Fixed Satellite Services Market

Fixed Satellite Services Market Size, Share & Trends Analysis Report by Type (Transponder Agreement, and Managed Services), and by End-User Industry (Media, Commercial, Aerospace & Defense, Government, Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Fixed satellite services market is anticipated to grow at a considerable CAGR of 5.1% during the forecast period. The fixed satellite service providers are companies that own and operate geostationary satellites, offering communication services to a variety of customers across the globe. The continuous rise in the extensive use of data communications and increasing demand for high-speed internet is driving the growth of the global market.

In February 2023, the Federal Communications Commission (FCC) has granted, subject to conditions, the application of Kuiper Systems LLC (Kuiper) for modification of its license for a non-geostationary orbit (NGSO) satellite constellation providing fixed-satellite service (FSS) and Mobile Satellite Service (MSS) using Ka-band radio frequencies. This action has allowed Kuiper to start deployment of its constellation in order to bring high-speed broadband connectivity to customers globally.

Moreover, in September 2022, Hughes Communications India (HCI) in collaboration with the Indian Space Research Organization (ISRO) officially launched its first high throughput satellite (HTS) broadband internet service. HCI’s HTS broadband service will combine Ku-band capacity from ISRO's GSAT-11 and LSAT-29 satellites with Hughes JUPITER Platform ground technology. Ku-band is a microwave frequency band used for satellite communication and broadcasting, and uses frequencies of about 12 gigahertz for terrestrial reception, and 14 gigahertz for transmission. By combining Ku-band capacity from ISRO’s satellite with Hughes technology, high-speed broadband can be delivered across India, including the most remote areas. Such cohesive government collaborations are further contributing to the market growth.

Segmental Outlook

The global fixed satellite services market is segmented based on type of services and end-user industry. Based on type, the market is segmented into transponder agreement, and managed services. Based on end-user industry, the market is segmented into media, commercial, aerospace & defense, government, other (healthcare).

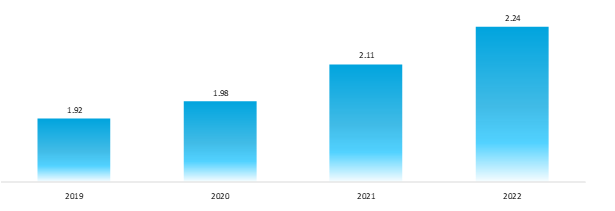

Military & Defense Held Considerable Share in Global Fixed Satellite Services Market

From keeping troops connected to one another when out in the field to coordinating surveillance efforts and monitoring operations from the ground, fixed PTT (push-to-talk) provides an essential communications channel. The US military also uses fixed PTT to communicate with troops stationed in remote locations across the globe that may be out of range of typical radio communication channels. The satellite-based signal ensures a reliable connection and uninterrupted communication even in extreme conditions or faraway places. Therefore, the high demand for fixed satellite services in military & defense along with growing military expenditure globally are driving the growth of this market segment. According to Stockholm International Peace Research Institute (SIPRI), in 2022, military spending worldwide amounted to $2.24 trillion, the highest during the period under consideration.

Global Military Spending, 2019-2022 ($ Trillion)

Source: SIPRI

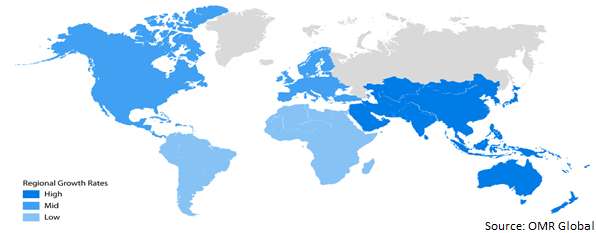

Regional Outlook

The global fixed satellite services market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among all the regions, the Asia-Pacific region is anticipated to exhibit highest CAGR during the forecast period.

Global Fixed Satellite Services Market Growth, by Region 2023-2030

North America Held Considerable Share in the Global Fixed Satellite Services Market

The regional market is driven by the continuous efforts of public and private entities in development of geospatial technologies across the region. In October 2023, a new project led by researchers at the Center for Fixed satellite services at North Carolina State University has modernized the infrastructure of GRASS GIS, a freely available geospatial software platform that has helped researchers create and innovate geospatial workflows for over forty years. The project also strategically grow the GRASS community to achieve a technologically and socially sustainable open-source ecosystem. The work is supported by a 2 year, $1.5 million grant from the National Science Foundation (NSF) Pathways to Enable Open-Source Ecosystems (POSE) program. The various grants for such projects are further contributing to the regional market growth.

Market Players Outlook

The major companies serving the global fixed satellite services market include Eutelsat Communication, Telesat Holdings, Singapore Telecommunications Ltd (Singtel), SES SA, and Intelsat SA among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. The stringent government regulation related to the market and limited orbital locations are key barriers new players entrance into the market. For instance, in June 2023, Bharti-backed OneWeb and Hughes Network Systems have signed a distribution pact to provide low-earth orbit (LEO) connectivity services to the global airline market. Hughes is launching new LEO in-flight connectivity (IFC) solutions, powered by company’s electronically steered antenna (ESA), for airlines to deliver fast and reliable Wi-Fi for passengers.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fixed satellite services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Eutelsat Communications

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Intelsat S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SES SA

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Singapore Telecommunications Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Telesat Holdings Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fixed Satellite Services Market by Type

4.1.1. Transponder Agreement

4.1.2. Managed Services

4.2. Global Fixed Satellite Services Market by End-User Industry

4.2.1. Media

4.2.2. Commercial

4.2.3. Aerospace & Defense

4.2.4. Government

4.2.5. Other (Healthcare)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arab Satellite Communications Organization

6.2. Arbasat Inc.

6.3. Cobham Ltd.

6.4. Echostar

6.5. Embratel Star One

6.6. Gilat Satellite Networks

6.7. Hispasat SA

6.8. Inmarsat Global Ltd.

6.9. Nigerian Communications Satellites Ltd.

6.10. SKY Perfect JSAT Corp.

6.11. Telenor Satellite AS

6.12. Thaicom Public Company Ltd.

6.13. Viasat Inc.

1. GLOBAL FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL TRANSPONDER AGREEMENT IN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MANAGED SERVICES IN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

5. GLOBAL FIXED SATELLITE SERVICES FOR MEDIA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL FIXED SATELLITE SERVICES FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL FIXED SATELLITE SERVICES FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL FIXED SATELLITE SERVICES FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL FIXED SATELLITE SERVICES FOR OTHERS END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

14. EUROPEAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

20. REST OF THE WORLD FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD FIXED SATELLITE SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

1. GLOBAL FIXED SATELLITE SERVICES MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL TRANSPONDER AGREEMENT IN FIXED SATELLITE SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL MANAGED SERVICES IN FIXED SATELLITE SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL GEO VISUALIZATION IN FIXED SATELLITE SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL FIXED SATELLITE SERVICES MARKET SHARE BY END-USER INDUSTRY, 2022 VS 2030 (%)

6. GLOBAL FIXED SATELLITE SERVICES FOR MEDIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL FIXED SATELLITE SERVICES FOR COMMERCIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL FIXED SATELLITE SERVICES FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL FIXED SATELLITE SERVICES FOR GOVERNMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL FIXED SATELLITE SERVICES FOR OTHERS NED-USER INDUSTRIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL FIXED SATELLITE SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. US FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

13. CANADA FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. UK FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. FRANCE FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. GERMANY FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. SPAIN FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF EUROPE FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

20. INDIA FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. CHINA FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

22. JAPAN FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

23. SOUTH KOREA FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF ASIA-PACIFIC FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD FIXED SATELLITE SERVICES MARKET SIZE, 2022-2030 ($ MILLION)