Food Grade Gases Market

Global Food Grade Gases Market Size, Share & Trends Analysis Report by Gas Type (Oxygen, Carbon Dioxide, Nitrogen, Sulphur Dioxide, and Others), by Application (Freezing & Chilling, Packaging, Carbonation, and Others), and by End-Use (Beverages, Fruits & Vegetables, Dairy & Frozen Products, Meat, Poultry, & Seafood Products, Bakery & Confectionery Products, Convenience Food Products, and Others (Sauces, Oil)) Forecast, 2021-2027 Update Available - Forecast 2025-2031

Food grade gases are used during the production stage of food as an additive or processing aid to maintain the quality and standards of the food. Food grade gases are extensively used in the food & beverages industry for a variety of applications including freezing, packaging, and carbonation of food products. Some of the common food grade gases are carbon dioxide, nitrogen, and oxygen. These gases can also be used alone or with certain combinations. The global food grade gases market is projected to grow at a modest CAGR of 4.2% during the forecast period (2021-2027). The key aspect that drives the growth of the market includes the variety of benefits offered by the food grade gases. For instance, carbon dioxide and nitrogen are utilized for the rapid freezing of food products and extend the shelf life of the food product. These gases are also used to get the right texture of food products and for the optimization of the wine production process along with the improvement of the quality. Food grade gases also keep the food product safe, hygienic, and maintaining the quality of foods. Hence, attributing to such benefits offered by the food grade gases, the market is likely to witness a sharp growth in the forecast period.

Another factor that catalyzes the food grade gases market growth is the growing consumption of packaged food across the globe. The quickening pace of life and changing lifestyles of the people has made them consume more packaged food. The packaged food industry is also driven substantially by the rising urbanization, increasing consumer spending, and the expansion of food retailers across the globe. Hence, this further demands the key ingredients including food grade gases for food preservation and enhancing the shelf life; which, in turn, contributes to the growth of the market over the forecast period.

Segmental Outlook

The global food grade gases market is segmented on the basis of gas type, application, and end-use. Based on the gas type, the market is segmented as oxygen, carbon dioxide, nitrogen, Sulphur dioxide, and others. Based on the application, the market is segmented as freezing & chilling, packaging, carbonation, and others. Based on the end-use, the market is segmented as beverages, fruits & vegetables, dairy & frozen products, meat, poultry, & seafood products, bakery & confectionery products, convenience food products, and others (sauces, oil).

Carbon Dioxide Food Grade Gas to Hold a Substantial Share in the

Amongst the gas type segment of the global food grade gases, the carbon dioxide food grade gas segment is projected to hold the most lucrative share in the market. The segmental growth of the market is accredited to a variety of applications of carbon dioxide in food applications. Carbon dioxide has been extensively used for food preservation for a long time in a variety of applications such as carbonated beverages, modified atmospheric packaging, controlled atmosphere storage, inactivation of micro-organisms & enzymes, protein precipitation, meat industry, monitoring food quality, and many others. Besides, carbon dioxide is also used as a convenient inert medium for displacing the air from bread manufacturing machinery. It eliminates dust and bacteria carried by the air stream of the room. Carbon dioxide is also used in the manufacturing of ice cream, as a substitute for air before beating the ice cream mix. Thus, carbon dioxide has the ability to dissolve in materials and reduce their pH, which aids in prolonging life. Hence, this is a major driving factor for the segmental growth of the market.

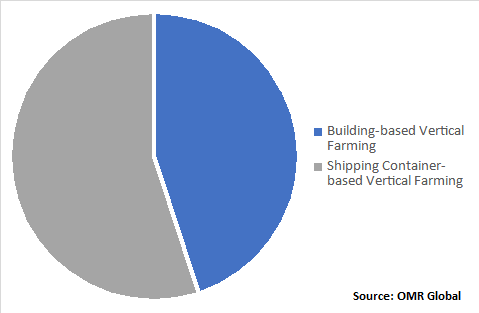

Global Food Grade Gases Market, by Structure Type 2020 (%)

Regional Outlook

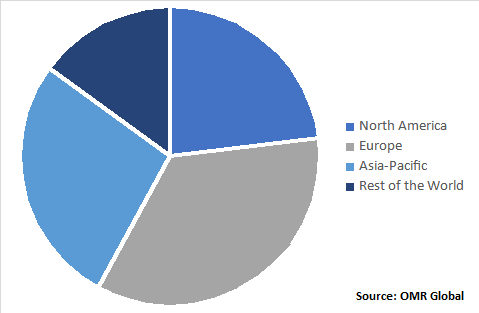

The global food grade gases market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The North American region is also estimated to witness a significant value for the market, attributing to the presence of key players across the region. Another major aspect driving the market growth is the rising demand for processed foods, bakery and confectionery, and breakfast cereals, in the region during the forecast period. In the North American region, millennials comprising a major group in the region, are largely focusing on consuming food products that are convenient and can be consumed with minimal preparation, owing to their busy work schedules; which also creates a wide scope for the market growth during the forecast period. Further, the Asia-Pacific region is projected to hold a significant market share. China, India, Japan, and the Rest of the Asia-Pacific are the major economies primarily contributing to the growth of the food grade gases market in the region. The market in Asia-Pacific is driven by the increasing disposable income and growing urbanization in major economies.

Global Food Grade Gases Market, by Region 2020 (%)

Market Players Outlook

The prominent players functioning in the global food grade gases market include Air Liquide SA, Air Products & Chemicals, Inc., Linde Plc, Massy Group, The Messer Group GmbH, Wesfarmers Ltd., and Mitsubishi Chemical Holdings Corp. (Taiyo Nippon Sanso) among others. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in July 2020, Air Products & Chemicals Inc. announced the opening of its novel industrial gases plant in Louisiana, US, and supply to Hunstman Corp. (US) neighboring industrial operations. The opening of a new plant will increase reliability and sustainability, with enhanced energy efficiency and reduced emissions.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food grade gases market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Food Grade Gases Market by Gas Type

5.1.1. Oxygen

5.1.2. Carbon Dioxide

5.1.3. Nitrogen

5.1.4. Sulphur Dioxide

5.1.5. Others

5.2. Global Food Grade Gases Market by Application

5.2.1. Freezing & Chilling

5.2.2. Packaging

5.2.3. Carbonation

5.2.4. Others

5.3. Global Food Grade Gases Market by End-Use

5.3.1. Beverages

5.3.2. Fruits &Vegetables

5.3.3. Dairy &Frozen Products

5.3.4. Meat, Poultry, &Seafood Products

5.3.5. Bakery &Confectionery Products

5.3.6. Convenience Food Products

5.3.7. Others (Sauces, Oil)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Air Liquide SA

7.2. Air Products & Chemicals, Inc.

7.3. Air Water, Inc.

7.4. Axcel Gases

7.5. Chengdu Taiyu Industrial Gases Co., Ltd.

7.6. Cryogenic Gases

7.7. Ijsbariek Strombeek N.V

7.8. Linde Plc

7.9. Massy Group

7.10. Mirates Industrial Gases Co., LLC

7.11. Mitsubishi Chemical Holdings Corp. (Taiyo Nippon Sanso)

7.12. Purity Cylinder Gases Inc.

7.13. SOL Group

7.14. The Messer Group GmbH

7.15. Universal Industrial Gases, Inc.

7.16. Wesfarmers Ltd.

7.17. Yingde Gas Group Ltd (China)

1. GLOBAL FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GAS TYPE, 2020-2027 ($ MILLION)

2. GLOBAL FOOD GRADE OXYGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL FOOD GRADE CARBON DIOXIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL FOOD GRADE NITROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL FOOD GRADE SULPHUR DIOXIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHER FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

8. GLOBAL FOOD FREEZING & CHILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL FOOD PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL FOOD CARBONATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

13. GLOBAL FOOD GRADE GASES FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL FOOD GRADE GASES FOR FRUITS & VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL FOOD GRADE GASES FOR DAIRY & FROZEN PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL FOOD GRADE GASES FOR MEAT, POULTRY, & SEAFOOD PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL FOOD GRADE GASES FOR BAKERY & CONFECTIONERY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL FOOD GRADE GASES FOR CONVENIENCE FOOD PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL FOOD GRADE GASES FOR OTHERS END-USES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

20. GLOBAL FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

21. NORTH AMERICAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. NORTH AMERICAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GAS TYPE, 2020-2027 ($ MILLION)

23. NORTH AMERICAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

24. NORTH AMERICAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

25. EUROPEAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. EUROPEAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GAS TYPE, 2020-2027 ($ MILLION)

27. EUROPEAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

28. EUROPEAN FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GAS TYPE, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

32. ASIA-PACIFIC FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

33. REST OF THE WORLD FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY GAS TYPE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

35. REST OF THE WORLD FOOD GRADE GASES MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

1. GLOBAL FOOD GRADE GASES MARKET SHARE BY GAS TYPE, 2020 VS 2027 (%)

2. GLOBAL FOOD GRADE GASES MARKET SHARE BY APPLICATION, 2020 VS 2027(%)

3. GLOBAL FOOD GRADE GASES MARKET SHARE BY END-USE, 2020 VS 2027 (%)

4. GLOBAL FOOD GRADE GASES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. US FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

6. CANADA FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

7. UK FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

8. FRANCE FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

9. GERMANY FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

10. ITALY FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

11. SPAIN FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

12. ROE FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

13. INDIA FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

14. CHINA FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

15. JAPAN FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

16. ASEAN FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

17. SOUTH KOREA FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF ASIA-PACIFIC FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)

19. REST OF THE WORLD FOOD GRADE GASES MARKET SIZE, 2020-2027 ($ MILLION)