Gas Engine Market

Gas Engine Market Size, Share & Trends Analysis Report by Fuel Type (Natural Gas and Special Gas), by Power Output (0.5-15 MW and Above 15 MW), by Application (Power Generation, Co-generation, and Mechanical Drive),and by End-Users (Utilities, Manufacturing, Oil & Gas and Marine) Forecast Period (2024-2031)

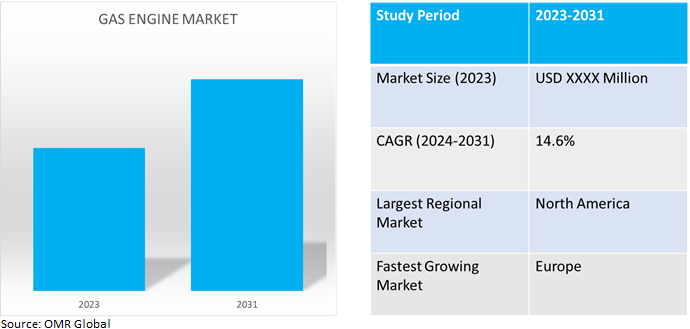

Gas engine market is anticipated to grow at a significant CAGR of 14.6% during the forecast period (2024-2031).The growth of the gas engine market is attributed to increasing demand for gas engines in applications such as industrial machinery, power generation, and automobiles driving the growth of the market.Gas engines can supply local facilities with heat and power, increasing resilience and energy efficiency in distributed energy systems, such as CHP applications. Continuous developments in gas engine technology, such as enhanced dependability, efficiency, and pollution control, have raised the attraction and competitiveness of these engines across a range of industries.

Market Dynamics

Improves Efficiency of Gas Engine

The improved efficiency of gas engines includes advancements in combustion technologies, design optimizations, and the integration of digital solutions for better monitoring and control by using higher compression ratios, optimizing fuel injection timing and fuel-air ratio, and using advanced ignition systems.Modern gasoline engines have a maximum thermal efficiency of more than 50.0%, but most road-legal cars use only about 20.0% to 40.0% when used to power a car. Many engines would be capable of running at higher thermal efficiency but at the cost of higher wear and emissions.Many types of gaseous fuels can power gas engines. Customers and the global community benefit from gas engines differently depending on their application. Gas engines can provide or support the following, depending on the configuration, gas, and application as well as the current energy mix for the local electrical grid.

Increasing Adoption of Hybridization and Electrification

The growing adoption of gas engines in hybrid powertrains includes applications such as marine propulsion, off-road vehicles, and stationary power generation. Hybrid-electric propulsion systems, which combine fuel-burning engines with electric motors and batteries, create opportunities to significantly improve aircraft fuel efficiency and lower carbon dioxide emissions, while also offering potential reductions in maintenance costs. Market players offer integrated systems that combine motors, controllers, and power for aircraft that need more range, 500-kilowatt turbogenerator combines the rugged, flight-proven engine with two miniaturized generators to feed motors or high-capacity batteries.

Market Segmentation

Our in-depth analysis of the global gas engine market includes the following segments fuel type,power output, application,and end-users.

- Based onfuel type, the market is sub-segmented into natural gas and special gas.

- Based on power output,the market is sub-segmented into 0.5-15 MW and above 15 MW.

- Based on application,the market is sub-segmented into power generation, co-generation, and mechanical drive.

- Based on end-users, the market is sub-segmented into utilities, manufacturing, oil & gas, and marine.

Mechanical Driveis Projected to Emerge as the Largest Segment

Based on the application,the global gas engine market is sub-segmented into power generation, co-generation, and mechanical drive.Among these mechanical drives, the sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include increasing application in industries mechanical drive for powering compressors, pumps, and other essential equipment used in extraction, processing, and transportation operations.For powering these essential pieces of equipment, gas engines provide a dependable and affordable option that minimizes running expenses while supplying the required power. Furthermore, with natural adaptability, gas engines may operate well in a wide range of mechanical drive applications, meeting different operating conditions and load requirements. The use of gas engines for mechanical drive applications is also being fueled by the rising demand for natural gas as a greener substitute for conventional fuels in industrial operations. Gas engines are widely utilized for mechanical drive applications in a variety of sectors owing to their demonstrated performance, adaptability, and environmental advantages.

0.5-15 MWSub-segment to Hold a Considerable Market Share

Based onthe power output,the global gas enginemarket is sub-segmented into0.5-15 MW and Above 15 MW.Among these, the 0.5-15 MW sub-segment is expected to hold a considerable share of the market. The increasing demand for 0.5-15 MW ranges in a wide range of applications across various industries, including industrial, commercial, and utility sectors. Gas engines with a power output of 0.5-15 MW are suitable for medium-sized facilities and operations, including data centers, manufacturing plants, and district heating systems, among others. Furthermore, improvements in gas engine technology have raised the power range's engines' economy, dependability, and performance, which has increased their appeal to end users looking for affordable and environmentally friendly power sources. Furthermore, end customers favor0.5-15 MW gas engines owing to their superior economics, which include cheaper installation and operating costs than bigger capacity engines.

Regional Outlook

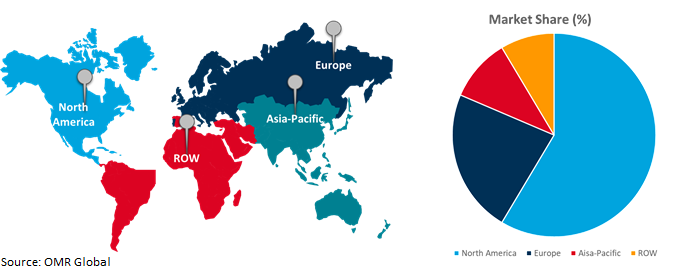

The globalgas engine market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Gas Engine Adoptionin Europe

- In Europe, rapid economic expansion and urbanization in nations such as the UK, Germany, and France are driving a surge in energy consumption. Gas engines are used to meet the growing demand for electricity and heat.

- Many countries in the region are turning to natural gas as a cleaner, more environmentally friendly fuel source to produce electricity. This transition has led to the adoption of gas engines that can run on natural gas or LNG (liquefied natural gas).

Global Gas Engine Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and gas engine providers.The growth is attributed to the increasing expansion of industrialization and infrastructure development with increasing demand for power generation in various industries such as manufacturing, oil and gas, and mining driving the growth of the gas engine market in the region. Motor gasoline is one of the most consumed fuels in the US and the main product that US oil refineries produce. Most of the finished motor gasoline sold for vehicles in the US is about 10.0% fuel ethanol by volume. For instance, in August 2023, US Energy Information Administration, In 2022, Americans used about 135.73 billion gallons of gasoline, including 134.55 billion gallons of finished motor gasoline (about 368.63 million gallons per day) and about 0.19 billion gallons of finished aviation gasoline.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global gas engine market include Caterpillar Inc., Doosan Corp., General Electric Company, Kawasaki Heavy Industries, Ltd., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2023,Cummins Inc. and Chevron U.S.A. Inc.a subsidiary of Chevron Corp., collaborated on a broad portfolio of engine-based solutions that reduce greenhouse gas and other emissions. The two companies’ previous strategic collaboration on hydrogen and renewable natural gas and is expected to encompass other liquid renewable fuels, such as renewable gasoline blends, biodiesel, and renewable diesel.

Recent Development

- In March 2024, MITSUI E&S Co. Ltd. announced that it had successfully tested a 50-bore MAN B&W two-stroke engine with up to 100.0% load at its Tamano facility while running on hydrogen, a first for the maritime industry. Adapted ME-GI gas engine runs on hydrogen up to 100.0% load. In collaboration with MAN Energy Solutions, MITSUI converted one of the four cylinders of a MAN B&W ME-GI (-Gas Injection) engine to hydrogen operation.

- In March 2024, MWM launched a 60 Hz Variant of TCG 3020 V20 Gas Engines. The company offers TCG 3020 V20 gas generator sets in a 60 Hz variant. Apart from expanding its product range, the 60 Hz variant of the TCG 3020 V20 gas engine enables MWM to address additional markets.

- In December 2023, Kawasaki Heavy Industries, Ltd. introduced a gas-engine hybrid propulsion system for use on a bulk carrier. By using a pure gas engine fueled only by natural gas as the main propulsion, the system cuts down CO2 emissions during operation by approximately 24.0% compared with a conventional heavy-fuel-oil engine used in the same vessel type.

- In March 2023, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. introduced SGP M2000, a new natural gas engine cogeneration system with a generation output of 2,000kW. The new package encloses a 16-cylinder natural gas-fired engine modeledG16NB that boasts electrical efficiency of 44.3%, the highest level for a 2,000kW-class and makes a cogeneration system(Note1) in compact packaging.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gas engine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Caterpillar Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Doosan Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. General Electric Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Gas Engine Market by Fuel Type

4.1.1. Natural Gas

4.1.2. Special Gas

4.2. Global Gas Engine Market by Power Output

4.2.1. 0.5-15 MW

4.2.2. Above 15 MW

4.3. Global Gas Engine Market by Application

4.3.1. Power Generation

4.3.2. Co-generation

4.3.3. Mechanical Drive

4.4. Global Gas Engine Market by End-Users

4.4.1. Utilities

4.4.2. Manufacturing

4.4.3. Oil & Gas

4.4.4. Marine

4.4.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Briggs & Stratton Corp.

6.2. Cummins Inc.

6.3. Detroit Diesel Corp.

6.4. DEUTZ AG

6.5. Fairbanks Morse, LLC

6.6. Hatz GmbH & Co. KG

6.7. Honda Motor Co., Ltd.

6.8. Kawasaki Heavy Industries, Ltd.

6.9. Kohler Co.

6.10. Kubota Corp.

6.11. MAN Energy Solutions SE

6.12. MITSUBISHI HEAVY INDUSTRIES, LTD.

6.13. MTU Aero Engines AG

6.14. Perkins Engines Company Ltd.

6.15. Rolls-Royce plc

6.16. Siemens AG

6.17. Volvo Group

6.18. Wärtsilä Corp.

6.19. Yanmar Co., Ltd.

1. GLOBAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BYFUEL TYPE,2023-2031 ($ MILLION)

2. GLOBALNATURAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALSPECIAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT,2023-2031 ($ MILLION)

5. GLOBAL 0.5-15 MW GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ABOVE 15 MW GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

8. GLOBAL GAS ENGINE FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL GAS ENGINE FOR CO-GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL GAS ENGINE FOR MECHANICAL DRIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

12. GLOBAL GAS ENGINE FOR UTILITIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL GAS ENGINE FOR MANUFACTURINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL GAS ENGINE FOR OIL & GASMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL GAS ENGINE FOR MARINEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BYFUEL TYPE,2023-2031 ($ MILLION)

19. NORTH AMERICAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT,2023-2031 ($ MILLION)

20. NORTH AMERICAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

21. NORTH AMERICAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

22. EUROPEAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BYFUEL TYPE,2023-2031 ($ MILLION)

24. EUROPEAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT,2023-2031 ($ MILLION)

25. EUROPEAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

26. EUROPEAN GAS ENGINE MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

27. ASIA-PACIFIC GAS ENGINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFICGAS ENGINE MARKET RESEARCH AND ANALYSIS BYFUEL TYPE,2023-2031 ($ MILLION)

29. ASIA-PACIFICGAS ENGINE MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT,2023-2031 ($ MILLION)

30. ASIA-PACIFICGAS ENGINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

31. ASIA-PACIFICGAS ENGINE MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

32. REST OF THE WORLD GAS ENGINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD GAS ENGINE MARKET RESEARCH AND ANALYSIS BYFUEL TYPE,2023-2031 ($ MILLION)

34. REST OF THE WORLD GAS ENGINE MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT,2023-2031 ($ MILLION)

35. REST OF THE WORLD GAS ENGINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

36. REST OF THE WORLD GAS ENGINE MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

1. GLOBAL GAS ENGINEMARKET SHARE BYFUEL TYPE,2023 VS 2031 (%)

2. GLOBAL NATURAL GAS ENGINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SPECIAL GAS ENGINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GAS ENGINEMARKET SHAREBY POWER OUTPUT,2023 VS 2031 (%)

5. GLOBAL 0.5-15 MW GAS ENGINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ABOVE 15 MW GAS ENGINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL GAS ENGINEMARKET SHAREBY APPLICATION,2023 VS 2031 (%)

8. GLOBAL GAS ENGINEFOR POWER GENERATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL GAS ENGINEFOR CO-GENERATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL GAS ENGINEFOR MECHANICAL DRIVEMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL GAS ENGINEMARKET SHAREBY END-USERS,2023 VS 2031 (%)

12. GLOBAL GAS ENGINEFOR UTILITIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL GAS ENGINEFOR MANUFACTURINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL GAS ENGINEFOR OIL & GASMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL GAS ENGINEFOR MARINEMARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

18. UK GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA GAS ENGINE MARKET SIZE, 2023-2031 ($ MILLION)