Food Hydrocolloids Market

Food Hydrocolloids Market Size, Share & Trends Analysis Report by Type (Gelatin Gum, Pectin, Xanthan Gum, Guar Gum, and Others), and by Application (Dairy and Frozen Products, Bakery, Beverages, Confectionery, Meat, and Seafood Products, and Others) Forecast Period (2022-2028)

Food hydrocolloids market is anticipated to grow at a significant CAGR of 6.9% during the forecast period. One of the key factors fueling the market growth includes the rising demand for processed and convenience food products across the globe. Hydrocolloids provide a major opportunity for tailoring nutritional value and offer potential health benefits via control of gastric emptying and ileal brake mechanisms (potentially and satiety obesity), plasma cholesterol levels (cardiovascular disease), glycemic response (diabetes), and carbohydrate fermentation throughout the large intestine (colon cancer). Such benefits have been increasing the demand for food hydrocolloids which is reflected in the active participation of market players. For instance, in December 2020, CP Kelco introduced GENU Pectin YM-FP-2100, a clean-label-friendly element that offers a medium-to-high thickness in the fruited drinking yogurt and with ease of pumpability at the fruit grounding stage.

Segmental Outlook

The global food hydrocolloids market is segmented based on the type and application. Based on the type, the market is segmented into gelatin gum, pectin, xanthan gum, guar gum, and others. The other sub-segment includes carrageenan. Based on the application, the market is sub-segmented into dairy and frozen products, bakery, beverages, confectionery, meat and seafood products, and others. The other sub-segment includes oil and fats. The above-mentioned segments can be customized as per the requirements. Among the application, the bakery is anticipated to grow significantly in the market owing to its high usability, while, out of the type, the pectin sub-segment is anticipated to grow at a considerable CAGR during the forecast period owing to rising preferences toward plant-derived hydrocolloids.

Among the application, the bakery is anticipated to grow significantly in the market during the forecast period. The bakery uses hydrocolloids for retarding staling and refining the freshness of the food even after freezing. The structural modification in wheat can store the bread by growing water retention capacity and avoiding the formation of ice crystals at the time of frozen storage. Such products do not damage the aroma and flavor of the baked products and offer the advantage of low-fat content. With growing global population and an increase in the demand for convenience food products, such as pasta, drinks, bread, gravies, cakes, and pastry, are driving the market's growth. Consumer demand for convenience, indulgence, and authenticity is driving significant growth in the bakery market. This resulted in more manufacturers innovating to provide more diverse and tempting products with numerous ingredients for meeting consumer expectations, which is further increasing the application of food hydrocolloids.

Regional Outlooks

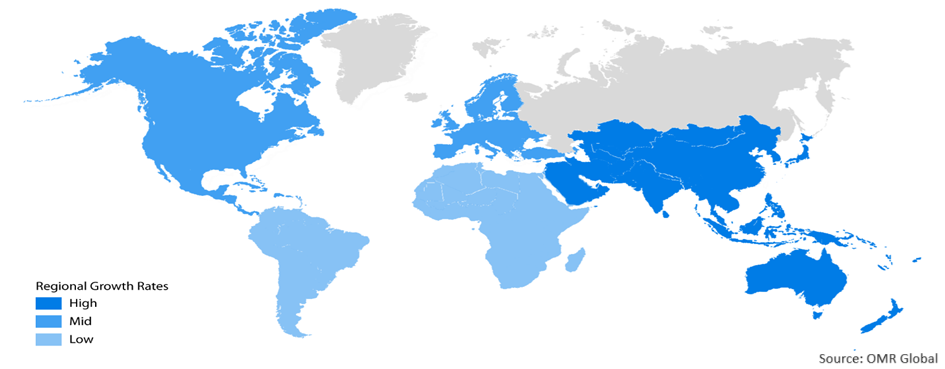

The global food hydrocolloids market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is anticipated to grow at the fastest rate in the market, while North America is anticipated to hold a prominent share during the forecast period.

Global Food Hydrocolloids Market Growth, by Region 2022-2028

The Asia-Pacific Region Anticipated to Grow Fastest in the Global Food Hydrocolloids Market

The Asia-Pacific region is anticipated to grow at the fastest rate in the market during the forecast period owing to the presence of prominent market countries such as China and Japan, which has huge demand. In the region, China is one of the major consumers and manufacturers of food hydrocolloids and has vast end-user industries such as food and beverage, oil and gas industry, personal care, and others. The country is one of the prime producers of seaweed hydrocolloids across the globe. As per the Food and Agriculture Organization of the United Nations, in 2019, China produced the largest seaweeds with 20,296,592 tonnes, which is 56.75% of the total production of seaweeds, globally. In China, the market for food hydrocolloids is prominently driven by dairy applications. Gellan gum is broadly used for the production of yogurt products, such as Ambrosia from Yili, in the country. The flourishing dairy sector fuels the demand for food-based hydrocolloids used for stabilizing and thickening purposes in the country and also the other countries in the region. Moreover, Japan's market for Hydrocolloids is prominently driven by the rising demand for convenience foods, particularly confectioneries.

Market Players Outlook

The major companies serving the global food hydrocolloids market include Archer Daniels Midland Co., Cargill, Inc., International Flavors & Fragrances Inc., J.M. HUBER Group (CP Kelco US Inc.), Koninklijke DSM N.V., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Ingredion launched a new range of single hydrocolloids to its existing widespread food and beverage portfolio. The new products provided are TIC Gum Arabic FT Powder, Pre-Hydrated Gum Arabic Spray Dry Powder, TIC Tara Gum 100, Ticalose CMC 400 Granular Powder, and Ticaxan Xanthan EC.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food hydrocolloids market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Archer Daniels Midland Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Cargill, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. International Flavors & Fragrances Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. J.M. HUBER Group (CP Kelco US Inc.)

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Koninklijke DSM N.V.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Food Hydrocolloids Market by Type

4.1.1. Gelatin Gum

4.1.2. Pectin

4.1.3. Xanthan Gum

4.1.4. Guar Gum

4.1.5. Others (Carrageenan)

4.2. Global Food Hydrocolloids Market by Application

4.2.1. Dairy and Frozen Products

4.2.2. Bakery

4.2.3. Beverages

4.2.4. Confectionery

4.2.5. Meat and Seafood Products

4.2.6. Others (Oils and Fats)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ashland Global Holdings Inc.

6.2. Behn Meyer Deutschland Holding AG & Co. KG

6.3. FDL

6.4. HEBEI XINHE BIOCHEMICAL CO. , LTD.

6.5. HISPANAGAR S.A.

6.6. Ingredion Inc.

6.7. J.F. Hydrocolloids, Inc.

6.8. Kerry Group plc

6.9. Lucid Colloids Ltd.

6.10. Rico Carrageenan

1. GLOBAL FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL GELATIN GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PECTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL XANTHAN GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL GUAR GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL FOOD HYDROCOLLOIDS FOR DAIRY AND FROZEN PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FOOD HYDROCOLLOIDS FOR BAKERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FOOD HYDROCOLLOIDS FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL FOOD HYDROCOLLOIDS FOR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL FOOD HYDROCOLLOIDS FOR MEAT AND SEAFOOD PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL FOOD HYDROCOLLOIDS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. REST OF THE WORLD FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. REST OF THE WORLD FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD FOOD HYDROCOLLOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL FOOD HYDROCOLLOIDS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL GELATIN GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL PECTIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL XANTHAN GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL GUAR GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL FOOD HYDROCOLLOIDS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL FOOD HYDROCOLLOIDS FOR DAIRY AND FROZEN PRODUCTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL FOOD HYDROCOLLOIDSFOR BAKERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL FOOD HYDROCOLLOIDS FOR BEVERAGES MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL FOOD HYDROCOLLOIDS FOR CONFECTIONERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL FOOD HYDROCOLLOIDS FOR MEAT AND SEAFOOD PRODUCTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL FOOD HYDROCOLLOIDS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL FOOD HYDROCOLLOIDS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

17. UK FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD FOOD HYDROCOLLOIDS MARKET SIZE, 2021-2028 ($ MILLION)