Fertilizers Market

Global Fertilizers Market Size, Share & Trends Analysis Report by Application (Crop Based, Non-Crop Based, and Others), and by Type (Nitrogen, Phosphate, and Potash) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global fertilizers market is anticipated to grow at a significant CAGR of 3% during the forecast period. Fertilizers are natural or artificial substances that contain chemical elements to improve the growth and productivity of plants. Additionally, they also enhance the soil’s natural fertility as well as assist in replacing the chemical elements taken from the soil by previous crops. Modern fertilizers include nitrogenous, potash, and phosphate fertilizers. Moreover, some fertilizers contain certain micronutrients such as zinc and other metals necessary for plant growth. The major factor driving the growth of the global fertilizers market during the forecast is the increasing population growth and high demand for food products. According to the United Nations (UN), the global population has grown from 1 billion in 1800 to 7.9 billion in 2020. Additionally, it is anticipated to keep growing and reach 8.6 billion by mid-2030, 9.8 billion by mid-2050, and 11.2 billion by 2100. Hence, the growing population globally is driving the demand for food products which in turn is driving the growth of the market.

Impact of COVID-19 Pandemic on Global Fertilizers Market

The COVID-19 pandemic harmed the global fertilizers market. During COVID-19, as of May 2020, 212 countries had been impacted by the pandemic, and the governments of these countries had ordered nationwide lockdowns which disrupted the supply chain operation of the fertilizer industry. However, as the COVID-19 situation normalizes, the global fertilizers market started to recover as industrial operations were normalized after the recovery.

Segmental Outlook

The global fertilizers market is segmented based on application and type. Based on the application, the market is sub-segmented into crop based, non-crop based, and others. Based on the type, the market is sub-segmented into nitrogen (ammonia, ammonium sulfate, ammonium nitrate, calcium ammonium nitrate, urea, calcium nitrate, sodium nitrate, and other nitrogen fertilizers), phosphate (single superphosphate, triple superphosphate, diammonium phosphate, monoammonium phosphate, ground rock phosphate, and other phosphate fertilizers) and potash (potassium nitrate, potassium chloride, potassium sulfate, and other potash fertilizers).

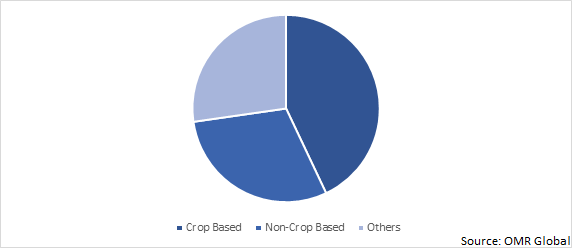

Global Fertilizers Market Share by Application, 2021 (%)

Crop Based is Expected to Hold a Prominent Share in the Global Fertilizers Market

Among the application, the crop-based segment in the global fertilizers market is expected to hold a significant market share in the global fertilizers. Fertilizers improve the growth of crops as well as improves the fertility of the soil. The growth of the segment is attributed to the increasing demand for fertilizers in agriculture for crop production across the globe.

Regional Outlook

The global fertilizers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). North America is anticipated to grow during the forecast period due to the increasing demand for fertilizer in the region.

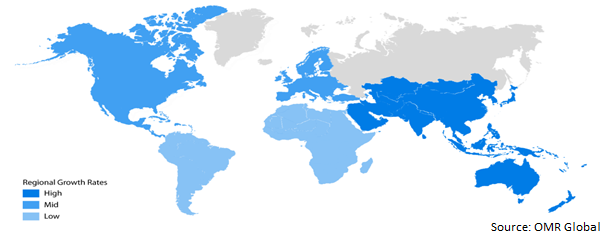

Global Fertilizers Market Growth by Region, 2022-2028

Asia-Pacific Region Anticipated to Hold a Prominent Share in the Global Fertilizers Market

The Asia-Pacific region is anticipated to hold a prominent share of the fertilizers market over the forecast period. The major factor driving the growth of the market in the region is due to the high population base and high demand for food in emerging countries such as India, China, and Pakistan. Additionally, rice is a big nitrogen-consuming crop in the region. India is the globe’s second-largest producer of rice and the largest exporter of rice. Hence, this is augmenting the market growth in the region.

Market Players Outlook

The major companies serving the global fertilizers market include The Mosaic Co., Yara International, Nutrien Ltd., K+S Group, and OCP Group, among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships, geographical expansion, and collaborations to stay competitive in the market. For instance, in September 2021, Yara announced the acquisition of Finish colan to expand its organic fertilizer business which shows the company's commitment to playing a bigger role in the organic fertilizer business.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fertilizers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Fertilizers Market

• Recovery Scenario of Global Fertilizers Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Fertilizers Market by Application

4.1.1. Crop Based

4.1.2. Non-Crop Based

4.1.3. Others

4.2. Global Fertilizers Market by Type

4.2.1. Nitrogen Fertilizers

4.2.1.1. Ammonia

4.2.1.2. Ammonium Sulfate

4.2.1.3. Ammonium Nitrate

4.2.1.4. Calcium Ammonium Nitrate

4.2.1.5. Urea

4.2.1.6. Calcium Nitrate

4.2.1.7. Sodium Nitrate

4.2.1.8. Other Nitrogen Fertilizers

4.2.2. Phosphate Fertilizers

4.2.2.1. Single Superphosphate

4.2.2.2. Triple Superphosphate

4.2.2.3. Diammonium Phosphate

4.2.2.4. Monoammonium Phosphate

4.2.2.5. Ground Rock Phosphate

4.2.2.6. Other Phosphate Fertilizers

4.2.3. Potash Fertilizers

4.2.3.1. Potassium Nitrate

4.2.3.2. Potassium Chloride

4.2.3.3. Potassium Sulfate

4.2.3.4. Other Potash Fertilizers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acron PJSC

6.2. BELARUSKALI

6.3. Bunge Ltd.

6.4. CF Industries Holdings, Inc.

6.5. Coromandel International Ltd.

6.6. ICL Fertilizers Ltd.

6.7. IFFCO Group

6.8. K+S AG

6.9. National Fertilizers Ltd.

6.10. OCP Group

6.11. Orascom Construction Industries Co.

6.12. Potash Corp. Of Saskatchewan

6.13. Qatar Fertiliser Co. (P.S.C)

6.14. Saudi Arabian Fertilizer Co. (SAFCO AB)

6.15. Sociedad Quimica Y Minera De Chile SA (SQM)

6.16. The Mosaic Co.

6.17. UPL Ltd.

6.18. URALKALI PJSC

6.19. Yara International ASA

1. GLOBAL FERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

2. GLOBAL CROP BASED FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL NON-CROP BASED FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

6. GLOBAL NITROGEN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PHOSPHATE FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL POTASH FERTILIZERS RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FERTILIZERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

13. EUROPEAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. EUROPEAN FERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC FERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC FERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC FERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. REST OF THE WORLD FERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD FERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATYION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD FERTILIZERS MARKET RESEARCH AND ANALYSIS BY CORE TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FERTILIZERS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FERTILIZERS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL FERTILIZERS MARKET, 2022-2028 (%)

4. GLOBAL FERTILIZERS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL CROP BASED FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL NON-CROP BASED FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL OTHER FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL FERTILIZERS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

9. GLOBAL NITROGEN FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL PHOSPHATE FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL POTASH FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL FERTILIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

15. UK FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD FERTILIZERS MARKET SIZE, 2021-2028 ($ MILLION)