Flash Memory Market

Flash Memory Market Size, Share & Trends Analysis Report by Product type (NAND Flash and NRO Flash), by Application (Cell phones, Digital Camera, Media Player, Solid State Drives (SSD), Security Systems, and Others), by End-User (Industry, Individual, and Enterprise) Forecast Period (2024-2031)

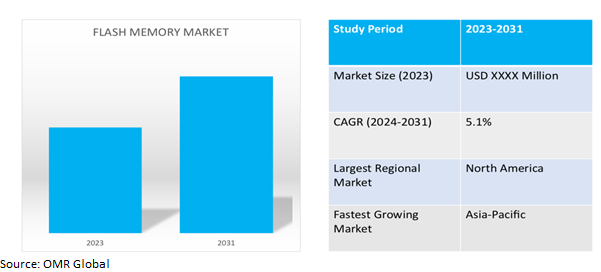

Flash memory market is anticipated to grow at a considerable CAGR of 5.1% during the forecast period (2024-2031). Flash memory has application in portable devices due to their small size, low power consumption, high storage capacity, and other benefits. The market growth is driven by increased usage and sales of smartphones and related digital devices and growing investment in cloud data centers and digital storage by consumers, governments and enterprises.

Market Dynamics

Increase in Digital Storage may benefit the industry

The growth in flash memory market is driven by rising usage of digital storage globally. Major reason being increased use of PCs, laptops, portable storage devices and systems requiring storage facility without energy supply which is more feasible through flash memory (specifically SSD). For instance, according to the World Economic Forum, by 2025, it is estimated that 463 exabytes of data will be created each day globally. Data of such magnitude will require portable storage provided by SSDs used in personal devices as well as cloud storage.

Optimizing Flash Storage technology creating opportunity for companies

Major players are trying to optimize flash storage technology to make it cost effective while providing improvements in storage architecture and speed. For instance, in July 2023, Micron Technology launched the first of its kind 232-layer NAND memory which offers world’s first six-plane TLC production NAND. It has the most planes per die of any TLC flash3 and features independent read capability in each plane. Constant efforts id being made by major players to optimize layers of memory for better performance. Also, the introduction of new technology with more than 300 layers is already in development by SK Hynix.

Segmental Outlook

Our in-depth analysis of the global flash memory market includes the following segments by product type, application, andend-user

- Based on product type, the market is bifurcated into NAND and NOR flash memory.

- Based on application, the market is sub-segmented into cell phones, digital camera, media player, Solid State Drives (SSD), security systems and others.

- Based onend-user, the market has enterprise, industries and individual consumption.

NAND flash memory is projected to Emerge as the Largest Segment

Based on product type, the market is bifurcated into NAND and NOR flash memory. Among the two, NAND flash is gaining more traction in the market offering more endurance and efficiency over NOR flash.NAND flash memoryis used to pack more bits into smaller and lower-profile chips making it useful forcomputer devices such as smartphones, memory cards, SSDs and even memory-intensive projects such as artificial intelligence. Major players are already optimizing and extending its layer size and dimension for better output and integration in future technology.

Cell phones Sub-segment to Hold a Considerable Market Share

Cell phones is one of the major applications of flash memory with biggest market in electronic devices and wide usage. For instance, as per International Telecommunication Union (ITU) globally, 73.0% of the population aged 10 and over own a mobile phone in 2022, 7.0%higher than the individuals who use the Internet. Demand for smartphones and related devices is projected to grow in coming years making it a dominant segment for memory application.

Enterprises sub-segment is expected to grow over coming years

Companies such as IBM, Open stackand Zstore have already launched their offerings for flash memory in cloud and data center industry which is the future of storage and memory technology. Cloud and data center are growing globally to fulfill storage demand of enterprises and individuals using 3D NAND flash and all flash technology making it a growing sub-segment for flash memory.

Regional Outlook

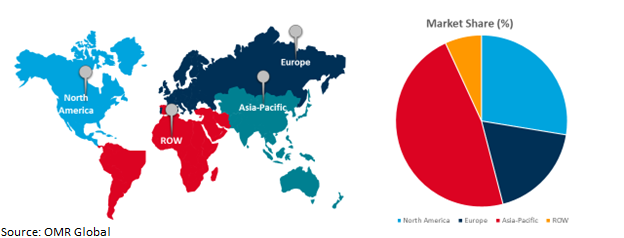

The global flash Memory market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Flash Memory Market

North America holds the highest share of the global flash memory market share. The key factor contributing to the growth is the market presence of major flash memory manufacturers such as Intel, Western Digital, and others. Well-established R&D infrastructure and availability of funds give them an advantage over other regions. Additionally, North America is a leader in export of devices and technology using flash memory as a storage source, particularly the US which is driving demand for flash memory. For instance, according to Bureau of Economic Analysis, in 2023, the export of electric apparatus $6.2 billion, other industrial machinery $5.5 billion and civilian aircraft $4.7 billion increased showing signs for more demand of storage memory in coming years.

Global Flash Memory Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing in Flash Memory market

Asia being the hub for electrical manufacturing with countries such as Taiwan, China, and others provides low-cost manufacturing for global consumption as well as local manufacturing. Also, ample support by government for setting up manufacturing capacities for semiconductors and electronic components and increasing exports. For instance, as per ASEAN 2021 global value chain report E&E (Electronics and electrical) industry was the largest export industry in the region, accounting for 27.0%of the region’s total goods exports in 2019delivering a wide range of industrial and consumer products such as Integrated Circuits (IC), semiconductors, microchips, hard disk drives, computers, mobile phones and televisions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global flash memory market are Samsung, SK Hynix, and Western Digital , Micron Technology and Intel among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in December 2021, SK Hynix acquired Intel’s SSD business and Dalian NAND Flash Manufacturing Facility assets in China aiming to become a global 1sttier technology company. The new entity will be branded as‘Solidigm’.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global flash memory market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Intel Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Micron Technology, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Samsung Electronics Co. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SK Hynix Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Western Digital Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Flash memory Product by type

4.1.1. NAND Flash

4.1.2. NOR Flash

4.2. Global Flash memory Market by Application

4.2.1. Cell phones

4.2.2. Digital cameras

4.2.3. Media players

4.2.4. PCs and Laptops

4.2.5. Solid state drives (SSD)

4.2.6. Security Systems

4.2.7. Others

4.3. Global Flash memory Market by End-User

4.3.1. Industry

4.3.2. Individual

4.3.3. Enterprise

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

Rest of the WorldLatin America

5.4. The Middle East & Africa

6. Company Profiles

6.1. ATP Corp.

6.2. Biwin Storage Technology CO., LTD.

6.3. Greenliant Systems Ltd.

6.4. GigaDevices Semiconductor, Inc.

6.5. Kioxia Corp.

6.6. Marvell Semiconductor, Inc.,

6.7. Nexus Global Business Solutions, Inc.

6.8. Renesas Electronics Corp.

6.9. Silicon Motion Technology Corp

6.10. Swissbit Holding AG

6.11. Tekmos Inc.

6.12. Toshiba Corp.

6.13. Transcend Services, Inc.

6.14. VIA Technologies, Inc.

6.15. Winbond Electronics Corp.

1. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL NAND FLASH MEMORYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NOR FLASHMEMORYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL FLASH MEMORY FOR CELL PHONES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FLASH MEMORY FOR DIGITAL CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FLASH MEMORY FOR MEDIA PLAYERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FLASH MEMORY FOR SOLID STATE DRIVES (SSD) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FLASH MEMORY FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL FLASH MEMORY FOR INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FLASH MEMORY FOR INDIVIDUAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL FLASH MEMORY FOR ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION).

18. NORTH AMERICAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

19. NORTH AMERICAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION).

20. EUROPEAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION).

21. EUROPEAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION).

22. EUROPEAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

23. EUROPEAN FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION).

24. ASIA-PACIFIC FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION).

25. ASIA-PACIFIC FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION).

26. ASIA-PACIFIC FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

27. ASIA-PACIFIC FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION).

28. REST OF THE WORLD FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION).

29. REST OF THE WORLD FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION).

30. REST OF THE WORLD FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

31. REST OF THE WORLD FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION).

1. GLOBAL FLASH MEMORY MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL NAND FLASH MEMORY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NOR FLASH MEMORY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FLASH MEMORY MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL FLASH MEMORY FOR CELL PHONES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FLASH MEMORY FOR DIGITAL CAMERA MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FLASH MEMORY FOR MEDIA PLAYERS-MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FLASH MEMORY FOR SOLID STATE DRIVES (SSD) MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FLASH MEMORY FOR SECURITY SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FLASH MEMORY FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL FLASH MEMORY MARKET SHARE FOR INDUSTRY BY REGION, 2023 VS 2031 (%)

13. GLOBAL FLASH MEMORY MARKET SHARE FOR INDIVIDUAL BY REGION, 2023 VS 2031 (%)

14. GLOBAL FLASH MEMORY MARKET SHARE FOR ENTERPRISES BY REGION, 2023 VS 2031 (%)

15. GLOBAL FLASH MEMORY MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

18. UK FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)

30. THE MIDDLE EAST AND AFRICA FLASH MEMORY MARKET SIZE, 2023-2031 ($ MILLION)