Fleet Management Solution Market

Fleet Management Solution Market Size, Share & Trends Analysis Report by Deployment Model (On-premise, On-Demand, and Hybrid), by Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and Other), and by End-User (Transportation, Energy, Construction, Manufacturing, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Fleet management solution market is anticipated to grow at a CAGR of 14.5% during the forecast period. The government initiatives and regulations in various end-user industries to use fleet management solution are contributing to the global market growth. For instance, the Federal Highway Association (FHWA), the American Association of State Highway and Transportation Officials (AASHTO), and state and local departments of transportation (DOTs), have been encouraging the application of asset management in the transportation and logistics industry to increase operational efficiencies and resolve compliance requirements.

New product launches is further contributing to the global market growth. For instance, in April 2023, Netradyne, a SaaS provider of artificial intelligence (AI) focused on safety and driver coaching for commercial fleets has introduced new solutions and updates to its existing product suite. Netradyne’s new features, Recommended Coaching, Collision Management, Fleet Safety Progress Report, and Fleet Tracking, aim to support commercial fleets of all sizes address these challenges and better adapt to the ever-changing economic and industry climates.

Segmental Outlook

The global fleet management solution market is segmented based on deployment model, solution, and end-user. Based on deployment model, the market is segmented into on-premise, on-demand, and hybrid. Based on solution, the market is segmented into asset management, information management, driver management, safety and compliance management, risk management, operations management, and other solutions. Based on end-user, the market is sub-segmented into transportation, energy, construction, manufacturing, and other end-users.

Asset Management Holds a Considerable Share in the Global Fleet Management Solution Market

Asset management solutions are used for the creation of connections between financial, property and maintenance management, eliminating duplication of databases and maintaining a direct connection to the Fleet Automotive Statistical Tool (FAST). The availability of data and efficient analyses of the same allows for the consequences of each activity for an asset to be monitored such that a review of the cost-benefit analysis can be made.

Mobile assets are a significant source of demand for custom hardware tracking solutions. Over the past few years, the global asset tracking market has witnessed several collaborations that were formed to build advanced tracking solutions; which in turn creating huge deand for asset tracking solutions in fleet management solution market. Implementation of the asset trackers utilizing RFID technology is expected to strengthen demand in several industries, including industrial automation, supply chain, logistics, agriculture, construction, mining, and related markets; which in turn will drive segmental market growth.

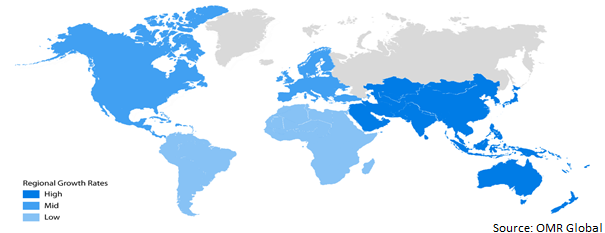

Regional Outlooks

The global fleet management solution market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Asia-Pacific is anticipated to exhibit considerable growth in the global fleet management solution market.

Global Fleet Management Solution Market Growth, by Region 2023-2030

North America Region held Considerable Share in the Global Fleet Management Solution Market

The strong presence of the end-user industries such as manufacturing, transportation, and logistics industries is a key factor creating demand for the fleet management solutions market. The presence of key market players along with the key product launches is further contributing to the market growth. For instance, in May 2023, SVT Fleet Solutions (SVT) has launched its concierge, an end-to-end fleet optimization solution to support companies and municipalities worldwide maximize vehicle efficiency, productivity, and total value.

Further, in March 2023, Carota, provider of global OTA upgrades, remote diagnosis, and fleet solutions, has entered a partnership with Drimaes, a Korean company that provides smart mobility solutions. The agreement aims to introduce OTA functionality into smart control solutions for vehicles, enhance existing software and hardware ecosystem, and provide feature solutions such as Fleet Management System (FMS), Over-the-Air (OTA) updates, OTA update testing, vehicle security, and remote management.

Market Players Outlook

The major companies serving the global fleet management solution market include Cisco Systems Inc., AT&T Inc., Ctrack (Inseego Corp.), I.D. Systems Inc., IBM Corp. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2022, UAE-based IT smart Facilities Management (FM) solutions company HITEK Services, a part of Farnek Group, has launched a custom-built fleet management solution FLEETEK. Developed by HITEK’s in-house tech team, the digital solution can optimize the performance of company transport fleets.

Digitizing the entire fleet management process, FLEETEK identifies both fleet and driver productivity in real time. It achieves this using a system-based inventory and digital schedule, which is powered by IoT sensors fitted to the vehicles and connected with Google Maps to enable tracking and navigation for route optimization.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fleet management solution market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AT&T Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cisco Systems Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fleet Management Solutions Market by Deployment Model

4.1.1. On-Premises

4.1.2. On-Demand

4.1.3. Hydrid

4.2. Global Fleet Management Solutions Markey by Solution

4.2.1. Asset Management

4.2.2. Information Management

4.2.3. Driver Management

4.2.4. Safety & Compliance Management

4.2.5. Risk Management

4.2.6. Operation Management

4.2.7. Other

4.3. Global Fleet Management Solutions Market by End-User

4.3.1. Transportation

4.3.2. Energy

4.3.3. Construction

4.3.4. Manufacturing

4.3.5. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Astrata Group

6.2. AT&T Inc.

6.3. Cisco Systems Inc.

6.4. Ctrack (Inseego Corp.)

6.5. Fleet Complete Inc.

6.6. Fleetable (Affable Web Solutions Co.)

6.7. Geotab Inc.

6.8. IBM Corp.

6.9. KeepTrucking Inc.

6.10. Mix Telematics Ltd.

6.11. Octo Group SpA

6.12. Odoo SA

6.13. Omnitracs LLC

6.14. Rarestep Inc. (FLEETIO)

6.15. Samsara Network Inc.

6.16. Tenna LLC

6.17. Tomtom NV

6.18. Trimble Navigation LTD.

6.19. Verizon Communications Inc.

6.20. Wheels Inc.

1. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2022-2030 ($ MILLION)

2. GLOBAL ON-PREMISE BASED FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL ON-DEMAND BASED FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HYBRID BASED FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

6. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR INFORMATION MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR DRIVER MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR SAFETY & COMPLIANCE MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OPERATION MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OTHER SOLUTIONS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

14. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

15. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR ENERGY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

16. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

17. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

18. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

19. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. NORTH AMERICAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. NORTH AMERICAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2022-2030 ($ MILLION)

22. NORTH AMERICAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

23. NORTH AMERICAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

24. EUROPEAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. EUROPEAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2022-2030 ($ MILLION)

26. EUROPEAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

27. EUROPEAN FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

28. ASIA- PACIFIC FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. ASIA- PACIFIC FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2022-2030 ($ MILLION)

30. ASIA- PACIFIC FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

31. ASIA- PACIFIC FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

32. REST OF THE WORLD FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

33. REST OF THE WORLD FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2022-2030 ($ MILLION)

34. REST OF THE WORLD FLEET MANAGEMENT SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY DEPLOYMENT MODEL, 2022 VS 2030 (%)

2. GLOBAL ON-PREMISES BASED FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL ON-DEMAND BASED FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL HYBRID BASED FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY SOLUTION, 2022 VS 2030 ($ MILLION)

6. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR ASSET MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR INFORMATION MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR DRIVER MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR SAFETY & COMPLIANCE MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR RISK MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OPERATION MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OTHERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET SHARE ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

14. GLOBAL TRANSPORTATION BASED FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR ENERGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR CONSTRUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR MANUFACTURING MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL FLEET MANAGEMENT SOLUTIONS FOR OTHER END-USERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL FLEET MANAGEMENT SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. US FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

21. CANADA FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

22. UK FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

23. FRANCE FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

24. GERMANY FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

25. ITALY FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

26. SPAIN FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF EUROPE FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

28. INDIA FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

29. CHINA FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

30. JAPAN FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

31. SOUTH KOREA FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

32. REST OF ASIA-PACIFIC FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)

33. REST OF THE WORLD FLEET MANAGEMENT SOLUTIONS MARKET SIZE, 2022-2030 ($ MILLION)