Fluoroelastomer Market

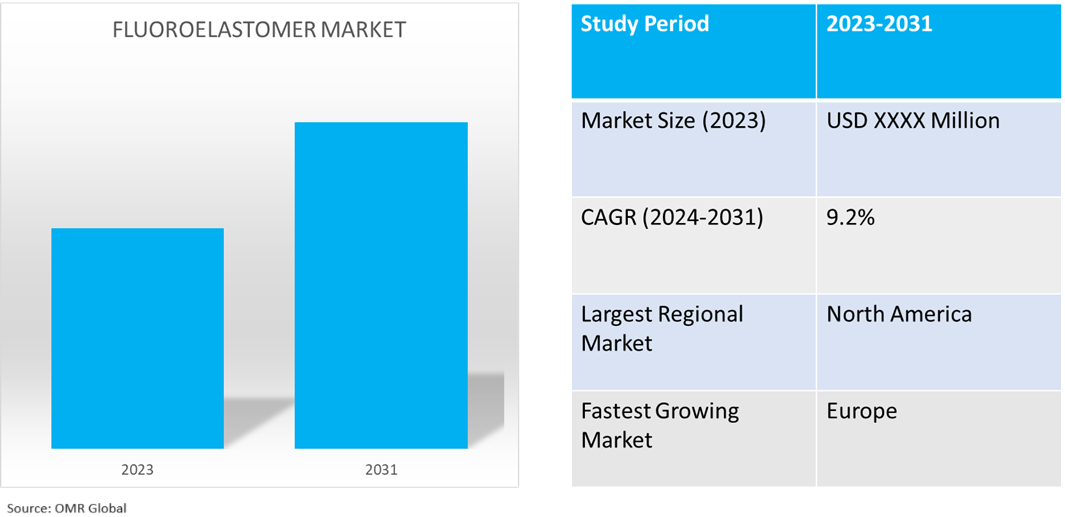

Fluoroelastomer Market Size, Share & Trends Analysis Report by Sales Channel (Direct, and Indirect), by Application (O-rings, Seals and Gaskets, Hoses and Tubing, and Other), and by End-User (Automotive and Transportation, Chemical Processing, Aerospace, Oil and Gas, Petroleum Refining, Food and Pharmaceutical, and Other) Forecast Period (2024-2031)

Fluoroelastomer market is anticipated to grow at a considerable CAGR of 9.2% during the forecast period (2024-2031). Fluoroelastomer (FKM) is a synthetic rubber based on fluorocarbons. It has many properties that make it useful in a variety of high-performance applications. The market growth is attributed to the increasing demand for fuel-efficient vehicles, and the growing adoption of high-temperature resistance materials with significant applications in end-user industries such as automotive, aerospace, and oil & gas industries.

Market Dynamics

Increased Demand for High-Performance Rubber Materials

Fluoroelastomers are growing increasingly common owing to their exceptional durability, chemical resistance, and heat resistance, which makes them perfect for usage in the oil and gas, automotive, and aerospace industries. For instance, Trelleborg Group offers High-performance fluoroelastomer materials to provide vacuum integrity, demonstrating very low O2 and H2O permeation, along with very low outgassing rates. These materials are suitable for use in a wide variety of applications such as transfer chambers and subfab applications where vacuum integrity is extremely important to maintain high process yields. The company provides custom-designed seals including rubber-to-metal and rubber-to-plastic bonded products such as wafer handling seals.

Advancements in Manufacturing Technologies to increase Efficiency and Capabilities

Innovations in manufacturing techniques such as extrusion and injection molding are boosting fluoroelastomer production's capacity and efficiency, resulting in lower costs and better-quality materials. Fluoroelastomers are appealing polymeric materials owing to their distinct characteristics and successful applications across numerous industries. The potential for fluoroelastomers grows as various technologies and demands in the industrial environment advance. For instance, Syensqo’s portfolio of specialty polymers for smart devices, such as smartphones and wearables, offers an abundance of select materials to simplify manufacturing and improve application performance.

Market Segmentation

- Based on the sales channel, the market is segmented into direct and indirect.

- Based on the application, the market is segmented into O-rings, seals and gaskets, hoses and tubing, and other (diaphragms).

- Based on the end-user, the market is segmented into automotive and transportation, chemical processing, aerospace, oil and gas, petroleum refining, food and pharmaceutical, and other (energy & power).

Seals and Gaskets is Projected to Hold the Largest Segment

The seals and gaskets segment is expected to hold the largest share of the market. A long service life of fluoroelastomer components at temperatures above 150°C (302°F) is a key factor promoting the adoption of fluoroelastomer for making seals & gaskets. Additionally, some specialty perfluoroelastomer parts can withstand sustained temperatures above 300°C (572°F). Market players offering industrial coatings and sealants applications in offering solutions to problems caused by chemical attacks, mechanical abrasion, and erosion/corrosion of metal and other substrates. Common uses include concrete crack repair, expansion joint sealant, coating metal housings, sealant for tank lids, and improving existing gasket seals. For instance, Pelseal Technologies, LLC offers new liquid fluoromer product formulations for industrial coatings and sealants. Pelseal created the formulations to refine the physical properties of its existing products for better Volatile organic compounds (VOC), higher solids content, process viscosity, or adhesion properties.

Automotive and Transportation Segment to Hold a Considerable Market Share

The automotive and transportation segment is expected to hold a considerable share of the market. The factors supporting segment growth include the extensive production of automotive components globally. Fluoroelastomer is integrated into vehicle components such as drivetrains and fuel management systems to increase fuel economy and reduce pollution. The growing usage of hoses, gaskets, 0-rings, and seals in aircraft fuel systems, which serve as resistance to fuels and as barriers against emissions is further aiding the growth of this market segment.

Regional Outlook

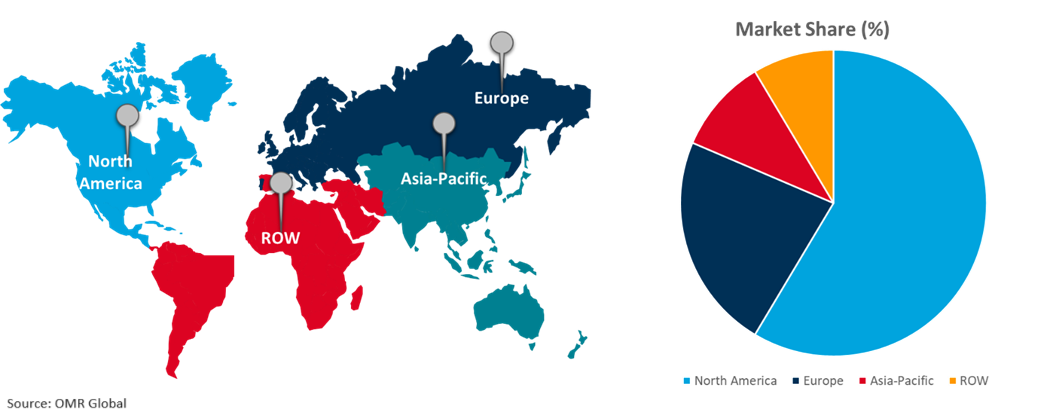

Global fluoroelastomer market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Fluoroelastomers in Europe

- The regional growth is attributed to increasing demand for fuel-efficient vehicles from consumers. To get the required efficiency, automotive manufacturers are heavily investing in R&D to alter their current designs and concentrate on lightweight materials. To increase efficiency, the manufacturers are reducing the size of engine and powertrain parts and adding air circulation systems. Fluoroelastomer is expected to experience a surge in demand owing to its resistance to a broad range of temperatures and its compatibility with a wide range of solvents. The fluoroelastomer market expands owing to conventional elastomers' incapacity to withstand high temperatures.

- Owing to the presence of major aerospace and automotive manufacturers such as Airbus and Dassault Aviation, the demand for these fluoroelastomers is rising in Europe. The main countries that fueled the demand were France, Germany, and the UK. The demand for fluoroelastomers is expected to increase owing to their broad usage in the chemical and oil and gas industries.

Global Fluoroelastomer Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of numerous prominent fluoroelastomer companies and providers such as 3M, DuPont de Nemours, Inc., Parker Hannifin Corp., and The Chemours Co. in the region. The market growth is attributed to the increasing demand for highly fluorinated carbon-based polymers called fluoroelastomers employed in major industries for sealing, oil and chemical resistance, and high thermal stability. Owing to having better mechanical qualities than traditional rubbers, the automotive sector is placing a lot of demand on this market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the fluoroelastomer market include 3M Company, Daikin Industries, Ltd., DuPont de Nemours, Inc., Parker Hannifin Corp., and Zeon Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In May 2022, The Chemours Co. announced Process Innovation with New Viton Fluoroelastomers Advanced Polymer Architecture (APA) Offering to produce Advanced Polymer Architecture (APA) grade Viton fluoroelastomers, without the use of a fluorinated polymerization aid. With the introduction of this new technology and prior innovations, Chemours now manufactures the entire Viton fluoroelastomers portfolio using a non-fluorinated surfactant and continues its leadership in fluoroelastomer process and product development.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the fluoroelastomer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Daikin Industries, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DuPont de Nemours, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Parker Hannifin Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Zeon Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fluoroelastomer Market by Sales Channel

4.1.1. Direct

4.1.2. Indirect

4.2. Global Fluoroelastomer Market by Application

4.2.1. O-rings

4.2.2. Seals and Gaskets

4.2.3. Hoses and Tubing

4.2.4. Other (Diaphragms)

4.3. Global Fluoroelastomer Market by End-Users

4.3.1. Automotive and Transportation

4.3.2. Chemical Processing

4.3.3. Aerospace

4.3.4. Oil and Gas

4.3.5. Petroleum Refining

4.3.6. Food and Pharmaceutical

4.3.7. Other (Energy & Power)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. A.R. Thomson Group Inc.

6.2. Eagle Elastomer Inc.

6.3. Fluoron Inc.

6.4. Freudenberg FST GmbH

6.5. GC Chemicals Americas, Inc.

6.6. Greene, Tweed & Co.

6.7. Hallstar Innovations Corp.

6.8. HaloPolymer Trading Inc.

6.9. Hutchinson Aerospace & Industry Inc.

6.10. James Walker Group Ltd.

6.11. Mantaline Corp.

6.12. Momentive Performance Materials Inc.

6.13. Pelseal Technologies, LLC

6.14. PolyComp GmbH

6.15. Precision Polymer Engineering Ltd.

6.16. Seal & Design Inc.

6.17. Shandong Huaxia Shenzhou New Material Co., Ltd.

6.18. Solvay S.A.

6.19. Syensqo

6.20. The Chemours Co.

6.21. Trelleborg AB

1. GLOBAL FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

2. GLOBAL FLUOROELASTOMER VIA DIRECT SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FLUOROELASTOMER VIA INDIRECT SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL FLUOROELASTOMER FOR O-RINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FLUOROELASTOMER FOR SEALS AND GASKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FLUOROELASTOMER FOR HOSES AND TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FLUOROELASTOMER FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

10. GLOBAL FLUOROELASTOMER FOR AUTOMOTIVE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FLUOROELASTOMER FOR CHEMICAL PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL FLUOROELASTOMER FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FLUOROELASTOMER FOR OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL FLUOROELASTOMER FOR PETROLEUM REFINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FLUOROELASTOMER FOR FOOD AND PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL FLUOROELASTOMER FOR OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

20. NORTH AMERICAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. EUROPEAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

24. EUROPEAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. EUROPEAN FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

30. REST OF THE WORLD FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

32. REST OF THE WORLD FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD FLUOROELASTOMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL FLUOROELASTOMER MARKET SHARE BY SALES CHANNEL, 2023 VS 2031 (%)

2. GLOBAL FLUOROELASTOMER VIA DIRECT SALES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FLUOROELASTOMER VIA INDIRECT SALES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FLUOROELASTOMER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL FLUOROELASTOMER FOR O-RINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FLUOROELASTOMER FOR SEALS AND GASKETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FLUOROELASTOMER FOR HOSES AND TUBING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FLUOROELASTOMER FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FLUOROELASTOMER MARKET SHARE BY END-USER, 2023 VS 2031 (%)

10. GLOBAL FLUOROELASTOMER FOR AUTOMOTIVE AND TRANSPORTATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FLUOROELASTOMER FOR CHEMICAL PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FLUOROELASTOMER FOR AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FLUOROELASTOMER FOR OIL AND GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL FLUOROELASTOMER FOR PETROLEUM REFINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL FLUOROELASTOMER FOR FOOD AND PHARMACEUTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL FLUOROELASTOMER FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL FLUOROELASTOMER MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

20. UK FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA FLUOROELASTOMER MARKET SIZE, 2023-2031 ($ MILLION)