Food Acidulants Market

Global Food Acidulants Market Size, Share & Trends Analysis Report By Type (Acetic Acid, Citric Acid, Lactic Acid, Malic Acid, Phosphoric Acid, and Others) and by Applications (Dairy & Frozen Products, Bakery & Confectionery, Beverages, Meat Products, and Others) Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global food acidulants market is projected to grow at a CAGR of around 7.2% during the forecast period (2020-2026). Food acidulants aids in enhancing the shelf life of any food product by reducing spoilage from air, bacteria, fungi, and yeast. Acidulants aids in preserving, stabilizing, maintaining the pH level, and enhancing the food property. The major factors that drive the growth of the market include the wide scope of applications of food acidulants in the overall food and beverage industries. The robust growth in the food and beverage industry is likely to positively impact the growth of the food acidulant market over the forecast period.

The other factor that contributes to the growth of the market includes rising instant food consumption. The packaged food industry has been substantially rising with the increasing urbanization, increasing consumer spending, and the expansion of food retailers across the globe. Hence, this further demands the key food ingredients including acidulants for food preservation and enhancing the shelf life. This, in turn, contributes to the growth of the market over the forecast period.

Segmental Outlook

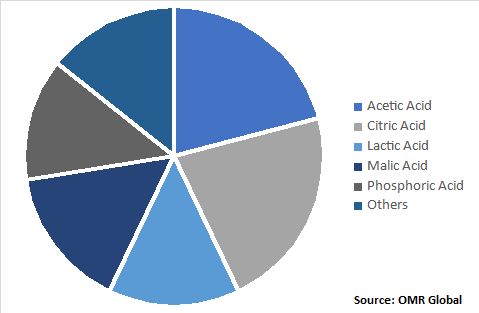

The global food acidulants market is segmented on the basis of type and application. Based on the type, the market is segmented into acetic acid, citric acid, lactic acid, malic acid, phosphoric acid, and others. Based on the applications, the market is segmented into dairy & frozen products, bakery & confectionery, beverages, meat products, and others.

Citric Acid Segment to Hold a Significant Market Share

Among the type of food acidulants segment, the citric acid segment is projected to hold a prominent share in the market. The segmental growth of the market is attributed to the wide acceptance of citric acid in a variety of products such as ice-creams, soda, wine, canned fruits, among many more. Citric acid imparts tartness & sourness and improves the flavor of the product. When used as an additive in food products, citric acid inhibits microbial growth and, therefore, extends its shelf life. Citric acid also allows the manufacturers to offer a clean label to the products which further enhances its adoption and in turn, contributes to the segmental growth of the market. Hence, such aforementioned factors are likely to flourish the growth of the market.

Global Food Acidulants Market by Type, 2019 (%)

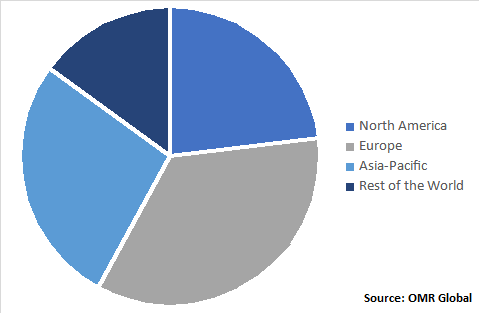

Regional Outlook

The global food acidulants market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is projected to witness significant growth during the forecast period. China, India, and Japan are the major economies primarily contributing to the growth of the food acidulants market in the region. The regional growth of the market is attributed to the presence of a wide range of key players along with the high domestic production of organic and inorganic acids in the countries such as China and India. China is considered as a major producer and exporter of citric acid as it has the footprints of major as well as local acid manufacturers such as Huangshi Xinghua Biochemical Co. Ltd. and COFCO Biochemical. Further, North America is also likely to support the market growth owing to the rising food & beverage industry in the region. Besides, there has been increased adoption of packaged food across the countries such as the US and Canada which further supports the market growth over the forecast period.

Global Food Acidulants Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global food acidulants market include Archer Daniels Midland Co., Cargill Inc., Corbion NV, Hawkins Watts Ltd., Bartek Ingredients, and Tate & Lyle Plc. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in February 2019, Bartek Ingredients completed its capacity expansion by increasing the production of malic and fumaric acid by 4,000 tons per year. This expansion is likely to address the growing demand for acid regulators across the globe.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food acidulants market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. BASF SE

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Archer Daniels Midland Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Cargill Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Tate & Lyle Plc

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Food Acidulants Market by Type

5.1.1. Acetic Acid

5.1.2. Citric Acid

5.1.3. Lactic Acid

5.1.4. Malic Acid

5.1.5. Phosphoric Acid

5.1.6. Others

5.2. Global Food Acidulants Market by Applications

5.2.1. Dairy & Frozen products

5.2.2. Bakery&Confectionery

5.2.3. Beverages

5.2.4. Meat Products

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland Co.

7.2. Batory Foods, Inc.

7.3. Brenntag SE

7.4. Cargill Inc.

7.5. Corbion NV

7.6. FBC Industries, Inc.

7.7. Foodchem Group

7.8. Fuerst Day Lawson Ltd.

7.9. Global Specialty Ingredients (M) Sdn Bhd.

7.10. Hawkins Watts Ltd.

7.11. Industrial TecnicaPecuaria SA

7.12. JUNGBUNZLAUER SUISSE AG

7.13. Kemin Industries Inc.

7.14. Prinova Group LLC

7.15. RP International Ltd.

7.16. SuntranIndustrial Group Ltd.

7.17. Tate& Lyle Plc

7.18. Univar Solutions Inc.

7.19. Yara International ASA

1. GLOBAL FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ACETIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CITRIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL LACTIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MALIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PHOSPHORIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

9. GLOBAL DAIRY & FROZEN PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL BAKERY & CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MEAT PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

18. EUROPEAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

24. REST OF THE WORLD FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD FOOD ACIDULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

1. GLOBAL FOOD ACIDULANTS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL FOOD ACIDULANTS MARKET SHARE BY APPLICATIONS, 2019 VS 2026 (%)

3. GLOBAL FOOD ACIDULANTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

15. ASEAN FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD FOOD ACIDULANTS MARKET SIZE, 2019-2026 ($ MILLION)