Fluoropolymer Tubing Market

Global Fluoropolymer Tubing Market Size, Share & Trends Analysis Report By Type (PTFE Tubing, FEP Tubing, PFA Tubing, and Others), and By Application (Medical, Chemical, Electronics, and Others) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The global fluoropolymer tubing market is anticipated to grow at a significant CAGR of 4.6% during the forecast period. One of the major factors contributing to the growth of the market is the increasing applications provided by fluoropolymer tubing. Fluoropolymer tubing is built with non-stick fluoropolymer resins, merged with their low obtainable levels and having chemically non-reactive attributes, which makes it resist mechanical and thermal shock, and is non-aging. These properties have grown the demand for fluoropolymer tubing in industries.

Impact of COVID-19 Pandemic on Global Fluoropolymer Tubing Market

The COVID-19 pandemic had disrupted the manufacturing operations of various industries including fluoropolymer production owing to the imposition of lockdown across the globe by several governments. Further, the COVID-19 pandemic had also affected the buying behavior of the consumers, as people were more focused on buying more essential goods. Many companies operating in the market were also impacted in an adverse manner due to the COVID-19 pandemic. For instance, as per the annual report of AMETEK Inc., the net sale of the company in 2020 was decreased to $4.5 billion which was $5.1 billion in 2019.

Segmental Outlook

The global fluoropolymer tubing market is segmented based on the type and application. Based on the type, the market is segmented into polytetrafluoroethylene (PTFE) tubing, fluorinated ethylene-propylene (FEP) tubing, perfluoroalkoxy polymer (PFA) tubing, and others. The other types of fluoropolymer tubing are ETFE tubing, PVDF tubing, H2 tubing, and heat shrink tubing. Based on the application, the market is sub-segmented into the medical, chemical, electronics, and others. The other applications of fluoropolymer tubing are automotive, semiconductor, waste processing, and food & beverage.

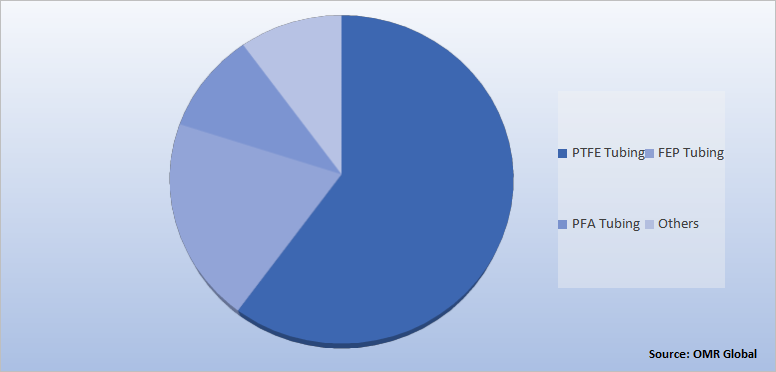

Global Fluoropolymer Tubing Market Share by Type, 2020 (%)

The PTFE Tubing Segment Holds the Major Share in the Global Fluoropolymer Tubing Market

The PTFE tubing segment holds the major share in the market and is anticipated to remain the fastest-growing segment during the forecast period. PTFE tubing has been preferred by most industries that include medical, chemical, electronics, automotive among others due to its wide range of unique properties such as high-temperature resistance and chemical resistance with non-sticky appearances. Moreover, comparing the flexibility, PFA is more flexible than PTFE, however, PFA has lower flex life (a capability to endure repetitive folding) when compared. Additionally, PTFE is a bit more resistant to heat, water absorption, and weathering.

Regional Outlooks

The global fluoropolymer tubing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

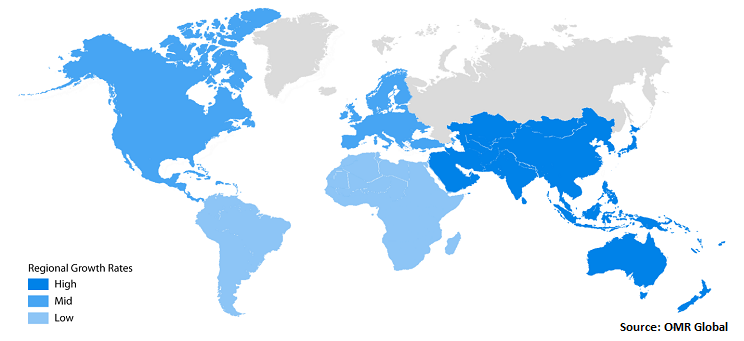

Global Fluoropolymer Tubing Market Growth by Region, 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Fluoropolymer Tubing Market

Asia-Pacific region holds the major share and is projected to be the fastest-growing market during the forecast period, owing to the rise in demand for fluoropolymers products. The presence of big manufacturing centers in China and India drives the Asia-Pacific fluoropolymer tubing market, due to the rise in need for high-quality medical, consumer, automotive, and electronics goods. A substantial volume of fluoropolymers and fluoropolymer tubings consumed within the US is manufactured in China. Additionally, China is also among the most vital consumers of fluoropolymer tubing globally.

Market Players Outlook

The major companies serving the global fluoropolymer tubing market include AMETEK FPP, NICHIAS Corp., PARKER HANNIFIN CORP., Saint-Gobain Performance Plastics, and Zeus Industrial Products, Inc. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Zeus Industrial Products, Inc. had elaborated its StreamLiner family of thin, extruded PTFE catheter liners. Through a proprietary process, the company can include xtrude liners over-the-wire (OTW) in sizes comparable to film cast tubing.

In March 2019, one of the leading solutions providers for extremely corrosive and ultra-high purity applications named AMETEK FPP launched a high purity shell for corrosive and pure chemicals and a tube heat exchanger for cooling and heating. The XXP280 is a 100% Fluoropolymer construction with a rugged design that allows precise temperature control in extreme environments. Additionally, its honeycomb design enables better heat transfer rates while keeping a high-pressure capability and compact size.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global fluoropolymer tubing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Fluoropolymer Tubing Market

• Recovery Scenario of Global Fluoropolymer Tubing Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. AMETEK Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. NICHIAS Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. PARKER HANNIFIN CORP.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Saint-Gobain Performance Plastics

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Zeus Industrial Products, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Fluoropolymer Tubing Market by Type

4.1.1. Polytetrafluoroethylene (PTFE) Tubing

4.1.2. Fluorinated ethylene-propylene (FEP) Tubing

4.1.3. Perfluoroalkoxy polymer (PFA) Tubing

4.1.4. Others (ETFE Tubing, PVDF Tubing, H2 Tubing, and Heat Shrink Tubing)

4.2. Global Fluoropolymer Tubing Market by Application

4.2.1. Medical

4.2.2. Chemical

4.2.3. Electronics

4.2.4. Others (Automotive, Semiconductor, Waste Processing, and Food & Beverage)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adtech Polymer Engineering Ltd. Co.

6.2. Altaflo

6.3. Dongguan Saniu Electronics Co., Ltd.

6.4. Entegris

6.5. Habia Teknofluor AB

6.6. Junkosha Inc.

6.7. Integrated Polymer Solutions

6.8. NewAge Industries

6.9. Polyflon Technology Ltd.

6.10. Shanghai Eco Polymer Sci.&Tech. Co., Ltd.

6.11. Swagelok Co.

6.12. Tef-Cap Industries Inc.

6.13. Xtraflex

6.14. Yodogawa Hu-Tech Co, Ltd.

1. GLOBAL FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL PTFE TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL FEP TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL PFA TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

7. GLOBAL MEDICAL FOR FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL CHEMICAL FOR FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ELECTRONICS FOR FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OTHERS FOR FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

14. NORTH AMERICAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. EUROPEAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. REST OF THE WORLD FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD FLUOROPOLYMER TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FLUOROPOLYMER TUBING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FLUOROPOLYMER TUBING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL FLUOROPOLYMER TUBING MARKET, 2021-2027 (%)

4. GLOBAL FLUOROPOLYMER TUBING MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL PTFE TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL FEP TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL PFA TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL OTHERSTUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL FLUOROPOLYMER TUBING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

10. GLOBAL MEDICAL FOR FLUOROPOLYMER TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL CHEMICAL FOR FLUOROPOLYMER TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL ELECTRONICS FOR FLUOROPOLYMER TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL OTHERS FOR FLUOROPOLYMER TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL FLUOROPOLYMER TUBING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

17. UK FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD FLUOROPOLYMER TUBING MARKET SIZE, 2020-2027 ($ MILLION)