Frozen Chicken Market

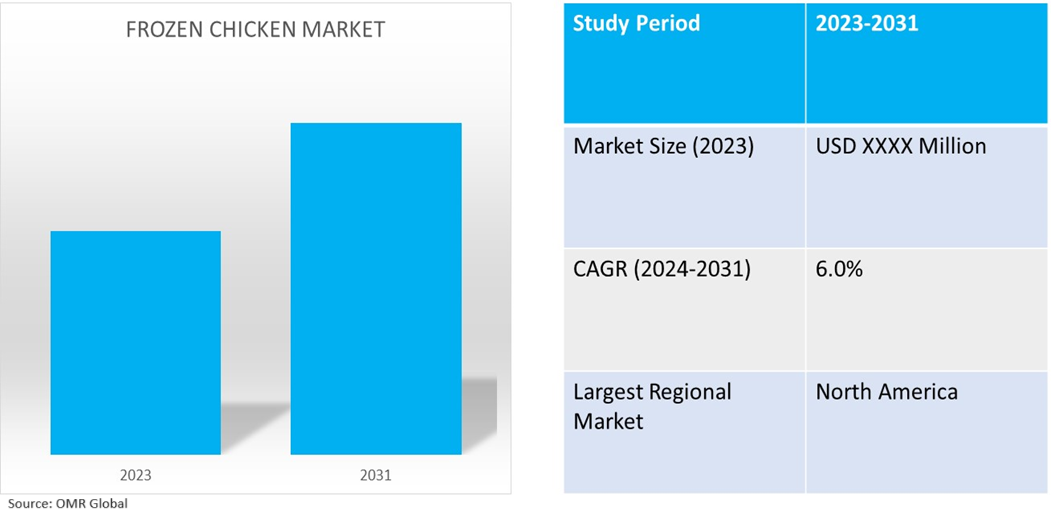

Frozen Chicken Market Size, Share & Trends Analysis Report by Type (Chicken Breast, Chicken Thigh, Chicken Drumstick, Chicken Wings, and Others), by Product (Chicken Nuggets, Chicken Popcorn, Chicken Fingers, Chicken Patty, and Others), and by Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail) Forecast Period (2024-2031)

Frozen chicken market is anticipated to grow at a CAGR of 6.0% during the forecast period (2024-2031). The market growth is attributed to the growing advancement in cold chain infrastructure & logistics with the growing popularity of frozen food across the globe. The increasing rate of urbanization, growing availability of organic frozen chicken, and low-processed frozen chicken is also contributing to the regional market growth. Further, the market is expected to be negatively influenced by the consumer shift towards a vegan diet.

Market Dynamics

Growing Frozen Food Industry

The increasing demand for frozen foods owing to the high availability of frozen foods, changes in food consumption patterns, growing working population, and rising use of frozen foods by QSRs among others is driving the demand for the frozen chicken market. For instance, according to the Power of Frozen in Retail 2023 report commissioned by the American Frozen Food Institute (AFFI) in collaboration with the Food Industry Association (FMI), frozen food retail sales increased 7.9% to $74.2 billion in 2022, an increase of more than $10.0 billion over the previous three years. Furthermore, consumers spent an average of $4.99 per unit for frozen food items, up 13.5% from the previous year and 29.6% from three years before. Furthermore, processed meat/poultry, which earned $5.2 billion last year, experienced the largest growth rate of any frozen food category, growing by 19.6%. Fruits/vegetables and baked goods followed with 10.6% and 9.3% growth rates respectively.

Increasing Vegan, Vegetarian or Flexitarian Population

The shift in consumer consumption towards vegan and vegetarian food-driven diets is expected to impede the growth of the frozen chicken market. Further, countries with a higher level of non-vegetarian population have recorded signs of consumer shift towards vegan or vegetarian diets owing to the rising influence of plant-based diets, health-related reasons, and efforts to reduce animal cruelty in non-veg production, which is expected to highly influence the future of the market. In the US, around 2.0% of people are vegan but many more are reducing their meat intake. The Alliance for Science estimates that one in 10 Americans don’t eat meat and research conducted by One Poll in 2021, found that nearly one in every two Americans consumes more plant-based meals than meat, with 54.0% of those aged 24 to 39 identifying as flexitarian. Additionally, in Australia, 42.0% of people reported eating less meat or no meat in 2019. Among them, 20.0% as flexitarians, 12.0% as meat-reducers, and 10.0% as vegans or vegetarians.

Market segmentation

- Based on type, the market is segmented into chicken breast, chicken thigh, chicken drumstick, chicken wings, and others (inner fillet, and neck).

- Based on product, the market is segmented into chicken nuggets, chicken popcorn, chicken fingers, chicken patty, and others (lollipop).

- Based on the distribution channel, the market is segmented into supermarkets/ hypermarkets, convenience stores, specialty stores, and online retail.

Frozen Chicken Market Dominated by Chicken Nuggets in Products Segment

Chicken Nuggets led the market growth owing to its convenience, and diverse product offerings in terms of flavors, style, and cuts, among others. The faster preparation time and substantial demand among customers are further aiding the growth of this market segment. In September 2022, CAULIPOWER launched All Natural Chicken Nuggets in the US. CAULIPOWER's newest innovation is produced with all-natural white flesh chicken raised without antibiotics, with a vegetarian coating of chickpeas and cauliflower, making them the ONLY chickpea and cauliflower-coated chicken nuggets available. Such developments are further contributing to the growth of this market segment.

Supermarkets and Hypermarkets Lead Dominance in Distribution Channel

Hypermarkets and supermarkets dominate the frozen chicken distribution channel segment owing to their wide presence, high customer footfall, collaboration and partnership with prominent frozen chicken brands, diverse product availability, low-cost offerings, and adherence to high-quality standards. For instance, in May 2024, Wilko plans to expand its grocery cooperation with Iceland Foods. Wilko outlets in St Albans and Rotherham now stock freezers with Iceland's own-label and exclusive items. A third concession is scheduled to debut at a Wilko store in Poole later this year. The offer includes an initial 500 goods from 150 of Iceland's frozen lines. It features items from its exclusive brand relationships with Greggs, TGI's, and My Protein.

Regional Outlook

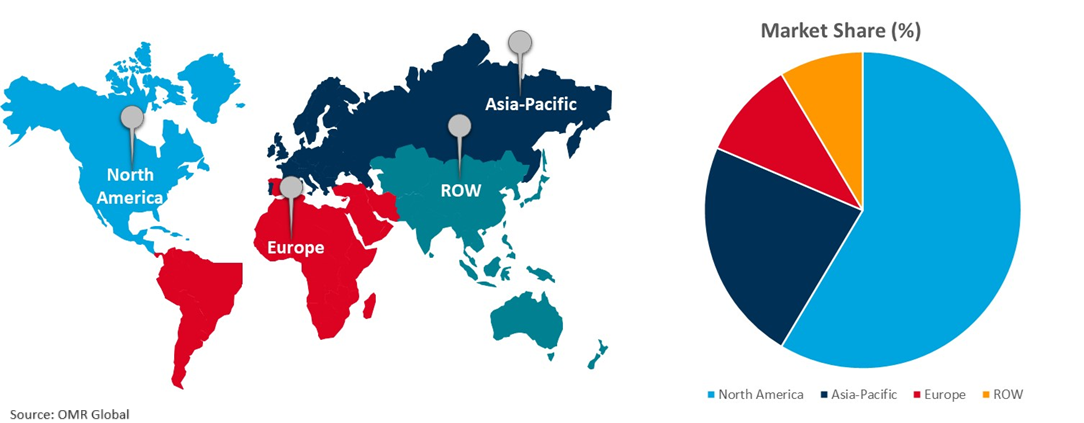

The global frozen chicken market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Largest Market Share in Global Frozen Chicken Market

North America holds a substantial share of the frozen chicken market, attributed to the majority of the population consuming non-vegetarian food, rising consumption of frozen foods, changing lifestyle dynamics, and a growing urban population. The presence of major frozen chicken manufacturers such as Tyson Foods and Foster Foods, among others, developed cold chain infrastructure, and a growing poultry and egg export industry are further driving the regional market growth. According to the United States Department of Agriculture's Economic Research Service, the US poultry industry is the world's largest producer and second-largest exporter of poultry meat and is a major egg producer. The US consumption of poultry meat (broilers, other chicken, and turkey) is considerably higher than beef or pork but less than total red meat consumption. In 2022, nearly 15.0% of poultry meat produced in the US was exported.

Major Player Outlook

*Note: Major Players Sorted in No Particular Order”

The major companies serving in the global frozen chicken market include Foster Foods, Iceland Foods Inc., and Tyson Foods Inc. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in May 2024, Kraft Heinz and TGI Fridays announced an exclusive, perpetual renewal of their existing licensing agreement, under which Kraft Heinz produces restaurant-inspired, TGI Fridays branded frozen appetizers for retail across North America.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global frozen chicken market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Foster Farms

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Iceland Foods, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Tyson Foods, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Frozen Chicken Market by Type

4.1.1. Chicken Breast

4.1.2. Chicken Thigh

4.1.3. Chicken Drumstick

4.1.4. Chicken Wings

4.1.5. Others (Innerfillet, and Neck)

4.2. Global Frozen Chicken Market by Product

4.2.1. Chicken Nuggets

4.2.2. Chicken Popcorn

4.2.3. Chicken Fingers

4.2.4. Chicken Patty

4.2.5. Others (Lollipop)

4.3. Global Frozen Chicken Market by Distribution Channel

4.3.1. Supermarkets/ Hypermarkets

4.3.2. Convenience Stores

4.3.3. Specialty Stores

4.3.4. Online Retail

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. BRF S.A.

6.2. Cargill Inc.

6.3. Farbest Foods

6.4. Hormel Foods Corp.

6.5. Iceland Foods

6.6. Inghams Group Ltd.

6.7. Jaqcee Seafood

6.8. JBS S.A.

6.9. Koninklijke Ahold Delhaize N.V.

6.10. Marfrig Global Foods S.A.

6.11. Perdue Farms

6.12. Pilgrim’s Pride Corp.

6.13. Sanderson Farms, Inc.

6.14. Smithfield Farmland Careers

1. GLOBAL FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FROZEN CHICKEN BREAST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FROZEN CHICKEN THIGH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FROZEN CHICKEN DRUMSTICK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FROZEN CHICKEN WINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER TYPE FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

8. GLOBAL FROZEN CHICKEN NUGGETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FROZEN CHICKEN POPCORN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FROZEN CHICKEN FINGERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FROZEN CHICKEN PATTY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OTHER PRODUCTS OF FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

14. GLOBAL FROZEN CHICKEN IN SUPERMARKETS/ HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FROZEN CHICKEN IN CONVENIENCE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL FROZEN CHICKEN IN SPECIALTY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL FROZEN CHICKEN IN ONLINE RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. NORTH AMERICAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

22. EUROPEAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. EUROPEAN FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

30. REST OF THE WORLD FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

31. REST OF THE WORLD FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

33. REST OF THE WORLD FROZEN CHICKEN MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL FROZEN CHICKEN MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL FROZEN CHICKEN BREAST MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FROZEN CHICKEN THIGH MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FROZEN CHICKEN DRUMSTICK MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FROZEN CHICKEN WINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER TYPES OF FROZEN CHICKEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FROZEN CHICKEN MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

8. GLOBAL FROZEN CHICKEN NUGGETS SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FROZEN CHICKEN POPCORN MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FROZEN CHICKEN FINGERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FROZEN CHICKEN PATTY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FROZEN CHICKEN OTHER PRODUCTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FROZEN CHICKEN MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

14. GLOBAL FROZEN CHICKEN IN SUPERMARKETS/ HYPERMARKETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL FROZEN CHICKEN IN CONVENIENCE STORES MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL FROZEN CHICKEN IN SPECIALTY STORES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL FROZEN CHICKEN IN ONLINE RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL FROZEN CHICKEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

21. UK FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA FROZEN CHICKEN MARKET SIZE, 2023-2031 ($ MILLION)