Financial Analytics Market

Financial Analytics Market - Global Industry Share, Growth, Competitive Analysis and Forecast, 2019-2025 Update Available - Forecast 2025-2035

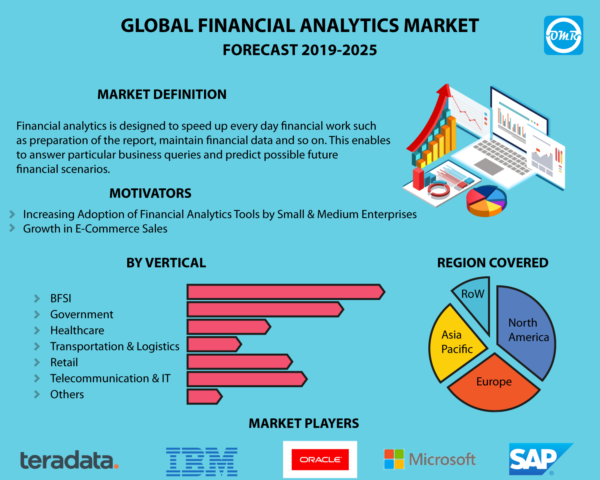

Financial Analytics Market is expected to grow at a significant rate during the forecast period 2019-2025. Financial analytics is designed to speed up everyday financial work such as preparation of the report, maintain financial data and so on. This enables to answer particular business queries and predict possible future financial scenarios. Financial analytics software presents the data in a graphical representation or in an executive dashboard that is simple to read and interpret compared to a series of spreadsheets with the pivot table. Some of the popular examples of financial analytics software include Balanced Scorecard. It is a financial tool to assess current position and historical performance of the company. The tool analyzes operating income, overall return, capital financing, and other financial specific processes. Additionally, the PrevisionEPM financial reporting is a management tool to build report books and combine real-time accounting and IT information.

The major factors contributing to the growth of the market include increasing adoption of financial analytics tools by small & medium enterprises and growth in e-commerce sales. For instance, according to the US Department of Commerce, the US retail e-commerce sales were estimated totaled $121.5 billion in 2018 for the third quarter of 2018. This is a rise of 0.8% from the second quarter of 2018. Additionally, in the third quarter of 2018, e-commerce sales accounted for 9.1% of total sales in the US. The trend towards e-commerce sales is boosting the demand for financial analytics solutions for management and keep track of financial transactions and calculate profitability. The platform enables retailers to understand total revenue generation from customers in a particular duration. It aggregates total cost paid to suppliers and associated costs for storage, transportation, and packaging of all stock keeping unit (SKU) sold in a particular period and presents financial earnings. However, privacy and security concerns are hindering the growth of the market.

The global financial analytics market is segmented into type, application, and verticals. Based on the type, the market is further classified into Online Analytical Processing (OLAP) & visualization tools, reporting & analysis, consulting & support services, database management system, query, analytics solution, and others. Based on application, the market is further classified into risk management, profitability management, budgetary control management, payable management, receivable management, ledger management, asset & liability management, and others. Based on vertical, the market is further classified into BFSI, government, healthcare, transportation & logistics, retail, telecommunication, and IT and others. Banking and financial institutions face more challenges to meet rising customer expectations and evolving regulatory requirements. Other managing challenges include thinning ROE (Return on Equity) and margins, and elusive growth. Financial analytics solutions enable financial institutions to overcome such problems and achieve business goals. These tools are enabling financial institutions to not only manage the rising cost of compliance, however, the risk of non-compliance. This, in turn, is contributing to the adoption of financial analytics solutions in BFSI.

Geographically, the global financial analytics market is segmented into four major regions, including North America, Europe, Asia-Pacific, and RoW. North America is estimated to hold the largest share in 2017, due to the significant adoption of business intelligence solutions and the presence of major players in the region. However, Asia-Pacific is estimated to show lucrative growth during the forecast period due to the rising number of small and medium enterprises coupled with increasing adoption of cloud solutions in the region.

The major players involved in the report comprise IBM Corp., Microsoft Corp., Oracle Corp., SAP SE, Teradata Corp., FinancialCAD Corp., and so on. The strategies followed by these companies to increase market presence and share across the globe include merger and acquisitions, product launches, partnership and collaboration and amongst others. For instance, in October 2018, FinancialCAD Corp. introduced Pythogen toolkit for valuation and risk analytics. A comprehensive F3 Pythogen toolkit enables companies to address the challenges, such as data management, version control, calculation scaling, and admin and security. The FINCAD F3 Python toolkit comprises an F3 Python MicroServices, F3 Python SDK and F3 Python Trade Scripting. The platform will enable portfolio managers, risk managers quants, and traders to rapidly generate custom reports, analytics and applications to drive better risk and investment decisions.

Research Methodology

The market study of global financial analytics market is incorporated by extensive primary and secondary research conducted by the research team at OMR. Secondary research has been conducted to refine the available data to breakdown the market in various segments, derive total market size, market forecast, and growth rate. Different approaches have been worked on to derive the market value and market growth rate. Our team collects facts and data related to the market from different geography to provide a better regional outlook. In the report, the country-level analysis is provided by analyzing various regional players, consumer behavior and macro-economic factors. Numbers extracted from secondary research have been authenticated by conducting proper primary research. It includes tracking down key people from the industry and interviewing them to validate the data. This enables our analyst to derive the closest possible figures without any major deviations in the actual number. Our analysts try to contact as many executives, managers, key opinion leaders, and industry experts. Primary research brings the authenticity of our reports.

Secondary Sources Include

- Financial reports of companies involved in the market

- Authentic Public Databases such as Eurostat, U.S. Department of the Treasury and so on.

- Whitepapers, research-papers, and news blogs

- Company websites and their product catalog

The report is intended for government and private companies for overall market analysis and competitive analysis. The report provides in-depth analysis on pricing, market size, intended quality of the product preferred by consumers. The report will serve as a source for 360-degree analysis of the market thoroughly integrating different models.

Market Segmentation

Global financial analytics market is segmented on the basis of regional outlook and following segments:

- Global Financial Analytics Market Research and Analysis by Type

- Global Financial Analytics Market Research and Analysis by Application

- Global Financial Analytics Market Research and Analysis by Verticals

- Global Financial Analytics Market Research and Analysis by Region

The Report Covers

- Comprehensive research methodology of global financial analytics market.

- This report also includes a detailed and extensive market overview with key analyst insights.

- An exhaustive analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global financial analytics market.

- Insights about market determinants which are stimulating the global financial analytics market.

- Detailed and extensive market segments with regional distribution of forecasted revenues.

- Extensive profiles and recent developments of market players.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Impact Analysis

3.4. Key Company Analysis

3.4.1. IBM Corp.

3.4.1.1. Overview

3.4.1.2. Financial Analysis

3.4.1.3. SWOT Analysis

3.4.1.4. Recent Developments

3.4.2. Oracle Corp.

3.4.2.1. Overview

3.4.2.2. Financial Analysis

3.4.2.3. SWOT Analysis

3.4.2.4. Recent Developments

3.4.3. Microsoft Corp.

3.4.3.1. Overview

3.4.3.2. Financial Analysis

3.4.3.3. SWOT Analysis

3.4.3.4. Recent Developments

3.4.4. SAP SE

3.4.4.1. Overview

3.4.4.2. Financial Analysis

3.4.4.3. SWOT Analysis

3.4.4.4. Recent Developments

3.4.5. Teradata Corp.

3.4.5.1. Overview

3.4.5.2. Financial Analysis

3.4.5.3. SWOT Analysis

3.4.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Financial Analytics Market by Type

5.1.1. Online Analytical Processing (OLAP) & Visualization Tools

5.1.2. Reporting & Analysis

5.1.3. Consulting & Support Services

5.1.4. Data Base Management System

5.1.5. Query

5.1.6. Analytics Solutions

5.1.7. Others

5.2. Global Financial Analytics Market by Application

5.2.1. Risk Management

5.2.2. Profitability Management

5.2.3. Budgetary Control Management

5.2.4. Payable Management

5.2.5. Receivable Management

5.2.6. Ledger Management

5.2.7. Asset & Liability Management

5.2.8. Others

5.3. Global Financial Analytics Market by Vertical

5.3.1. BFSI (Banking, Financial Services and Insurance)

5.3.2. Government

5.3.3. Healthcare

5.3.4. Transportation & Logistics

5.3.5. Retail

5.3.6. Telecommunication & IT

5.3.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accenture PLC

7.2. Alteryx, Inc.

7.3. Cleanwater Analytics, LLC

7.4. datapine GmbH

7.5. eMoney Advisor, LLC

7.6. FactSet Research Systems, Inc.

7.7. Fair Isaac Corpo. (FICO)

7.8. FinancialCAD Corp.

7.9. IBM Corp.

7.10. Innovaccer, Inc.

7.11. Investortools, Inc.

7.12. Magnitude Software, Inc.

7.13. Microsoft Corp.

7.14. MicroStrategy, Inc.

7.15. Northstar Risk Corp.

7.16. Novus Partners, Inc.

7.17. Oracle Corp.

7.18. Rosslyn Analytics Ltd.

7.19. SAP SE

7.20. SAS Institute, Inc.

7.21. Sisense, Inc.

7.22. StatPro Group PLC

7.23. Teradata Corp.

7.24. TIBCO Software, Inc.