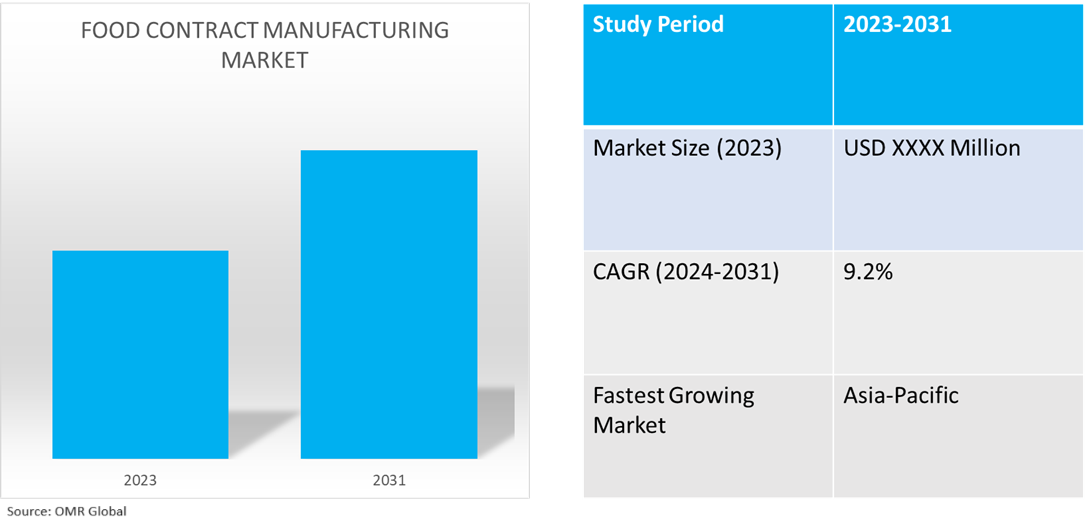

Food Contract Manufacturing Market

Food Contract Manufacturing Market Size, Share & Trends Analysis Report by Service (Food Manufacturing Services, Research and Development, and Food Packaging Services) Forecast Period (2024-2031)

- Based on service, the market is segmented into food manufacturing services, research and development, and food packaging services.

- The food manufacturing services is further segmented into convenience foods, bakery products, dietary supplements, confectionery products, dairy products, and others (savory & snacks).

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global food contract manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Hindustan Foods

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. PacMoore Product, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SAJ Food Products

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Makson Group of Companies

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Food Contract Manufacturing Market by Services

4.1.1.1. Food Manufacturing Services

4.1.1.2. Convenience Foods

4.1.1.3. Bakery Products

4.1.1.4. Dietary Supplement

4.1.1.5. Confectionery Products

4.1.1.6. Dairy Products

4.1.1.7. Others (Savory & Snacks)

4.1.2. Research and Development

4.1.3. Food Packaging Services

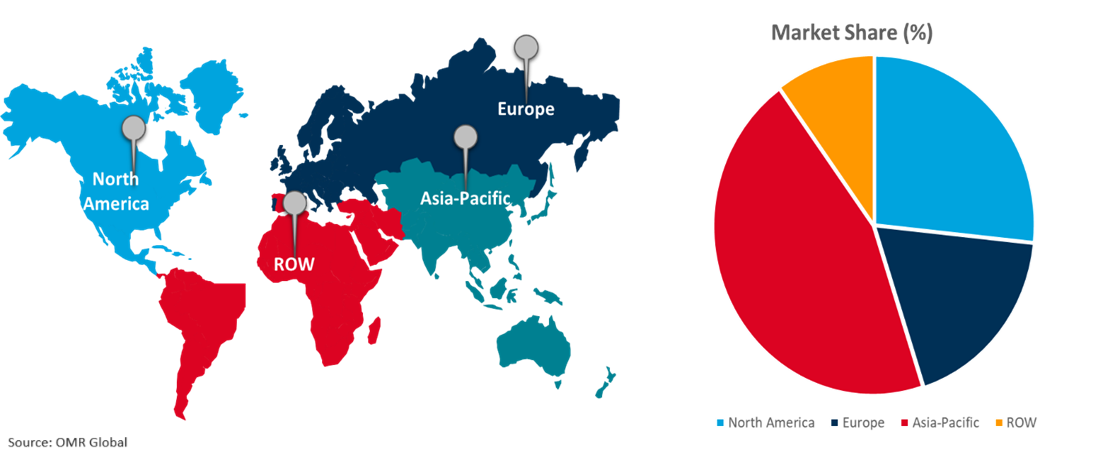

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Access Business Group LLC

6.2. Adirondack Beverages Inc. (Polar Corp.)

6.3. AFP Advanced Food Products LLC.

6.4. American Custom Drying

6.5. American Soy Products, Inc.

6.6. Amerilab Technologies, Inc.

6.7. AmeriQual Foods

6.8. Arizona Nutritional Supplements, LLC.

6.9. Berner Food & Beverage, Inc.

6.10. Big Brands, LLC

6.11. Blue Chip Group

6.12. Brady Enterprises, Inc.

6.13. Case Mason Filling, Inc.

6.14. Christy Foods

6.15. Claremont Foods

6.16. Combined Technologies, Inc.

6.17. Compact Industries Inc.

6.18. Continuum Packing Solutions LLC

6.19. Corim Industries

6.20. Create-A-Pack, Inc.

6.21. Creekside Springs, LLC

6.22. Crosby Foods Ltd.

6.23. Delmaine Fine Foods

6.24. Dominion Liquid Technologies

6.25. Dreampak LLC

6.26. Element Food Solutions, LLC.

6.27. Gehl Foods, LLC

6.28. Giovanni Foods Co., Inc.

6.29. Goerlich Pharma GmbH

6.30. Hearthside Food Solutions LLC

6.31. Heartland Food Products Group.

6.32. Hormel Foods Corp.

6.33. Hügli Holding AG

6.34. Imagine Baking Inc.

6.35. Inter-American Products Group

6.36. Jakana Foods

6.37. Jel Sert Co.

6.38. Lake City Foods

6.39. Lassonde Pappas & Co., Inc.

6.40. Lidestri Foods

6.41. Maltra Foods

6.42. Natural Development, Inc.

6.43. Particle Control Inc.

6.44. Q & B Foods Inc.

6.45. Sizani Foods Pty Ltd.

6.46. Skjodt-Barrett Foods Inc.

6.47. Subco Foods, Inc.

6.48. Tasman Bay Food Co.

6.49. Thrive Foods.

6.50. Trailblazer Foods

6.51. TruFoodMfg.

6.52. Wyandot, Inc.

1. Global Food Contract Manufacturing Market Research And Analysis By Services, 2023-2031 ($ Million)

2. Global Food Contract Manufacturing Services Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Research & Development Services In Food Contract Manufacturing Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Food Packaging Services In Food Contract Manufacturing Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Food Contract Manufacturing Analysis Market Research And By Region, 2023-2031 ($ Million)

6. North American Food Contract Manufacturing Market Research And Analysis By Country, 2023-2031 ($ Million)

7. North American Food Contract Manufacturing Market Research And Analysis Services, 2023-2031 ($ Million)

8. European Food Contract Manufacturing Market Research And Analysis By Country, 2023-2031 ($ Million)

9. European Food Contract Manufacturing Market Research And Analysis By Material Composition, 2023-2031 ($ Million)

10. European Food Contract Manufacturing Market Research And Analysis By Services, 2023-2031 ($ Million)

11. Asia-Pacific Food Contract Manufacturing Market Research And Analysis By Country, 2023-2031 ($ Million)

12. Asia-Pacific Food Contract Manufacturing Market Research And Analysis By Services, 2023-2031 ($ Million)

13. Rest Of The World Food Contract Manufacturing Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Rest Of The World Food Contract Manufacturing Market Research And Analysis By Services 2023-2031 ($ Million)

1. Global Food Contract Manufacturing Market Share By Services, 2023 Vs 2031 (%)

2. Global Food Contract Manufacturing Services Market Share By Region, 2023 Vs 2031 (%)

3. Global Research & Development In Food Contract Manufacturing Market Share By Region, 2023 Vs 2031 (%)

4. Global Food Packaging Services In Food Contract Manufacturing Market Share By Region, 2023 Vs 2031 (%)

5. Global Food Contract Manufacturing Market Share By Region, 2023 Vs 2031 (%)

6. US Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

7. Canada Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

8. UK Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

9. France Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

10. Germany Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

11. Italy Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

12. Spain Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

13. Rest Of Europe Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

14. India Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

15. China Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

16. Japan Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

17. South Korea Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

18. Rest Of Asia-Pacific Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

19. Latin America Food Contract Manufacturing Market Size, 2023-2031 ($ Million)

20. Middle East And Africa Food Contract Manufacturing Market Size, 2023-2031 ($ Million)