Foam Tape Market

Foam Tape Market Size, Share & Trends Analysis Report by Type (Single Sided Foam Tape and Double Sided Foam Tape), by Resin Type (Acrylic, Rubber, Silicone, and Ethylene Vinyl Acetate (EVA)), by Technology (Solvent-based, Water-based, and Hot Melt-based), and by End-User (Automotive, Aerospace, Building and Construction, Electrical and Electronics, Furniture, Medical, and Packaging) Forecast Period (2024-2031)

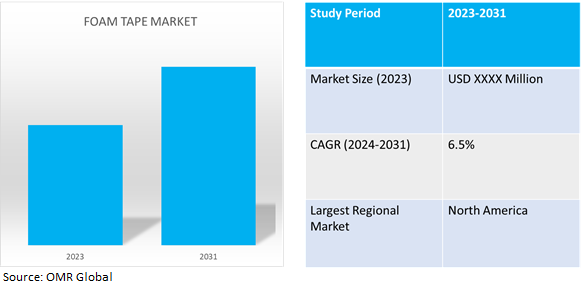

Foam tape market is anticipated to grow at a CAGR of 6.5% during the forecast period (2024-2031). The foam tape market is driven by the increasing demand for lightweight and energy-efficient materials in various industries such as automotive, construction, and electronics. Foam tape offers excellent properties such as insulation, shock absorption, vibration dampening, and sealing capabilities, making it a preferred choice in these sectors. The growth in e-commerce and the packaging industry also boosts the demand for foam tape due to its protective qualities during shipping. Additionally, the rising trend of sustainable and eco-friendly products encourages the use of foam tape as an alternative to traditional fastening and sealing methods, further propelling market growth.

Market Dynamics

Advancements in adhesive technology

Foam tapes with outstanding bonding strength and performance are being produced because of innovations in adhesive compositions. These stronger connections are appropriate for a broader range of applications since they can tolerate higher stress and harsher conditions. It broadens the market because foam tapes can, in some situations, successfully replace more conventional techniques like welding or riveting. Foam tapes with improved resistance to elements including moisture, UV light, and severe temperatures are being produced with the help of advances in adhesive technology. Long-term performance and dependable bonds are ensured by this increased durability. As a result, the goods in which they are utilized last longer and require less maintenance and replacement, which is advantageous to both producers and customers.

Continuous growth of the electronics industry

Globally, the electronics industry is always pushing the boundaries, creating lighter and smaller devices. Foam tapes are essential to this trend because of their thin profiles and capacity to conform to complex shapes, which make them perfect for attaching components to small electronic devices like laptops and smartphones. Foam tapes with thermal conductivity qualities assist in regulating heat by transporting it away from sensitive components, reducing overheating, and guaranteeing maximum device performance. As electronic devices become more powerful, effective heat dissipation becomes crucial.

Market Segmentation

Our in-depth analysis of the global foam tape market includes the following segments by type, resin type, technology, and end-user:

- Based on type, the market is sub-segmented into single-sided foam tape and double-sided foam tape.

- Based on resin type, the market is segmented into acrylic, rubber, silicone, and EVA.

- Based on technology, the market is segmented into solvent-based, water-based, and hot melt-based.

- Based on end-users, the market is sub-segmented into automotive, aerospace, building and construction, electrical and electronics, furniture, medical, and packaging.

The Automotive Sub-segment is Projected to Emerge as the Largest Segment

Based on the end-users, the global foam tape market is sub-segmented into automotive, aerospace, building and construction, electrical and electronics, furniture, medical, and packaging. Among these, the automotive sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its use in bonding trim, sealing doors, and reducing noise and vibration, fueled by the expansion of the automotive industry and the demand for lightweight materials.

Acrylic Foam Tapes Sub-segment to Hold a Considerable Market Share

The acrylic foam tape sub-segment growth is driven by its exceptional bonding strength and durability. This translates to strong and long-lasting adhesion on various surfaces, including metals, plastics, and even composites making them ideal for demanding applications. Acrylic foam tapes are known for their resilience against harsh environmental factors. They demonstrate exceptional resistance to moisture, UV rays, and extreme temperatures which makes them suitable for both indoor and outdoor applications, ensuring a long-lasting and reliable bond. It comes in a variety of thicknesses, densities, and adhesive strengths which allows for customization based on specific application requirements. This widespread adoption across various industries positions them as the leading sub-segment within the global foam tape market.

Regional Outlook

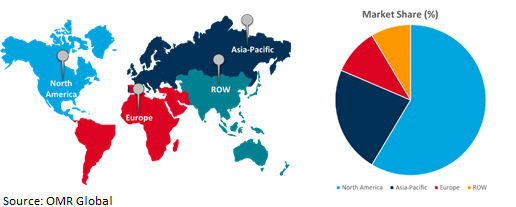

The global foam tape market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in the foam tape market

- China’s rising demand for foam tape from the construction industry with the growing population is driving the market growth.

- The growing service sector in India has led to an increase in residential and commercial buildings, which in turn has increased demand for foam tape.

Global Foam Tape Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the region's developed industrial landscape, especially in the automotive, construction, and electronics sectors, all of which are significant users of foam tapes for a variety of purposes, including bonding, sealing, and insulation which is one of the primary causes of this market dominance. Furthermore, North America has strong technological know-how and sophisticated manufacturing skills, which enable the creation of premium foam tapes that satisfy exacting performance standards.

Furthermore, the area's strong distribution networks and solid infrastructure guarantee prompt delivery of foam tape goods to final consumers as well as effective supply chain management. North America's innovation and product development drive advancements in adhesive technology, introducing new foam tape solutions. Additionally, stringent regulatory standards and consumer preferences for eco-friendly products promote sustainability. The United States leads the region in foam tape usage and innovation due to its strong industrial environment, sophisticated manufacturing capabilities, and broad economy spanning important industries like aerospace, automotive, construction, electronics, and healthcare.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global foam tape market include 3M, LINTEC Corporation, Nitto Denko Corp, Scapa Group plc, tesa SE, Avery Dennison, and RPM International Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in November 2023, CCL Design announced the launch of a new 5400 LSE series of acrylic foam tapes. This innovative product is the result of three years of dedicated research and development by the specialized research and development team of the company in Venray, Netherlands. The 5400 LSE series features primerless adhesion to plastics, ultra-strong bond to PP, and superb bonding to automotive paints.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global foam tape market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Foam Tape Market by Type

4.1.1. Single Sided Foam Tape

4.1.2. Double Sided Foam Tape

4.2. Global Foam Tape Market by Resin Type

4.2.1. Acrylic

4.2.2. Rubber

4.2.3. Silicone

4.2.4. Ethylene Vinyl Acetate (EVA)

4.3. Global Foam Tape Market by Technology

4.3.1. Solvent-based

4.3.2. Water-based

4.3.3. Hot Melt-based

4.4. Global Foam Tape Market by End-User

4.4.1. Automotive

4.4.2. Aerospace

4.4.3. Building and Construction

4.4.4. Electrical and Electronics

4.4.5. Furniture

4.4.6. Medical

4.4.7. Packaging

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. 3F GmbH Klebe- & Kaschiertechnik

6.2. 3M Co.

6.3. AFTC Group

6.4. AFT Fasteners

6.5. Ajit Industries Pvt. Ltd.

6.6. Atlantic Gasket Corp.

6.7. Avery Dennison

6.8. Duraco Specialty Tapes

6.9. Eastern Adhesive, Inc.

6.10. HALCO Europe Ltd

6.11. Intertape Polymer Group Inc.

6.12. LAMATEK, Inc.

6.13. LINTEC Corporation

6.14. Lohmann GmbH & Co. KG.

6.15. Lynvale Ltd.

6.16. NADCO Tapes & Labels, Inc.

6.17. Nitto Denko Corp.

6.18. RPM International Inc.

6.19. Scapa Group plc

6.20. Seal Kind Industrial Co., Ltd

6.21. tesa SE - a Beiersdorf Company

6.22. Wuxi Canaan Adhesive Technology Co., Ltd.

1. GLOBAL FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SINGLE-SIDED FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DOUBLE-SIDED FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FOAM TAPE MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2023-2031 ($ MILLION)

5. GLOBAL ACRYLIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL RUBBER FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SILICONE FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL EVA FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

10. GLOBAL SOLVENT-BASED FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL WATER-BASED FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL HOT MELT-BASED FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FOAM TAPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

14. GLOBAL FOAM TAPE FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FOAM TAPE FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL FOAM TAPE FOR BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL FOAM TAPE FOR ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL FOAM TAPE FOR FURNITURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL FOAM TAPE FOR MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL FOAM TAPE FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. NORTH AMERICAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2023-2031 ($ MILLION)

25. NORTH AMERICAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

26. NORTH AMERICAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. EUROPEAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. EUROPEAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. EUROPEAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2023-2031 ($ MILLION)

30. EUROPEAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

31. EUROPEAN FOAM TAPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

37. REST OF THE WORLD FOAM TAPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

39. REST OF THE WORLD FOAM TAPE MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2023-2031 ($ MILLION)

40. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

41. ASIA-PACIFIC FOAM TAPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL FOAM TAPE MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL SINGLE-SIDED FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DOUBLE-SIDED FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FOAM TAPE MARKET SHARE BY RESIN TYPE, 2023 VS 2031 (%)

5. GLOBAL ACRYLIC FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL RUBBER FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SILICONE FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL EVA FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FOAM TAPE MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

10. GLOBAL SOLVENT-BASED FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL WATER-BASED FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL HOT MELT-BASED FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FOAM TAPE MARKET SHARE BY END-USER, 2023 VS 2031 (%)

14. GLOBAL FOAM TAPE FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL FOAM TAPE FOR AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL FOAM TAPE FOR BUILDING AND CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL FOAM TAPE FOR ELECTRICAL AND ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL FOAM TAPE FOR FURNITURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL FOAM TAPE FOR MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL FOAM TAPE FOR PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL FOAM TAPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. US FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

23. CANADA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

24. UK FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

25. FRANCE FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

26. GERMANY FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

27. ITALY FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

28. SPAIN FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF EUROPE FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

30. INDIA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

31. CHINA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

32. JAPAN FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

33. SOUTH KOREA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

34. REST OF ASIA-PACIFIC FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

35. LATIN AMERICA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)

36. MIDDLE EAST AND AFRICA FOAM TAPE MARKET SIZE, 2023-2031 ($ MILLION)