Feed Vitamins Market

Global Feed Vitamins Market Size, Share & Trends Analysis Report by Vitamin Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Vitamin K), by Animal type (Swine, Ruminants, Poultry, Aquatic Animals, and Others) and by formulation(Dry and Liquid) Forecast Period (2022-2028)

The global feed vitamins market is anticipated to grow at a significant CAGR of around 7.5% during the forecast period. Rising health concerns due to diseases outbreak in livestock and growing demand for high-quality meat and increasing meat consumption are factors that are augmented in the feed additives market growth. Moreover, preventing growth disorders in young animals and its protective functions has importance in older animals. Moreover, major players such as BASF SE, Adisseo, and DSM are investing more and more in the development of new vitamin-based products. For instance, in December 2021, BASF SE launched a new enzyme product Natyoulse for animal feed. It will produce up to 30% of nutrients in poultry diets increase the digestibility of feed and ensure more sustainable production. In November 2021, Adisseo launched Rovabio PhyPlus feed digestibility solutions that limit the antinutritional capacity of phytates to chelate valuable nutrients in the animal intestine. It extracts more than 80% of the phosphorus contained in poultry feed formulas.

Impact of COVID-19 Pandemic on Global Feed Vitamins Market

COVID-19 has affected with low impact on feed vitamins market owing to in most of countries restriction was imposed by which the direct supply of import and export of all animal food supplements were hundred as well as a manufacturing process. Various clusters of cases among workers in meat processing plants evolved quickly and various manufacturing sites of food and supplements of feed vitamins were closed due to which various types of the animal were occurring with diseases and were dying.

Segmental Outlook

The global feed vitamins market is segmented based on the vitamin type, animal type, and formulation. Based on the vitamin type, the market is segmented into vitamin A, vitamin B, vitamin C, vitamin D, vitamin E, and vitamin K. On the basis of animal type, the market is sub-divided into the swine, ruminants, poultry, aquatic animals, and others. On the basis of formulation, the market is classified into dry and liquid. Among the animal type sub-segment poultry uses the largest no of vitamins due to a large number of species and in specific conditions required by the birds and due to the increase in demand for white meat the segment is dominating in the feed vitamins market

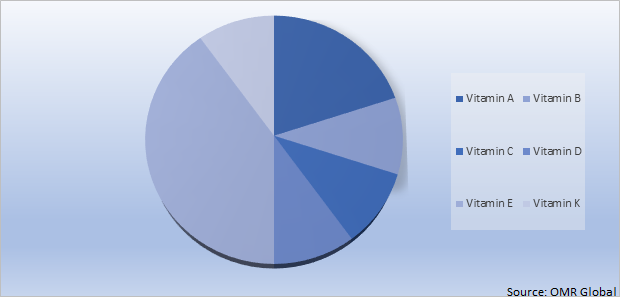

Global Feed Vitamins Market Share by Vitamins Type, 2021 (%)

The Vitamin E Segment is Dominating in the Global Feed Vitamins Market

Vitamins in the animal are the foundation of balanced animal nutrition they are essential irreplaceable micronutrients required for normal physiological functions including growth, body development, and reproduction among others. Moreover, vitamin E plays an important role in poultry and swine nutritional levels on immune modulation and meat quality also. Vitamin E helps to resist diseases in animals and keep up the basic structure of tissues.

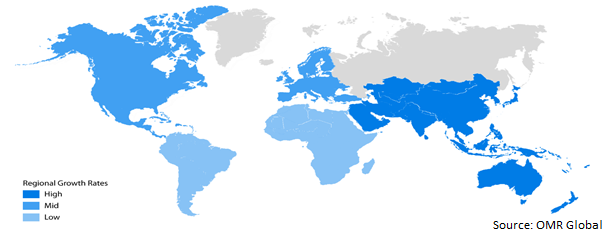

Regional Outlooks

The global Feed Vitamins market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. Various government Asia Pacific regions in several countries are introducing initiatives such as India launched National Livestock Misson to develop the livestock sector. For instance, in September 2021, National Livestock Mission (NLM) was launched to increase the effectiveness and ensure transparency in the implementation of the scheme. It is an online portal that aims to enable a workflow between both the State Implementing Agency (SIA), lenders, and Ministry as required under the National Livestock Mission.

Global Feed Vitamins Market Growth, by Region 2022-2028

The North America Region is Fastest Growing in the Global Feed Vitamins Market

Increasing consumption of meat is driving the feed vitamins to the fastest-growing region. For instance, according to the data published by the North American meat institute, it stated that meat and poultry industry is the largest segment of US agriculture. For instance, in March 2021, according to an article published Americans consume approximately 274 billion pounds of meat per year on average, and from 1961 it is increased by 40%. Moreover, the increasing technological advancement in livestock by key manufacturers and leading players in the region is propelling the market to hold a major share in the feed vitamins market. For instance, in February 2021, AgriWebb launched Livestock Management Platform in the US, to help ranchers across the country leverage their data more effectively to improve the lives of ranchers, large and small, through technology.

Market Players Outlook

The major companies serving the global Feed Vitamins market include Adisseo, BASF SE, Cargill, Inc., DSM, Trouw Nutrition, VIRTUAL EXPO, Zhejiang NHU Co., Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2020, DSM launched Animal Nutrition & Health premix plant in Baishazhau Industrial Parkin Hengyang city. The company with the new facility of advanced processed and innovative solutions is to promote sustainable animal protein production in the Chinese market. Moreover, with this, it has also launched DSM Vitamin Academy in its company will serve research and practices with players across the animal feed and husbandry value chain. It stated that by initiative company will understand the role of the vitamin in animal proteins for a healthier and more sustainable future.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Feed Vitamins market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Feed Vitamins Market

• Recovery Scenario of Global Feed Vitamins Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Adisseo

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cargill, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DSM

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Zhejiang NHU Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Feed Vitamins Market by Vitamins Type

4.1.1. Vitamin A

4.1.2. Vitamin B

4.1.3. Vitamin C

4.1.4. Vitamin D

4.1.5. Vitamin E

4.1.6. Vitamin K

4.2. Global Feed Vitamins Market by Animals Type

4.2.1. Swine

4.2.2. Ruminants

4.2.3. Poultry

4.2.4. Aquatic Animals

4.2.5. Others

4.3. Global Feed Vitamins Market by Formulation

4.3.1. Dry

4.3.2. Liquid

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.3. Spain

5.3.1.

5.3.2. France

5.3.3. Rest of Europe

5.4. Asia-Pacific

5.4.1. China

5.4.2. India

5.4.3. Japan

5.4.4. South Korea

5.4.5. Rest of Asia-Pacific

5.5. Rest of the World

6. Company Profiles

6.1. Alltech

6.2. ADM Animal Nutrition

6.3. Advanced Enzyme Technologies Ltd

6.4. Animax Pharma Pvt. Ltd.

6.5. Avitech Nutrition Pvt. Ltd.

6.6. Bactolac Pharmaceutical, Inc.

6.7. Biovet, S.A

6.8. Charoen Pokphand Foods PCL.

6.9. Davidson Brothers (Shotts) Ltd

6.10. Evonik Industries AG

6.11. ForFarmers.

6.12. Kemin Industries, Inc.

6.13. Lallemand Inc

6.14. Land O’Lakes, Inc.

6.15. New Hope Liuhe Co., Ltd.

6.16. Trouw Nutrition

6.17. VIRTUAL EXPO

6.18. VITAFOR

6.19. WATT Global Media

6.20. Zoetis

6.21. 3A FEED VITAMINSS

6.22. 3V Sigma USA Inc. -

1. GLOBAL FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY VITAMINS TYPE, 2021-2028 ($ MILLION)

2. GLOBAL FEED VITAMINS A MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FEED VITAMINS B MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

4. GLOBAL FEED VITAMINS C MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FEED VITAMINS D MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

6. GLOBAL FEED VITAMINS E MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FEED VITAMINS K MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

8. GLOBAL FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

9. GLOBAL SWINE FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL RUMINANTS FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL POULTRY FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL AQUATIC ANIMALS FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL FEED VITAMINS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2021-2028 ($ MILLION)

15. GLOBAL DRY FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL FEED VITAMINS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY VITAMINS TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2021-2028 ($ MILLION)

21. EUROPEAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. EUROPEAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY VIITAMINS TYPE, 2021-2028 ($ MILLION)

23. EUROPEAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY VITAMINS TYPE, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2021-2028 ($ MILLION)

29. REST OF THE WORLD FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. REST OF THE WORLD FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY VITAMIN TYPE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE,2021-2028 ($ MILLION)

32. REST OF THE WORLD FEED VITAMINS MARKET RESEARCH AND ANALYSIS BY FORMULATION,2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FEED VITAMINS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FEED VITAMINS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL FEED VITAMINS MARKET, 2021-2028 (%)

4. GLOBAL FEED VITAMINS MARKET SHARE BY VITAMINS TYPE, 2021 VS 2028 (%)

5. GLOBAL FEED VITAMINS A MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL FEED VITAMINS B MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL FEED VITAMINS C MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL FEED VITAMINS DD MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL FEED VITAMINS E MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL FEED VITAMINS K MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL FEED VITAMINS MARKET SHARE BY ANIMALS TYPE, 2021 VS 2028 (%)

12. GLOBAL SWINE FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL RUMINANTS FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL POULTRY FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL AQUATIC ANIMALS FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL OTHERS FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL FEED VITAMINS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

18. GLOBAL DRY FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL LIQUID FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL FEED VITAMINS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. US FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

22. CANADA FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

23. UK FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

24. FRANCE FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

25. GERMANY FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

26. ITALY FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

27. SPAIN FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF EUROPE FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

29. INDIA FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

30. CHINA FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

31. JAPAN FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

32. SOUTH KOREA FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF ASIA-PACIFIC FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD FEED VITAMINS MARKET SIZE, 2021-2028 ($ MILLION)