Folic Acid Market

Global Folic Acid Market Size, Share & Trends Analysis Report, By Form (Tablets, Capsules and Softgels, Powder, and Others), By Application (Dietary Supplements, Pharmaceuticals, Food and Beverages, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global folic acid market is estimated to grow at a CAGR of nearly 4.5% during the forecast period. The major factors contributing to the market growth include a significant prevalence of anemia and emerging applications in pharmaceuticals and dietary supplements. As per the World Health Organization (WHO), 42% of children below 5 years of age and 40% of pregnant women globally are anemic. As per the World Bank, in 2016, there were 32.8% women of reproductive age (15-49) suffering from anemia globally. Nutritional deficiencies, especially iron deficiency, deficiencies in folate, and lack of vitamins A and B12 are some major causes of anemia.

Anemia is caused by either a reduction in the production of red blood cells or hemoglobin or rise in the loss or destruction of red blood cells. These results in an emerging demand for folic acid (Vitamin B9) that enables the body to make healthy red blood cells. Certain foods and drinks, such as dark green vegetables and citrus juices, are primarily good sources of folate, which is highly crucial in women of childbearing age. During pregnancy, a folate deficiency can lead to birth defects. Most people get an adequate amount of folate from food. Several foods contain additional folate which is in the form of folic acid, for prevention of deficiency.

However, folic acid-based supplements are suggested for women who may become pregnant. In pregnant women, it enables proper development of unborn baby's brain, spinal cord, and skull to avoid development problems such as spina bifida. Therefore, in the case of women who are pregnant or trying for a baby, it is recommended to take folic acid until they are 12 weeks pregnant that supports the baby to grow normally. The normal dose for most women during the first 12 weeks of pregnancy and who are trying to get pregnant is 400 micrograms, taken once a day.

When there is a higher risk of neural tube defects during pregnancy, the doctor recommends a higher dose of 5 mg in a day. Owing to the increasing folate-deficiency, the food and beverage manufacturers and providers of dietary supplements are adding folic-acid to foods such as enriched grain products and fortified foods and supplements to meet the demand for adequate folic acid in deficient population. Additionally, the emerging focus on folic acid in cosmetics applications is expected to offer an opportunity for market growth.

Market Segmentation

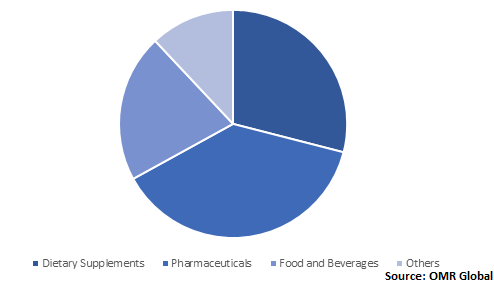

The global folic acid market is segmented into form and application. Based on form, the market is classified into tablets, capsules and softgels, powder, and others. Based on application, the market is classified into dietary supplements, pharmaceuticals, food and beverages, and others.

Folic Acid Find Significant Application in Pharmaceuticals

Folic acid is being significantly used in pharmaceutical formulations for the treatment of folic acid deficiency and certain kinds of anemia caused by folic acid deficiency. Folic acid is often used along with other medications for the treatment of normocytic, pernicious, or aplastic anemia. It is also used in drug-induced folate deficiency, in renal dialysis, and for prophylaxis in chronic haemolytic states. Inadequate folate levels can lead to a range of health concerns including CVD, neural tube defects, megaloblastic anemias, and cognitive deficiencies. Folic acid is normally supplemented during pregnancy for prevention of the development of neural tube defects and in people with alcoholism for prevention of the development of neurological disorders.

Global Folic Acid Market Share by Application, 2019 (%)

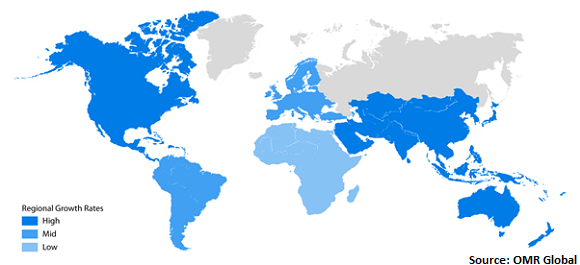

Regional Outlook

Geographically, in 2019, Asia-Pacific is estimated to hold a potential share in the market owing to the significant number of patients with anemia and emerging demand for folic acid-based nutraceuticals in the region. As per the National Family Health Survey (NFHS), in India, 50.4% of pregnant women, 58.6% of children, and 53.2% of non-pregnant women were found to be anemic in 2016. This, in turn, has led the demand for folic acid supplements, medications, and foods and beverages in the region. In addition, increasing demand for plant-based antioxidant in skincare products is further driving the market growth in the region. Europe is estimated to grow significantly owing to the significant presence of major food and beverage and pharmaceutical companies in the region.

Global Folic Acid Market Growth, by Region 2020-2026.

Market Players Outlook

Some prominent players in the market include Koninklijke DSM N.V., BASF SE, Cadila Healthcare Ltd., Merck KGaA, and Jiangxi Tianxin Pharmaceutical Co., Ltd. Emerging demand for folic acid have led the introduction of new folic acid products for a range of applications. For instance, in May 2019, Merck introduced Arcofolin L-Methylfolate, a new and improved proprietary product for pharmaceutical and nutritional applications. Similar to the naturally derived major form of folate, it offers supplementation intended to enhance the diet with natural folate. It is an active form of vitamin B9 (folic acid). As compared to folic acid, this biologically active kind of folate is easier for the body to metabolize. It contains a unique formula that eliminates the need for any extra steps to be absorbed and enter circulation when ingested. Pharmaceutical manufacturers and dietary supplement can take the benefit from the high active folate content of the compound, improved overall stability, enhanced water solubility, and increased purity (as per the company’s statement).

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global folic acid market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Koninklijke DSM N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. BASF SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Cadila Healthcare Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Merck KGaA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Jiangxi Tianxin Pharmaceutical Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Folic Acid Market by Form

5.1.1. Tablets

5.1.2. Capsules and Softgels

5.1.3. Powder

5.1.4. Others

5.2. Global Folic Acid Market by Application

5.2.1. Dietary Supplements

5.2.2. Pharmaceuticals

5.2.3. Food and Beverages

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accord-UK Ltd.

7.2. Amway Corp.

7.3. BASF SE

7.4. Cadila Healthcare Ltd.

7.5. Changzhou Yabang Pharmaceutical Co., Ltd.

7.6. Cipla Ltd.

7.7. Cytoplan Ltd.

7.8. Elmed Life Sciences Pvt. Ltd.

7.9. Emcure Pharmaceuticals Ltd.

7.10. General Nutrition Corp. (GNC)

7.11. Healthy Hey LLP

7.12. INLIFE Pharma Pvt. Ltd.

7.13. Jiangxi Tianxin Pharmaceutical Co., Ltd.

7.14. Kirkman Group Inc.

7.15. Koninklijke DSM N.V.

7.16. Medicamen Biotech Ltd.

7.17. Merck KGaA

7.18. NOW Health Group, Inc.

7.19. The Nature's Bounty Co.

7.20. West-Coast Pharmaceutical Works Ltd.

7.21. Xinfa Pharmaceutical Co., Ltd.

1. GLOBAL FOLIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

2. GLOBAL FOLIC ACID TABLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FOLIC ACID CAPSULES AND SOFTGELS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FOLIC ACID POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER FORMS OF FOLIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FOLIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. GLOBAL FOLIC ACID IN DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FOLIC ACID IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FOLIC ACID IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FOLIC ACID IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL FOLIC ACID MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

14. NORTH AMERICAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

15. EUROPEAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

17. EUROPEAN FOLIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FOLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FOLIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC FOLIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. REST OF THE WORLD FOLIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

22. REST OF THE WORLD FOLIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL FOLIC ACID MARKET SHARE BY FORM, 2019 VS 2026 (%)

2. GLOBAL FOLIC ACID MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL FOLIC ACID MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FOLIC ACID MARKET SIZE, 2019-2026 ($ MILLION)