Gaming Console Market

Gaming Console Market Size, Share & Trends Analysis Report by Product (Handheld Gaming Consoles and Stationary Gaming Console) and by Storage (External Storage, Internal Storage, and Cloud Storage) Forecast Period (2024-2031)

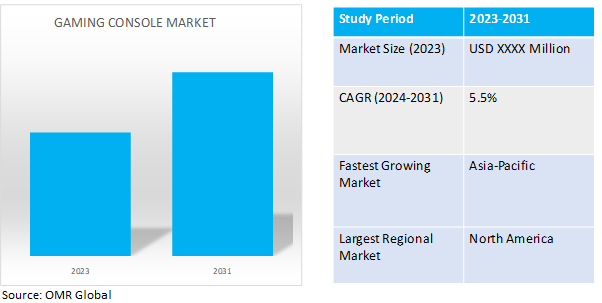

Gaming console market is anticipated to grow at a CAGR of 5.45% during the forecast period (2024-2031). A gaming console is a computer device that allows users to play video games on a screen. Some consoles connect to a television, while others are handheld and have their own screens. Games can be inserted into the device as a disc or card, or downloaded directly onto the device via the internet and the device's online store.

Market Dynamics

Technology is Revolutionizing Gaming Consoles

Technological advancements are highly driving the console market. Next-gen consoles boast features like high-fidelity graphics and faster processors, creating a more immersive and realistic experience. These advancements allow for complex game mechanics and pave the way for VR/AR integration, opening doors to entirely new ways to play. For instance, Lenovo unveiled the Legion AR Glasses at IFA 2023, featuring a large micro-OLED display. Compatible with Legion Go and various Windows, Android, and macOS devices via USB-C, they provide 1080p resolution and 60Hz refresh rate. Equipped with high-fidelity speakers, these AR glasses offer a portable, immersive viewing experience for gamers and users seeking comfortable viewing angles. These innovations push the boundaries of gaming, captivating players and fueling demand for the latest consoles.

Advancement in Technologies and Content: Propelling the Gaming Experience

The gaming audience is undergoing a significant transformation, with demographics expanding beyond the traditional core. This growth is fueled by a rise in casual gamers who are drawn to the affordability and user-friendliness of consoles compared to high-powered PCs. According to Online Nation 2022 published by OfCom 39.0% of men and 22.0% of women play games on consoles followed by smartphones 33.0% of men and 41.0% of women. Moreover, Thirty percent of adults use game consoles, which are more commonly used by younger adults. These casual players often enjoy a wider variety of game genres and prioritize accessible gameplay experiences. Furthermore, the booming esports scene, with its global reach and diverse player base, is attracting new demographics to console gaming. This exposure to competitive gaming and the rise of engaging titles with broader appeal are contributing to a more inclusive gaming landscape.

Market Segmentation

Our in-depth analysis of the global gaming console market includes the following segments by product and by storage:

- Based on product, the market is sub-segmented into handheld gaming consoles and stationary gaming consoles.

- Based on storage, the market is augmented into external storage, internal storage, and cloud storage.

Handheld Gaming Consoles Outpace Stationary Counterparts

The handheld gaming console segment is experiencing the highest growth within the gaming console market. This can be attributed to factors such as increasing demand for portable gaming options, advancements in technology allowing for more powerful handheld devices, and the convenience they offer for gaming on the go. For instance, in January 2024, MSI unveiled the Claw handheld gaming console aligns with the burgeoning growth of the handheld gaming market. Featuring powerful hardware, including an Intel Core Ultra processor and Windows 11 compatibility, the Claw caters to the increasing demand for portable gaming options. With its ergonomic design and high-performance specifications, MSI's entry into the handheld gaming space reflects the industry's shift towards mobile gaming experiences, driving further growth in this segment. Additionally, the rise of portable gaming and the popularity of hybrid gaming consoles, which can be used both as handheld devices and connected to a larger screen for stationary gaming, contribute to the growth of this segment.

Cloud Storage Dominates Storage Market Expansion

The cloud storage segment is experiencing the highest growth within the storage market. This can be attributed to various factors such as the increasing adoption of cloud computing, the need for scalable storage solutions, and the rise of remote work and digitalization. In September 2023, Sony announces the integration of PS5 games into its cloud gaming service, initially available exclusively on consoles. PlayStation Plus Premium subscribers gain access to titles like Horizon Forbidden West and Marvel’s Spider-Man: Miles Morales at up to 4K resolution with HDR and full PS5 audio. This move reflects Sony's strategic expansion into cloud gaming, aligning with the growing trend towards cloud-based gaming experiences on consoles. Cloud storage offers flexibility, accessibility, and scalability, making it an attractive option for businesses and individuals alike. Additionally, advancements in cloud technology and security measures further drive the growth of this segment.

Regional Outlook

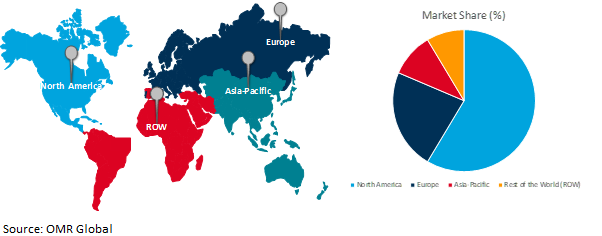

The global gaming console market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America: A Leader in the Gaming Console Market

- The established gaming industry in North America comprises major companies, developers, and publishers, fostering innovation and driving consumer interest in gaming consoles through the creation of compelling games and immersive experiences.

- In the gaming console market, North America benefits from its robust technological infrastructure, which includes advanced internet connectivity, modern hardware, and digital platforms. For instance, according to the Benton Institute for Broadband & Society, expansion of fiber access across the US has shown consistent growth. From December 2021 to June 2023, the average fiber access rate rose from approximately 45.9% to about 55.6% of households. This increase reflects the addition of approximately 5.6 million new households subscribing to fiber during this period. This infrastructure supports online gaming, digital downloads, streaming services, and multiplayer connectivity, contributing to the region's dominance in the gaming console market through enhanced gaming experiences and widespread accessibility for consumers.

Global Gaming Console Market Growth by Region 2024-2031

Expanding Internet Access: Driving Growth in the Asia-Pacific Gaming Console Market

Rising internet penetration refers to the increasing availability and adoption of Internet services among the population. In the Asia-Pacific region, internet penetration has seen remarkable growth due to several factors. Firstly, advancements in telecommunications infrastructure, such as the expansion of broadband networks and the deployment of 4G and 5G technologies, have improved connectivity and made internet access more accessible. For instance, India has witnessed significant advancements in its telecommunications infrastructure. The number of Base Trans-receivers Stations (BTS) has surged from 6.49 lakhs in March 2014 to 25.42 lakhs in March 2023, facilitating widespread internet access. Internet user numbers have soared from 25.15 crore to 88.12 crore during the same period. India's 5G rollout has been the world's fastest, with 3.99 lakhs BTS deployed across 738 districts, leading to substantial improvements in mobile broadband speeds, rising from 1.30 Mbps in March 2014 to 75.80 Mbps in October 2023. Additionally, the proliferation of affordable smartphones and mobile devices has enabled a larger portion of the population to go online. Governments and private sector initiatives to bridge the digital divide and provide internet access to underserved areas have also contributed to rising internet penetration rates. As more people gain access to the internet, they become potential consumers of online services, including gaming. This trend fuels the growth of the gaming console market in the Asia-Pacific region as more individuals engage in online gaming activities.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global gaming console market include ASUSTEK Computer Inc., Lenovo Group Ltd., Microsoft Corp., Micro-Star INT'L CO., LTD (MSI), Nintendo Co. Ltd., and Sony Interactive Entertainment Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Lenovo introduced the Lenovo Legion Go, its inaugural Windows gaming handheld, offering gamers premium specifications and visuals for on-the-go gaming. Paired with the micro-OLED Lenovo Legion Glasses and Lenovo Legion E510 7.1 RGB Gaming In-Ear Headphones, it expands the Lenovo Legion ecosystem, providing gamers with immersive experiences across devices, monitors, accessories, software, and services.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gaming console market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ASUSTEK Computer Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Lenovo Group Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Micro-Star INT'L CO., LTD. (MSI)

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Nintendo Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Sony Interactive Entertainment Inc

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Key Strategy Analysis

4. Market Segmentation

4.1. Global Gaming Console Market by Product

4.1.1. Handheld Gaming Consoles

4.1.2. Stationary Gaming Console

4.2. Global Gaming Console Market by Storage

4.2.1. External Storage

4.2.2. Internal Storage

4.2.3. Cloud Storage

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. ABXYLUTE Inc.

6.2. Amkette

6.3. Analogue

6.4. Anbernic

6.5. Anyun Intelligent Technology (Hong Kong) Co., Ltd

6.6. Atari, Inc.

6.7. Intellivision Entertainment, LLC.

6.8. Logitech International SA

6.9. Hyperkin, Inc.

6.10. ONE-NETBOOK

6.11. Powkiddy

6.12. Sameo Distribution India Private Ltd.

6.13. Valve Corp.

1. GLOBAL GAMING CONSOLE MARKET BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL HANDHELD GAMING CONSOLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL STATIONARY GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GAMING CONSOLEMARKET BY STORAGE, 2023-2031 ($ MILLION)

5. GLOBAL EXTERNAL STORAGE GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INTERNAL STORAGE GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CLOUD STORAGE GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALGAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY PRODUCT2023-2031 ($ MILLION)

11. NORTH AMERICAN GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY STORAGE, 2023-2031 ($ MILLION)

12. EUROPEANGAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BYPRODUCT2023-2031 ($ MILLION)

14. EUROPEANGAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY STORAGE, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA- PACIFIC GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. ASIA- PACIFIC GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY STORAGE, 2023-2031 ($ MILLION)

18. REST OF THE WORLD GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. REST OF THE WORLD GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. REST OF THE WORLD GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY STORAGE, 2023-2031 ($ MILLION)

1. GLOBAL GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL HANDHELD GAMING CONSOLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL STATIONARY GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY STORAGE, 2023 VS 2031 (%)

5. GLOBAL EXTERNAL STORAGE GAMING CONSOLEMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL INTERNAL STORAGE GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL CLOUD STORAGE GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL GAMING CONSOLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. US GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

11. UK GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC GAMING CONSOLE MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA GAMING CONSOLE MARKET S031 ($ 2031 ($ MILLION)

23. THE MIDDLE EAST & AFRICA GAMING CONSOLE MARKET S031 ($ 2031 ($ MILLION)