Fungicide Market

Fungicide Market Size, Share &Trend Analysis Report, By Type (Synthetic Fungicides and Biological Fungicide), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), By Form (Liquid and Powder) and Forecast Period, 2019-2025 Update Available - Forecast 2025-2035

The global fungicides market is estimated to grow at a CAGR of around 3% during the forecast period. The major factors contributing to the growth of the market include increasing adoption of fungicide in the seed treatment and growing concern towards the crop protection in order to increase the yield of the crop. New farming techniques and government regulation towards fungicides encouraging the market to grow. The high cost associated with the high quality of seeds in crop production needs to be protected by ensuring the high yield of the crop using fungicides.

Fungicides are an efficient and effective way to protect the crop from fungal disease. It is eco-friendly, biodegradable and less harmful that does not affect the fertility of the soil. This is also one of the factors encouraging the adoption of fungicides and the growth of the fungicides market. The growing adoption of fungicides owing to an increase in population in order to meet the demand ensuring high yield and high quality is essential.

Segmentation

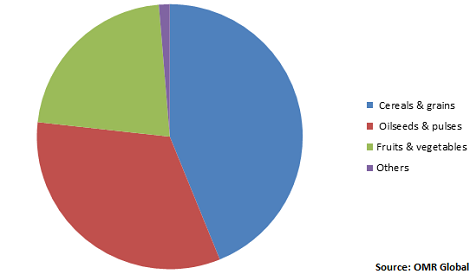

The global fungicides market is segmented based on type, crop type, and form. Based on type, the market is classified into synthetic fungicides and biological fungicides. Based on crop type, the market is classified into cereals & grains, oilseeds & pulses, fruits &vegetables, and others. Based on form, the market is classified into liquid and powder. The increasing concern about the quality and safety of crops will boost the demand for biological fungicides.

Growing demand for biochemical fungicides in the market

As biological fungicides are less harmful in nature as they are easily biodegradable, natural in origin and eco-friendly, encouraging the adoption of bio fungicides in crop production. The adverse effect of chemical fungicides on human and animal health fueling the biological fungicide segment. Biological fungicides provide high yield and high-quality crop drives the segment as the cost associated with the production of the crop is very high and ensuring its protection is very necessary due to the high demand for food. The government is also encouraging to adopt bio fungicides by running various awareness programs related to the benefit of using bio-fungicides and also supporting through subsidy programs.

Global Fungicides Market Share by Crop Type,2018 (%)

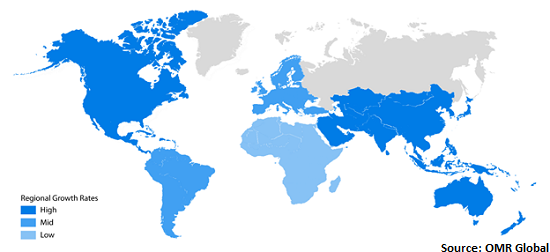

Regional Outlook

Geographically, the global fungicides market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific region is estimated to grow at the fastest pace. Increasing farming activities in countries like India and China is driving the market to grow in order to meet the food requirement of the economies is fueling the growth of the market. Governments of these countries are taking initiatives to encourage the use of good quality fungicides to increase productivity without degrading the fertility of the soil. The Indian government has launched Kisaan TV and apps for assistance and awareness among farmers. Additionally, subsidies are provided on Fertilizers to encourage the adoption of fungicides.

Global Fungicides Market Growth by Region 2019-2025

Europe to hold a considerable share in the market

Europe is estimated to hold a considerable market share in the forecast period. The growing demand for Cereals, fruits and vegetables and wheat in Europe is driving the fungicide market in the region to grow. The presence of major players in the fungicides market is propelling the growth of the market. Companies such as BASF SE and Bayer Crop Science AG are focusing on marketing their products across the globe and gain competitive advantage. Additionally, the adoption of advanced farming techniques and focus on the high yield of the crop in order to meet the demand of the growing population will encourage the growth of the fungicides market.

Competitive Landscape

Major players in the fungicides market include BASF SE, Bayer CropScience AG, FMC Corp., Corteva, Inc., Syngenta AG, Nufarm Ltd., and UPL Ltd. These players are making efforts to manufactures innovative products to capture a higher share in the market. For instance, in September 2019, Bayer CropScience announced its fungicide product under the iblon technology brand. It is based on the active ingredient isoflucypram that provides full disease control helping in high yield production of crops. In June 2019, BASF received the registration from U.S. Environmental Protection Agency (EPA) for the Revysol fungicide. This is designed with an aim to meet maximum regulatory standards and long-lasting disease control for a broad range of crops.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global s fungicides market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bayer CropScience AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. FMC Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Corteva, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Syngenta AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Fungicides Market by Type

5.1.1. Synthetic Fungicides

5.1.1.1. Triazoles

5.1.1.2. Phenylamides

5.1.1.3. Dicarbamates

5.1.1.4. Others

5.1.2. Biological fungicides

5.2. Global Fungicides Market by Crop Type

5.2.1.1. Cereals & Grains

5.2.1.2. Oilseeds & Pulses

5.2.1.3. Fruits & Vegetables

5.2.1.4. Others

5.3. Global Fungicides Market by Form

5.3.1.1. Liquid

5.3.1.2. Powder

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adama Agricultural Solution Ltd. (Hubei Sanonda Co. Ltd.)

7.2. American vanguard Corp.

7.3. BASF SE

7.4. Bayer Cropscience AG

7.5. Bioworks Inc.

7.6. Corteva, Inc.

7.7. Dow Agrosciences, LLC

7.8. FMC Corp.

7.9. Ishihara Sangyo Kaisha, Ltd.

7.10. Lanxess AG

7.11. Marrone Bio Innovations, Inc.

7.12. Nippon Soda Co. Ltd.

7.13. Novozymes A/S

7.14. Nufarm Ltd.

7.15. STK Bio-AG

7.16. Sumitomo Chemical Co. Ltd.

7.17. Syngenta AG

7.18. United Phosphorus Ltd. (UPL Ltd.)

1. GLOBAL FUNGICIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL SYNTHETIC CHEMICAL FUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL BIOLOGICALFUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FUNGICIDESMARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

5. GLOBAL CEREALS & GRAINS FUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OILSEEDS & PULSES FUNGICIDESMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL FRUITS & PULSES FUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER FUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL FUNGICIDES MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

10. GLOBAL LIQUID FUNGICIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL POWDER FUNGICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL FUNGICIDES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

17. EUROPEAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. EUROPEAN FUNGICIDES MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN FUNGICIDESMARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC FUNGICIDESMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC FUNGICIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC FUNGICIDES MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC FUNGICIDES MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

25. REST OF THE WORLD FUNGICIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

26. REST OF THE WORLD FUNGICIDES MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

27. REST OF THE WORLD FUNGICIDES MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

1. GLOBAL FUNGICIDES MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL FUNGICIDES MARKET SHARE BY CROP TYPE, 2018 VS 2025 (%)

3. GLOBAL FUNGICIDES MARKET SHARE BY FORM, 2018 VS 2025 (%)

4. GLOBAL FUNGICIDES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

7. UK FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD FUNGICIDES MARKET SIZE, 2018-2025 ($ MILLION)