Foreign Exchange Services Market

Foreign Exchange Services Market Size, Share & Trends Analysis Report by Services (Currency Exchange, Remittance Services, and Foreign Currency Accounts), by Providers (Banks and Money Transfer Operators), and by Application (Businesses and Individuals), Forecast Period (2024-2031)

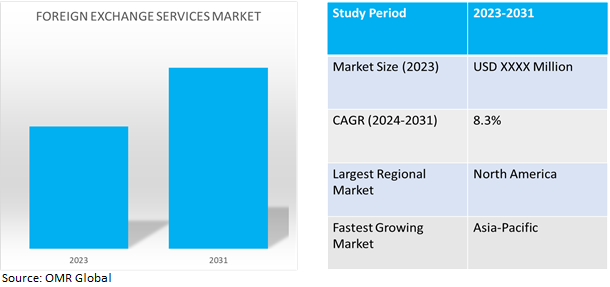

Foreign exchange services market is anticipated to grow at a considerable CAGR of 8.3% during the forecast period (2024-2031).Foreign exchange services means the provision of foreign exchangeservices to clients, including but not limited to selling, purchasing, and delivering currency transactions. These transactions may be spot or forward. It is the global market where different currencies are traded. It is used for conducting business transactions, investing, and hedging against currency fluctuations. In the foreign exchange services market, currency exchange rates are determined by supply and demand dynamics.

Market Dynamics

Increasing Trend in Tourism

The anticipated growth of the foreign exchange service market in the future is expected to be fueled by the increasing trend in tourism. Tourism involves individuals traveling to and staying in locations beyond their usual surroundings, whether for recreational, business, or other purposes. The influx of tourists into a country typically requires the conversion of their home currency to the local currency, leading to a surge in foreign exchange transactions at various points such as airports, banks, and other currency exchange facilities. For example, in May 2023, a report from the United Nations World Tourism Organization, a specialized agency based in Spain, highlighted a rebound in international tourist arrivals in the first quarter of 2023, reaching 80.0% of pre-pandemic levels with approximately 235.0 million travelers. This marked a more than twofold increase compared to the same period in 2022. The tourism sector demonstrated remarkable resilience, as revised data for 2022 indicated that over 960.0 million international tourists explored foreign destinations last year, achieving a recovery of two-thirds (66.0%) of pre-pandemic levels. Hence, the upsurge in tourism is a driving factor for the growth of the foreign exchange service market.

Growing Global Trade and Investment

The growth of global trade and investment has a positive impact on the foreign exchange services market. As countries engage in more international trade, the demand for foreign exchange services increases. In addition, these services allow businesses and individuals to convert one currency into another to facilitate cross-border transactions. Therefore, the growth of global trade and investment creates new opportunities for foreign exchange serviceproviders to offer their services to a wider range of customers. For instance, a recent example of growing global trade and investment is the increase in cross-border e-commerce between the US and Europe. With the growth of online shopping and advancements in logistics and delivery systems, many businesses are now able to sell their products and services to customers across the globe. Therefore, the increase in cross-border e-commerce has led to an increase in demand for foreign exchange services, as businesses need to convert payments and transactions into different currencies. Therefore, these factors lead to the market growth in upcoming years.

Market Segmentation

Our in-depth analysis of the global foreign exchange services market includes the following segments by services, providers, and applications:

- Based on services, the market is segmented into currency exchange, remittance services, and foreign currency accounts.

- Based on providers, the market is segmented into banks and money transfers.

- Based on applications, the market is segmented into businesses and individuals.

Remittance Service is Projected to Emerge as the Largest Segment

The remittance service segment is expected to hold the largest share of the market. A remittance service is a financial service that allows people to send money to individuals or businesses in other countries. Remittance services can be offered by banks, money transfer companies, and other financial institutions. There are several reasons why there may be a growing demand for foreign exchange remittance services. As the world becomes more interconnected, people are increasingly working and doing business across borders. This means that there is a growing need for foreign exchange remittance services to send money internationally, which increases demand for foreign exchange services market.

Bank Segment to Hold a Considerable Market Share

The bankssegment is expected to be the fastest-growing segment in the global foreign exchange services market due to established reputation, extensive network, and ability to offer comprehensive forex services to businesses and individuals. They benefit from increased demand for currency exchange, international trade, and hedging services, making them a preferred choice for clients seeking trustworthiness and a wide range of financial services.

Regional Outlook

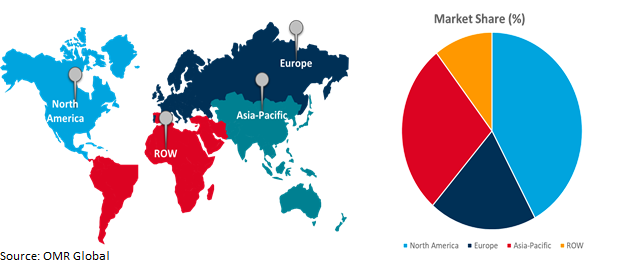

The globalforeign exchange servicesmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Grow at the Fastest CAGR

Asia-Pacific is expected to be the fastest-growing region across the global foreign exchange services market. APAC's robust economic growth, increased trade activity, expanding financial markets, and rising individual wealth have all contributed to the demand for foreign exchange services. Additionally, the region's technological advancements and widespread internet accessibility have facilitated greater retail participation in forex trading. Furthermore, the region's diverse currencies, including the Chinese Yuan and Japanese Yen, have gained prominence in international trade and investment, attracting traders and investors. Overall, APAC's dynamic economic landscape, combined with its embrace of forex technology and increased market integration, positions it as a vibrant hub for foreign exchange services and a significant driver of market growth.

Global Foreign Exchange Services Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the region's well-established and mature market reflects a consistently high demand for these services, driven by extensive international trade, investment activities, and a robust financial sector. Secondly, North America's technological prowess plays a pivotal role. The region is a hub for cutting-edge forex trading platforms and technologies, offering a competitive edge and attracting globaltraders and investors. Additionally, major financial centers like New York and Toronto further solidify North America's dominance in the industry. Thus, these factors make North America a powerhouse in the global foreign exchange services market, continuously driving its growth and influence.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global foreign exchange servicesmarket includeBarclays, Goldman Sachs, HSBC Group, and JPMorgan Chase & Co.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in July 2023, Barclays published its third annual Diversity, Equity, and Inclusion (DEI) report as part of its commitment to greater transparency, accountability, and engagement. It captures the progress made in 2022, which included introducing ‘equity’ to the Diversity and Inclusion strategy, relaunching the colleague networks as 12 Employee Resource Groups, and surpassing its Race at Work Ambition to double the number of Black Managing Directors in the US and UK by the end of the year.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global foreign exchange servicemarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Barclays Corporate Banking

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Goldman Sachs

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. HSBC Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. JPMorgan Chase & Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Foreign Exchange ServicesMarket by Services

4.1.1. Currency Exchange

4.1.2. Remittance Services

4.1.3. Foreign Currency Accounts

4.2. Global Foreign Exchange ServicesMarket by Providers

4.2.1. Banks

4.2.2. Money Transfer Operators

4.3. Global Foreign Exchange ServicesMarket by Application

4.3.1. Businesses

4.3.2. Individuals

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Airwallex

6.2. American Express Co.

6.3. Citigroup Inc.

6.4. Currencies Direct

6.5. CurrencyFair Ltd.

6.6. Dandelion Payments, Inc.

6.7. Deutsche Bank AG

6.8. Japan Post Bank Co.,Ltd.

6.9. MoneyGram

6.10. Muthoot Foreign Exchange

6.11. PayPal Payments Pvt. Ltd.

6.12. Revolut Ltd.

6.13. Standard Chartered Bank

6.14. Tor Currency Exchange Ltd.

6.15. Travelex Foreign Coin Services Ltd.

6.16. UAE Exchange Centre Co.

6.17. Wells Fargo.

6.18. Western Union Holdings, Inc.

6.19. Wise Payments Ltd.

6.20. WorldFirst

6.21. XE.com Inc.

1. GLOBALFOREIGNEXCHANGESERVICESMARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

2. GLOBAL FOREIGN CURRENCY EXCHANGESERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALFOREIGNEXCHANGEREMITTANCE SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBALFOREIGNCURRENCY ACCOUNTS EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FOREIGN EXCHANGE SERVICESMARKET RESEARCH AND ANALYSIS BY PROVIDERS, 2023-2031 ($ MILLION)

6. GLOBAL FOREIGN EXCHANGE SERVICES BY BANKSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FOREIGN EXCHANGE SERVICES BYMONEY TRANSFER OPERATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FOREIGN EXCHANGE SERVICESMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL FOREIGN EXCHANGE SERVICES FOR BUSINESSESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FOREIGN EXCHANGE SERVICES FORINDIVIDUALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

14. NORTH AMERICAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY PROVIDERS, 2023-2031 ($ MILLION)

15. NORTH AMERICAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

16. EUROPEAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

18. EUROPEAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY PROVIDERS, 2023-2031 ($ MILLION)

19. EUROPEAN FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICFOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

22. ASIA-PACIFICFOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY PROVIDERS, 2023-2031 ($ MILLION)

23. ASIA-PACIFICFOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

26. REST OF THE WORLD FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY PROVIDERS, 2023-2031 ($ MILLION)

27. REST OF THE WORLD FOREIGN EXCHANGE SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL FOREIGNEXCHANGESERVICESMARKET SHARE BY SERVICES, 2023 VS 2031 (%)

2. GLOBAL FOREIGN CURRENCY EXCHANGESERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FOREIGNEXCHANGEREMITTANCE SERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBALFOREIGN CURRENCY ACCOUNTS EXCHANGE SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FOREIGN EXCHANGE SERVICESMARKET SHARE BY PROVIDERS, 2023 VS 2031 (%)

6. GLOBAL FOREIGN EXCHANGE SERVICES BY BANKSMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FOREIGN EXCHANGE SERVICES BY BANKS MONEY TRANSFER OPERATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FOREIGN EXCHANGE SERVICES BYMONEY TRANSFER OPERATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FOREIGN EXCHANGE SERVICESMARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL FOREIGN EXCHANGE SERVICES FOR BUSINESSESMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FOREIGN EXCHANGE SERVICES FORINDIVIDUALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FOREIGN EXCHANGE SERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

15. UK FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC FOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICAFOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICAFOREIGN EXCHANGE SERVICESMARKET SIZE, 2023-2031 ($ MILLION)