Fiber Management Systems Market

Fiber Management Systems Market Size, Share & Trends Analysis Report by Component (Software, and Services), by Cable Type(Single Mode, and Multi-mode) and by End-User (Telecommunication Industry, Data Centers, Enterprise Networking, Government and Public Sector, Energy and Utilities, Healthcare, and Others) Forecast Period (2024-2031)

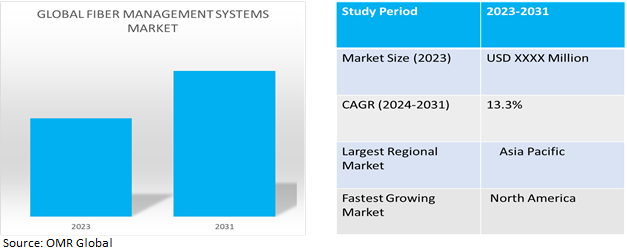

Fiber management systems market is anticipated to grow at a significant CAGR of 13.3% during the forecast period (2024-2031).The fiber management systems market includes solutions for organizing, protecting, and managing fiber optic cables in telecommunications networks, data centers, and enterprise IT infrastructure. The demand for these systems is driven by the rapid expansion of data center infrastructure, the deployment of 5G networks, and the global push for high-speed broadband connectivity. High-density fiber solutions are additionally in high demand, as network operators and enterprises aim to maximize space efficiency. Fiber management systems help minimize signal loss, prevent cable damage, and enhance network uptime and performance in mission-critical applications. Technological advancements, such as higher data rates and advanced software, drive the evolution of these systems.

Market Dynamics

Increasing infrastructure expansion for mobile connectivity

The expanding mobile consumer base requires the emergence of significant infrastructure, including fiber optic networks, for which fiber management solutions are essential to the effective deployment and operation. According to the GSMA, in 2023, the number of global mobile service subscribers exceeded $5.4 billion, with $4.4 billion of them also using the mobile internet. Additionally, the contribution of mobile technologies and services to the global GDP amounted to $5.2 trillion, supporting 28 million jobs and generating economic value across various industries.

Growing demand for enhanced security components

The rise of cybercrime necessitates the integration of advanced security features into fiber management systems, including secure connectivity solutions, encryption protocols, and intrusion detection capabilities. According to the Cybercrime Magazine, in Feburary 2024, the global costs of cybercrime are projected to increase by 15.0% annually over the next five years, potentially reaching a staggering $10.5 trillion per year by 2025. This significant rise in cybercrime poses economic challenges, potentially impacting incentives for innovation and investment, and surpassing the damages caused by natural disasters in a given year. Furthermore, the potential profitability of cybercrime may even exceed the combined global trade of major illegal drugs.

Market Segmentation

Our in-depth analysis of the global fiber management systems market includes the following segments by component, cable typeandend-user:

- Based on component, the market is sub-segmented into software, and services.

- Based on cable type, the market is bifurcated into single mode, and multi-mode.

- Based on end-user, the market is augmented into telecommunication industry, data centers, enterprise networking, government and public sector, energy and utilities, healthcare, and others (surveillance and security systems,transportation networks, and educational institutions).

Telecommunication Industryis Projected to Emerge as the Largest Segment

Based on the end-user, the global fiber management systems market is sub-segmented into telecommunication industry, data centers, enterprise networking, government and public sector, energy and utilities, healthcare, and others. Among these, the telecommunication industrysub-segment is expected to hold the largest share of the market. This is attributed to the high investments in digital services and internet access, that highlights the necessity for reliable fiber optic networks and calls for effective fiber management solutions. According to the International Trade Administration, in Feburary 2024, the Ecuadorian government has shown interest in developing digital opportunities for the country, with a focus on increasing internet access and providing digital services to improve efficiency and productivity. In 2022, the telecom industry in Ecuador received aninvestment of $904.0 million, with $885.0 million coming from the private sector. The sector is projected to grow by at least 5.0% annually, representing 2.0% of the country's GDP. The expansion of fiber optic deployment has also been a priority, with approximately 10.0% of Ecuador's fiber optic cable laid in 2022.

Software Sub-segment to Hold a Considerable Market Share

The increasing demand for next-generation network infrastructure, driven by trends such as, 5G, cloud computing, edge computing, and IoT connectivity, is driving the adoption of advanced fiber management solutions.. For instance, in June 2023, ActelisNetworks introduced a new line of advanced, software-managed, temperature and cyber-hardened fiber optic switching devices, enabling a wider range of solutions for hybrid-fiber-copper networks at higher speeds.

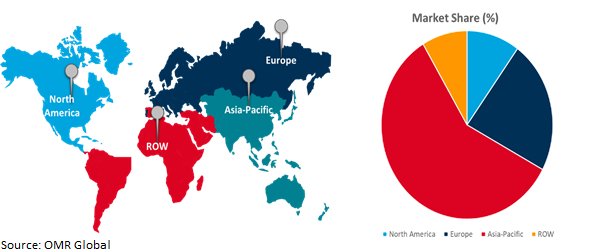

Regional Outlook

The globalfiber management systems market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia- Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increased demand for deployment of fiber networks in North America

The expansion of fiber networks in the US increased access to high-speed broadband, driving global demand for fiber management systems to maintain the growing network infrastructure. For instance, in March 2023, CommScope expanded fiber-optic cable production to expedite broadband rollout in the US, connecting more communities and underserved areas. It plans to increase US fiber-optic cable production, boost employment opportunities, and strengthen supply chain production. The company introduced a new HeliARC cable for rural deployments and invest $47.0 million in CapEx to expand production, aiming to support 500,000 homes per year in FTTH deployments.

Global Fiber Management Systems Market Growth by Region 2024-2031

Asia-PacificHolds Major Market Share

The rise in 5G connections fiber optic networks are needed for bandwidth and dependability in order to meet the high-speed, low-latency connectivity requirements of India's 5G connections. Network deployment and management are supported by fiber management systems. According to the invest India, in March 2023,India is boasting approximately $1.0 billion installed devices. By the same year, the country is expected to have around $920.0 million unique mobile subscribers, which include $88.0 million 5G connections. Furthermore, it is estimated that the Indian economy will receive a significant boost of approximately $450.0 billion from the implementation of 5G technology between 2023 and 2040.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global fiber management systems market includeCommScope, Inc., Corning Inc.,Panduit Corp.,HellermannTytonPvt Ltd., Leviton Manufacturing Co., Inc.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in June 2023, Bridgewired, entered into an agreement with altafiber to acquire its broadband infrastructure assets, including its existing customer base and fiber network, and to provide management services under a transition services agreement.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fiber management systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. CommScope

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Corning Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. HellermannTytonPvt Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fiber Management Systems Market by Component

4.1.1. Software

4.1.2. Services

4.2. Global Fiber Management Systems Market by Cable Type

4.2.1. Single Mode

4.2.2. Multi-mode

4.3. Global Fiber Management Systems Market by End-User

4.3.1. Telecommunication Industry

4.3.2. Data Centers

4.3.3. Enterprise Networking

4.3.4. Government and Public Sector

4.3.5. Energy and Utilities

4.3.6. Healthcare

4.3.7. Others (Surveillance and Security Systems,Transportation Networks and Educational Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. 3M Co.

6.2. America Fujikura Ltd. (AFL)

6.3. Belden Inc.

6.4. Fujikura Ltd.

6.5. Hubbell Inc.

6.6. HUBER+SUHNER

6.7. Leviton Manufacturing Co., Inc.

6.8. Nexans

6.9. Panduit Corp.

6.10. ProterialAmerica, Ltd.

6.11. RackOm System

6.12. Santron Electronics

6.13. Sumitomo Electric Group

6.14. The Siemon Co.

6.15. Zoho Corporation Pvt. Ltd.

1. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL FIBER MANAGEMENT SYSTEMS SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FIBER MANAGEMENT SYSTEMS SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY CABLE TYPE, 2023-2031 ($ MILLION)

5. GLOBAL SINGLE MODE FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MULTI-MODE FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL FIBER MANAGEMENT SYSTEMS FOR TELECOMMUNICATION INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FIBER MANAGEMENT SYSTEMS FOR DATA CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FIBER MANAGEMENT SYSTEMS FOR ENTERPRISE NETWORKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FIBER MANAGEMENT SYSTEMS FOR GOVERNMENT AND PUBLIC SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL FIBER MANAGEMENT SYSTEMS FOR ENERGY AND UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FIBER MANAGEMENT SYSTEMS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL FIBER MANAGEMENT SYSTEMS FOR OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

18. NORTH AMERICAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY CABLE TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

22. EUROPEAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY CABLE TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICFIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY CABLE TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

30. REST OF THE WORLD FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY CABLE TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD FIBER MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL FIBER MANAGEMENT SYSTEMS MARKETSHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL SOFTWARE FIBER MANAGEMENT SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SERVICES FIBER MANAGEMENT SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET SHARE BY CABLE TYPE, 2023 VS 2031 (%)

5. GLOBAL SINGLE MODE FIBER MANAGEMENT SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MULTI-MODE FIBER MANAGEMENT SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FIBER MANAGEMENT SYSTEMS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL FIBER MANAGEMENT SYSTEMS FOR TELECOMMUNICATION INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FIBER MANAGEMENT SYSTEMS FOR GOVERNMENT AND PUBLIC SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FIBER MANAGEMENT SYSTEMS FOR ENTERPRISE NETWORKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FIBER MANAGEMENT SYSTEMS FOR GOVERNMENT AND PUBLIC SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FIBER MANAGEMENT SYSTEMS FOR ENERGY AND UTILITIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FIBER MANAGEMENT SYSTEMS FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL FIBER MANAGEMENT SYSTEMS FOR OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL FIBER MANAGEMENT SYSTEMS MARKETSHARE BY REGION, 2023 VS 2031 (%)

16. US FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

18. UK FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA FIBER MANAGEMENT SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)