Freight Forwarding Market

Freight Forwarding Market Size, Share & Trends Analysis Report by Customer Type (Business-to-Business (B2B) and Business-to-Customer (B2C)), by Mode of Transport (Air, Ocean, Rail, and Railway), and by Application (Industrial & Manufacturing, Retail, Healthcare, Oil and Gas, Food and Beverages, and Others) Forecast Period (2022-2030) Update Available - Forecast 2025-2035

Freight forwarding market is anticipated to grow at a considerable CAGR of 4.5% during the forecast period. Growth in cross-border and sea trade volume is driving the growth of the freight forwarding market. The growing e-commerce trade across the globe has promoted the freight forwarding market. According to the Brand Equity Foundation (BEF), the overall e-commerce market is expected to reach $350 billion by 2030 and will experience 21.5% growth in 2022 and reach $74.8 billion.

Apart from this, the increased demand for freight forwarding services to bring efficiency in time management is further driving the growth of the global freight forwarding market. According to the Container Xchange Report, Container xChange survey of 1,000+ logistics professionals reveals that 92.0% spend 3-4 hours to source one new partner and 53.0% spend 3-4 hours discussing T&Cs with new partners; 93% spend 2-4 hours contacting depots for release + drop off references. Freight forwarders using online marketplaces spend only 5-10 minutes sourcing partners, saving 170 minutes per new partner compared to non-digital counterparts. The rise in incidences of nearshoring manufacturing actions across the globe, which is to conclude in the absence of acceptance of trade activities, is anticipated to restrain the market growth.

Segmental Outlook

The global freight forwarding market is segmented based on customer type, mode of transportation, and application. Based on customer type, the market is segmented into B2B and B2C. Based on mode of transportation, the market is segmented into air, ocean, rail, and road. Based on application, the market is sub-segmented into industrial & manufacturing, retail, healthcare, oil and gas, food and beverages, and other applications.

Ocean is Expected to Hold a Considerable Share in the Global Freight forwarding Market

The growing trade through the ocean is a key factor driving the growth of this market segment. According to the OECD, the main transport mode for global trade is ocean shipping: around 90.0% of traded goods are carried over the waves. Shipping represents 2.9% of total greenhouse emissions. As demand for global freight increases, maritime trade volumes are set to triple by 2050; thus, driving the demand for ocean freight forwarding market.

Regional Outlooks

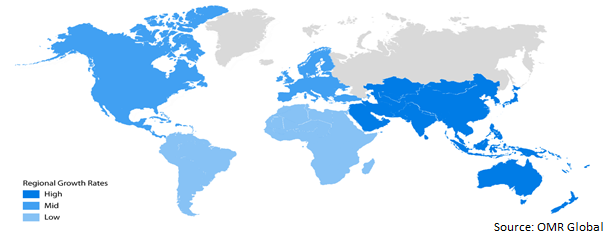

The global freight forwarding market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific region is anticipated to exhibit considerable growth in the global freight forwarding market. The growing e-commerce industry of the region is a key contributor to the regional market growth. Towards the regional market growth, in March 2023, Freight forwarder Europa Air & Sea is set to open a new office in Delhi as it continues its international expansion. The new office will be the forwarder’s first move into the Indian subcontinent and is part of efforts to “grow its geographical footprint, bringing services closer to customers, and supporting local supply chain requirements”.

Global Freight Forwarding Market Growth, by Region 2023-2030

North America to Hold a Considerable Share in the Global Freight Forwarding Market

Among all regions, North America is expected to hold a considerable share of the global freight forwarding market. The regional market is driven by the presence of key market players along with the growing funding for new startups. For instance, in February 2023, GoFreight, a Los Angeles-based provider of cloud-based software for the freight forwarding industry raised $23 million through a Series A funding round. The infusion of cash will go toward expanding the company’s workforce and product offerings.

Market Players Outlook

The major companies serving the global freight forwarding market include Kuehne+Nagel International AG, DB Schenker, Bollore Logistics, DHL Global Forwarding, and Nippon Express Co., Ltd. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2023, Aramex Corp. the Middle East’s courier company, has signed an agreement with Abu Dhabi Ports Group to set up a joint venture to serve the freight forwarding industry. With this the NVOCC company will provide “tailored solutions to all freight forwarding industry players” and will serve their ocean-bound container cargo. This will aids in company to enhance and develop shipping connectivity across the GCC, Indian, and East and West African markets with a target of 10,000 containers in the short-term.

In February 2023, GEODIS has collaborated with Volvo Australia to pilot the first Fully Electric (FE) variant truck for freight forwarding within the Australian market. This strategic partnership will deploy Volvo’s FE model trucks-powered by both solar energy and energy-efficient charging systems – as part of a concerted effort to support long-term customers with sustainable delivery solutions to complement existing freight forwarding services across the local market.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global freight forwarding market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. DHL Global Forwarding

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kuehne + Nagel International AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nippon Express Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Freight Forwarding Market by Customer Type

4.1.1. Business-to-Business (B2B)

4.1.2. Business-to-Customer (B2C)

4.2. Global Freight Forwarding Markey by Mode of Transport

4.2.1. Air

4.2.2. Ocean

4.2.3. Road

4.2.4. Rail

4.3. Global Freight Forwarding Market by Application

4.3.1. Industrial & Manufacturing

4.3.2. Retail

4.3.3. Healthcare

4.3.4. Oil & Gas

4.3.5. Food & Beverages

4.3.6. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Bollore Logistics

6.2. C.H. Robinson

6.3. CEVA Logistics

6.4. Dachser Group SE & Co. KG

6.5. DB Schenker

6.6. DHL Global Forwarding

6.7. DSV Global Transports and Logistics

6.8. Expeditors International

6.9. FedEx Corp.

6.10. Hellmann Worldwide Logistics

6.11. Imerco A/S

6.12. Kuehne + Nagel International AG

6.13. MGF (Manitoulin Global Forwarding)

6.14. Nippon Express Co., Ltd.

6.15. Panalpina Welttransport Holding AG

6.16. Sinotrans India Private Limited

6.17. The Maersk Group

6.18. Uber Freight LLC

6.19. United Parcel Service Inc.

6.20. Walmart Group

1. GLOBAL FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY CUSTOMER TYPE, 2022-2030 ($ MILLION)

2. GLOBAL B2B FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL B2C FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

5. GLOBAL AIR-BASED FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

6. GLOBAL OCEAN-BASED FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL ROAD-BASED FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL RAIL-BASED FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL FREIGHT FORWARDING FOR INDUSTRIAL & MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL FREIGHT FORWARDING FOR RETAIL MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL FREIGHT FORWARDING FO HEALTHCARE MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL FREIGHT FORWARDING FOR OIL & GAS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

14. GLOBAL FREIGHT FORWARDING FOR FOOD &BEVERAGES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

15. GLOBAL FREIGHT FORWARDING FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

16. GLOBAL FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY CUSTOMER TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

20. NORTH AMERICAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. EUROPEAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY CUSTOMER TYPE, 2022-2030 ($ MILLION)

23. EUROPEAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

24. EUROPEAN FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY CUSTOMER TYPE, 2022-2030 ($ MILLION)

27. ASIA- PACIFIC FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

28. ASIA- PACIFIC FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

29. REST OF THE WORLD FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY CUSTOMER TYPE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

31. REST OF THE WORLD FREIGHT FORWARDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL FREIGHT FORWARDING MARKET SHARE BY CUSTOMER TYPE, 2022 VS 2030 (%)

2. GLOBAL B2B FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL B2C FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL FREIGHT FORWARDING MARKET SHARE BY MODE OF TRANSPORT, 2022 VS 2030 ($ MILLION)

5. GLOBAL AIR-BASED FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL OCEAN-BASED FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL ROAD-BASED FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL RAILWAY-BASED FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL FREIGHT FORWARDING MARKET SHARE ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL FREIGHT FORWARDING FOR INDUSTRIAL & MANUFACTURING MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL FREIGHT FORWARDING FOR RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL FREIGHT FORWARDING FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL FREIGHT FORWARDING FOR OIL & GAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL FREIGHT FORWARDING FOR FOOD & BEVERAGES MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL FREIGHT FORWARDING FOR OTHER APPLICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL FREIGHT FORWARDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

19. UK FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD FREIGHT FORWARDING MARKET SIZE, 2022-2030 ($ MILLION)