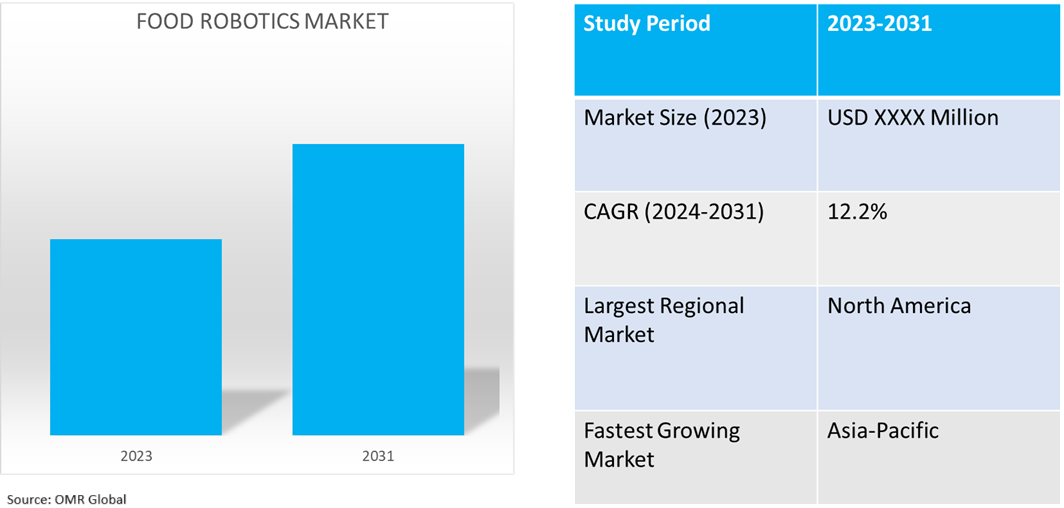

Food Robotics Market

Food Robotics Market Size, Share & Trends Analysis Report by Product Type (Articulated, Cartesian, SCARA, Parallel, Cylindrical, and Collaborative), by Payload (Low, Medium, and High), and by Application (Packaging, Repackaging, Palletizing, Picking, Processing, and Others (Cutting & Slicing, Quality Inspection)) Forecast Period (2024-2031)

Food robotics market is anticipated to grow at a significant CAGR of 12.2% during the forecast period (2024-2031). Robotic technology, combined with the added value of AI and machine learning, is much more accurate and adaptive in terms of handling food. AI-enabled robots can slice, sort, and portion with high accuracy. For instance, AI-enabled robots are used by FANUC and ABB to automate inspection and sorting, which helps manufacturing lines run more efficiently and minimize human error. Market players such as ABB serves a wide range of customers through its Robotics & Discrete Automation Business area. The food and beverage industry is one of the main focus areas for the company within the Robotics & Discrete Automation sector. ABB's Robotics & Discrete Automation Business area generated $3.6 billion in revenues in 2023. Furthermore, YASKAWA Electric Corp generated 40% of its revenue in 2023 from the robotics sector. The company offers Motoman Robots in the Food Industry / Food Processing. Motoman Robots with Food Grade Grease are permitted to handle and process food, preventing food contamination in the unlikely event of leaks.

Market Dynamics

Food Hygiene and Safety Standards

The global food industry is increasing its requirement for automation to meet stringent food safety regulations, reduce human intervention, and maintain hygiene standards in processing, sorting, and packaging. According to the Centers for Disease Control and Prevention, in the US alone, foodborne infections affect around 128,000 individuals annually and cause 3,000 fatalities. Maintaining clean conveyors along their processing and packaging lines is essential for US food companies to reduce the risk of contamination and bacterial accumulation. For instance, in October 2024, Vecna Robotics introduced CaseFlow, a robotic case-picking solution that automates 90% of warehouse travel and doubles worker throughput. The system uses pallet-handling robots for up to 90% of warehouse travel and directs workers with dynamic, directed zone picking. The system enhances employee satisfaction and safety, even doubling site performance along with using fewer employees than operations executed manually.

- In September 2023, Rotzinger launched a robot with an integrated buffer and hygienic conveyor for dry cleaning. The solution, designed for confectionery and bakery products, combines flexibility, compactness, and easy operation, boosting uptime and lowering ownership costs.

Rising demand for Processed and Packaged Foods

Urbanization and active lifestyle are driving increased demand for ready-to-eat and convenience foods, required expansion, efficient robotic solutions for consistent product quality, and faster production rates that drive market growth. Global food trade expanded substantially between 2000 and 2021, increasing by 350% to reach a total value of $1.7 trillion. Over this period, food's share of global merchandise trade rose from 6% to 8%. Developed economies import a larger share of processed food at 48%, compared to 35% for developing economies, which indicates the complex dynamics of global food distribution.

Market Segmentation

- Based on the type, the market is segmented into articulated, cartesian, SCARA, parallel, cylindrical, and collaborative.

- Based on the payload, the market is segmented into low, medium, and high.

- Based on the Application, the market is segmented into packaging, repackaging, palletizing, picking, processing, and others (cutting & slicing, quality inspection)

The Packaging Segment is projected to Hold the Largest Market Share

The rising demand for Ready-to-Eat (RTE) and Ready-to-Cook (RTC) foods are major factors propelling the food robotics market's growth. Robotic technologies are being used by food manufacturers to meet this need to increase productivity, guarantee product consistency, and uphold food safety regulations. For instance, in October 2024, Premier Tech introduced TOMA, its new product line. TOMA is a new product line that accelerates packaging automation projects with a user-friendly, user-friendly do-it-yourself experience with a comprehensive palletizing solution.

- In August 2024, Paxiom Group recently launched the PKR-Dual Delta Robot pick and place case packing cell, which can accommodate several products such as pouches, cartons, or trays. It is a high-speed, accurate, and efficient system that manufacturers in numerous industries need.

SCARA Segment to Hold a Considerable Market Share

Robots ensure higher operational efficiency while waste elimination, hence ensuring profitability within a competitive market and contributing to the growth of the market. For instance, in November 2023, ABB developed the IRB 930 SCARA robot that would enhance pick-and-place and assembly operations. These high-performance SCARA robots are intended for use in a variety of industries, including manufacturing and packing, where pick-and-place and assembly tasks require speed and repeatability are necessary. The robot can be up to 10% more productive and 200% stronger in push-down compared to standard robots, hence more productivity and product quality while performing force-intensive operations.

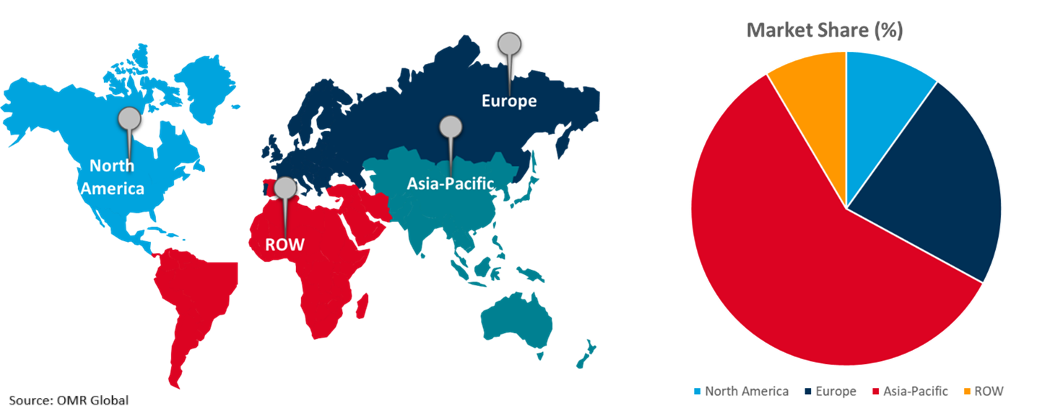

Regional Outlook

The global food robotics market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Food Robotics Market Growth by Region 2024-2031

Asia Pacific Region is Projected to Showcase Growth Opportunities for the Food Robotics Market

Asia-Pacific is expected to provide growth opportunities in the coming years owing to the growing demand for processed foods and government policies promoting automation in the food industry, especially in export-quality products. A nation such as Japan is home to some of the most prominent manufacturers and robotics companies. In industries including logistics, food, and pharmaceuticals, there has been an increasing trend toward automation in packaging and transportation. In 2021, there were 631 robots for every 10,000 individuals employed in Japan's manufacturing sector. In contrast, there were 274 robots for every 10,000 people in the US.

Furthermore, according to the India Brand Equity Foundation (IBEF), India's expanding population, changing dietary tastes encouraged by rising disposable income, and urbanization is estimated to propel the country's food processing market's growth from $866 billion in 2022 to $1,274 billion in 2027. India is the sixth-largest food and grocery market globally. The food processing sector of India accounts for 32% of the food market, 13% of all exports, and 6% of industrial investment.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the food robotics market include ABB Group, FANUC CORP., Rockwell Automation Inc., and KUKA AG, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In October 2024, Serve Robotics and Wing Aviation partnered to expand on eco-friendly, autonomous food delivery, so merchants can tap into drone delivery without having to change their facilities or workflow. The partnership aims to make highly automated delivery the preferred mode for millions of small packages globally.

- In October 2024, Estonian tech giants Starship and Bolt partnered to launch a robot-powered grocery delivery service. The partnership looks to transform sustainable city delivery across Europe, providing customers with flexible, sustainable, and low-cost options over the final mile.

- In August 2024, Grubhub and Starship Technologies partnered with UNM Food to introduce the robot food delivery service at the University of New Mexico. The service delivers food and drinks from eight campus eateries within minutes.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food robotics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. FANUC CORP.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rockwell Automation Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. KUKA AG Rockwell Automation Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Food Robotics Market by Type

4.1.1. Articulated

4.1.2. Cartesian

4.1.3. SCARA

4.1.4. Parallel

4.1.5. Cylindrical

4.1.6. Collaborative

4.2. Global Food Robotics Market by Payload

4.2.1. Low

4.2.2. Medium

4.2.3. High

4.3. Global Food Robotics Market by Application

4.3.1. Packaging

4.3.2. Repackaging

4.3.3. Palletizing

4.3.4. Picking

4.3.5. Processing

4.3.6. Others (Cutting & Slicing, Quality Inspection)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. autonox Robotics GmbH

6.2. Bastian Solutions, LLC

6.3. Bizerba SE & Co. KG

6.4. Comau S.p.A.

6.5. DENSO International America, Inc.

6.6. GEA Group Aktiengesellschaft

6.7. Kawasaki Robotics GmbH

6.8. Mayekawa Group

6.9. Mitsubishi Electric Corp.

6.10. OMRON Corp.

6.11. Schneider Electric

6.12. Epson America, Inc.

6.13. SIASUN Robot & Automation CO., Ltd.

6.14. Stäubli International AG

6.15. Techman Robot Inc

6.16. Universal Robots A/S

6.17. Yaskawa Electric Corp.

1. Global Food Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Articulated Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Cartesian Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global SCARA Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Parallel Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Cylindrical Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Collaborative Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Food Robotics Market Research And Analysis By Payload, 2023-2031 ($ Million)

9. Global Low Payload Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Medium Payload Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global High Payload Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Food Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

13. Global Food Robotics For Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Food Robotics For Repackaging Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Food Robotics For Palletizing Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Food Robotics For Picking Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Food Robotics For Processing Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Food Robotics For Other Applications Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

20. North American Food Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

21. North American Food Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

22. North American Food Robotics Market Research And Analysis By Payload, 2023-2031 ($ Million)

23. North American Food Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

24. European Food Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

25. European Food Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

26. European Food Robotics Market Research And Analysis By Payload, 2023-2031 ($ Million)

27. European Food Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

28. Asia-Pacific Food Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

29. Asia-Pacific Food Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Asia-Pacific Food Robotics Market Research And Analysis By Payload, 2023-2031 ($ Million)

31. Asia-Pacific Food Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

32. Rest Of The World Food Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

33. Rest Of The World Food Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

34. Rest Of The World Food Robotics Market Research And Analysis By Payload, 2023-2031 ($ Million)

35. Rest Of The World Food Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Food Robotics Market Share By Type, 2023 Vs 2031 (%)

2. Global Articulated Food Robotics Market Share By Region, 2023 Vs 2031 (%)

3. Global Cartesian Food Robotics Market Share By Region, 2023 Vs 2031 (%)

4. Global SCARA Food Robotics Market Share By Region, 2023 Vs 2031 (%)

5. Global Parallel Food Robotics Market Share By Region, 2023 Vs 2031 (%)

6. Global Cylindrical Food Robotics Market Share By Region, 2023 Vs 2031 (%)

7. Global Collaborative Food Robotics Market Share By Region, 2023 Vs 2031 (%)

8. Global Food Robotics Market Share By Payload, 2023 Vs 2031 (%)

9. Global Low Payload Food Robotics Hospitals Market Share By Region, 2023 Vs 2031 (%)

10. Global Medium Payload Food Robotics Market Share By Region, 2023 Vs 2031 (%)

11. Global High Payload Food Robotics Market Share By Region, 2023 Vs 2031 (%)

12. Global Food Robotics Market Share By Application, 2023 Vs 2031 (%)

13. Global Food Robotics For Packaging Market Share By Region, 2023 Vs 2031 (%)

14. Global Food Robotics For Repackaging Market Share By Region, 2023 Vs 2031 (%)

15. Global Food Robotics For Palletizing Market Share By Region, 2023 Vs 2031 (%)

16. Global Food Robotics For Picking Market Share By Region, 2023 Vs 2031 (%)

17. Global Food Robotics For Processing Market Share By Region, 2023 Vs 2031 (%)

18. Global Food Robotics For Application Market Share By Region, 2023 Vs 2031 (%)

19. Global Food Robotics Market Share By Region, 2023 Vs 2031 (%)

20. US Food Robotics Market Size, 2023-2031 ($ Million)

21. Canada Food Robotics Market Size, 2023-2031 ($ Million)

22. UK Food Robotics Market Size, 2023-2031 ($ Million)

23. France Food Robotics Market Size, 2023-2031 ($ Million)

24. Germany Food Robotics Market Size, 2023-2031 ($ Million)

25. Italy Food Robotics Market Size, 2023-2031 ($ Million)

26. Spain Food Robotics Market Size, 2023-2031 ($ Million)

27. Rest Of Europe Food Robotics Market Size, 2023-2031 ($ Million)

28. India Food Robotics Market Size, 2023-2031 ($ Million)

29. China Food Robotics Market Size, 2023-2031 ($ Million)

30. Japan Food Robotics Market Size, 2023-2031 ($ Million)

31. South Korea Food Robotics Market Size, 2023-2031 ($ Million)

32. Rest Of Asia-Pacific Food Robotics Market Size, 2023-2031 ($ Million)

33. Latin America Food Robotics Market Size, 2023-2031 ($ Million)

34. Middle East And Africa Food Robotics Market Size, 2023-2031 ($ Million)