Filter Needles Market

Filter Needles Market Size, Share & Trends Analysis Report by Raw Material (Stainless-Steel and Glass), by End-User (Hospital, Clinics, and Ambulatory Surgery Centers), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Filter needles market is anticipated to grow at a CAGR of 7.4% during the forecast period (2023-2030). Pivotal factors such as the increasing geriatric population, increasing prevalence of diabetes, the increasing cases of accidents such as burns, road accidents and trauma incidences and surgical processes are some of the major factors driving the market.

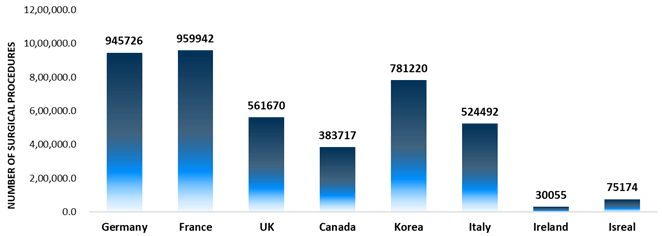

Surgical Procedures Performed, 2021

Source: OECD Statistics

Segmental Outlook

The global filter needles market is segmented based on the type, and end-user. Based on the type, the market is sub-segmented into stainless steel and glass. Further, based on end user, the market is sub-segmented into hospital, clinics, and ambulatory surgery centers. Among the end user, the ambulatory surgical centers sub-segment is anticipated to hold a considerable share of the market, owing to the significant shift toward outpatient procedures, proper specialization in specific procedures, the rising focus on minimally invasive procedures, and the adoption of technological advancements.

The Glass Sub-Segment is Anticipated to Hold a Considerable Share of the Global Filter Needles Market

Among the raw material, the glass sub-segment is expected to hold a considerable share of the global filter needles market. Segmental growth is attributed to several advantages of glass needles, such as suitability for high precision work, low volume error, and cost efficiency, are projected to drive the market. These advantages of glass needles make them appropriate for use in fields comparable medical technology. According to the National Institutes of Health study, article published Glass particulate adulterated in single dose ampoules: A patient safety concern, using filtered needles and leaning the ampoules can help reduce the number of glass particulates that pass into the solutions being drawn into the syringes.

Regional Outlook

The global filter needles market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the rising treatment rates, the rising disposable income and improving healthcare infrastructure in emerging economies are driving the filter needles market in the Asia-Pacific.

Global Filter Needles Market Growth, by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Filter Needles Market

Among all regions, the North America regions is anticipated to grow at a considerable CAGR over the forecast period. The North America market is growing owing to factors including the rising number of surgeries, increasing demand for innovative filter needles, and rising healthcare expenditure are projected to drive market growth over the forecast period. According to the Organization for Economic Co-operation and Development (OECD), in 2021, the US spent 17.8% of gross domestic product (GDP) on health care, nearly twice as much as the average OECD country. Further, rising prevalence of chronic diseases, such as cardiovascular and neurological disorders is growing at a rapid pace thus accelerating the surgical needle holder market in North America. American Society for Metabolic and Bariatric Surgery, in 2021, type 2 diabetes, the most common form of diabetes. There are 32.6 million people in the US living with type 2 diabetes. Moreover, this disease led to many serious health problems including heart disease, stroke, high blood pressure, kidney failure, blindness, skin wounds, nerve damage (neuropathy), erectile dysfunction, and cognitive decline among many others. Such diseases required to the surgery which anticipate propelling the demand for filter needles market.

Market Players Outlook

The major companies serving the filter needles market include ICU Medical Inc., MYCO Medical Supplies, Inc., Novo Nordisk Inc., Sentra Medical, Sol-Millennium Medical Group, Stryker Corp., Terumo Corp., Thermo Fisher Scientific Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2023, CarrTech Corp. developed FROG® filter needle, an industry-altering innovation. FROG®, their flagship product, stands for “filter removal of glass.” This revolutionary device is the first and only all-in-one package filter and hypodermic needle combined. Sue was inspired by decades of professional experience, seeing the dangers associated with opening and extracting medicines from glass ampoules.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global filter needles market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Becton, Dickinson, and Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. B. Braun SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cardinal Health, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Medtronic plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Filter Needles Market by Raw Material

4.1.1. Stainless-Steel

4.1.2. Glass

4.2. Global Filter Needles Market by End-User

4.2.1. Hospitals and Clinics

4.2.2. Ambulatory Surgery Centers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ICU Medical Inc.

6.2. MYCO Medical Supplies, Inc.

6.3. Novo Nordisk Inc.

6.4. Sentra Medical

6.5. Sol-Millennium Medical Group

6.6. Stryker Corp.

6.7. Terumo Corp.

6.8. Thermo Fisher Scientific Inc.

6.9. Life-Assist, Inc.

6.10. Medline Industries, LP

6.11. Medical Warehouse, Inc.

6.12. Shanghai Kohope Medical Devices Co., Ltd.

6.13. VWR International, LLC

6.14. Shenzhen Manners Technology Co., Ltd.

1. GLOBAL FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2022-2030 ($ MILLION)

2. GLOBAL FILTER NEEDLES OF STAINLESS-STEEL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL FILTER NEEDLES OF GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

5. GLOBAL FILTER NEEDLES FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL FILTER NEEDLES FOR AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. NORTH AMERICAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

9. NORTH AMERICAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2022-2030 ($ MILLION)

10. NORTH AMERICAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

11. EUROPEAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2022-2030 ($ MILLION)

13. EUROPEAN FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER,2022-2030 ($ MILLION)

17. REST OF THE WORLD FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. REST OF THE WORLD FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2022-2030 ($ MILLION)

19. REST OF THE WORLD FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL FILTER NEEDLES MARKET SHARE BY RAW MATERIAL, 2022 VS 2030 (%)

2. GLOBAL FILTER NEEDLES OF STAINLESS-STEEL MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL FILTER NEEDLES OF GLASS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL FILTER NEEDLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2022 VS 2030 (%)

5. GLOBAL FILTER NEEDLES FOR HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL FILTER NEEDLES FOR AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL FILTER NEEDLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. US FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

9. CANADA FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

10. UK FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

11. FRANCE FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

12. GERMANY FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

14. SPAIN FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

15. REST OF EUROPE FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

16. INDIA FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

17. CHINA FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

18. JAPAN FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

19. SOUTH KOREA FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF ASIA-PACIFIC FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD FILTER NEEDLES MARKET SIZE, 2022-2030 ($ MILLION)