Forage Feed Market

Global Forage Feed Market Size, Share & Trends Analysis Report by Products (Stored Forage, Fresh Forage, and Others), By Animal Type (Ruminants, Poultry, Swine, and Others) Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global market for forage feed is projected to have a considerable CAGR of around 4.5% during the forecast period. Forages are plants or parts of plants eaten by herbivorous animals. These are mainly the plant leaves and stems consumed by grazing livestock. The price of forage feed is lower as compared to other feeds, such as oilseed and wheat bran and they do not depend on pesticides and synthetic fertilizers. The demand for forage feed is heavily influenced by animal husbandry and livestock. Forage seeds are in high demand due to rising animal feed demands. Over the forecast period, rising per capita meat consumption is predicted to boost demand for forage feed. Farmers particularly prefer the cultivation of these feeds due to the obvious economic benefits, which include risk diversification, crop rotation, soil erosion prevention, and enhanced soil structure. There are some restraints and constraints that will impede overall market expansion such as farmers' reluctance to pay for high-quality seeds, time-consuming cultivation, production uncertainty, and the need for a large investment.

Segmental Outlook

The global forage feed market is segmented based on products, and animal type. Based on the products, the market is further classified into stored forage, fresh forage, and others. Further, based on the animal type the market is classified into ruminants, poultry, swine, and others.

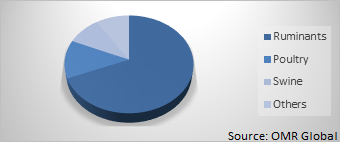

Global Forage Feed Market Share by Animal Type, 2021 (%)

The Ruminants Segment is Considered the Dominating Segment in the Global Forage Feed market.

Among animal types, the ruminant’s segment is estimated as dominating segment during the forecast period. Within the animal, livestock products group, milk, and milk products hold the dominant share due to their demand. The global consumption of animal products, such as milk and meat, is rising, owing to a growing awareness of the health benefits of milk and the growing demand for protein. The high demand for quality products is increasing the demand for quality forage feed, which, in turn, is driving the market for forage feeds. To obtain high-quality products from their cattle, farmers choose good quality forage for them. As per the FAO, the annual growth of the meat and dairy market in developing countries is projected to be valued at 2.1% and 2.3%, respectively, from 2015 to 2030. Therefore, the growing demand for meat and dairy products is promoting the forage seed market.

Regional Outlook

Geographically, the global Forage Feed market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Europe is projected to hold a significant share global forage feed market. Germany and the U.K are the major contributors of poultry products, which, in turn, boost the market growth in this region. Furthermore, the availability of large grazing land for animals and cultivating land for fodder production is giving a push to the growth of the forage seeds market. Furthermore, rising demand for organic food, dairy, and poultry products in the region is expected to propel the forage seed market ahead throughout the forecast period.

Global Forage Feed Market Growth, by Region 2022-2028

North America to Hold a Considerable Share in the Global Forage Feed Market

Geographically, North America is projected to hold a significant share global forage feed market as there is a surge in the livestock population, due to the increased demand for beef and chicken in the region. The consumption of alfalfa hay is beneficial due to its crude protein level, especially for chicken feed, followed by animal feed. The most major agricultural industry in the US is cattle production. Timothy and bromegrass, two commonly grown forage types of grass in Canada, are the most widely produced grass seeds on a global scale. In addition, in comparison to other North American countries, the US has the most established animal production industry and well-developed feed manufacturing firms, considering it a significant market share. According to USDA, The total amount of hay produced in the country accounted for 128 million metric tons in 2019.

Market Players Outlook

The key players in the forage feed market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include ADM Alliance Nutrition, Wilbur Ellis Holdings Inc, Mitsubishi Corp, Standlee Premium Products, LLC among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In November 2020, S&W Seed Company a global agricultural company announced that it has agreed to commercial terms with Calyxt, Inc. In collaboration with Calyxt, S&W Seed Company identified a novel, proprietary trait for increased forage quality in commercial alfalfa production. The new trait, branded as IQ Alfalfa gives farmers a new way to produce alfalfa forage with improved ruminant digestibility for livestock.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Forage Feed market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Forage Feed Industry

• Recovery Scenario of Global Forage Feed Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Forage Feed Market by Products

5.1.1. Stored Forage

5.1.2. Fresh Forage

5.1.3. Others

5.2. Global Forage Feed Market by Animal Type

5.2.1. Ruminants

5.2.2. Poultry

5.2.3. Swine

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ADM Alliance Nutrition Inc

7.2. Al Dahra ACX Global Inc.

7.3. Baileys Horse Feeds

7.4. BASF SE

7.5. Cargill Inc

7.6. Chaffhaye Inc

7.7. Enterra Corp

7.8. Germinal GB Ltd

7.9. Hindustan Animal Feeds

7.10. Kemin Industries, Inc

7.11. Land O Lake Inc

7.12. Lucerne Farms

7.13. NWF Agriculture Ltd

7.14. Riverina Australia Pty Ltd.

7.15. SGS SA

7.16. Standlee Premium Products, LLC

7.17. Taj Agro Products Ltd

7.18. Triple Crown Nutrition

7.19. Triple Crown Nutrition Inc.

7.20. Wilbur-Ellis Holdings Inc.

1. GLOBAL FORAGE FEED MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2021-2028 ($ MILLION)

2. GLOBAL STORED FORAGE FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FRESH FORAGE FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHERS FORAGE FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FORAGE FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2021-2028 ($ MILLION)

6. GLOBAL FORAGE FEED FOR RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL FORAGE FEED FOR POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL FORAGE FEED FOR SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL FORAGE FEED FOR OTHER ANIMALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FORAGE FEED MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2021-2028 ($ MILLION)

13. NORTH AMERICAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

14. EUROPEAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2021-2028 ($ MILLION)

16. EUROPEAN FORAGE FEED MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC FORAGE FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC FORAGE FEED MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC FORAGE FEED MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

20. REST OF THE FORAGE FEED MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2021-2028 ($ MILLION)

21. REST OF THE WORLD FORAGE FEED MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FORAGE FEED MARKET, 2021-2028(% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FORAGE FEED MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL FORAGE FEED MARKET, 2021-2028 (%)

4. GLOBAL FORAGE FEED MARKET SHARE BY PRODUCTS, 2021 VS 2028 (%)

5. GLOBAL FORAGE FEED MARKET SHARE BY ANIMAL TYPE, 2021 VS 2028 (%)

6. GLOBAL STORED FORAGE MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

7. GLOBAL FRESH FORAGE FEED MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

8. GLOBAL OTHER FORAGE FEED PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

9. GLOBAL FORAGE FEED FOR RUMINANTS MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

10. GLOBAL FORAGE FEED FOR POULTRY MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

11. GLOBAL FORAGE FEED FOR SWINE MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

12. GLOBAL FORAGE FEED FOR OTHER ANIMALS MARKET SHARE BY GEOGRAPHY, 2021-2028 ($MILLION)

13. US FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

15. UK FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

20. ROE FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

24. ASEAN FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD FORAGE FEED MARKET SIZE, 2021-2028 ($ MILLION)