Gene Amplification Market

Global Gene Amplification Market Size, Share & Trends Analysis Report by Technology (Target Isothermal DNA, Isothermal Signal Amplification, Linear Gene, Cyclic Temperature, and Cyclic Temperature Signal Gene Amplification), and by Application (Forensics, Identity, Food Safety, Paternity, Medical, and Veterinary) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global gene amplification market is anticipated to grow at a significant CAGR during the forecast period. The factor that grows the global gene amplification market is attributed to advancements in molecular diagnostic tools such as NGS, droplet digital PCR, and genome-wide sequencing concerning reproducibility, accuracy, and timeline have influenced the adoption of gene multiplication techniques in the market. In addition, global initiatives such as the Africa Pathogen Genomics Initiative (Africa PGI) have driven the market for gene multiplication technologies. This initiative was launched in October 2020 to expand genomics-based public health pathogen surveillance.

Impact of COVID-19 Pandemic on Global Gene Amplification Market

The COVID-19 pandemic has had a positive effect on the global gene amplification market due to the increase in COVID-19 cases the demand for PCR was increasing which indirectly boost the global gene amplification market. The growing demand for PCR in hospitals, clinics, pharma companies, and research institutes. The widespread application of RT-PCR tests for COVID-19 has skyrocketed the demand for PCR-based amplification segments globally.

Segmental Outlook

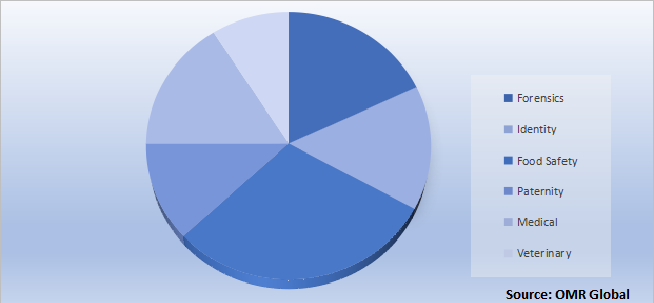

The global gene amplification market is segmented based on technology and application. Based on the Technology, the market is segmented into target isothermal DNA, isothermal signal amplification, linear gene, cyclic temperature, and cyclic temperature signal gene amplification. Based on the application, the market is sub-segmented into forensics, identity, food safety, paternity, medical and veterinary. The above-mentioned segments can be customized as per the requirements. The above-mentioned segments can be customized as per the requirements. The medical segment is expected to cater to a significant share in the global gene amplification market due to increasing investment in genomics by pharmaceutical and biotechnology companies is anticipated to drive the market significantly over the near future. In recent years, the biotechnology sector has witnessed a significant shift toward new drugs and treatments, genome sequencing-based medicines, and advancements in technologies, thereby propelling market growth.

Global Gene Amplification Market Share by Application, 2021 (%)

The Food Safety Segment is Expected to Hold a Prominent Share in the Global Gene Amplification Market

The food safety segment is expected to hold a prominent share in the global gene amplification market. Foodborne illnesses are a growing public concern in developed and developing countries. Increasing food consumption patterns and changing industry needs as per regulations are further steering growth for newer and faster food safety diagnostics. Rapid screening methods such as the PCR IMS, immunoassay, and ELISA-based methods, and traditional methods that include culture enrichment process and selective agar method are the major food safety testing technologies utilized In the food safety segment.

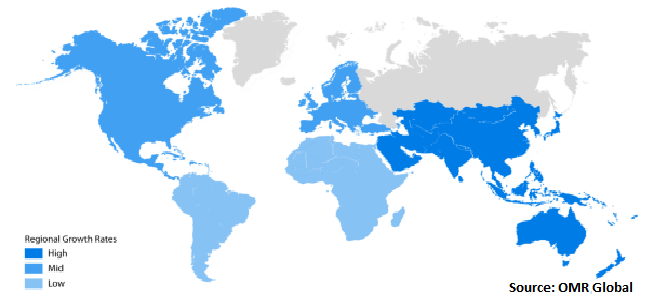

Regional Outlooks

The global gene amplification market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific is anticipated to be the fastest-growing region in the global gene amplification market as emerging economies such as India and China are significantly contributing to research and development, lower costs, the abundant manpower of skilled workers, and supportive government policies for research.

Global Gene Amplification Market Growth, by Region 2022-2028

The North American Region is expected to Hold the Prominent Share in the Global Gene Amplification Market

The North American region is expected to hold a prominent share in the global gene amplification market due to the increasing prevalence of chronic diseases such as cancer. According to the American Cancer Society, Inc. in 2022, there will be an estimated 1.9 million new cancer cases diagnosed and 609,360 cancer mortalities which is about 1,670 a day in the US. It is estimated that 10,470 children and 5,480 adolescents will be diagnosed with cancer, of which 1,050 and 550 will die from the disease.

Market Players Outlook

The major companies serving the global gene amplification market include Abbott Laboratories, Inc., QIAGEN N.V., Bayer Corp., Becton Dickinson and Co., Molecular Systems, Inc., Bio-Rad Laboratories, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2020, Becton Dickinson, and Co. acquired NAT Diagnostics to expand its business into point-of-care MDx.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gene amplification market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Gene Amplification Market

- Recovery Scenario of Global Gene Amplification Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.2.Abbott Laboratories, Inc.

3.2.1.Overview

3.2.2.Financial Analysis

3.2.3.SWOT Analysis

3.2.4.Recent Developments

3.3.Bayer AG

3.3.1.Overview

3.3.2.Financial Analysis

3.3.3.SWOT Analysis

3.3.4.Recent Developments

3.4.Thermo Fisher Scientific Inc.

3.4.1.Overview

3.4.2.Financial Analysis

3.4.3.SWOT Analysis

3.4.4.Recent Developments

3.5.Key Strategy Analysis

3.6.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Gene Amplification Market by Technology

4.1.1.Target Amplification

4.1.2.Isothermal DNA Amplification

4.1.3.Isothermal Signal Amplification

4.1.4.Linear Gene Amplification

4.1.5.Cyclic Temperature Amplification

4.1.6.Cyclic Temperature Signal Gene Amplification

4.2.Global Gene Amplification Market by Application

4.2.1.Forensics

4.2.2.Identity

4.2.3.Food Safety

4.2.4.Paternity

4.2.5.Medical

4.2.6.Veterinary

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Agilent Technologies, Inc.

6.2.Alphabet Inc.

6.3.Becton, Dickinson, and Co.

6.4.Bio-Rad Laboratories, Inc.

6.5.Biodiscovery, LLC

6.6.BIOMÉRIEUX

6.7.Cepheid

6.8.Daicel Arbor Biosciences

6.9.deCODE genetics

6.10.Exact Sciences Corp

6.11.F. Hoffmann-La Roche Ltd

6.12.Laboratory Corp of America Holdings

6.13.Pacific Biosciences of California, Inc.

6.14.TAKARA BIO INC.

6.15.Veritas Genetics

1.GLOBAL GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

2.GLOBAL TARGET GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL ISOTHERMAL DNA GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL ISOTHERMAL SIGNAL GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL LINEAR GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBAL CYCLIC TEMPERATURE GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL CYCLIC TEMPERATURE SIGNAL GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

9.GLOBAL GENE AMPLIFICATION IN FORENSICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.GLOBAL GENE AMPLIFICATION IN IDENTITY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL GENE AMPLIFICATION IN FOOD SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12.GLOBAL GENE AMPLIFICATION IN PATERNITY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13.GLOBAL GENE AMPLIFICATION IN MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14.GLOBAL GENE AMPLIFICATION IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15.GLOBAL GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16.NORTH AMERICAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17.NORTH AMERICAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

18.NORTH AMERICAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19.EUROPEAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20.EUROPEAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

21.EUROPEAN GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22.ASIA-PACIFIC GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23.ASIA-PACIFIC GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

24.ASIA-PACIFIC GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25.REST OF THE WORLD GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26.REST OF THE WORLD GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

27.REST OF THE WORLD GENE AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL GENE AMPLIFICATION MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL GENE AMPLIFICATION MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL GENE AMPLIFICATION MARKET, 2022-2028 (%)

4.GLOBAL GENE AMPLIFICATION MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

5.GLOBAL TARGET GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL ISOTHERMAL DNA GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL ISOTHERMAL SIGNAL GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL LINEAR GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.GLOBAL CYCLIC TEMPERATURE GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL CYCLIC TEMPERATURE SIGNAL GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL GENE AMPLIFICATION MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

12.GLOBAL GENE AMPLIFICATION IN FORENSICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.GLOBAL GENE AMPLIFICATION IN IDENTITY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.GLOBAL GENE AMPLIFICATION IN FOOD SAFETY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15.GLOBAL GENE AMPLIFICATION IN PATERNITY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.GLOBAL GENE AMPLIFICATION IN MEDICAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17.GLOBAL GENE AMPLIFICATION IN VETERINARY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18.GLOBAL GENE AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19.US GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

20.CANADA GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

21.UK GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

22.FRANCE GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

23.GERMANY GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

24.ITALY GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

25.SPAIN GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

26.REST OF EUROPE GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

27.INDIA GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

28.CHINA GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

29.JAPAN GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

30.SOUTH KOREA GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

31.REST OF ASIA-PACIFIC GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)

32.REST OF THE WORLD GENE AMPLIFICATION MARKET SIZE, 2021-2028 ($ MILLION)