GCC e-commerce Logistics Market

GCC e-Commerce Logistics Market Research By Products (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products and Other), By Services (Transportation Services, Warehousing Services and Other), and By Locations (Urban, Rural and Semi-Urban) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The GCC e-commerce logistics market is growing at a considerable CAGR of 3.1% during the forecast period. Enlarging network of railway is one of the prime factors affecting and driving the market. Developed infrastructure in major GCC countries and availability of emigrant workforce is also estimated to be the key factors that are contributing significantly towards the growth of the market. However, political instability in few countries is major constraints that are hindering the growth of the GCC e-commerce logistics market.

Further, scope for backward and horizontal integration is one of the important factors that are creating opportunity for the market. New product launches in the market are likely to drive the growth of the GCC e-commerce logistics market. For instance, in October 2020, FedEx had introduced Roxo that will arrive for the first time in United Arab Emirates (UAE). Roxo is designed in order to transport small deliveries to home along with business travelling on paths and roadsides as it is one of the autonomous delivery bot.

Impact of COVID-19 on the GCC e-Commerce Logistics Market

The GCC e-commerce logistics market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic had disrupted manufacturing and transportation along with warehousing. Moreover, due to COVID-19 pandemic decision had also been made by many retailers to cancel the order for next delivery date owing to lockdown in the region.

Segmental Outlook

The market is segmented based on products, services, and locations. By products, the market is segmented into baby products, personal care products, books, home furnishing products, apparel products, electronics products, automotive products and other. Based on services, the market is segmented into transportation services, warehousing services and other. Further, by locations, market is segmented into urban, rural and semi-urban.

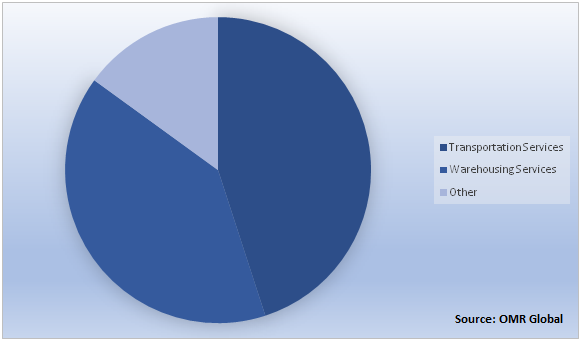

GCC e-Commerce Logistics Market Share by Services 2020 (%)

Based on the services, Transportation services hold a significant share in the GCC e-commerce logistics market. It provides effective movement for the finished goods. Efficient transportation is acting as an important economic benefit to the business along with consumers for getting their placed order on time. There is a significant demand for railways, waterways, and roadways for transporting e-commerce products to consumers more rapidly and effectively. Further, the rising cross-border e-commerce activities are creating an opportunity for e-commerce transportation services.

Regional Outlooks

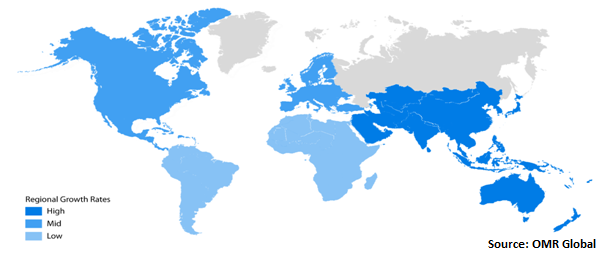

The GCC e-commerce logistics market is analyzed based on the countries that are contributing significantly towards the growth of the market. Based on the countries, the market is segmented into Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE. Saudi Arabia held a considerable share in 2020 in the GCC e-commerce logistics market. Some factors that are boosting the market growth in Saudi Arabia are well developed infrastructure along with broad range of products offering by manufacturers. Moreover, increasing user of internet in the country is also driving the growth of the market.

GCC e-commerce Logistics Market, by Region

Market Player Outlook

Key players of the GCC e-Commerce logistics market are Deutsche Post AGHL, FedEx, Gulf Pinnacle Logistics, Emirates Post Group Corp., and Prime Express among others. To survive in the market, these players adopt different marketing strategies such as product launches and collaboration. For instance, in March 2021, FedEx had decided to introduce an e-commerce subsidiary with the name FedEx Cross Border. This business works as a part of the FedEx trade network that will support issues in cross broader with an online retailer.

In March 2021, DHL Express had set forward its new whitepaper. In that the company had highlighted that due to COVID-19 pandemic the pace of acceleration is there in digital transformation that will lead to increase in B2B and B2B e-commerce growth.

In January 2021, Emirates Post Group Corp. had team up with one of the technological services providers named Lleida.net for the purpose of offering registered digital communication services. Through this any individual along with any organization are allow to deliver registered communications using digital means that includes SMS, email among others. Additionally, it tracks and it can trace documents along with its verification.

In June 2020, Aramex had put forward its new Aramex SMART that is considered a solution for e-tailers. The consumer would be benefited for convenient online shopping that will support them to get faster delivery, easy return along with payment with various method after getting delivery within 14 days of time.

In December 2020, FedEx had acquired one of the e-commerce platforms named as shop runner in order to connect various brands with people who do online shopping. Through this acquisition, the company will diversify the portfolio of e-commerce by connecting and adding 100 brands and merchants of shop runner in it to offer effective services to its millions of consumers.

In November 2019, Aramex had introduced its solution across Saudi Arabia and UAE as last mile delivery named as Aramex Spot. This will support in enhancing services to customer along with pick up facility as per increasing demand.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the GCC e-Commerce logistics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the GCC e-commerce Logistics Industry

• Recovery Scenario of GCC e-commerce Logistics Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. GCC E-Commerce Logistics Market by Products

5.1.1. Baby Products

5.1.2. Personal Care Products

5.1.3. Books

5.1.4. Home Furnishing Products

5.1.5. Apparel Products

5.1.6. Electronics Products

5.1.7. Automotive Products

5.1.8. Other

5.2. GCC E-Commerce Logistics Market by Services

5.2.1. Transportation Services

5.2.2. Warehouse Services

5.2.3. Other

5.3. GCC E-Commerce Logistics Market by Locations

5.3.1. Urban

5.3.2. Rural

5.3.3. Semi-Urban

6. Regional Analysis

6.1. GCC

6.1.1. BAHRAIN

6.1.2. KUWAIT

6.1.3. OMAN

6.1.4. QATAR

6.1.5. SAUDI ARABIA

6.1.6. UAE

7. Company Profiles

7.1. ARABCO Logistics

7.2. Aramex

7.3. Caravel.in

7.4. Deutsche Post AG

7.5. DTDC Express Ltd.

7.6. DOT Express Pty Ltd.

7.7. Emirates Post Group Corp.

7.8. FedEx

7.9. Gulf Pinnacle Logistics

7.10. OCS Group Ltd.

7.11. ORBIT XPRESS

7.12. Prime Express

7.13. professionalcourier.ae

7.14. Royal Express Delivery co.

7.15. Sky Express International LLC.

7.16. Saudi Post Corp.

7.17. United Parcel Service of America, Inc.

1. GCC E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GCC E-COMMERCE LOGISTICS MARKET BY PRODUCTS, 2020-2027 ($ MILLION)

3. GCC BABY PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

4. GCC PERSONAL CARE PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

5. GCC BOOKS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

6. GCC HOME FURNISHING PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

7. GCC APPAREL PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

8. GCC ELECTRONICS PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

9. GCC AUTOMOTIVE PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

10. GCC OTHER MARKET BY COUNTRY, 2020-2027 ($ MILLION)

11. GCC E-COMMERCE LOGISTICS MARKET BY SERVICES, 2020-2027 ($ MILLION)

12. GCC TRANSPORTATION SERVICES MARKET BY COUNTRY, 2020-2027 ($ MILLION)

13. GCC WAREHOUSE SERVICES MARKET BY COUNTRY, 2020-2027 ($ MILLION)

14. GCC OTHER MARKET BY COUNTRY, 2020-2027 ($ MILLION)

15. GCC E-COMMERCE LOGISTICS MARKET BY LOCATIONS, 2020-2027 ($ MILLION)

16. GCC URBAN MARKET BY COUNTRY, 2020-2027 ($ MILLION)

17. GCC RURAL MARKET BY COUNTRY, 2020-2027 ($ MILLION)

18. GCC SEMI-URBAN MARKET BY COUNTRY, 2020-2027 ($ MILLION)

19. GCC E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. BAHRAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

21. BAHRAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

22. BAHRAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

23. KUWAIT E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

24. KUWAIT E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

25. KUWAIT E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

26. OMAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

27. OMAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

28. OMAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

29. QATAR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

30. QATAR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

31. QATAR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

32. SAUDI ARABIA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

33. SAUDI ARABIA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

34. SAUDI ARABIA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

35. UAE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

36. UAE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

37. UAE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GCC E-COMMERCE LOGISTICS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GCC E-COMMERCE LOGISTICS MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GCC E-COMMERCE LOGISTICS MARKET, 2021-2027 (%)

4. GCC E-COMMERCE LOGISTICS MARKET SHARE BY PRODUCTS, 2020 VS 2027 (%)

5. GCC E-COMMERCE LOGISTICS MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

6. GCC E-COMMERCE LOGISTICS MARKET SHARE BY LOCATIONS, 2020 VS 2027 (%)

7. GCC E-COMMERCE LOGISTICS MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

8. GCCBA BY PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

9. GCC PERSONAL CARE PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

10. GCC BOOKS MARKET BY COUNTRY, 2020 VS 2027 (%)

11. GCC HOME FURNISHING PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

12. GCC APPAREL PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

13. GCC ELECTRONICS PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

14. GCC AUTOMOTIVE PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

15. GCC OTHER MARKET BY COUNTRY, 2020 VS 2027 (%)

16. GCC TRANSPORTATION SERVICES MARKET BY COUNTRY, 2020 VS 2027 (%)

17. GCC WAREHOUSING SERVICES MARKET BY COUNTRY, 2020 VS 2027 (%)

18. GCC OTHER MARKET BY COUNTRY, 2020 VS 2027 (%)

19. GCC URBAN MARKET BY COUNTRY, 2020 VS 2027 (%)

20. GCC RURAL MARKET BY COUNTRY, 2020 VS 2027 (%)

21. GCC SEMI-URBAN MARKET BY COUNTRY, 2020 VS 2027 (%)

22. BAHRAIN E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

23. KUWAIT E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

24. OMAN E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

25. QATAR E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

26. SAUDI ARABIA E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

27. UAE E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)