Fiber Termination Box Market

Global Fiber Termination Box Market Size, Share & Trends Analysis Report By Type (Wall Mount, and Rack Mount), and By Application (Telephone, Television and, Data and Image Transmission) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The global fiber termination box market is anticipated to grow at a CAGR of 4.0% during the forecast period. The growing demand for networking components to extend the life of networking fiber is driving the growth of the fiber termination box market. For instance, in October 2020, Telefónica and Allianz partnered to deploy Fibre-to-the-Home (FTTH) in Germany. Through this partnership, the deployment of the local fiber-optic networks in underserved rural and semi-rural areas across Germany had been done to offer FTTH access to all telecommunication service provider so that they can offer these services to end-users. Additionally, the fiber termination box consist of a fast transmission rate, which has less signal loss than copper termination box. Optical fibers are introduced to provide efficient network services and handle packet traffic efficiently. The demand for termination boxes is growing in order to protect this optical fiber from external environment to enhance their better usage and also delivering effective network connectivity. However, the restraining factor to the market is reduction of network speed due to the use of wireless techniques, which limits the market growth.

Impact of COVID-19 Pandemic on Global Fiber Termination box Market

Due to COVID-19 pandemic, educational institutions and offices were shut down which had resulted in a situation of work from home and due to this the use of the internet increased, and also the demand for optical fiber which in turn had increased the demand for fiber termination box for safeguarding purposes. For instance, in April 2021, according to the Cellular Operators Association of India (COAI), major telecommunication companies such as Bharti Airtel, Vodafone Idea, and Reliance Jio had spent Rs 9,000 crore in improving network infrastructure telecom sites and laying optic fiber cable. The Department of Telecommunications had also assigned 855.60 MHz of airwaves sold to the telecom operators in March auction across the 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, and 2300 MHz bands which is supporting the market growth.

Segmental Outlook

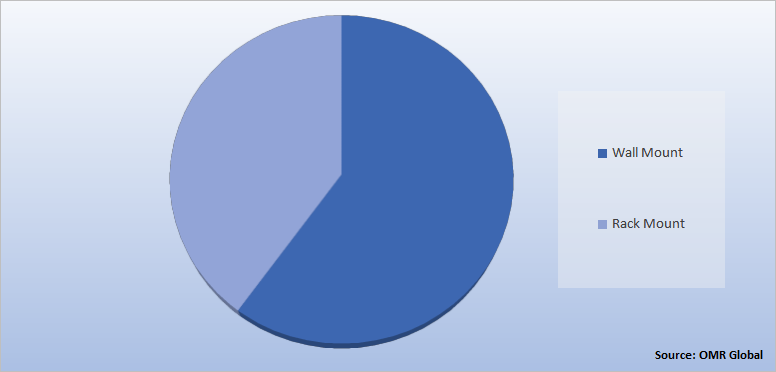

The global fiber termination box market is segmented based on type and application. Based on the type, the market is segmented into wall mount, and rack mount. Based on the application, the market is sub-segmented into the telephone, television, and data and image transmission. Among the application, the television segment is dominating the market as it is majorly used to provide fiber welding and optical connector transfer. Additionally, it is used to offer mechanical protection and environmental protection for optical fibers and its components in order to allow the proper inspection for maintaining the highest standards.

Global Fiber Termination Box Market Share by Type, 2020 (%)

The Wall Mount Segment Expected to Hold Prominent Market Share in the Global Fiber Termination Box Market

Wall mount fiber termination box is expected to dominate the market during the forecast period, as it provides the perfect solution used in building entrance terminals, telecommunication closets, main cross-connects, computer room, and optical connector transfer. Moreover, this device is suitable for pre-connected cables, field installation of connectors, and field splicing of pigtails. For instance, in February 2021, Amazon had launched a new wall mount echo device with a large touchscreen display. However, that would not be portable as it was in the previous echo devices although it could be mounted on the wall.

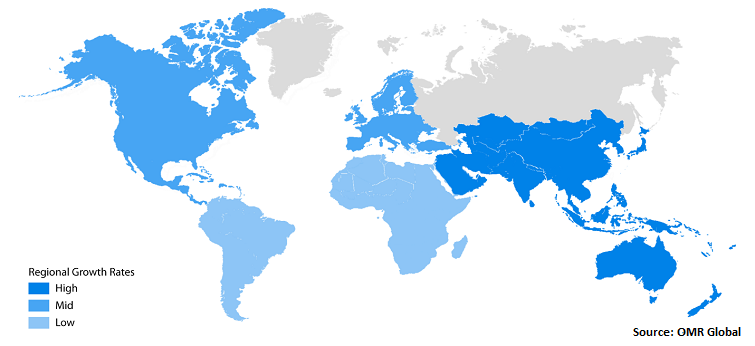

Regional Outlooks

The global fiber termination box market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Fiber Termination Box Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Fiber Termination Box Market

The Asia-Pacific region is anticipated to grow during the forecast period due to the demand for telecommunication services. Additionally, the young demographic profile of the region, importance of domestic savings, and entrepreneurial culture are also supporting the growth of the market. In countries such as India, China, and Singapore, an increase in new operators drive the growth of fiber termination box. For instance, in November 2019, the Kerala government approved around $64.5 million fiber-optic network project to support countries in industry and to provide various opportunities in the field of AI, blockchain, and startups.

Market Players Outlook

The major companies serving the global fiber termination box market Corning Incorporated, Furukawa Electric Co., Ltd., Hengtong Group Co., Ltd., Prysmian Group, Yangtze Optical Fibre, and Cable Joint Stock Ltd. Co., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Liteboxer announced the next generation product: the Liteboxer Wall Mount. Providing the same immersive, sports-fueled workout experience offered by the Floor Stand model, the Wall Mount takes up zero floor space and installs similar to a TV mount, lowering the bar to entry of adoption for at-home exercisers.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global fiber termination box market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Fiber Termination Box Market

• Recovery Scenario of Global Fiber Termination Box Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Corning Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Furukawa Electric Co., Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. HENGTONG GROUP CO.,LTD.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Prysmian Group

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Yangtze Optical Fibre and Cable Joint Stock Ltd. Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Fiber Termination Box Market by Type

4.1.1. Wall Mount

4.1.2. Rack Mount

4.2. Global Fiber Termination Box Market by Application

4.2.1. Telephone

4.2.2. Television

4.2.3. Data and Image Transmission

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Belden Inc.

6.2. Carefiber Optical Technology Co.,Ltd.

6.3. CommScope, Inc.

6.4. ECPlaza Network Inc.

6.5. FiberHome Telecommunication Technologies Co.,LTD.

6.6. FUJIKURA LTD.

6.7. Green Telecom Technology Co.,Ltd

6.8. Hexatronic Group

6.9. K&M Solutions Co.,Ltd.

6.10. Nexans AmerCable

6.11. Ningbo Hi-Tech Zone Newsunn Optronics Technology Co., Ltd.

6.12. Shenzhen Sopto Technology Co., Ltd

6.13. Shenzhen Wirenet Telecom Technology Co., Ltd.

6.14. Sterlite Technologies Ltd.

6.15. Sumitomo Electric Industries, Ltd.

6.16. Thorlabs, Inc.

6.17. ZTT

1. GLOBAL FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL WALL MOUNT FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL RACK MOUNT FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

5. GLOBAL TELEPHONE FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL TELEVISION FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL DATA AND IMAGE TRANSMISSION FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

9. NORTH AMERICAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

11. NORTH AMERICAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

12. EUROPEAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. EUROPEAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

14. EUROPEAN FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. ASIA-PACIFIC FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. ASIA-PACIFIC FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

18. REST OF THE WORLD FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. REST OF THE WORLD FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. REST OF THE WORLD FIBER TERMINATION BOX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FIBER TERMINATION BOX MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FIBER TERMINATION BOX MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL FIBER TERMINATION BOX MARKET, 2021-2027 (%)

4. GLOBAL FIBER TERMINATION BOX MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL WALL MOUNTFIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL RACK MOUNT FIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL FIBER TERMINATION BOX MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

8. GLOBAL TELEPHONE FIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL TELEVISION FIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL DATA AND IMAGE TRANSMISSION FIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL FIBER TERMINATION BOX MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. US FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

13. CANADA FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

14. UK FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

15. FRANCE FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

16. GERMANY FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

17. ITALY FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

18. SPAIN FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

19. REST OF EUROPE FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

20. INDIA FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

21. CHINA FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

22. JAPAN FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

23. SOUTH KOREA FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF ASIA-PACIFIC FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD FIBER TERMINATION BOX MARKET SIZE, 2020-2027 ($ MILLION)