Foam Glass Market

Foam Glass Market Size, Share & Trends Analysis Report by Type (Open Cell Foam Glass, Closed Cell Foam Glass, and Mixed Cell Foam Glass) and by Application (Building and Construction, Industrial, Chemical, and Marine) Forecast Period (2024-2031)

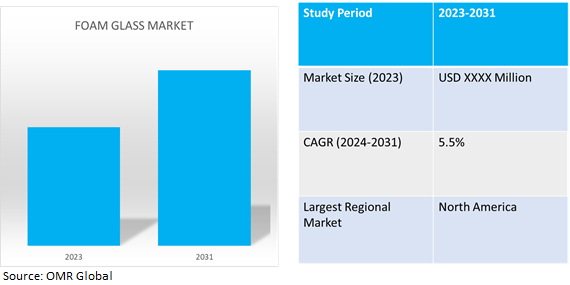

Foam glass market is anticipated to grow at a considerable CAGR of 5.5% during the forecast period (2024-2031). The foam glass has the properties of low thermal conductivity, high compression strength, high frost resistance, and better durability. This material can be used to build walls, regulate heat in refrigerating equipment, or used as floating and filtering material.

Market Dynamics

Lightweight and durability

As foam glass is lightweight, building costs can be significantly reduced. It eases the load on building structures, possibly enabling lighter foundations and thinner support beams. Furthermore, the labor expenditures related to installation are decreased by its effortless handling and cutting. Foam glass is lighter than heavier insulation materials, therefore it requires less energy to transport. During the construction process, this results in lower transportation costs and a smaller environmental impact. Foam glass is lightweight and ideal for inverted roofs and existing building insulation. Its exceptional durability, resistance to moisture, extreme temperatures, and mechanical wear, ensures long-lasting performance and lower maintenance costs over a building's lifespan.

Rising use of sustainable products

Globally, the growing focus on sustainable construction practices is a key driver propelling the global foam glass market.The main raw material used to make foam glass is recycled glass, which keeps waste out of landfills and lowers the demand for virgin raw materials. This is exactly in line with the increased emphasis in the building industry on the concepts of the circular economy. Foam glass has outstanding thermal insulation qualities. Minimizing heat transfer results in reduced energy consumption for both heating and cooling, which can be translated into significant energy savings for buildings. This directly lowers the carbon footprint of a structure. Foam glass is a durable, fireproof material that reduces environmental impact and requires minimal replacement. Its fireproof properties enhance safety and prevent toxic fumes during fires. As regulations and green building initiatives increase, demand for sustainable building materials like foam glass is expected to rise.

Market Segmentation

Our in-depth analysis of the global foam glass market includes the following segments by type and application:

- Based on type, the market is sub-segmented into open-cell foam glass, closed-cell foam glass, and mixed-cell foam glass.

- Based on application, the market is augmented into building and construction, industrial, chemical, and marine.

Closed-cell foam glass is Projected to Emerge as the Largest Segment

Based on the type, the global foam glass market is sub-segmented into open-cell foam glass, closed-cell foam glass, and mixed-cell foam glass. Among these, the closed-cell foam glass sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the features that the closed-cell foam glass carries. Closed-cell foam glass boasts a network of completely sealed, air-filled bubbles which acts as a great thermal insulator, significantly hindering heat transfer. This makes it ideal for applications where minimizing heat loss or gain is crucial, like building insulation, pipe lagging in cryogenic systems, and flat roofs.

Building and Construction Sub-segment to Hold a Considerable Market Share

Foam glass is incredibly durable and resistant to degradation, unaffected by moisture, harsh weather conditions, and even pest infestations. This ensures its long-lasting performance and minimizes the need for replacements, reducing overall building maintenance costs. It can be used in various building components, including flat roofs, cavity wall insulation, external foundation insulation, and even inverted roofs. Its ability to withstand high loads makes it suitable for applications requiring structural support. Because of these qualities, foam glass is a useful tool for architects and builders who want to create long-lasting, fire-resistant, and energy-efficient buildings. The demand for foam glass is anticipated to rise further due to the construction industry's growing emphasis on sustainability and energy saving, increasing its position as the leading material segment in the global foam glass market.

Regional Outlook

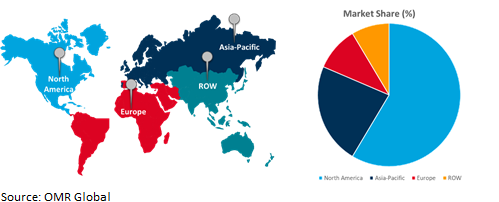

The global foam glass marketis further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Countries To Invest In The Foam Glass Market

- Rising awareness of energy-efficient materials and an increase in construction activities is leading to a rise in demand for foam glass in China.

- Rising investment to boost petrochemical output and rising government initiatives for sustainable production are expected to propel product demand.

Global Foam Glass Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the rising demand for the use of sustainable and energy-efficient materials in the region's modern building and industrial sectors, which is in line with foam glass's characteristics. Owing to its exceptional thermal and acoustic insulation, foam glass is a great substitute for traditional materials used in construction. This is especially true as building codes and energy efficiency requirements rise.

Furthermore, environmental sustainability and green building practices are highly valued in North America, foam glass is in high demand as a recycled and eco-friendly material. With the region's well-established infrastructure and expertise in research and development, foam glass is being used in a wide range of applications and encourages innovation.The US dominates the North American foam glass industry, renowned for its high demand for building and infrastructure insulation, sustainable construction techniques, and innovation. The US government's green programs and environmental legislation encourage the use of environmentally friendly materials, and its well-established industries also contribute to its widespread use.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global foam glass market includeKanthal (Alleima AB), Owens Corning, AeroAggregates, Dehe Technology Group Co., LTD, and Foamit, among others.The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.For instance,in May2023, Schlüsselbauer and Reiling, two family-run companies in the foam glass sector, merged their German operations to form a new company called Veriso GmbH & Co. KG. Both companies hold a 50.0% stake in the new entity and have contributed their production sites. The new company has taken over the activities of Schlüsselbauer Geomaterials GmbH and Veriso Schaumglas GmbH, giving it four foam glass furnaces across three production sites, making it one of the largest foam glass gravel producers in Europe

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global foam glass market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aeroagregates

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dehe Technology Group Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Owens Corning

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Foam Glass Market by Type

4.1.1. Open Cell Foam Glass

4.1.2. Closed-Cell Foam Glass

4.1.3. Mixed Cell Foam Glass

4.2. Global Foam Glass Market by Application

4.2.1. Building and Construction

4.2.2. Industrial

4.2.3. Chemical

4.2.4. Marine

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Foamit

6.2. JahanAyegh Pars Company

6.3. Kanthal (Alleima AB)

6.4. LangfangChaochen Thermal Insulation Materials Co., Ltd

6.5. Lincolnshire Lime

6.6. Mike Wye Ltd.

6.7. MISAPOR Management AG

6.8. PINOSKLO cellular glass

6.9. Polydros, S.A.

6.10. Refaglass

6.11. Shanghai Metal Corp.

6.12. SchlüsselbauerGeomaterials GmbH

6.13. Ty-Mawr Lime Ltd.

6.14. UusioainesOy

6.15. Zhejiang Zhenshen Insulation Technology Corp. Ltd.

1. GLOBAL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL OPEN CELL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CLOSED CELL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MIXED CELL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL FOAM GLASS FOR BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBALFOAM GLASSFOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FOAM GLASS FOR CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FOAM GLASS FOR MARINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FOAM GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. EUROPEAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN FOAM GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC FOAM GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFICFOAM GLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC FOAM GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD FOAM GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD FOAM GLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD FOAM GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL FOAM GLASS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL OPEN CELL FOAM GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CLOSED CELL FOAM GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MIXED CELL FOAM GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FOAM GLASS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL FOAM GLASS FOR BUILDING AND CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FOAM GLASS FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FOAM GLASS FOR CHEMICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FOAM GLASS FOR MARINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FOAM GLASS MARKETSHARE BY REGION, 2023 VS 2031 (%)

11. US FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

13. UK FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA FOAM GLASS MARKET SIZE, 2023-2031 ($ MILLION)