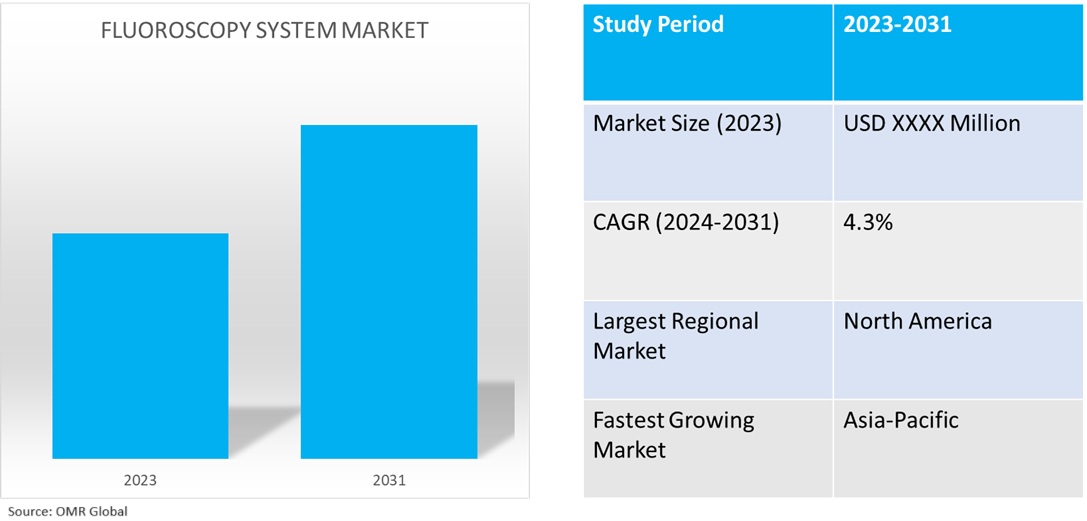

Fluoroscopy system market

Fluoroscopy System Market Size, Share & Trends Analysis Report by Product Type (Fixed C-Arms, Fluoroscopy Devices, and Mobile C-arms), by Application (Urology, Neurology, Orthopedic, Cardiovascular, General Surgery, Gastrointestinal, and Pain Management & Trauma)), and by End-User (Hospital, Diagnostic Centers, and Specialty Clinics) Forecast Period (2024-2031)

Fluoroscopy system market is anticipated to grow at a CAGR of 4.3% during the forecast period (2024-2031). Fluoroscopy system is a medical imaging system that utilizes X-ray technology to capture continuous images of moving internal structures, enabling physicians to monitor and guide various medical procedures in real time. The market growth is driven by growing spending on advanced scanning technology such as digital fluoroscopy and flat-panel detectors for chronic disease treatment.

Market Dynamics

Increasing Investment in Healthcare Infrastructure Modernization

The surge in funding for the modernization of healthcare infrastructure has significantly expanded the fluoroscopy systems market, particularly in developing nations. This funding involves upgrading state-owned medical equipment, including fluoroscopy systems that are essential for conducting precise and efficient diagnostic and interventional procedures. Moreover, the investment in modernization is specifically aimed at enhancing patient outcomes, streamlining workflow, adhering to regulatory standards, and meeting the growing demand for advanced diagnostics and specialized procedures. For instance, the US Department of Healthcare and Human Services has proposed a budget that includes investments in aging systems and facilities crucial to the department's mission. In FY 2024, HHS is seeking to allocate $650 million from the fund for information technology and infrastructure projects throughout the department, including at IHS (India Health Services), NIH (National Institute for Health), and CDC (Center for Disease Control). This fund allows HHS to move unobligated balances of expired discretionary funds into this account for essential information technology and facility infrastructure acquisitions. Since FY 2013, the fund has distributed more than $6.5 billion in capital investment projects across the department.

Constant Innovation in Imaging Technology

The advancement of imaging systems has been a leading propeller for the growth of the fluoroscopy systems market. The advancements such as digital fluoroscopy systems and flat-panel detectors have resulted in enhanced image quality, reduced radiation exposure, wider clinical applications, and improved overall system efficiency features, all of which have enabled healthcare professionals to exercise better workflow alongside enhancing data-capturing abilities, better technological integration, and improved post-examination procedural workflow. For instance, in November 2023, Fujifilm Healthcare Americas Corporation, a provider of diagnostic and enterprise imaging solutions, unveiled a selection of new medical systems at the 2023 Radiological Society of North America (RSNA) annual meeting in Chicago. Among these were the Persona RF PREMIUM+ and Persona C-HR fluoroscopy systems. The Persona RF PREMIUM+ features a distinctive 71-inch source-to-image distance (SID) suitable for chest and long-length exams, effectively meeting a variety of clinical needs. Conversely, the Persona C-HR represents Fujifilm's latest mobile fluoroscopy c-arm solution, delivering high-quality images for real-time visualization of intricate details during cardiac procedures, thanks to its 81 cm opening.

Segmental Outlook

- Based on type, the market is segmented into fixed c-arms, fluoroscopy devices, and mobile c-arms

- Based on application, the market is segmented into urology, neurology, orthopedic, cardiovascular, general surgery, gastrointestinal, and pain management & trauma.

- Based on end-users, the market is segmented into hospitals, diagnostic centers, and specialty clinics.

Cardiovascular Holds Major Share Based on Application

Cardiovascular procedures are the primary application segment for fluoroscopy systems owing to their capability to guide intricate interventions like cardiac catheterizations. Advancements in minimally invasive techniques demanding real-time imaging, ongoing improvements in image clarity and safety, and expanding healthcare accessibility globally are also aiding to segment’s growth. For instance, according to the World Heart Report 2023, over 500 million individuals globally are still impacted by cardiovascular diseases, resulting in 20.5 million fatalities in 2021. This represents nearly one-third of all global deaths and a general rise from the previously estimated 121 million CVD-related deaths.

Hospital is the Prominent Fluoroscopy System End-User

Hospitals remain the prominent end-users of fluoroscopy systems owing to escalating demand for advanced imaging technologies in hospitals to facilitate intricate treatments, and ongoing enhancements in system capabilities enhancing patient outcomes. The larger patient footfalls in hospitals, the regulatory focus on patient safety and care standards, and the expansion of healthcare facility investment in emerging markets necessitating modern medical equipment are further creating growth in the hospital segment.

Regional Outlook

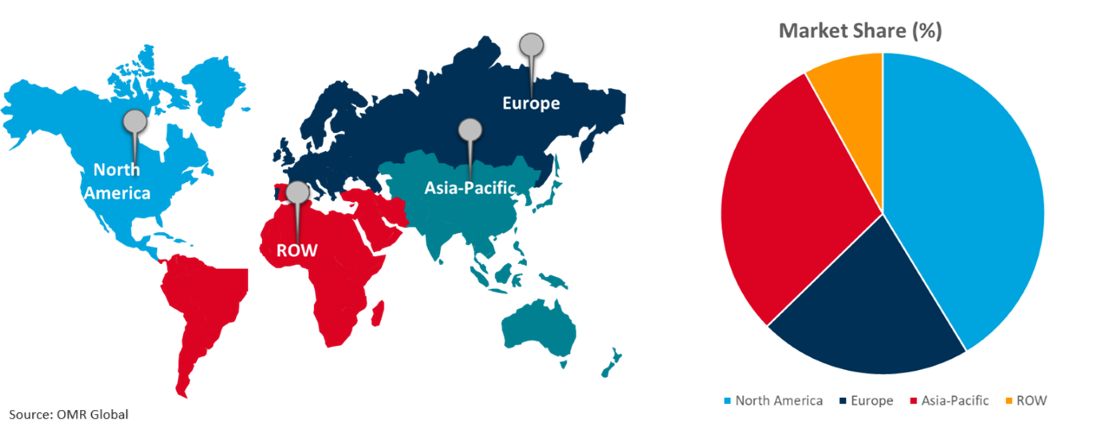

The global fluoroscopy system market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Fluoroscopy System Market Growth by Region 2024-2031

North America to Dominate the Global Fluoroscopy System Market

North America is projected to dominate the fluoroscopy systems market in the future, attributed to the ongoing investment in modernizing healthcare infrastructure, comparatively higher healthcare spending in the region, the presence of major fluoroscopy systems manufacturers such as Stryker and Abbott, among others, stringent regulatory requirements for the deployment of modern or up-to-date healthcare systems in healthcare institutions, and higher early diagnosis consciousness in the region. For instance, according to the American Medical Association, health spending in the US rose by 4.1% in 2022 to $4.5 trillion, or $13,493 per capita. This growth rate mirrors pre-pandemic levels (4.1% in 2019). Despite increased government spending to address the pandemic, these expenses decreased significantly in 2021, while the use of medical services and products rebounded. By 2022, the overall trends in health spending more closely resembled those of the pre-pandemic era. In 2022, health spending accounted for 17.3% of GDP, similar to pre-pandemic levels (17.5% in 2019) following a rise in 2020 (19.5%) and 2021 (18.2%).

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global fluoroscopy system market include Abbott, B Braun SE, KARL STORZ SE & Co. KG, Medtronic PLC, and Stryker Corp., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in November 2022, Canon Medical Systems Europe officially declared a partnership with French radiology manufacturer, DMS Imaging, within the European Union. This collaboration aims to introduce a cutting-edge generation of radiography and fluoroscopy (RF) systems. The newly developed digital RF system, which is remote-controlled and incorporates Canon Medical's technology, is designed to enhance workflow efficiency and patient comfort. With its flexibility, versatility, and advanced features, this system is well-equipped to address the intricate requirements and stringent quality standards of the modern medical imaging landscape.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fluoroscopy system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. B Braun SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. KARL STORZ SE & Co. KG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Medtronic PLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Stryker Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fluoroscopy System Market by Product

4.1.1. Fixed C-Arms

4.1.2. Fluoroscopy Devices

4.1.3. Mobile C-arms

4.2. Global Fluoroscopy System Market by Application

4.2.1. Urology

4.2.2. Neurology

4.2.3. Orthopedic

4.2.4. Cardiovascular

4.2.5. General Surgery

4.2.6. Gastrointestinal

4.2.7. Pain Management & Trauma

4.3. Global Fluoroscopy System Market by End-User

4.3.1. Hospital

4.3.2. Diagnostic Centers

4.3.3. Specialty Clinics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Block Imaging, Inc.

6.2. BMI Biomedical International s.r.l

6.3. Braun & Co.

6.4. Canon Medical Systems Corp.

6.5. Carestream Health, Inc.

6.6. FUJIFILM Holdings Corp.

6.7. General Electric Co.

6.8. Hitachi, Ltd.

6.9. Hologic, Inc.

6.10. Koninklijke Philips N.V.

6.11. Medtronic Plc.

6.12. Nanjing Perlove Medical Equipment Co., Ltd.

6.13. Siemens Healthcare Pvt. Ltd.

6.14. Shimadzu Corp.

6.15. Toshiba Inspection Solutions Co., Ltd.

6.16. Varian Medical Systems, Inc.

6.17. Vieworks Co., Ltd.

6.18. Villa Sistemi Medicali SpA

1. Global Fluoroscopy System Market Share by Product, 2023 Vs 2031 (%)

2. Global Fixed C-Arms Market Share by Region, 2023 Vs 2031 (%)

3. Global Fluoroscopy Devices Market Share by Region, 2023 Vs 2031 (%)

4. Global Mobile C-Arms Market Share by Region, 2023 Vs 2031 (%)

5. Global Fluoroscopy System Market Share by Application, 2023 Vs 2031 (%)

6. Global Fluoroscopy System in Urology Market Share by Region, 2023 Vs 2031 (%)

7. Global Fluoroscopy System in Neurology Market Share by Region, 2023 Vs 2031 (%)

8. Global Fluoroscopy System in Orthopedic Market Share by Region, 2023 Vs 2031 (%)

9. Global Fluoroscopy System in Cardiovascular Market Share by Region, 2023 Vs 2031 (%)

10. Global Fluoroscopy System in General Surgery Market Share by Region, 2023 Vs 2031 (%)

11. Global Fluoroscopy System in Gastrointestinal Market Share by Region, 2023 Vs 2031 (%)

12. Global Fluoroscopy System in Pain Management & Trauma Market Share by Region, 2023 Vs 2031 (%)

13. Global Fluoroscopy System Market Share by End-User, 2023 Vs 2031 (%)

14. Global Fluoroscopy System for Hospital Market Share by Region, 2023 Vs 2031 (%)

15. Global Fluoroscopy System for Diagnostic Centers Market Share by Region, 2023 Vs 2031 (%)

16. Global Fluoroscopy System for Specialty Clinics Market Share by Region, 2023 Vs 2031 (%)

17. Global Fluoroscopy System Market Share by Region, 2023 Vs 2031 (%)

18. US Fluoroscopy System Market Size, 2023-2031 ($ Million)

19. Canada Fluoroscopy System Market Size, 2023-2031 ($ Million)

20. UK Fluoroscopy System Market Size, 2023-2031 ($ Million)

21. France Fluoroscopy System Market Size, 2023-2031 ($ Million)

22. Germany Fluoroscopy System Market Size, 2023-2031 ($ Million)

23. Italy Fluoroscopy System Market Size, 2023-2031 ($ Million)

24. Spain Fluoroscopy System Market Size, 2023-2031 ($ Million)

25. Rest of Europe Fluoroscopy System Market Size, 2023-2031 ($ Million)

26. India Fluoroscopy System Market Size, 2023-2031 ($ Million)

27. China Fluoroscopy System Market Size, 2023-2031 ($ Million)

28. Japan Fluoroscopy System Market Size, 2023-2031 ($ Million)

29. South Korea Fluoroscopy System Market Size, 2023-2031 ($ Million)

30. Rest of Asia-Pacific Fluoroscopy System Market Size, 2023-2031 ($ Million)

31. Latin America Fluoroscopy System Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Fluoroscopy System Market Size, 2023-2031 ($ Million)