Formic Acid Market

Formic Acid Market Size, Share & Trends Analysis Report by Grade (Industrial Grade, Pharmaceutical Grade, and Feed Grade) and Application (Silage Additive & Animal Feed, Leather Tanning, Textile Dyeing and Finishing, Rubber Coagulation, Chemical Intermediates and Cleaning Agents) Forecast Period (2025-2035)

Industry Overview

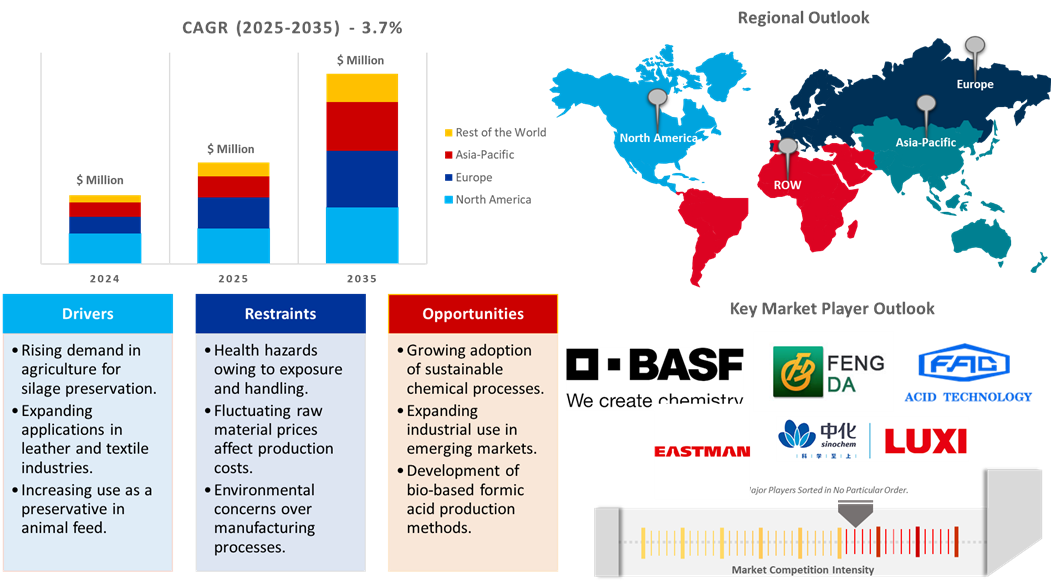

Formic acid market is anticipated to grow at a CAGR of 3.7% during the forecast period (2025-2035). The market is driven by demand for formic acid in a variety of industries such as agriculture, leather, textiles, and chemicals. Its use as a preservative and antibacterial agent in animal feed is significant. Formic acid is also growing popular in the pharmaceutical sector and as a reducing agent in other chemical processes.

Market Dynamics

Increasing Demand for Sustainable Agricultural Practices

The formic acid market is going through a highly increasing demand mainly owing to the rising adoption of environment-friendly agricultural practices. Farmers as well as farming companies are looking for sustainable solutions, which would make the crop healthier and the health of livestock better. Silage preservatives in the natural form, thus preventing spoilage by inhibiting bacterial growth, fermentation, formic acid gains popularity. To provide the animals with higher-quality feed, the treatment aids in maintaining the nutrients in the feed. Aside from this, the majority of producers who care about the environment favor formic acid as a feed addition as it is biodegradable and has a lower ecological impact. Governments and other organizations for sustainable farming activities provide support to such producers through various subsidies and campaigns. These factors are pushing the growth of formic acid applications in agriculture forward, placing it as one of the critical players in modern agriculture.

Expansion of Industrial Applications

Formic acid has been applied across several industries, primarily owing to its acidic properties and efficiency in various processes such as leather processing, textile dyeing, and rubber production. It is used to preserve hides, as well as improve the quality of leather, in the process of tanning leather. It acts as a pH regulator during the dyeing process in the textile industry. In the rubber industry, it is used as a coagulating agent that enhances the strength and elasticity of rubber products. High demand for good-quality leather, textiles, and rubber components in the global market fuels this growth.

Market Segmentation

- Based on the grade, the market is segmented into industrial grade, pharmaceutical grade, and feed grade.

- Based on the application, the market is segmented into silage additive & animal feed, leather tanning, textile dyeing and finishing, rubber coagulation, chemical intermediates, and cleaning agents.

Industrial Grade Segment to Lead the Market with the Largest Share

Industrial-grade formic acid is consumed in large quantities in rubber, textiles, and leather as a preservative and processing agent. Agricultural demand formic acid as a feed additive and preservative. The versatility of formic acid as an intermediate in the synthesis of other chemicals also increases its adoption with innovations in industries. With the growing demand for sustainable and efficient industrial processes, the market for industrial-grade formic acid is expected to grow further. Its increasing role in the pharmaceutical and food sectors also enhances its market presence. Other industries that currently use formic acid include dyeing and finishing textiles. It is also widely applied as a coagulant for many rubber manufacturing processes. The use of formic acid is very high through its usage both as an antibacterial preservative and also as a pesticide in agricultural use.

Silage Additive & Animal Feed: A Key Segment in Market Growth

Increasing utilization of formic acid as an additive in the process of silage preservation and animal feed application has been driving the growth of the market. Formic acid prevents bacterial growth as it enhances the preservation procedure for silage, which remains a popular practice among farmers and livestock producers. The requirement for the chemical increases with growing necessity, considering the ability of the chemical to enhance the nutritional value and digestibility of animal feed.

Regional Outlook

The global formic acid market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Growing Demand for Formic Acid in Industries in Europe

The European market for formic acid is increasing owing to rising demand in different industries such as agriculture and chemicals. The use of formic acid in many applications, including animal feed additives, leather processing, and chemical production, increases demand further. In addition, environmentally responsible and friendly solutions are making the usage of formic acid in green technologies increase. As domestic production continues and strategic imports are maintained, there remains a critical center in Europe for the formic acid market. Favorable government regulations and industry collaborations add further strength to the growth prospects of the market.

Asia-Pacific Region Dominates the Market with Major Share

The Asia-Pacific market for formic acid is experiencing major growth based on growing demand in various sectors including agriculture, leather, and textiles. In China and India, significant industrial activities lead to higher growth rates. Additionally, progress in the field of chemical production has strengthened the building blocks of the market. For instance, Shandong Xinhua Pharma. I&E Co., Ltd. provides formic acid in Asia and holds a very central position as these companies have delivered formic acid to rising demands in Asian regions. Gaining importance among eco-friendly, sustainable solutions drives market demand. On the other side, with help from supportive governments and technological innovations, the Asia Pacific formic acid growing rapidly.

Market Players Outlook

The major companies operating in the global formic acid market include BASF SE, Eastman Chemical Co., Gujarat Narmada Valley Fertilizers & Chemicals Ltd., Hubei Sanli Fengxiang Technology Co., Ltd., Luxi Chemical Group, and Mudanjiang Fengda Chemicals Co., Ltd. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2024, new research by US Department of Energy (DOE) national laboratories found a promising pathway to the high-energy efficiency and durable production of formic acid from CO2 using renewable electricity. Formic acid is a potential intermediate chemical that has a wide range of applications, especially as a feedstock for the chemical or biomanufacturing industries. Formic acid has also been identified as an input for biological upgrading into sustainable aviation fuel (SAF).

- In December 2023, Nitto Denko Corporation and Air Water Inc. launched an initiative to produce formic acid, which is used to preserve grass, from CO2 derived from livestock manure biomass by utilizing Nitto's CO2 chemical conversion technology. The project aims to contribute to the decarbonization of the livestock industry by producing carbon-negative formic acid from biomass-derived feedstock through a conversion technology that efficiently produces formic acid from CO2 and hydrogen.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global formic acid market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Formic Acid Market Sales Analysis – Grade| Application ($ Million)

• Formic Acid Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Formic Acid Industry Trends

2.2.2. Market Recommendations

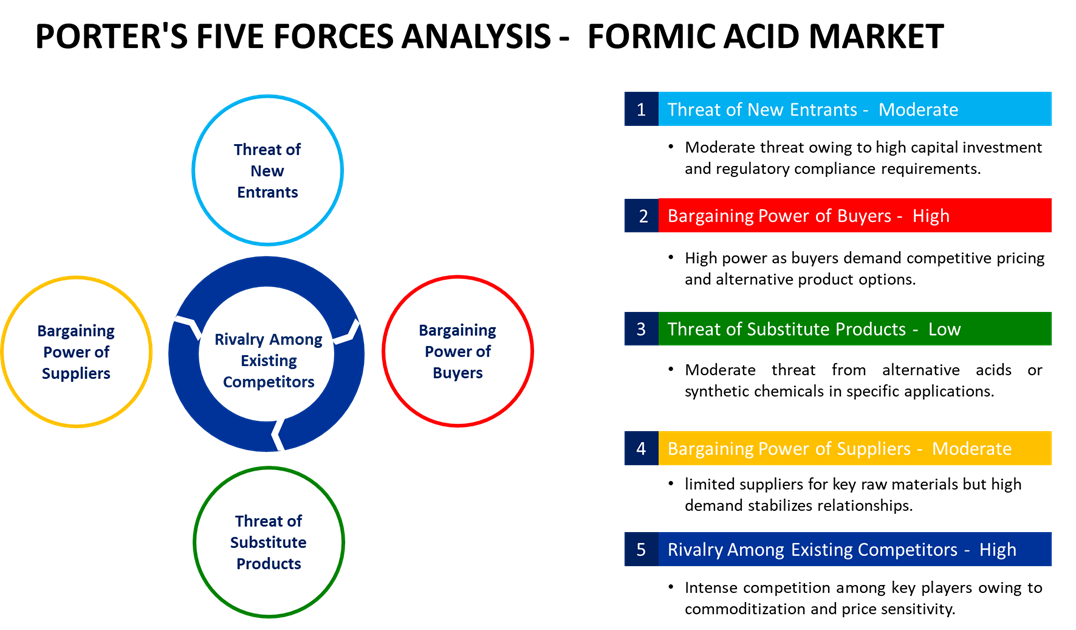

2.3. Porter's Five Forces Analysis for the Formic Acid Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Formic Acid Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Formic Acid Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Formic Acid Market Revenue and Share by Manufacturers

• Formic Acid Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Eastman Chemical Co.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Shandong Acid Technology Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Mudanjiang Fengda Chemicals Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Formic Acid Market Sales Analysis by Grade ($ Million)

5.1. Industrial Grade

5.2. Pharmaceutical Grade

5.3. Feed Grade

6. Global Formic Acid Market Sales Analysis by Application ($ Million)

6.1. Silage Additive & Animal Feed

6.2. Leather Tanning

6.3. Textile Dyeing and Finishing

6.4. Rubber Coagulation

6.5. Chemical Intermediates

6.6. Cleaning Agents

6.7. Others (Preservatives)

7. Regional Analysis

7.1. North American Formic Acid Market Sales Analysis –Grade | Application| Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Formic Acid Market Sales Analysis – Grade | Application| Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Formic Acid Market Sales Analysis – Grade | Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Formic Acid Market Sales Analysis – Grade | Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. ADDEASY BIO-TECHNOLOGY CO., LTD.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. ATAMAN KIMYA A.S

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. BASF SE

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Brenntag (Shanghai) Enterprise Management Co., Ltd.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Dominique DUTSCHER SAS

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Eastman Chemical Co.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. ECSA Group

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Fengchen Group Co., Ltd.

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. FOODCOM S.A.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Glentham Life Sciences Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Hebei Pengfa Chemical Co. Ltd.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Hubei Sanli Fengxiang Technology Co., Ltd.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Hydrite Chemical

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. ITW Reagents, S.R.L.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Luxi Chemical Group

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Merck KGaA

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Molekula Group

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Mudanjiang Fengda Chemicals Co., Ltd.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Multichem Corp.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Shandong Acid Technology Co., Ltd.

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Shandong Xinhua Pharma. I&E Co., Ltd.

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. The Perstorp Group

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Thermo Fisher Scientific Inc.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Tokyo Chemical Industry Co., Ltd. (TCI)

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

8.26. Vinipul Chemicals Pvt. Ltd.

8.26.1. Quick Facts

8.26.2. Company Overview

8.26.3. Product Portfolio

8.26.4. Business Strategies

8.27. Zhengzhou Meiya Chemical Products Co., Ltd.

8.27.1. Quick Facts

8.27.2. Company Overview

8.27.3. Product Portfolio

8.27.4. Business Strategies

1. Global Formic Acid Market Research And Analysis By Grade, 2024-2035 ($ Million)

2. Global Industrial Formic Acid Grade Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Pharmaceutical Formic Acid Grade Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Feed Formic Acid Grade Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Formic Acid Market Research And Analysis By Application, 2024-2035 ($ Million)

6. Global Formic Acid For Silage Additive & Animal Feed Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Formic Acid For Leather Tanning Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Formic Acid For Textile Dyeing and Finishing Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Formic Acid For Rubber Coagulation Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Formic Acid For Chemical Intermediates Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Formic Acid For Cleaning Agents Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Other Formic Acid Application Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Formic Acid Market Research And Analysis By Region, 2024-2035 ($ Million)

14. North American Formic Acid Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Formic Acid Market Research And Analysis By Grade, 2024-2035 ($ Million)

16. North American Formic Acid Market Research And Analysis By Application, 2024-2035 ($ Million)

17. European Formic Acid Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Formic Acid Market Research And Analysis By Grade, 2024-2035 ($ Million)

19. European Formic Acid Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Asia-Pacific Formic Acid Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Formic Acid Market Research And Analysis By Grade, 2024-2035 ($ Million)

22. Asia-Pacific Formic Acid Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Rest Of The World Formic Acid Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Rest Of The World Formic Acid Market Research And Analysis By Grade, 2024-2035 ($ Million)

25. Rest Of The World Formic Acid Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Formic Acid Market Share By Grade, 2024 Vs 2035 (%)

2. Global Industrial Formic Acid Grade Market Share By Region, 2024 Vs 2035 (%)

3. Global Pharmaceutical Formic Acid Grade Market Share By Region, 2024 Vs 2035 (%)

4. Global Feed Formic Acid Grade Market Share By Region, 2024 Vs 2035 (%)

5. Global Formic Acid Market Share By Application, 2024 Vs 2035 (%)

6. Global Formic Acid For Silage Additive & Animal Feed Market Share By Region, 2024 Vs 2035 (%)

7. Global Formic Acid For Leather Tanning Market Share By Region, 2024 Vs 2035 (%)

8. Global Formic Acid For Textile Dyeing and Finishing Market Share By Region, 2024 Vs 2035 (%)

9. Global Formic Acid For Rubber Coagulation Market Share By Region, 2024 Vs 2035 (%)

10. Global Formic Acid For Chemical Intermediates Market Share By Region, 2024 Vs 2035 (%)

11. Global Formic Acid For Cleaning Agents Market Share By Region, 2024 Vs 2035 (%)

12. Global Other Formic Acid Application Market Share By Region, 2024 Vs 2035 (%)

13. Global Formic Acid Market Share By Region, 2024 Vs 2035 (%)

14. US Formic Acid Market Size, 2024-2035 ($ Million)

15. Canada Formic Acid Market Size, 2024-2035 ($ Million)

16. UK Formic Acid Market Size, 2024-2035 ($ Million)

17. France Formic Acid Market Size, 2024-2035 ($ Million)

18. Germany Formic Acid Market Size, 2024-2035 ($ Million)

19. Italy Formic Acid Market Size, 2024-2035 ($ Million)

20. Spain Formic Acid Market Size, 2024-2035 ($ Million)

21. Russia Formic Acid Market Size, 2024-2035 ($ Million)

22. Rest Of Europe Formic Acid Market Size, 2024-2035 ($ Million)

23. India Formic Acid Market Size, 2024-2035 ($ Million)

24. China Formic Acid Market Size, 2024-2035 ($ Million)

25. Japan Formic Acid Market Size, 2024-2035 ($ Million)

26. South Korea Formic Acid Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Formic Acid Market Size, 2024-2035 ($ Million)

28. ASEAN Formic Acid Market Size, 2024-2035 ($ Million)

29. Rest Of Asia-Pacific Formic Acid Market Size, 2024-2035 ($ Million)

30. Latin America Formic Acid Market Size, 2024-2035 ($ Million)

31. Middle East And Africa Formic Acid Market Size, 2024-2035 ($ Million)