Generative AI in Fintech Market

Generative AI in Fintech Market Size, Share & Trends Analysis Report by Component (Service, and Software).by Deployment (On-premises, and Cloud). by Application (Compliance & Fraud Detection, Personal Assistants, Asset Management, Predictive Analysis, Insurance, Business Analytics & Reporting, Customer Behavioral Analytics, and Others). andby End-User (Retail Banking, Investment BankInsurance Companies, Stock Trading Firms, Hedge Funds, and Others).Forecast Period (2024-2031).

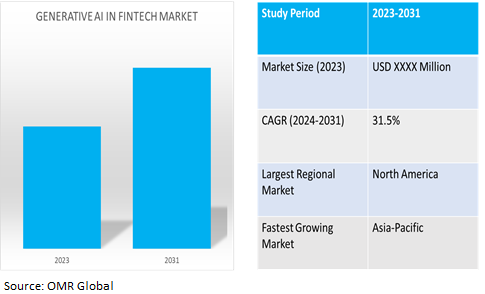

Generative AI in fintech market is anticipated to grow at anexponentialCAGR of 31.5% during the forecast period (2024-2031).The global generative AI market in fintech is expanding owing to factors such as data-driven decision-making, enhanced customer experience, fraud detection, algorithmic trading, risk management, operational efficiency, and cost reduction. The adoption of generative AI solutions is influenced by regulatory frameworks, technological advancements, and strategic partnerships between fintech companies and technology providers.

Market Dynamics

Growing Demand for Accessible Financing

The demand for accessible financing solutions, particularly for SMBs, is on the rise, with AI-powered management and platforms aiming to streamline this process. For instance, in March 2024, Worth AIlaunched its groundbreaking artificial intelligence (AI)-powered risk management and underwriting platform. The AI aims to improve financing for SMBs by utilizing AI to assess creditworthiness, reduce risks, enhance data transparency, and stimulate economic growth.

Development of New Products and Market Expansion

The company is expanding its product offerings to cater to the growing demand for tailored financial solutions in mid-market, multi-entity companies. For instance, in March 2024, Nominal, launched with $9.2 million in seed funding, uses generative AI to replace costly ERP systems with modern financial management solutions for mid-market businesses. The$44.0 billion ERP company automates accounting workflows using generative AI, expanding product offerings and US market reach for mid-market, and multi-entity companies like holding companies, real estate, and energy.

Market Segmentation

Our in-depth analysis of the global generative AI in fintechmarket includes the following segments by component, deployment, application,and end-user:

- Based on component, the market is sub-segmented into service and software.

- Based on deployment, the market is bifurcated into on-premises and cloud.

- Based on application, the market is bifurcated into compliance & fraud detection, personal assistants, asset management, predictive analysis insurance, business analytics & reporting, customer behavioral analytics, and others(debt collection, and financial management).

- Based on end-user, the market is sub-segmented into retail banking, investment bank, stock trading firms, hedge funds, and other(insurance companies).

Predictive Analysis InsuranceIs Projected To Emerge As TheLargest Segment

Based on the application, the global generative AI in fintechmarket is sub-segmented into compliance & fraud detection, personal assistants, asset management, predictive analysis, insurance, business analytics & reporting, customer behavioral analytics, and others.Among these, the predictive analysis insurancesolutionssub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includestechnological advancements in predictive analytics and generative AI drive innovation in fintech, utilizing businesses to invest for competitive advantage and operational efficiency. For instance, in January 2024,Pecan AI introduced Predictive GenAI, a combination of predictive analytics and generative AI, aiming to accelerate the adoption of enterprise AI. This innovative approach combines generative AI and predictive AI to unlock the value of businesses' data, despite the lag in actual adoption.

Retail Banking Sub-segment to Hold a Considerable Market Share

The implementation of generative AI to analyze transaction data is fueling the growing need for tailored financial services, whichis driving the fintech market's growth. For instance, in September 2023,Temenos introduced a secure solution for banks using Generative Artificial Intelligence (AI) to automatically classify customers' banking transactions. This technology enhances customer loyalty, provides personalized insights, and improves digital banking experiences. It'sthe first to deploy Generative AI and Large Language Models in banking, paving the way for innovation and personalization.

Regional Outlook

The globalgenerative AI in fintechmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demnd for Innovation and Entrepreneurial PerspectiveInthe Aisa-Pacific Region

Generative AI startups in India are playing a significant role in driving innovation and entrepreneurship, which in turn is contributing to the growth of the global fintech market through the development of innovative applications and products.According to the Generative AI StartupLandscape report by Nasscom, in January 2024 the generative AI ecosystem in India has seen significant growth over the past three years, with over 100 startups and a total funding of $700.0 million. The report also highlights that between 2013 and 2022, a total of $8.0 billion was invested in AI startups in India, with $3.2 billion invested in 2022 alone, spanning more than 1,900 startups.

Global Generative AI in Fintech Market Growth by Region 2024-2031

North AmericaHolds Major Market Share

The financial industry is embracing AI and machine learning technologies to improve efficiency and decision-making across various domains such as risk management, underwriting, fraud detection, and customer service. This growing demand for AI-driven solutions in fintech is leading to increased investment in research and development.For instance, inFebruary 2023, Columbia University established the Center for Artificial Intelligence in Business Analytics and Financial Technology (FinTech), aiming to foster research and innovation in the financial services industry. The center, housed in the School of Engineering and Applied Science, enabled faculty, staff, and students to apply AI, machine learning, and deep learning to real-world challenges. The center additionally focuses on real estate, aiming to become the epicenter of technological advancements in the industry.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global generative AI in fintech market includeGoogle LLC,IBM Corp.,Microsoft Corp.,Salesforce, Inc., and SAS Institute Inc.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive. For instance, inFebruary2024, Wipro launched the Wipro Enterprise Artificial Intelligence (AI)-Ready Platform, a service that enables clients to create fully integrated, customized AI environments. The platform uses IBM's Watsonx AI and data platform to accelerate AI adoption and enhance operations. The partnership between Wipro and IBM aims to build joint solutions for robust, reliable, integrated, and enterprise-ready AI solutions.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global generative AI in fintechmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Google LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Generative AI in Fintech Market by Component

4.1.1. Service

4.1.2. Software

4.2. Global Generative AI in Fintech Market by Deployment

4.2.1. On-premises

4.2.2. Cloud

4.3. Global Generative AI in Fintech Market by End User

4.3.1. Compliance & Fraud Detection

4.3.2. Personal Assistants

4.3.3. Asset Management

4.3.4. Predictive Analysis

4.3.5. Insurance

4.3.6. Business Analytics & Reporting

4.3.7. Customer Behavioral Analytics

4.3.8. Others (Debt Collection, and Financial Management)

4.4. Global Generative AI in Fintech Market by End-user

4.4.1. Retail Banking

4.4.2. Investment Bank

4.4.3. Stock Trading Firms

4.4.4. Hedge Funds

4.4.5. Other (Insurance Companies)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Accenture PLC

6.2. Adobe

6.3. Block, Inc.

6.4. Coinbase

6.5. Genie AI Ltd.

6.6. MOSTLY AI Solutions MP GmbH

6.7. NVIDIA Corp.

6.8. OpenAI

6.9. Oracle Corp.

6.10. Plaid Inc.

6.11. Robinhood

6.12. Salesforce, Inc.

6.13. SAP SE

6.14. SAS Institute Inc.

6.15. Synthesis AI

6.16. Visual

1. GLOBAL GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL GENERATIVE AI IN FINTECH SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL GENERATIVE AI IN FINTECH SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

5. GLOBAL GENERATIVE AI IN FINTECH BASED ON-PREMISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL GENERATIVE AI IN FINTECH BASED CLOUD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL GENERATIVE AI IN FINTECH FOR COMPLIANCE & FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL GENERATIVE AI IN FINTECH FOR PERSONAL ASSISTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL GENERATIVE AI IN FINTECH FOR ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL GENERATIVE AI IN FINTECH FOR PREDICTIVE ANALYSIS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL GENERATIVE AI IN FINTECH FOR INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL GENERATIVE AI IN FINTECH FOR BUSINESS ANALYTICS & REPORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL GENERATIVE AI IN FINTECH FOR CUSTOMER BEHAVIORAL ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL GENERATIVE AI IN FINTECH FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

17. GLOBAL GENERATIVE AI IN FINTECH IN RETAIL BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL GENERATIVE AI IN FINTECH IN INVESTMENT BANK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL GENERATIVE AI IN FINTECH IN STOCK TRADING FIRMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL GENERATIVE AI IN FINTECH IN HEDGE FUNDS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL GENERATIVE AI IN FINTECH IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. NORTH AMERICAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. NORTH AMERICAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

25. NORTH AMERICAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

26. NORTH AMERICAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. NORTH AMERICAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

28. EUROPEAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. EUROPEAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

30. EUROPEAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

31. EUROPEAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. EUROPEAN GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

37. ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

38. REST OF THE WORLD GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

39. REST OF THE WORLD GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

40. REST OF THE WORLD GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

41. REST OF THE WORLD GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

42. REST OF THE WORLD GENERATIVE AI IN FINTECH MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL GENERATIVE AI IN FINTECH MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL GENERATIVE AI IN FINTECH SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL GENERATIVE AI IN FINTECH SOFTWARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GENERATIVE AI IN FINTECH MARKET SHARE BY DEPLOYMENT, 2023 VS 2031 (%)

5. GLOBAL GENERATIVE AI IN FINTECH BASED ON-PREMISES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL GENERATIVE AI IN FINTECH BASED ON CLOUD MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL GENERATIVE AI IN FINTECH MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL GENERATIVE AI IN FINTECH COMPLIANCE & FRAUD DETECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL GENERATIVE AI IN FINTECH PERSONAL ASSISTANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL GENERATIVE AI IN FINTECH ASSET MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL GENERATIVE AI IN FINTECH PREDICTIVE ANALYSIS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL GENERATIVE AI IN FINTECH INSURANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL GENERATIVE AI IN FINTECH BUSINESS ANALYTICS & REPORTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL GENERATIVE AI IN FINTECH CUSTOMER BEHAVIORAL ANALYTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL GENERATIVE AI IN FINTECH OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL GENERATIVE AI IN FINTECH MARKET SHARE BY END-USER, 2023 VS 2031 (%)

17. GLOBAL GENERATIVE AI IN FINTECH IN RETAIL BANKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL GENERATIVE AI IN FINTECH IN INVESTMENT BANK MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL GENERATIVE AI IN FINTECH IN STOCK TRADING FIRMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL GENERATIVE AI IN FINTECH IN HEDGE FUNDS MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL GENERATIVE AI IN FINTECH IN OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL GENERATIVE AI IN FINTECH MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. US GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

24. CANADA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

25. UK GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

26. FRANCE GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

27. GERMANY GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

28. ITALY GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

29. SPAIN GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF EUROPE GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

31. INDIA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

32. CHINA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

33. JAPAN GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

34. SOUTH KOREA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF ASIA-PACIFIC GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

36. LATIN AMERICA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)

37. MIDDLE EAST AND AFRICA GENERATIVE AI IN FINTECH MARKET SIZE, 2023-2031 ($ MILLION)