Feed Phytogenics Market

Feed Phytogenics Market Size, Share & Trends Analysis Report by Type (Spices and Herbs, Essential Oils, and Oleoresins) by Livestock (Swine, Poultry, Ruminants, and Others) Forecast 2022-2028 Update Available - Forecast 2025-2035

Feed phytogenics market is anticipated to grow at a significant CAGR of 7.1% during the forecast period. With the increasing antibiotic-free nature of phytogenics and other health-related benefits of phytogenics in animals, the feed phytogenics industry is expected to gain traction during the forecast period. Phytogenics are non-antibiotic feed addictive ingredients produced from plants that are added to cattle feed. An increasing concern associated with the side effects of prolonged chemical feed additives, feed phytogenic is considered an alternative source of nutrition, along with the increasing growth of the livestock industry is expected to fuel the growth of the global feed phytogenic market. According to Economic Research Service.org, agriculture, food, and related industries contributed $1.055 trillion to the US gross domestic product (GDP) in 2020, a 5.0% share. The output of America’s farms contributed $134.7 billion to this sum.

Moreover, the feed phytogenic has the potential antimicrobial properties other than providing anti-oxidative effects, and consumption of phytogenic in feed results in a decline in the frequency of thin bowels in animals, and an upgrade in feed proficiency. Thus, the rising key developments and new product launches by the major market players such as Cargill, ADM, and DuPont Inc. will further aid in the market growth. For instance, in June 2022, Cargill signed a binding agreement to acquire Delacon, to leverage its global network and expertise in animal nutrition technologies in phytogenic feed additives.

Segmental Outlook

The global feed phytogenics market is segmented based on type and livestock. Based on type, the market is bifurcated into spices and herbs, essential oils, and oleoresins. Based on livestock the market is bifurcated into swine, poultry, ruminants, and others.

Among the type, the oleoresins segment is expected to hold a prominent share in the market during the forecast period. Oleoresins are solvent-free extracts that contain non-volatile components and provide different flavors. They are extensively used in animal nutrition feed as digestive and appetite stimulants for the treatment of some pathological conditions. Mounting demand for oleoresins among the feed additives for improving the health of livestock animals is foreseen to boost segment demand in the coming year. Moreover, the market players such as Tilley, Phoenix Group, and Mul Group are continuously adopting various strategic moves such as collaboration and partnership among others to stay competitive in the market across the globe. For instance, in December 2021, Baltimore merged its operations with Phoenix Aromas to provide high-quality ingredients to customers. With a comprehensive portfolio of flavor and fragrance ingredients including essential oils, natural aroma chemicals, and oleoresins, Phoenix meets the demand of the customers by serving such ingredients.

Regional Outlooks

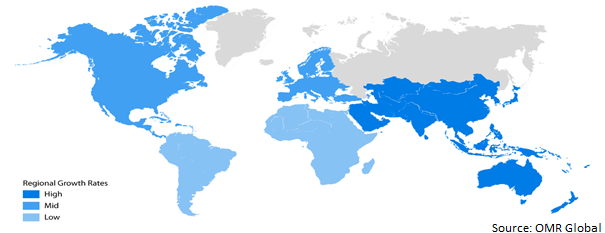

The global feed phytogenics market is further segmented based on geography including North America (The US, and Canada), Europe (Italy, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The European region is expected to witness considerable growth during the forecast period. The ban on the consumption of antibiotics and stringent regulations imposed on synthetic feed additives such as fertilizers, and pesticides, boost the growth of the market in the European region. For instance, the European Commission (EC) has unveiled its Farm to Fork and Biodiversity Strategies that imposed restrictions on European Union (EU) agriculture through targeted reductions in the use of land, fertilizers, antimicrobials, and pesticides in 2020.

Global Feed Phytogenics Market Growth, by Region 2021-2028

Asia-Pacific Region is Expected to Witness a Higher Growth during the Forecast Period

The Asia-Pacific region is expected to attain favorable market growth in the global feed phytogenic market. The growth is mainly attributed owing to increasing investment in livestock activity, and rising health concerns of the people, which lead to higher consumption of feed additives ingredients in the different kinds of food. For instance, according to the Department of Animal Husbandry & Dairying report 2022, the government of India has allocated 19.00 million to Animal Husbandry Infrastructure Development Fund (AHIDF) under the Atma Nirbhar Bharat Abhiyan stimulus package. The Animal Husbandry Infrastructure Development (AHIDF) has been approved for incentivizing investments by individual entrepreneurs, private companies, MSME, Farmers Producers Organizations (FPOs), and section 8 companies to establish, the dairy processing and value addition infrastructure, meat processing and value addition infrastructure and, animal feed plant.

Market Players Outlook

The major companies serving the global feed phytogenics market are Archer Daniels Midland Co., Cargill Inc., Himalaya Food International Ltd., International Flavors & Fragrances Inc., Royal DSM, Dostofarm Gmbh, DSM Austria GmbH, Igusol S.A., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2022, Delacon developed Biostrong Fertile which offers a revolutionary natural solution to support the reproduction of breeding males, which increases the percentage of fertilized eggs. The formulation is based on extensive and deep knowledge of the universe of phytogenic active substances and their respective effects on the metabolism of farm animals. Big strong Fertile is a tailored solution, addressing a primary customer need to optimize breeding flocks' fertility.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global feed phytogenics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analsysis

3.1.1. Archer Daniels Midland Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.2. Cargill Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.3. Himalaya Food International Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. International Flavors & Fragrances Inc.

3.4.1.1. Overview

3.4.1.2. Financial Analysis

3.4.1.3. SWOT Analysis

3.4.1.4. Recent Developments

3.5. Royal DSM

3.5.1.1. Overview

3.5.1.2. Financial Analysis

3.5.1.3. SWOT Analysis

3.5.1.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Feed PhytogenicsMarket by Type

4.1.1. Spices and herbs

4.1.2. Essential oils

4.1.3. Oleoresins

4.2. Global Feed Phytogenics Market by Livestock

4.2.1. Swine

4.2.2. Poultry

4.2.3. Ruminants

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. A&A Pharmachem Inc.

6.2. Adisseo France SAS

6.3. Delacon Biotechnik GmbH

6.4. Dostofarm Gmbh

6.5. DSM Austria GmbH

6.6. Igusol S.A.

6.7. Kemin

6.8. Natural Remedies Pvt Ltd.

6.9. Nor-Feed A/S

6.10. Nutrex

6.11. Phytobiotics Futterzusatzstoffe GmbH

6.12. Phytosynthese

6.13. Royal DSM

6.14. Synthite Industries Ltd.

1. GLOBAL FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL SPICES AND HERBS FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ESSENTIAL OILS FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OLEORESINS FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2021-2028 ($ MILLION)

6. GLOBAL FEED PHYTOGENICS FOR SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FEED PHYTOGENICS FOR POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL FEED PHYTOGENICS FOR RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2021-2028 ($ MILLION)

13. EUROPEAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC FEED PHYTOGENICSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2021-2028 ($ MILLION)

19. REST OF THE WORLD FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD FEED PHYTOGENICS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2021-2028 ($ MILLION)

1. GLOBAL FEED PHYTOGENICS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL SPEICES AND HERBS FEED PHYTOGENICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ESSENTIAL OIL FEED PHYTOGENICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL OLEORESINS FEED PHYTOGENICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL FEED PHYTOGENICS MARKET SHARE BY LIVESTOCK, 2021 VS 2028 (%)

6. GLOBAL FEED PHYTOGENICS FOR SWINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL FEED PHYTOGENICS FOR POULTRY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL FEED PHYTOGENICS FOR RUMINANTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL FEED PHYTOGENICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. US FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

12. UK FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD FEED PHYTOGENICS MARKET SIZE, 2021-2028 ($ MILLION)