Food Preservatives Market

Global Food Preservatives Market Size, Share & Trends Analysis Report by Type (Natural Preservatives and Synthetic Preservatives) and by Application (Bakery, Dairy & Frozen Products, Meat, Poultry & Seafood, Beverages, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global food preservatives market is growing at a significant CAGR of around 3.4% during the forecast period (2020-2026). Food preservatives are regarded as a chief ingredient in the food industry for increasing the shelf-life of the product. These are added into the food to enhance its efficiency against spoilage organisms. There are several pivotal factors that are driving the global food preservatives market, which includes the rising demand for convenience food products and increasing use of natural preservatives in non-vegetation food products. The demand for convenience food is mounting the need for the development of convenience stores for food. According the National Association of Convenience Store, there are around one million convenience stores across the globe. These convenience stores are further expected to grow during the forecast period, owing to the rising disposable income, backed by the significant adoption of advertisement services for the branding of the convenience food products.

Moreover, increasing trend for natural preservatives and clean label products are further expected to drive the market growth during the forecast period. In addition, the continuous growth in the food processing industry in emerging economies, such as India and China, will certainly offer growth to the market in the near future. The Indian government has set up a $300 million “Food Processing Fund” to support the opening and growth of food parks. There are currently 42 Mega Food parks being set up. This program by the government has prompted investment from many multinational food processing companies such as Kraft, Mars, Nestle, Kellogg, Coca Cola, and others. However, the transition towards organic food products, use of preservation technique, and limited availability of natural preservatives will affect the market growth during the forecast period.

Segmental Outlook

The food preservatives market is classified on the basis of type and application. Based on type, the market is bifurcated into natural preservatives and synthetic preservatives. Based on application, the market is segregated into bakery, dairy & frozen products, meat, poultry & seafood, beverages, and others.

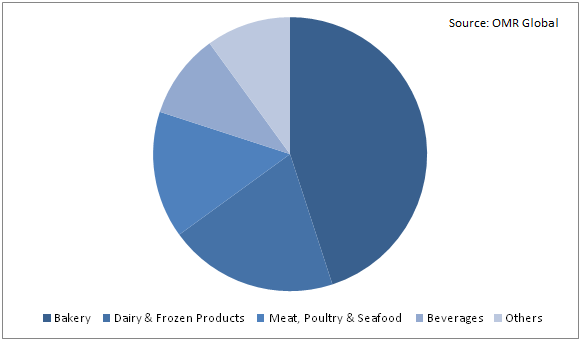

Global Food Preservatives Market Share by Application, 2019(%)

Global food preservatives market is driven by its application in bakery products

The bakery products segment contributes a significant share in the food preservatives market and is expected to contribute significantly, by exhibiting a fastest CAGR, during the forecast period. This growth is attributed to the increasing demand for seeded, whole meal, gluten-free, and other breads provides a healthy soar to the health-conscious population. Owing to this, the demand for bakery products is increasing in the emerged economies such as the US. Moreover, the introduction of breads enriched with added nutrients is another factor that contributes to the growing demand for premium breads and other related bakery products.

Regional Outlook

The global food preservatives market is classified on the basis of geography,which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global food preservatives market. The US plays the critical role in geographic contribution of North America in global food preservatives market. The rising trend for convenience food due to fast-moving lifestyle has increased the growth of food preservatives market in the country. Such huge demand for convenience food has led to the opening of a number convenience stores in the country. According the National Association of Convenience Store, around 152,720 convenience stores are functioning in the US, which marks the revenue of about $650 billion in total sales. In addition, the wide presence of major food contract manufacturers and increasing innovations in food products are further offering growth opportunity to the market in the region.

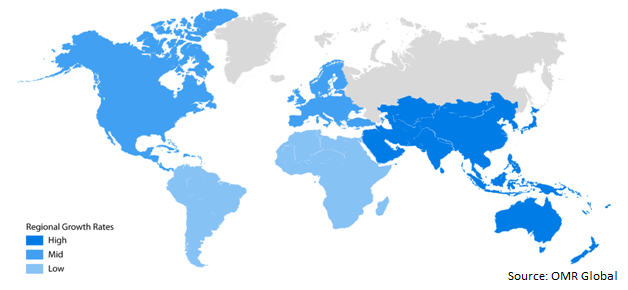

Global Food Preservatives Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacificis estimated to project a considerable CAGR in the global food preservatives market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. There is a significant scope for contract manufacturing in food industry owing to increasing food & beverage industry in developing countries. According to the India Brand Equity Foundation (IBEF), in 2019, India exported around $38.5 billion of agricultural and processed food products. These exports statistics were more than 100 countries/regions across the globe, among which, the major countries/regions are the US, Southeast Asia, SAARC countries, EU, and the Middle East.

Moreover, the food processing industry augmented by an increasing population and urbanization can be considered as other factors for the growth of the market in the region. China has benefitted from the emergence of a large number of middle-class consumers. There are many food and beverage companies are now seeing China as a potential growth vehicle due to this rise of disposable income, the industry for food and beverage processing equipment has grown substantially in the past few years. China has substantial market potential due to high food consumption by its immense and growing population. Such large consumption rate along with the rise in urbanization will create a growth opportunity for the food preservatives market during the forecast period.

Market Players Outlook

The key players in the food preservatives market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global food preservatives market include DuPont de Nemours, Inc., Cargill, Inc., Kemin Industries, Inc., ITA 3 s.r.l., Kerry Group PLC, BASF SE, and Corbion NV.These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food preservatives market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. DuPont de Nemours, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cargill, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kemin Industries, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. ITA 3 s.r.l.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Kerry Group PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Food Preservatives Market by Type

5.1.1. Natural Preservatives

5.1.2. Synthetic Preservatives

5.2. Global Food Preservatives Market by Application

5.2.1. Bakery

5.2.2. Dairy & Frozen Products

5.2.3. Meat, Poultry & Seafood

5.2.4. Beverages

5.2.5. Others (Snacks and Sauces)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alliance, Inc.

7.2. Arjuna Natural Pvt Ltd.

7.3. BASF SE

7.4. BIOSECUR LAB Inc.

7.5. Brenntag Holding GmbH

7.6. Cargill, Inc.

7.7. Celanese Corp.

7.8. Corbion NV

7.9. DuPont de Nemours, Inc.

7.10. Galactic SA

7.11. Home Roots

7.12. ITA 3 s.r.l.

7.13. Kemin Industries, Inc.

7.14. Kerry Group PLC

7.15. Kilo Ltd.

7.16. Nouryon Chemicals Holding B.V.

7.17. Rigest Trading Ltd.

7.18. Univar Ltd.

1. GLOBAL FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL NATURAL PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SYNTHETIC PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL FOOD PRESERVATIVES FOR BAKERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FOOD PRESERVATIVES FOR DAIRY AND FROZEN PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FOOD PRESERVATIVES FOR MEAT, POULTRY & SEAFOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FOOD PRESERVATIVES FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FOOD PRESERVATIVES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD FOOD PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL FOOD PRESERVATIVES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL FOOD PRESERVATIVES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL FOOD PRESERVATIVES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FOOD PRESERVATIVES MARKET SIZE, 2019-2026 ($ MILLION)