Feed Prebiotics Market

Global Feed Prebiotics Market Size, Share & Trends Analysis Report by Type (Bacterial and Yeast & Fungi) by Application (Ruminants, Poultry, Swine, Aquaculture, and Others ), Forecast 2020-2026 Update Available - Forecast 2025-2035

Feed prebiotics market is projected to grow at a considerable CAGR of around 8% during the forecast period (2020-2026). Feed prebiotics is the essential fiber that assists in the growth of the useful bacteria in the gut of the host which is the animal. The feed prebiotics is additives that are generally given to the animals which are to be consumed or are used by the farmers. The feed prebiotics also reduces the contamination risk caused by the meat products which results in human disease by eliminating harmful parasites from the meat of the animal. The feed prebiotics market is driven by the increasing need of healthy animals and to alleviate their performance, awareness of people regarding their health and the digestive system and the bans and regulations which are imposed on the anti-biotic for the animals.

Food safety has become one of the major concerns for the people who depend on animal products such as meat and milk. The animal's meat such as the pork, fish and chicken are prone to contamination and are a source of disease-causing parasitic bacteria such as E.Coli, Listeria among others. These parasitic bacteria cause infectious diseases in humans such as African Swine Fever, Influenza and more. To avoid such diseases, feed prebiotics is given to the animals which assist in eliminating such harmful parasite from the meat of the animals. Thus, this results in the growth of the feed prebiotics market. However, the strict guidelines set by the government area key reason which hampers the growth of the animal feed prebiotic market.

Segmental Outlook

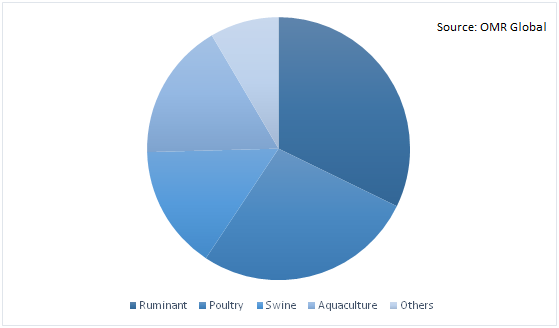

The feed prebiotics market is segmented on the basis of type, application. Based on the type, the market can be segmented into bacterial and yeast & fungi. Based on application the market is segmented into ruminant, poultry, swine, aquaculture, and others.

The Feed Prebiotics Segment by Application

The ruminant segment is considered to hold a significant market share in the market attributed to the high demand and consumption of the meat food product and the constant growth in it. The ruminants are also majorly the domestic cattle of the farmers in agriculture. The ruminants are also the source of milk products which further results inthe growth of the segment in the feed prebiotics market. The aquaculture and poultry segments are also considered to hold a large share in the global market.

Global Feed Prebiotics Market Share by Type, 2019 (%)

Regional Outlook

The global feed prebiotics market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific is expected to grow at a considerable CAGR during the forecast period. The factors attributing to the growth rate of Asia-Pacific include the growing concern of people about animal’s health in the region. China and India are the most populated country globally and hence there is significant demand for meat which boost the demand for animal feed probiotics products. India is also the largest producer of milk and milk products globally. This boosts the growth of the market in the region.

Market Players Outlook

The major companies operating in feed prebiotics market include Asahi Group Holdings, Ltd., Cargill, Inc., Chr. Hansen Holding A/S, DuPont de Nemours, Inc., DSM Nutritional Products, Inc., Jarrow Formulas, Inc., Lallemand, Inc., Orffa International Holding B.V.among others. These companies are expanding their research and development for the feed prebiotics market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global feed prebiotics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. DuPont de Nemours, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. DSM Nutritional Products, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Asahi Group Holdings, Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Cargill, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Lallemand, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Feed Prebiotics Market by Type

5.1.1. Bacteria

5.1.2. Yeast & Fungi

5.2. Global Feed Prebiotics Market by Application

5.2.1. Ruminant

5.2.2. Poultry

5.2.3. Swine

5.2.4. Aquaculture

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acadian Seaplants, Ltd.

7.2. Alltech, Inc.

7.3. Asahi Group Holdings, Ltd.

7.4. Behn Meyer Europe GmbH

7.5. BENEO GmbH

7.6. Cargill, Inc.

7.7. Chr. Hansen Holding A/S

7.8. DuPont de Nemours, Inc.

7.9. DSM Nutritional Products, Inc.

7.10. Jarrow Formulas, Inc.

7.11. Lallemand, Inc.

7.12. Orffa International Holding B.V.

7.13. Provita Eurotech, Ltd.

7.14. Vets Plus, Inc.

7.15. Yakult Pharmaceutical Industry Co., Ltd.

1. GLOBAL FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL bacterial MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL yeast and fungi MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL FEED PREBIOTICS for RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FEED PREBIOTICS for POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FEED PREBIOTICS for SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FEED PREBIOTICS for AQUACULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FEED PREBIOTICS for OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD FEED PREBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL FEED PREBIOTICS MARKET SHARE BY TYPE, 2020 VS 2026 (%)

2. GLOBAL FEED PREBIOTICS MARKET SHARE BY APPLICATION, 2020 VS 2026 (%)

3. GLOBAL FEED PREBIOTICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2026 (%)

4. US FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FEED PREBIOTICS MARKET SIZE, 2019-2026 ($ MILLION)