Feed Pigments Market

Feed Pigments Market Size, Share & Trends Analysis Report by Type (Carotenoids, Curcumin, Spirulina, and Others), by Source (Synthetic and Natural), and by Livestock (Swine, Poultry, Ruminants and Aquatic Animals) Forecast Period (2024-2031)

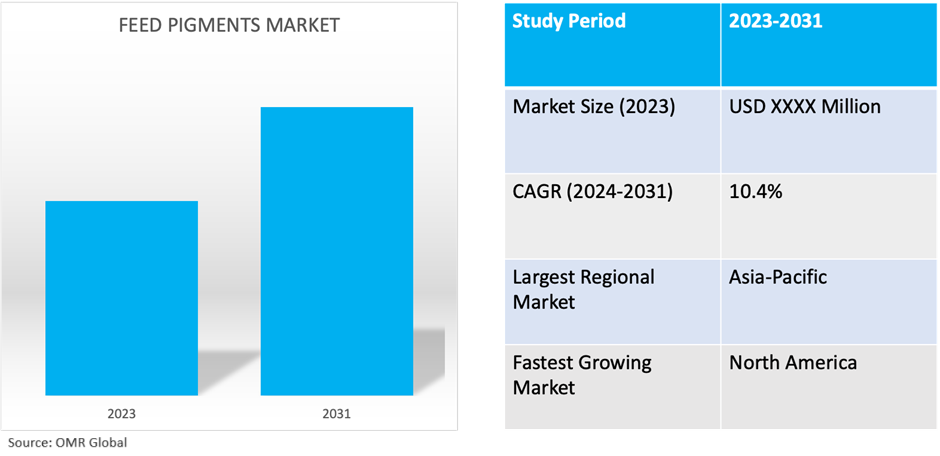

Feed pigments market is anticipated to grow at a CAGR of 10.4% during the forecast period (2024-2031). Feed pigments are natural or synthetic substances added to animal feed to enhance the color of animal products such as meat, eggs, and fish. These pigments are primarily used to improve the visual appeal of the final product, making it more attractive to consumers. Additionally, some feed pigments have nutritional benefits and can contribute to the overall health and well-being of the animals. The market growth is driven by the increased consumption of animal products, the health benefits of carotenoids for animals, and the industrialization of the hog, poultry, and aquaculture industries.

Market Dynamics

Meat as the Primary Driving Force Behind Global Feed Pigments Market

The increasing demand for meat products is a significant driver shaping the dynamics of the global feed pigment market. This trend is propelled by several factors, including population growth, rising disposable incomes, and urbanization. As more people transition to urban areas and adopt Westernized lifestyles, there is a notable uptick in the consumption of meat products. Additionally, dietary preferences are evolving, with meat increasingly becoming a staple in many diets worldwide. Consequently, there is a growing need for high-quality meat products that not only meet consumers' sensory preferences but also align with their expectations for nutritional value and food safety.

Elevated Awareness Driving Demand for Enhanced Animal Nutrition and Product Quality

The heightened awareness of animal nutrition among consumers, regulators, and industry stakeholders is contributing significantly towards market growth. This awareness stems from concerns regarding food safety, animal welfare, and environmental sustainability. Consumers are increasingly interested in understanding how the food they consume is produced and the impact it has on their health and the planet. As a result, there's a growing demand for transparency and accountability throughout the food supply chain, including animal agriculture. This heightened awareness has led to greater scrutiny of animal nutrition practices, driving the adoption of feed additives such as pigments to enhance the nutritional content and overall quality of animal products. For instance, in 2021, Kemin Industries Inc. launched KEMIN ORO GLO® 20 Dry, designed to uniformly disperse color throughout feed formulations, resulting in enhanced and consistent egg pigmentation.

Market Segmentation

- Based on type, the market is segmented into carotenoids, curcumin, spirulina, and others.

- Based on the source, the market is bifurcated into synthetic and natural.

- Based on livestock, the market is segmented into swine, poultry, ruminants, and aquatic animals.

Poultry is Projected to Emerge as the Largest Segment

The poultry segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the demand for visually appealing and nutritious poultry products. Consumers often associate the color of poultry meat, such as the yellow-orange hue of chicken skin and egg yolks, with freshness, quality, and nutritional value. The poultry producers utilize feed pigments, to meet these expectations, such as carotenoids derived from sources such as marigold flowers or paprika, to enhance the coloration of poultry products. Additionally, pigments such as carotenoids offer health benefits for poultry, including antioxidant properties that support immune function and overall bird health.

Natural Feed Pigments to Hold a Considerable Market Share

The natural segment is poised to hold a significant market share due to growing consumer preference for natural and organic products. The increasing concerns about health and sustainability impact the demand for natural pigments derived from natural sources such as plants and algae, which are increasingly favored over synthetic alternatives. Natural pigments are safer, more environmentally friendly, and offer additional health benefits due to their antioxidant content. Regulatory trends favoring natural additives further bolster this segment, alongside advancements in technology improving their stability and efficacy. As a result, natural feed pigments are positioned as a competitive and sought-after solution for livestock producers aiming to meet consumer demands for clean-label products.

Regional Outlook

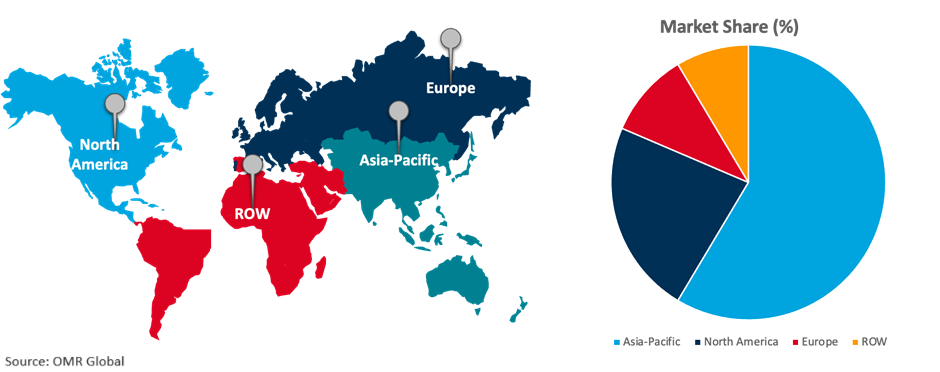

The global feed pigments market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The North American Market is Anticipated to Grow at the Fastest Rate

North America's rapid growth in the global feed pigments market is fueled by rising demand for natural and organic food products, driving the need for pigments to enhance the color and nutritional value of animal products. The expanding livestock industry in the region, coupled with continuous technological innovation, contributes to the development of advanced pigments meeting evolving consumer preferences and regulatory standards. For instance, in May 2022, Kemin Industries inaugurated new facilities, including offices and a distribution center, in Mexico. This strategic expansion aims to enhance Kemin Animal Nutrition's operational capabilities in the region, enabling the provision of premium services and tailored solutions to meet the evolving needs of customers.

Global Feed Pigments Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share the region is home to some of the world's largest and fastest-growing economies, including China and India. Rapid economic development in these countries has led to urbanization, rising disposable incomes, and a shift towards Westernized diets, driving increased consumption of meat products. Also, the region has a significant and expanding livestock industry, encompassing poultry, swine, aquaculture, and other animal farming sectors. As the demand for meat, eggs, and dairy products rises to meet the needs of a growing population, there is a corresponding need for feed pigments to enhance the quality and nutritional value of animal products. Additionally, the Asia-Pacific region boasts a diverse climate and ecosystem, making it conducive to agricultural production. This enables the cultivation of various feed crops and natural sources of pigments, such as corn, marigold flowers (a source of lutein), and algae (a source of astaxanthin). The availability of locally sourced raw materials reduces production costs and contributes to the competitiveness of feed pigment manufacturers in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global feed pigments market include BASF SE, EW Nutrition, Impextraco NV, Innovad®, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2022, Impextraco elevated the presence of the Impextraco brand in Mexico through the expansion of its facility in the region. This expansion initiative was undertaken to optimize storage capabilities for products and to enhance commercial opportunities.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global feed pigments market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Feed Pigments Market by Type

4.1.1. Carotenoids

4.1.2. Curcumin

4.1.3. Spirulina

4.1.4. Others (Lutein, Astaxanthin, Anthocyanins)

4.2. Global Feed Pigments Market by Source

4.2.1. Synthetic

4.2.2. Natural

4.3. Global Feed Pigments Market by Livestock

4.3.1. Swine

4.3.2. Poultry

4.3.3. Ruminants

4.3.4. Aquatic Animals

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. BASF SE

6.2. DSM-Firmenich AG

6.3. EW Nutrition

6.4. Guangzhou Leader Bio-Technology Co.Ltd.

6.5. Impextraco NV

6.6. Innovad®

6.7. Kemin Industries, Inc.

6.8. Larvicides MarKalsec Inc.

6.9. Nutrex

6.10. Synthite Industries Ltd.

6.11. Vitafor NV

1. GLOBAL FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CAROTENOIDS FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CURCUMIN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SPIRULINA FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

6. GLOBAL SYNTHETIC FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NATURAL FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2023-2031 ($ MILLION)

9. GLOBAL FEED PIGMENTS FOR SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FEED PIGMENTS FOR POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FEED PIGMENTS FOR RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL FEED PIGMENTS FOR AQUATIC ANIMALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2023-2031 ($ MILLION)

18. EUROPEAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

21. EUROPEAN FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2023-2031 ($ MILLION)

26. REST OF THE WORLD FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD FEED PIGMENTS MARKET RESEARCH AND ANALYSIS BY LIVESTOCK, 2023-2031 ($ MILLION)

1. GLOBAL FEED PIGMENTS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL CAROTENOIDS FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CURCUMIN FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SPIRULINA FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FEED PIGMENTS MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

6. GLOBAL SYNTHETIC FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NATURAL FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FEED PIGMENTS MARKET SHARE BY LIVESTOCK, 2023 VS 2031 (%)

9. GLOBAL FEED PIGMENTS FOR SWINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FEED PIGMENTS FOR POULTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FEED PIGMENTS FOR RUMINANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FEED PIGMENTS FOR AQUATIC ANIMALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FEED PIGMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA FEED PIGMENTS MARKET SIZE, 2023-2031 ($ MILLION)