Frozen Dessert Market

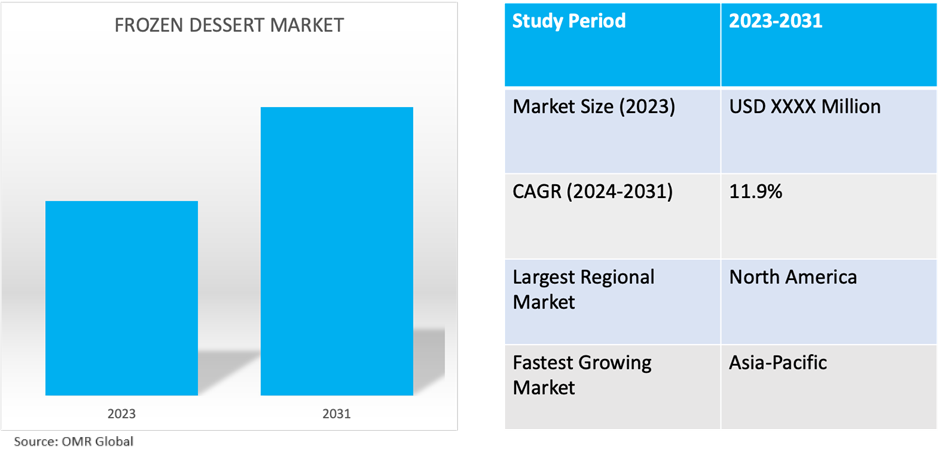

Frozen Dessert Market Size, Share & Trends Analysis Report by Product Type (Frozen Yogurt, Ice Cream and Frozen Cakes), and by Distribution Channel (Retail and Food Servicer), Forecast Period (2024-2031)

Frozen dessert market is anticipated to grow at a CAGR of 11.9% during the forecast period (2024-2031). Frozen desserts such as ice cream, gelato, sorbet, frozen yogurt, popsicles, ice cream sandwiches, and frozen pies or cakes are increasingly consumed around the globe owing to lifestyle changes, rising disposable income in emerging economies, rising standards of living, among others. They are often made with a base of dairy or non-dairy ingredients, combined with flavors, fruits, nuts, chocolate, or other ingredients to create a delicious frozen treat. The market growth is significantly propelled by evolving consumer preferences and lifestyles as well as by key market players launching different frozen dessert options.

Market Dynamics

Driving Growth through Innovation and Strategic Acquisitions in the Food Industry

Innovation and product development are essential elements in the dynamic landscape of the food industry. It involves the continuous creation and improvement of food products, processes, and technologies to meet evolving consumer demands, address emerging trends, and stay ahead of competitors. This process encompasses everything from introducing novel flavors and ingredients to optimizing packaging and production methods. Effective innovation and product development require a deep understanding of consumer preferences, market trends, and technological advancements, coupled with agility and adaptability to rapidly changing market dynamics. For instance, in June 2023, Unilever completed the acquisition of Yasso Holdings, Inc., marking a strategic move to enhance its product portfolio within North American markets. This acquisition aligns with Unilever's Ice-cream Business Group's premiumization strategy, aimed at diversifying offerings and strengthening market presence in the region.

Navigating Changing Consumer Preferences to Adapt Strategies in the Food Industry

Changing consumer preferences refers to shifts in the tastes, behaviors, and desires of consumers regarding the products and services they choose. In the food industry, these preferences can be influenced by factors such as health consciousness, environmental concerns, cultural influences, and evolving lifestyle trends. Consumers may seek healthier food options, such as organic or plant-based products, or they may prioritize convenience and sustainability in their choices. Understanding and adapting to these changing preferences is crucial for businesses to remain competitive and relevant in the market. This often involves innovating products, adjusting marketing strategies, and offering personalized experiences to cater to the diverse needs of modern consumers. For instance, in June 2022, Sovos Brands' subsidiary, Noosa, announced its inaugural entry into the frozen dessert sector with the launch of its innovative Noosa Frozen Yogurt Gelato line. This new offering boasts a luxuriously smooth texture that is sure to captivate aficionados of frozen treats. Crafted with the signature rich and creamy whole milk yogurt synonymous with the Noosa brand, the Frozen Yogurt Gelato promises a delightful indulgence that consumers will be eager to enjoy time and again.

Market Segmentation

- Based on product type, the market is segmented into frozen yogurt, ice cream, and frozen cakes.

- Based on the distribution channel, the market is segmented into retail and food service.

Retail is Projected to Emerge as the Largest Segment

The retail segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for convenience and accessibility among consumers. Technological advancement, robust growth in e-commerce industry, rapid urbanization, and lifestyle changes makes consumers to seek convenient options that can be easily accessed and enjoyed at home. Retail channels, such as supermarkets, convenience stores, and online platforms, offer a wide range of frozen dessert options, allowing consumers to purchase their favorite treats conveniently.

Ice Cream Segment to Hold a Considerable Market Share

Ice cream has a widespread appeal and is enjoyed by people of all ages globally, making it a staple in the frozen dessert category. Its rich and creamy texture, coupled with a wide variety of flavors and toppings, contributes to its popularity among consumers. Ice cream is a versatile product and can be consumed on its own, paired with other desserts, or used as an ingredient in various recipes. As a result it is increasingly consumed around the globe. The continuous innovation in the ice cream segment, such as the introduction of premium and artisanal flavors, healthier alternatives, and novel packaging formats, keeps consumers engaged and drives the market growth. For instance, in June 2021, Keventers announced its debut in the Indian dessert market with the introduction of its new brand, 'Ice Creamery.' This launch showcases a selection of six enticing ice cream flavors, including alphonso mango, Belgian chocolate, mocha almond fudge brownie, triple chocolate, exotic strawberry, and blueberry cheesecake. Notably, these ice creams are crafted without any additional flavors, or preservatives, emphasizing a commitment to natural ingredients and quality.

Regional Outlook

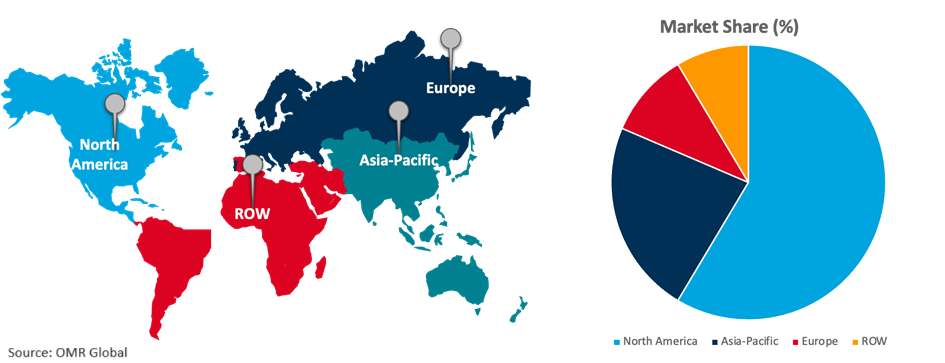

The global frozen dessert market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Leads Frozen Dessert Market Growth with Innovative Offerings and Shifting Consumer Preferences

The Asia-Pacific region is emerging as the fastest-growing market owing to rising disposable income and rapid urbanization coupled with lifestyle changes and increased spending on indulgent treats like frozen desserts. Moreover, a cultural shift towards western-style diets and the growing availability of these products through retail channels have made them more accessible to a wider population. Additionally, the introduction of innovative flavors tailored to local tastes is further stimulating demand. For instance, in October 2022, Kwality Walls, a brand under Hindustan Unilever, launched a new ice cream flavor in India specifically for the festive season. This innovative offering combines the traditional flavors of Gulab Jamun, a popular Indian dessert, with the addition of fruits and nuts, creating a unique and exotic taste experience for consumers.

Global Frozen Dessert Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its well-established culture of dessert consumption and highly developed retail infrastructure. Consumers across the continent have a strong affinity for indulgent frozen treats such as ice cream and frozen yogurt, creating massive scope for the growth of the market. The region's diverse population also contributes to the demand for a wide range of flavors and options. Furthermore, the presence of leading global players and a dynamic ecosystem of startups fosters innovation, resulting in continuous product development and the introduction of new flavors, and formats. For instance, in April 2023, Baskin Robbins (BR) announced its strategy to launch an array of product categories and fresh flavors tailored for the upcoming summer season. Renowned for its innovative products and widespread consumer popularity, the brand is expanding its existing portfolio to encompass a range of indulgent selections, aligning with the evolving tastes of consumers in India.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global frozen dessert market include Unilever PLC, General Mills Inc., Nestle S.A., China Mengniu Dairy Co. Ltd., The Hain Celestial Group, Inc., Conagra Brands, Inc., and ADM (Archer Daniels Midland Company), among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in March 2022, Vadilal Enterprises, a distinguished premium ice cream brand in India, unveiled its latest offering in the gourmet natural ice cream range. This new collection features five enticing flavors, namely gulab jamun, alphonso mango, kesar pista, classic malai, and falooda.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global frozen dessert market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. General Mills Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Nestle S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Unilever PLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Baskin Robbins LLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Frozen Dessert Market by Product Type

4.1.1. Frozen Yogurt

4.1.2. Ice Cream

4.1.3. Frozen Cakes

4.2. Global Frozen Dessert Market by Distribution Channel

4.2.1. Retail

4.2.2. Food Service

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ADM (Archer Daniels Midland Company)

6.2. Bulla Dairy Foods

6.3. China Mengniu Dairy Co. Ltd.

6.4. Conagra Brands, Inc.

6.5. Danone Murray Goulburn Pty Limited

6.6. Dunkin' Brands Group Inc. (Baskin-Robbins)

6.7. Fonterra Co-Operative Group Ltd.

6.8. Frosty Boy

6.9. Honey Hill Farms

6.10. Inner Mongolia Yili Industrial Group Co. Ltd (Yili Co.)

6.11. Kellogg's Co. (Kellanova)

6.12. London Dairy (Unipex Dairy Products Co., Ltd.)

6.13. Meiji Holdings Co., Ltd.

6.14. Mondel?z International group

6.15. Pinkberry (Kahala Franchising, L.L.C.)

6.16. Scott Brothers Dairy

6.17. The Hain Celestial Group, Inc.

6.18. Wells Enterprises

6.19. Yasso Greek Yogurt

1. GLOBAL FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FROZEN YOGURT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ICE CREAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FROZEN CAKES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

6. GLOBAL FROZEN DESSERT VIA RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FROZEN DESSERT VIA FOOD SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

11. NORTH AMERICAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

12. EUROPEAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

14. EUROPEAN FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

18. REST OF THE WORLD FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD FROZEN DESSERT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL FROZEN DESSERT MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL FROZEN YOGURT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ICE CREAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FROZEN CAKES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FROZEN DESSERT MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

6. GLOBAL FROZEN DESSERT VIA RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FROZEN DESSERT VIA FOOD SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FROZEN DESSERT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. US FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

11. UK FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)

23. MIDDLE EAST AND AFRICA FROZEN DESSERT MARKET SIZE, 2023-2031 ($ MILLION)