Food Colorants Market

Global Food Colorants Market Size, Share & Trends Analysis Report, By Product Type (Natural, Synthetic, Natural Identical, and Others), By Application (Bakery and Confectionery Products, Processed Food, Meat, Poultry, and Seafood, Dairy Products, Oils and Fats, and Beverages) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global food colorants market is estimated to grow at a CAGR of nearly 5.6% during the forecast period. The major factors contributing to the growth of the market include a significant rise in the food and beverage industry and the rising demand for natural food colorants. As per the FoodDrinkEurope, the turnover of the EU food and drink industry was nearly $1431 billion in 2017, which represented a 6.7% rise from 2016. The number of companies engaged in the manufacturing of food and beverage in the EU was 294,000 in 2017. Nearly 47.5% of food and drink turnover was generated from small and medium-sized companies.

During the period, 2013-2017, the EU share of global exports has increased from 17.5% to 19.0%. This represents that the food and beverage sector is among the major contributors to the growth of the European economy. This, in turn, contributes to the demand for food colorants to enhance the appearance of processed and fresh foods. Natural food colorants are gaining significant importance owing to their potential health benefits. Natural food colours are derived from a comprehensive range of sources such as fruits, vegetables, minerals, plants, and other edible natural sources. These colorants come in several forms including powders, gels, liquids, and pastes.

Owing to the increasing consumer concerns regarding synthetic dyes (artificial colors), there is an inclination towards natural colours in the food and beverage sector. Synthetic colors are used as they are less costly; however, they are also potent in providing intense and uniform colour. In addition, synthetic colors can also blend easily to offer a range of hues. Due to the harmful effects, the demand for synthetic food colours is increasingly coming down across the globe. This, in turn, results in the emerging demand for natural food colorants.

Market Segmentation

The global food colorants market is segmented based on product type and application. Based on product type, the market is classified into natural, synthetic, natural identical, and others. Based on application, the market is classified into food and beverages. Food is further segmented into bakery and confectionery products, meat, poultry, and seafood, processed food, dairy products, oils and fats, and others. Beverages are further segmented into alcoholic beverages, juices, carbonated soft drinks, functional beverages, and others.

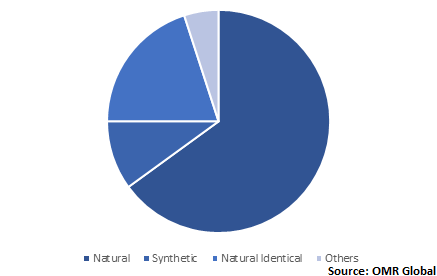

Natural food colorants are anticipated to hold significant share in the product type

There is an emerging demand for natural food colorants owing to its increasing awareness regarding the health benefits of natural colorants. Carotenoids is a major form of natural food colorants which is an essential antioxidant that has a crucial role in human health. Carotenoids acts as a potent antioxidant that can support the prevention of certain kinds of cancer and heart disease and improve the immune response to infections. The most common types of carotenoids comprise lutein, astaxanthin, beta carotene, lycopene, zeaxanthin. Some carotenoids can be converted into vitamin A, which is essential for eye health, human growth, and immune system function.

Owing to these benefits, carotenoids are significantly used in human food, nutraceutical, and pharmaceutical products. Carotenoid-rich foods enable to prevent the growth of cancerous cells and protect healthy cells in the eye. More than 400 different carotenoids have been identified in yellow/red/orange/ fruits, vegetables and plants. Carotenoids produced by nature at a rate of 1000 million tons annually. Most of the carotenoids are heat stable, oil-soluble, and are not affected by pH change. Carotenoids are used in dairy products, margarine, and soft drinks.

Global Food Colorants Market Share by Product Type, 2019 (%)

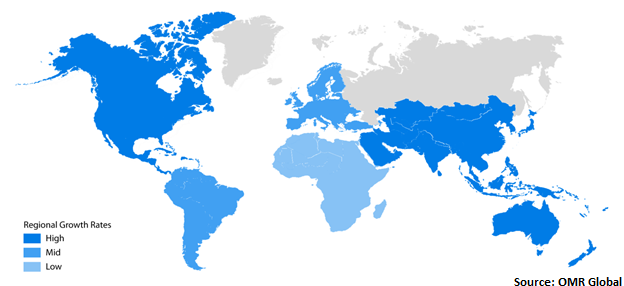

Regional Outlook

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). Asia-Pacific is estimated to witness considerable growth during the forecast period owing to the rising food processing industry and the expansion of major food and beverage manufacturers in the region. As per the United States Department of Agriculture (USDA) Foreign Agricultural Service, the food processing industry in China is maturing and the consumers are increasingly interested in buying eating more healthy and natural foods. Food processing accounted for 60% of the sector, however, the fastest growth is witnessed in the beverage sector coupled with the emerging trend for healthy, natural, and convenient drinks, juices, and yoghurts. In 2017, revenue from food processing industry in China climbed to $1.47 trillion, a rise of 6.3% compared to 2016. This, in turn, is supporting the demand for colorants in food products to enhance the flavor, safety, and nutritional value of the products.

Global Food Colorants Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Sensient Technologies Corp., Chr. Hansen Holding A/S, BASF SE, Koninklijke DSM N.V., and Givaudan SA. The market players are constantly focusing on gaining significant market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in April 2018, Chr. Hansen Chr. Hansen acquired the Banker Wire production facility in Mukwonago, Wisconsin that will enhance its presence in North America. This step is intended to meet the demand for US consumers in products developed from safe and natural ingredients. This expansion will reinforce the position of Chr. Hansen in terms of supply chain capabilities in natural color solutions to deliver its existing and future customers. This new advanced site will accelerate speed to market, while achieving more flexibility in manufacturing and supply chain and leads to high-quality products, faster.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food colorants market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Sensient Technologies Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Chr. Hansen Holding A/S

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke DSM N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. BASF SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Givaudan SA

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Food Colorants Market by Product Type

5.1.1. Natural

5.1.2. Synthetic

5.1.3. Natural Identical

5.1.4. Others

5.2. Global Food Colorants Market by Application

5.2.1. Food

5.2.1.1. Bakery and Confectionary Products

5.2.1.2. Processed Food

5.2.1.3. Meat, Poultry and Seafood

5.2.1.4. Dairy Products

5.2.1.5. Oils and Fats

5.2.1.6. Others

5.2.2. Beverages

5.2.2.1. Alcoholic Beverages

5.2.2.2. Juices

5.2.2.3. Carbonated Soft Drinks

5.2.2.4. Functional Beverages

5.2.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ajanta Chemical Industries

7.2. Archer Daniels Midland Co.

7.3. AromataGroup SRL

7.4. BASF SE

7.5. Cargill Inc.

7.6. Chr. Hansen Holding A/S

7.7. DDW, Inc.

7.8. Denim Colourchem Pvt. Ltd.

7.9. Döhler GmbH

7.10. Frutarom Group

7.11. Givaudan SA

7.12. GNT Group B.V.

7.13. IFC Solutions

7.14. Kalsec Inc.

7.15. Kemin Industries, Inc.

7.16. Kevin (India) Co.

7.17. Koninklijke DSM N.V.

7.18. Prinova US LLC (Nagase Group)

7.19. Riken Vitamin Co., Ltd.

7.20. San-Ei Gen F.F.I., Inc.

7.21. Sensient Technologies Corp.

7.22. Sethness-Roquette

7.23. Sun Food Tech Pvt. Ltd.

1. GLOBAL FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL NATURAL FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SYNTHETIC FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL NATURE IDENTICAL FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. GLOBAL FOOD COLORANTS IN FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FOOD COLORANTS IN BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. EUROPEAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. REST OF THE WORLD FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD FOOD COLORANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL FOOD COLORANTS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL FOOD COLORANTS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL FOOD COLORANTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FOOD COLORANTS MARKET SIZE, 2019-2026 ($ MILLION)