Food Emulsifiers Market

Global Food Emulsifiers Market Size, Share & Trends Analysis Report by Product Type (Monoglyceride, Diglyceride, and Derivatives, Polyglycerol Ester, Sorbitan Ester, Lecithin, and Others), by Application (Bakery, Dairy and Frozen Products, Food & Beverage, Confectionery, Meat, Poultry, and Seafood, Others) Forecast Period (2019-2025) Update Available - Forecast 2025-2035

The food emulsifier market is projected to grow at a considerable CAGR of 4.8% during the forecast period (2020-2026). Food emulsifiers are the chemical compounds that are used to improve the food texture, provide excellent flavor, and mix ingredients in a good manner. Owing to functional properties such as protein boosting, starch complexing, and aeration, increasing demand for specialized food additives, such as emulsifiers in different applications, is anticipated to drive the growth of the food emulsifier market across the globe.

With the increasing demand for high clarity on the ingredients used in food for consumers, it is expected that the market for clean label food ingredients will drive the market for food additives, such as emulsifiers. The growing urbanization has lead to the demand for processed foods. Food emulsifiers are used in the manufacturing process of instant noodles, fresh noodles, macaroni, and spaghetti as they offer elasticity to these products. The considerable rise in the demand for ready to make and instant foodstuff is anticipated to make a positive impact on the growth of the market.

Segmental Outlook

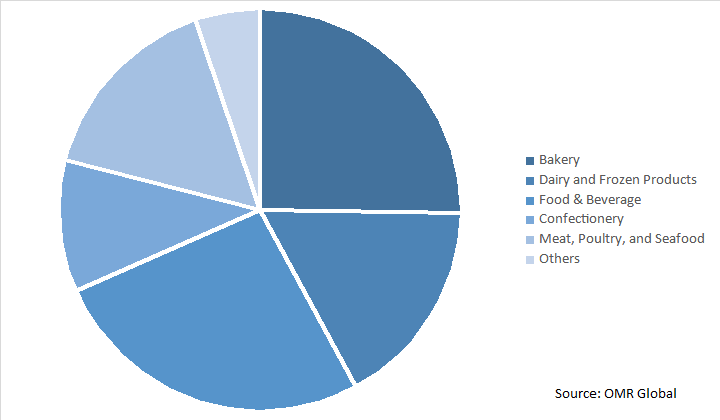

The food emulsifiers market is segmented on the basis of product type, and application. Based on product type the market is sub-segmented into monoglyceride, diglyceride, and derivatives, polyglycerol ester, sorbitan ester, lecithin, and others. Based on the product type, monoglyceride, diglyceride, and derivatives are anticipated to hold considerable market share during the forecast period owing to the high application of this product in bakery products. Based on the application, the food emulsifiers market is segmented into bakery, dairy and frozen products, food & beverage, confectionery, meat, poultry, and seafood, among others.

Bakery to be a Considerable Segment

The bakery is anticipated to hold major market share based on application. Bakery products generally comprise of cereal products, snacks, and a range of baked items such as crackers, cookies, stuffing, croutons, rye chips, pretzel chips, popcorn, breadsticks, snack mixes, muffins, and toaster pastries, among others. In the bakery industry, food emulsifiers are prominently used as dough containers. Improved tolerance to variations in flour and other ingredient quality, better gas retention resulting in lower yeast requirements, shorter proof times, and increased baked product volume among others are the major advantages of using food emulsifiers to prepare bakery products.

Global Food Emulsifier Market Share by Application, 2019 (%)

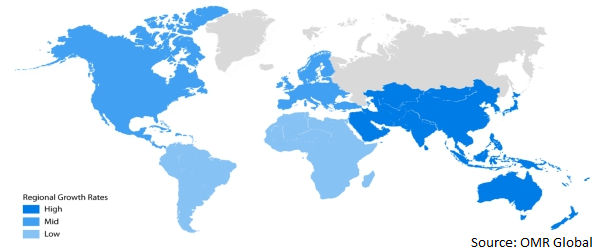

Regional Outlook

The global food emulsifier market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold a major market share in the global food emulsifier market during the forecast period. The US is anticipated to hold a major market share in the North American food emulsifier market. The US is among the key consumers of emulsifying products. The ongoing trend to go with a clean label regarding ingredients and additives incorporated during the processing of victuals in the country is anticipated to promote the requirement of natural and biobased ingredients during the forecast period. Piedmont Candy Co., Astor Chocolate, KLN Family Brands, Ganong Bros., Ltd., and Adams & Brooks Zachary Confections among others are major chocolate manufactures in the region. The significant presence of large chocolate manufacturers in the region are aiding to the high market growth in the region.

Global Food Emulsifier Market Growth, by Region 2020-2026

Asia-Pacific will augment with the significant growth rate in the food emulsifier market

Growing population, rising incomes, and rapid urbanization are among the key factors responsible for the shift of consumers towards the intake of processed or ultra-processed foods. A considerable increase in the consumption of processed food items owing to their easy availability through well-developed retail channels is further contributing to the growth of the regional market. According to the Brand Equity Federation, the Indian food processing industry accounts for 32% of the country’s total food market, one of the largest industries in India and is ranked fifth in terms of production, consumption, export and expected growth. Expanding the food processing industry in India is anticipated to promote the growth of the food emulsifier market in the region.

Market Players Outlook

The key players of food emulsifiers market include BASF SE, the Dow Chemical Company, Cargill Inc., Corbion N.V., Kerry Group Plc, Archer Daniels Midland Co., Ingredion Inc., Tate & Lyle PLC, Lonza Group Ltd., Palsgaard A/S, Mitsubishi Chemical Food Corp., and so on. The new product launch and product development are the core focus of these major market players. Moreover, the key players of the food emulsifiers market are actively adopting organic or inorganic market activities to increase their market share. For instance, in August 2018, DuPont Nutrition & Health had launched a new naturally-sourced, beaded monoglyceride emulsifier called Dimodan HP 90-M.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food emulsifier market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Kerry Group PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. The Dow Chemical Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Cargill Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Ingredion, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Food Emulsifiers Market by Product Type

5.1.1. Monoglyceride, Diglyceride, and Derivatives

5.1.2. Polyglycerol Ester

5.1.3. Sorbitan Ester

5.1.4. Lecithin

5.1.5. Others

5.2. Global Food Emulsifiers Market by Application

5.2.1. Bakery

5.2.2. Dairy and Frozen Products

5.2.3. Food & Beverage

5.2.4. Confectionery

5.2.5. Meat, Poultry, and Seafood

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland Co.

7.2. BASF SE

7.3. Cargill Inc.

7.4. Corbion N.V.

7.5. Ingredion Inc.

7.6. Kerry Group PLC

7.7. LasenorEmul, S.L.

7.8. Lonza Group Ltd.

7.9. Mitsubishi Chemical Food Corp.

7.10. Oleon NV

7.11. Palsgaard A/S

7.12. Puratos Group S.A.

7.13. Riken Vitamin Co. Ltd.

7.14. Solvay S.A.

7.15. Stepan Co.

7.16. Tate & Lyle PLC

7.17. The Dow Chemical Co.

7.18. Zhengzhou Honest Food Co., Ltd.

1. GLOBAL FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL MONOGLYCERIDE, DIGLYCERIDE, AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL POLYGLYCEROL ESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SORBITAN ESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LECITHIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL BAKERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL DAIRY AND FROZEN PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL MEAT, POULTRY, AND SEAFOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. EUROPEAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. REST OF THE WORLD FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD FOOD EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL FOOD EMULSIFIERS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL FOOD EMULSIFIERS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL FOOD EMULSIFIERS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FOOD EMULSIFIERS MARKET SIZE, 2019-2026 ($ MILLION)