Fruit Beer Market

Global Fruit Beer Market Size, Share & Trends Analysis Report, by Flavor (Peach, Raspberry, Apricot, Cherry, Apple, Blueberry, and Others), by Distribution Channel (Online and Offline) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global fruit beer market is estimated to grow at a CAGR of 5.7% during the forecast period. Increasing popularity in millennials and a significant rise in the demand for craft beer are the major factors contributing to the growth of the market. An American craft beer consists of an independent and small craft brewer. As per the Brewers Association, in the US, total beer volume sales were dropped 2% in 2019, while the sales of a craft brewer are continued to rise at a rate of 4% by volume, which is reaching 13.6% of the US beer market by volume. The retail sales of craft beer rose 6% up to $29.3 billion, which accounts for over 25% of the US beer market.

In the US, several craft breweries are incorporating fruits and vegetables, in their beers, owing to the changing test preferences of consumers. The use of fruit provides an additional tool to the brewers in achieving the exact flavor as per the changing consumer requirements. The fruit is more notably featured on the labels of beer, which expresses the healthier drink. Therefore, beer brands mainly use fruit flavor extracts, concentrate juice, and fruit peel. In Europe, the addition of fruit concentrate have started to spread in 2012, which normally involved combining half fruit juice or lemonade with half beer, referred to as shandies. Later on, all key brewers such as Anheuser-Busch InBev, Carlsberg, and Heineken, have started developing fruit-flavored beers.

A rising inclination towards fruit beer in Asia-Pacific countries have also reported owing to the rising consumption of premium beers and a significant millennial population who tends to significantly prefer drinking fruit-flavored drinks. Às a result, some fruit-flavored beer manufacturers are launching their beer considering millennial population. For instance, in February 2018, MillerCoors introduced cost-effective, fruit-flavored light beer for millennials. The light beer is brewed with a natural flavor and comprises alcohol by volume (ABV) of 4.2% and comes in pineapple and lime varieties. The beer companies are focusing on millennials as one of the key focus areas to expand their sales and using fruit flavors to make their beer product tastier, which, in turn, is accelerating the market growth.

Market Segmentation

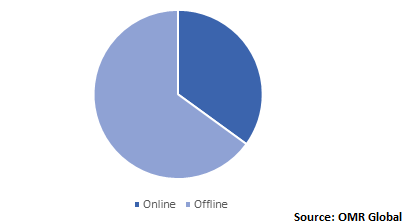

The global fruit beer market is segmented into flavor and distribution channel. Based on flavor, the market is classified into peach, raspberry, apricot, cherry, apple, blueberry, and others. Based on the distribution channel, the market is classified into online and offline.

Among distribution channel, online distribution channel to witness the fastest growth in the market during the forecast period

Online channels will likely show optimal growth during the forecast period owing to the rising internet penetration rate across countries and busy lifestyle of consumers. According to the World Bank, in 2017, 49.7% of the global population uses the internet. This is the major factor resulting in the expansion of e-commerce sales for groceries, clothing and accessories, and food and beverage products. E-commerce is considered as an effective medium to boost online presence and increase brand sales. Owing to the benefits associated with online sales, the manufacturers of wine and beer products are focusing on making their online presence that could support to reach a large number of consumers. Therefore, major fruit beer manufacturers such as Heineken and Anheuser Busch have expanded their online presence to further accelerate the sales of their products. During the lockdown amid COVID-19 outbreak, temporarily closure of offline stores have resulted in an increase in sales through online channels. This is further increasing the demand for fruit beer using online channels across countries.

Global Fruit Beer Market Share by Distribution Channel, 2019 (%)

Regional Outlook

Geographically, Asia-Pacific and Rest of the World are expected to witness potential growth during the forecast period owing to the increasing demand for premium beer products coupled with rising per-capita income in the region. In Asia-Pacific, the millennial population are moving towards major beer brands, with amazing taste, which led to the adoption of fruit beer in the region. Latin America consumers look for milder flavors compared to the bitter and most hoppy craft beers. Therefore, both craft brewers and mainstream brewers are mixing fruit juice to their IPA beer-styles and pale ales. In Brazil, young consumers increasingly shifting their focus towards premium beers that provides an authentic experience. Therefore, beer with fruity flavors or pilsner is becoming popular in the country.

Global Fruit Beer Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Anheuser-Busch InBev, Heineken N.V., FIFCO USA, The Boston Beer Co., and Kirin Holdings Co., Ltd. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in August 2019, Anheuser-Busch InBev acquired Platform Beer, the US-based brewery company. Under the acquisition, Platform will be integrated into Anheuser-Busch Brewers Collective unit, which involves a dozen craft beer partners. Platform produces barrel-aged beers, fruit ales, seasonal beverages, sour beer, ciders, and a range of hard seltzer. The acquisition will diversify the product portfolio of Anheuser-Busch InBev and will further strengthen its position in the US beer market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fruit beer market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Anheuser-Busch InBev

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Heineken N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. FIFCO USA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The Boston Beer Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Kirin Holdings Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Fruit Beer Market by Flavor

5.1.1. Peach

5.1.2. Raspberry

5.1.3. Apricot

5.1.4. Cherry

5.1.5. Apple

5.1.6. Blueberry

5.1.7. Others

5.2. Global Fruit Beer Market by Distribution Channel

5.2.1. Online

5.2.2. Offline

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. All Saints Brewing Co.

7.2. Allagash Brewing Co.

7.3. Anheuser-Busch InBev

7.4. Bell's Brewery, Inc.

7.5. Carlsberg Breweries A/S

7.6. FIFCO USA

7.7. Golden Road Brewing

7.8. Heineken N.V.

7.9. Jester King

7.10. Joseph James Brewing Co.

7.11. Kirin Holdings Co., Ltd.

7.12. Lindeman's Pty. Ltd.

7.13. Lost Coast Brewery

7.14. Mahou San Miguel

7.15. Molson Coors Beverage Co.

7.16. New Glarus Brewing Co.

7.17. Sapporo Holdings Ltd.

7.18. Shipyard Brewing Co.

7.19. Siren Craft Brew

7.20. Sixpoint Brewery

7.21. St Peter's Brewery Co. Ltd.

7.22. The Boston Beer Co.

1. GLOBAL FRUIT BEER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

2. GLOBAL PEACH BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL RASPBERRY BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL APRICOT BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL CHERRY BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL APPLE BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BLUEBERRY BEER IN BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHER FRUIT BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FRUIT BEER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

10. GLOBAL FRUIT BEER FROM ONLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL FRUIT BEER FROM OFFLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL FRUIT BEER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

15. NORTH AMERICAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. EUROPEAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

18. EUROPEAN FRUIT BEER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FRUIT BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC FRUIT BEER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC FRUIT BEER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

22. REST OF THE WORLD FRUIT BEER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

23. REST OF THE WORLD FRUIT BEER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL FRUIT BEER MARKET SHARE BY FLAVOR, 2019 VS 2026 (%)

2. GLOBAL FRUIT BEER MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL FRUIT BEER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FRUIT BEER MARKET SIZE, 2019-2026 ($ MILLION)