Food and Beverage Vending Machine Market

Food and Beverage Vending Machine Market Size, Share & Trends Analysis Report, By Product Type (Beverage Vending Machine and Food Vending Machine), By Payment Mode (Cash and Cashless), By Application (Corporate, Public infrastructure, Retail Stores, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Food and beverage vending machine market is anticipated to grow at a CAGR of 12% during the forecast period. Many companies globally have increased efforts to be more sustainable and eco-friendlier by introducing eco-friendly & energy-efficient vending machines which are escalating the growth of the market. Key players in the market are focusing on environmentally friendly vending machines which are manufactured using a natural refrigerant having a low global warming coefficient. Environment-friendly food and beverage vending machines are increasingly being deployed at schools, institutions, offices, malls, and other public places.

Moreover, buying eco-friendly vending machines supports consumers to reduce power use as they are equipped with energy-saving modes. The market players are focusing on environmental concerns as it necessitates the development of more energy-efficient vending machines which is fuelling the growth of the market. For instance, in 2020, developed by KOMPEITO Inc, SALAD STAND is a vending machine that sells salads 24 hours a day. The vending machine is eco-friendly as firstly dispenses in an eco-friendly manner without the use of disposable materials and secondly, the vending machine itself is a non-CFC vending machine that does not emit CFC gas, which is harmful to the ozone layer. Such a great initiative by key players is set to increase the demand for food and beverage vending machines in the market.

Impact of COVID-19 Pandemic on the Global Food and Beverage Vending Machine Market

COVID-19 pandemic has highly impacted the consumer goods industry owing to stringent lockdowns and reduced footfalls at malls and retail outlets. However, stringent social distancing restrictions imposed by the government of different countries raise the preference for automated systems. The need for contactless retail that the COVID-19 pandemic led to the growth of the market. People were inclined toward buying products with minimal or no human interaction and the contactless payment options further made it convenient and easy for consumers to make a purchase.

Segmental Outlook

The global food and beverage vending machine market is segmented based on the product type, payment mode, and application. Based on the product type, the market is segmented into beverage vending machines, and food vending machines. Based on the payment mode, the market is segmented into cash and cashless. Further, on the basis of application, the market is segmented into corporate, public infrastructure, retail stores, and others. Among the product type segment, the beverage vending machine segment is expected to cater to prominent market share during the forecast period owing to its popularity and increasing adoption across various applications.

Beverages Vending Machine Segment Holds Prominent Share in the Global Food and Beverage Vending Machine Market

The beverages vending machine segment is anticipated to hold a prominent share in the global food and beverage vending machine market owing to its popularity in most the places such as cafés, bars, restaurants, corporate offices, and others. The rising demand for ready-to-drink or packaged beverages among consumers is the driving factor that is stimulating the growth of the beverage vending machine market. Owing to the growing demand in developing nations, the market players are focusing on developing smart beverage vending machines to meet the demand of the large number of consumers, which is further adding to the growth of the segment. For instance, in 2021, Cherise India Private Ltd. launched a range of smart, IoT, and Android-based vending machines. The Cherise vending machines dispense teas, coffee, milk, and soups in a jiffy and the vending kiosks of Cherise come with their own proprietary Cherise IoT dashboard and app for monitoring the operations. Moreover, beverage vending machines such as hot beverage vending machines, and cold beverage vending machines are increasingly being installed in hotels and airports.

Regional Outlook

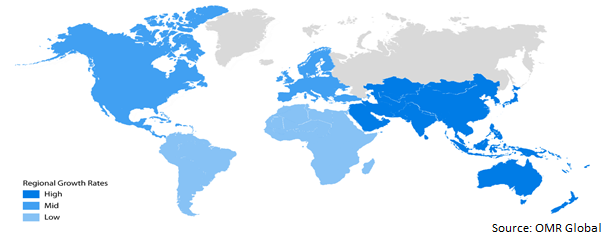

The global plant-based butter market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and Rest of the World (the Middle East &Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Asia-Pacific region is expected to cater to prominent growth during the forecast period, however, the North American region is projected to experience considerable growth in the food and beverage vending machine market

Global Food and Beverage Vending Machine Market Growth, by Region 2022-2028

Asia-Pacific Region to Witness Prominent Share in the Global Food and Beverage Vending Machine Market

The Asia-Pacific region is expected to hold a prominent share in the global food and beverage vending machine market owing to the popularity of the installation of the vending machines across countries, such as Japan. For instance, as per the Japan Vending Machine Manufacturers Association, Japan has over 5 million vending machines around the country. The machines sell several types of soft drinks, milk drinks, coffee, liquor/beer, instant noodles, frozen foods, ice cream, sweets, etc. Additionally, the rising popularity of noodles and frozen food vending machine in this region adds to the growth of the market as noodles have been a staple of Japanese food. For instance, Sanden Retail Systems Corp., a Japanese manufacturer, sold over 1,000 units of the machine for frozen foods, which it started retailing in January 2021, by the end of September that year. Hence, the growth of the market is mainly influenced by the already high acceptance and culture of vending machines across the country.

Market Players Outlook

The major companies serving the global food and beverage vending machine market include Bianchi Industry S.p.A., American Vending Machine, Inc., Fuji Electric Co., Ltd., SandenVendo GmbH, and Innovative Vending Solutions, LLC. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in 2022, Kepler Capital Ltd. announced that it has completed its seventh acquisition by acquiring majority ownership of Service Station Vending Equipment, Inc. (SSVE). With a fleet of 4,000 machines throughout New York state, New Jersey, Maryland, and several other states, SSVE is one of the leading players in the Northeast region.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food and beverage vending machine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Food and Beverages Vending Machine Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Bianchi Industry S.p.A.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. American Vending Machine, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Fuji Electric Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SandenVendo GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Innovative Vending Solutions, LLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Food and Beverages Vending Machine Market by Product Type

4.1.1. Beverage Vending Machine

4.1.2. Food Vending Machine

4.2. Global Food and Beverages Vending Machine Market by Payment Mode

4.2.1. Cash

4.2.2. Cashless

4.3. Global Food and Beverages Vending Machine Market by Application

4.3.1. Corporate

4.3.2. Public infrastructure

4.3.3. Retail Stores

4.3.4. Others (Restaurants and Hotels)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abberfield Industries Pty Ltd.

6.2. American Vending Machines, Inc.

6.3. Automated Merchandising Systems Inc.

6.4. AZKOYEN, SA

6.5. Beta Automation

6.6. BICOM s.r.l.

6.7. Braimex Maquinaria, s.l.

6.8. Bulk Vending Systems Ltd.

6.9. Cantaloupe, Inc.

6.10. Compass Group, UK & Ireland Ltd.

6.11. Crane Payment Innovations

6.12. Daalchini Technologies Pvt. Ltd

6.13. Future Techniks India Private Ltd.

6.14. Innovative Vending Solutions

6.15. Royal Vendors, Inc.

6.16. Selecta AG

6.17. UK Vending Ltd

6.18. Vendstop Vending Machines Trading LLC

1. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL BEVERAGE VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FOOD VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PAYMENT MODE, 2021-2028 ($ MILLION)

5. GLOBAL CASH FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CASHLESS FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN CORPORATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN PUBLIC INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PAYMENT MODE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

17. EUROPEAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PAYMENT MODE, 2021-2028 ($ MILLION)

20. EUROPEAN FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PAYMENT MODE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. REST OF THE WORLD FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY PAYMENT MODE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD FOOD AND BEVERAGES VENDING MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL BEVERAGE VENDING MACHINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL FOOD VENDING MACHINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY PAYMENT MODE, 2021 VS 2028 (%)

5. GLOBAL CASH FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL CASHLESS FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN CORPORATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN PUBLIC INFRASTRUCTURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN RETAIL STORES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL FOOD AND BEVERAGES VENDING MACHINE IN OTHERS APPLICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL FOOD AND BEVERAGES VENDING MACHINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

15. UK FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD FOOD AND BEVERAGES VENDING MACHINE MARKET SIZE, 2021-2028 ($ MILLION)