Flocculants Market

Global Flocculants Market Size, Share & Trends Analysis Report, By Type (Synthetic Flocculants and Natural Flocculants), By End-User (Municipalities, Oil & Gas, Food & Beverages, Metal & Mining, and Others), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global flocculants market is anticipated to grow at a CAGR of 4.9% during the forecast period. The market growth is attributed to the increasing application in surface and physical chemistry and rising demand for water treatment. Flocculants are widely used in water treatment plants as well as in water purifiers. In addition, these find application in the treatment of industrial wastewater. The process of water treatment includes grates, sedimentation, granular filtration, coagulation, flocculation, and disinfection. Therefore, increasing demand for flocculants in water treatment plants spurs the growth of the global flocculants market.

Additionally, power generation plants necessarily require water for day-to-day operations. The wastewater produced from this industry comprises significant levels of toxic metal impurities, including arsenic, mercury, lead, chromium, cadmium, and others, which, if not treated properly, may cause damage to the environment. This will increase the demand for water treatment chemicals such as flocculants in the industry. This, in turn, will drive the growth of the global flocculants industry.

Flocculants also find applications in the food & beverages industry for the treatment of wastewater. Further, in the mining industry, these are used for the removal of red muds from minerals during the treatment process. Increasing demand for specific formulations in emerging economies tends to create ample opportunity for the growth of the industry. However, the presence of alternative treatment technologies and rising demand for eco-friendly products may restrict the growth of the market.

Segmental Outlook

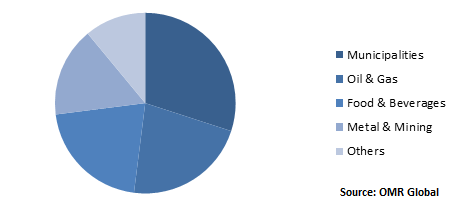

The global flocculants market is segmented on the basis of type and end-user. Based on type, the market is bifurcated into synthetic flocculants and natural flocculants. Synthetic flocculants are made from polyacrylamides. The different types of synthetic include polyamines, polyethylene-oxide, polyethylene-imines, sulfonated compounds, and polyamides amines. Based on end-user, the market is segmented into municipalities, oil & gas, food & beverage, metal & mining, and others.

Global Flocculants Market Share by End-User, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global flocculants market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Akzo Nobel NV

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Huntsman Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Kemira Oyj

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. SNF Group

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Flocculants Market by Type

5.1.1. Synthetic Flocculants

5.1.2. Natural Flocculants

5.2. Global Flocculants Market by End-User

5.2.1. Municipalities

5.2.2. Oil & Gas

5.2.3. Food & Beverages

5.2.4. Metal & Mining

5.2.5. Others

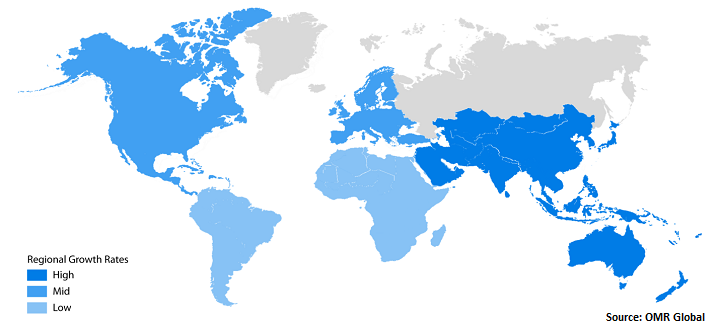

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aditya Birla Group

7.2. Ak-Kim

7.3. Ashland Inc.

7.4. Akzo Nobel NV

7.5. BASF SE

7.6. ChemTreat, Inc.

7.7. Ecolab Inc.

7.8. Feralco Group

7.9. Geo Specialty Chemicals, Inc.

7.10. HYMO Corp.

7.11. Huntsman Corp.

7.12. Ixom

7.13. Kemira Oyj

7.14. SNF Group

7.15. Solenis International LP

7.16. Solvay SA

7.17. The Dow Chemical Co.

7.18. Toagosei Group

1. GLOBAL FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL NATURAL FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SYNTHETIC FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

5. GLOBAL FLOCCULANTS IN MUNICIPALITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL FLOCCULANTS IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL FLOCCULANTS IN METAL & MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL FLOCCULANTS IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL FLOCCULANTS IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. EUROPEAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. REST OF THE WORLD FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD FLOCCULANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL FLOCCULANTS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL FLOCCULANTS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL FLOCCULANTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD FLOCCULANTS MARKET SIZE, 2018-2025 ($ MILLION)