GLOBAL ON PREMISE FEED MANAGEMENT SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL CLOUD-BASED FEED MANAGEMENT SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL FEED MANAGEMENT SOFTWARE MARKET SHARE BY ANIMAL TYPE, 2021 VS 2028 (%)

9. GLOBAL FEED MANAGEMENT SOFTWARE FOR RUMINANTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL FEED MANAGEMENT SOFTWARE FOR SWINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL FEED MANAGEMENT SOFTWARE FOR POULTRY MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL FEED MANAGEMENT SOFTWARE FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL FEED MANAGEMENT SOFTWARE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

14. GLOBAL FEED MANAGEMENT SOFTWARE FOR FEED FORMULATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL FEED MANAGEMENT SOFTWARE FOR FEED MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL FEED MANAGEMENT SOFTWARE FOR RATION BALANCING MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL FEED MANAGEMENT SOFTWARE FOR QUALITY CONTROL MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. GLOBAL FEED MANAGEMENT SOFTWARE FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL FEED MANAGEMENT SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. US FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

21. CANADA FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

22. UK FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

23. FRANCE FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

24. GERMANY FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

25. ITALY FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

26. SPAIN FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF EUROPE FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

28. INDIA FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

29. CHINA FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

30. JAPAN FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

31. SOUTH KOREA FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

32. REST OF ASIA-PACIFIC FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD FEED MANAGEMENT SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)