Freight Trucking Market

Global Freight Trucking Market Size, Share & Trends Analysis Report By Vehicle Type (Light Commercial Vehicle, and Heavy Commercial Vehicle), By Cargo Type (Dry Bulk, liquid bulk, and Refrigerated Products) and By End-User (Industrial Manufacturing, Oil & Gas Industries, Construction & Mining Industries, and Others) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global Freight Trucking market is anticipated to grow at a significant CAGR of 5.3% during the forecast period. One of the primary factors contributing towards the growth of the market is the growing culture of online shopping. As per the U.S. Bureau of the Census retrieved from FRED, Federal Reserve Bank of St. Louis, the e-commerce retail sales of U.S. has been increasing consistently, and it had 13% of retail sales’ market at the time of 3rd quarter of 2021, which was around 13.8% in the 3rd quarter of 2020 and 10.9% in the 3rd quarter of 2019. Additionally, rapid expansion of fast-moving consumer products is also acting as anthore factor that is supporting the growth of the market.

Impact of COVID-19 Pandemic on Global Freight Trucking Market

The COVID-19 pandemic had disrupted the freight trucking market. The lockdown across the globe, to prevent the spread of the virus and to reduce casualties, had stopped most of the transportations. It resulted in the non-availability of cargo for return trips. Thus, the various market players in the freight trucking market were impacted heavily due to the lockdown. However, the companies involved in the delivery of essential goods and services via freight trucking are anticipated to grow as the lockdown restrictions are lifted.

Segmental Outlook

The global freight trucking market is segmented based on the vehicle type, cargo type, and end-user. Based on the vehicle type, the market is segmented into light commercial vehicles and heavy commercial vehicles. Based on the cargo type, the market is sub-segmented into dry bulk, liquid bulk, and refrigerated products. Based on the end-user, the market has been segmented as industrial manufacturing, oil & gas industries, construction & mining industries, and others. The others type of segment includes chemical industries, agriculture industries, and food & beverages industries. Based on the cargo type, the dry bulk segment is expected to grow with the highest rest during the forecast period due to the continuous expansion of the manufacturing industries which has increased the demand in the freight trucking market globally.

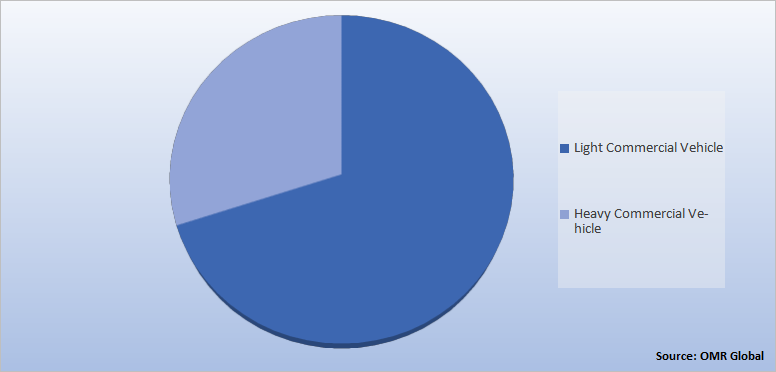

Global Freight Trucking Market Share by Vehicle Type, 2020 (%)

The Light Commercial Vehicle Segment Holds the Major Share in the Global Freight Trucking Market

The light commercial vehicle segment is anticipated to dominate and grow in the global freight trucking market during the forecast period. The developing manufacturing sector across the globe for the purpose of domestic deliveries are considered as the prime factors supporting the growth of the segment in the market. Additionally, light commercial vehicles are more economical, require lower maintenance, are easier to drive, and can reach most places. Furthermore, as the market is growing, the companies are investing in more light commercial vehicles. For instance, in December 2021, BrightDrop delivered the first of 500 electric delivery light trucks to FedEx as per their agreement. These EV units are formed by General Motors.

Regional Outlooks

The global Freight Trucking market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

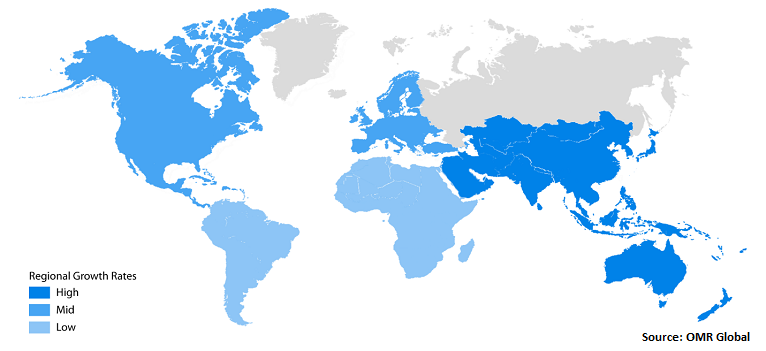

Global Freight Trucking Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Freight Trucking Market

The Asia-Pacific region dominates and is anticipated to hold the major share in the global freight trucking market. The growing industrialization in the developing countries such as China, India, Japan, and South Korea is expected to drive the market during the forecast period. Additionally, the export and import activities have been increased in the countries of the region. Furthermore, the growing urbanization and improving life standard in the region has grown the door-to-door transport service and retail services. As per the East Asia Forum’s published report in October 2021, China’s retail e-commerce market has been the largest across the globe since 2013. Its sales grew up to around $2.3 trillion in 2020, which is just above half of the world’s e-commerce market total, which was nearly $4.3 trillion.

Market Players Outlook

The major companies serving the global freight trucking market include Aramex International LCC, Deutsche Post AG, FedEx Corp., Hellmann Worldwide Logistics SE & Co. KG, and United Parcel Service of America, Inc. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2021, FedEx partnered with self-driving car startup Aurora Innovation Inc. to support moving cargo for FedEx Corp. in a pilot project in Texas. It uses the startup’s technology in a self-driving truck of Paccar Inc. It was marked as the first FedEx trial of autonomous driving.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global freight trucking market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Freight Trucking Market

• Recovery Scenario of Global Freight Trucking Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Aramex International LLC

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Deutsche Post AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. FedEx Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Hellmann Worldwide Logistics SE & Co. KG

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. United Parcel Service of America, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Freight Trucking Market by Vehicle Type

4.1.1. Light Commercial Vehicle

4.1.2. Heavy Commercial Vehicle

4.2. Global Freight Trucking Market by Cargo Type

4.2.1. Dry Bulk

4.2.2. Liquid Bulk

4.2.3. Refrigerated Products

4.3. Global Freight Trucking Market by End-User

4.3.1. Industrial Manufacturing

4.3.2. Oil & Gas industries

4.3.3. Construction & Mining industries

4.3.4. Others (Chemical Industries, Agriculture Industries, and Food & Beverages Industries)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. A.P. Moller Maersk

6.2. BDP International, Inc.

6.3. Canadian National Railway Co.

6.4. CEVA

6.5. CMA CGM

6.6. DB SCHENKER

6.7. Estes Express Lines

6.8. Expeditors International of Washington, Inc

6.9. Kuehne + Nagel

6.10. Nippon Express Co., Ltd.

6.11. R+L Carriers,Inc.

6.12. Saia LTL, Inc.

6.13. SNCF Group

6.14. Swift Transportation

6.15. XPO Logistics Inc.

6.16. Yellow Corp.

1. GLOBAL FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

2. GLOBAL LIGHT COMMERCIAL VEHICLE FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL HEAVY COMMERCIAL VEHICLE FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY CARGO TYPE, 2020-2027 ($ MILLION)

5. GLOBAL DRY BULK FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL LIQUID BULK FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL REFRIGERATED PRODUCTS FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

9. GLOBAL INDUSTRIAL MANUFACTURING FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OIL & GAS INDUSTRIES FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL CONSTRUCTION & MINING INDUSTRIES FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL OTHERS FOR FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY CARGO TYPE, 2020-2027 ($ MILLION)

17. NORTH AMERICAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

18. EUROPEAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. EUROPEAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

20. EUROPEAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY CARGO TYPE, 2020-2027 ($ MILLION)

21. EUROPEAN FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY CARGO TYPE, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

26. REST OF THE WORLD FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. REST OF THE WORLD FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY CARGO TYPE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD FREIGHT TRUCKING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FREIGHT TRUCKING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FREIGHT TRUCKING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL FREIGHT TRUCKING MARKET, 2021-2027 (%)

4. GLOBAL FREIGHT TRUCKING MARKET SHARE BY VEHICLE TYPE, 2020 VS 2027 (%)

5. GLOBAL LIGHT COMMERCIAL VEHICLE FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL HEAVY COMMERCIAL VEHICLE FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL FREIGHT TRUCKING MARKET SHARE BY CARGO TYPE, 2020 VS 2027 (%)

8. GLOBAL DRY BULK FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL LIQUID BULK FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL REFRIGERATED PRODUCTS FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL FREIGHT TRUCKING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

12. GLOBAL INDUSTRIAL MANUFACTURING FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL OIL & GAS INDUSTRIES FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL CONSTRUCTION & MINING INDUSTRIES FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL OTHERS FOR FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL FREIGHT TRUCKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. US FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

19. UK FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

20. FRANCE FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

22. ITALY FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

23. SPAIN FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF EUROPE FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

25. INDIA FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

26. CHINA FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

27. JAPAN FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD FREIGHT TRUCKING MARKET SIZE, 2020-2027 ($ MILLION)