Generator Sets Market

Global Generator Sets Market Size, Share & Trends Analysis Report by Capacity (Below 75 kVA, 75-350 kVA, and Above 350 kVA), By Fuel Type (Gas, Diesel, and Others) By Application (Standby Backup Power, Prime/Continuous Power, and Peak Shaving Power) Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global market for generator sets is projected to have a considerable CAGR of around 6.5% during the forecast period. Generator sets are equipped with an internal combustion engine. Depending on the needs and the type of fuel available, one can choose between a gasoline, diesel, or gas engine. Generator sets can add an extra layer of security in the event of brownouts or power outages and can provide a self-contained power supply in remote places off the power grid. Datacentre firms have become one of the largest consumers of electricity as a result of the widespread adoption of digital technologies. Given that data centers require billions of kilowatt-hours of electricity each year, they recommend using a generator as an emergency power source. Further, in the coming years, there will be greater demand for generator sets that can start up rapidly without disrupting surgeries, laboratories, or bench testing. As a result, hospitals have emerged as a significant end market for generator sets.

Segmental Outlook

The global generator sets market is segmented based on capacity, fuel type, and application. Based on the capacity, the market is further classified into below 75 kVA, 75-350 kVA, and above 350 kVA. Based on fuel type, the market is further segmented into gas, diesel, and others. Further, based on the application the market is classified into standby backup power, prime/continuous power, and peak shaving power.

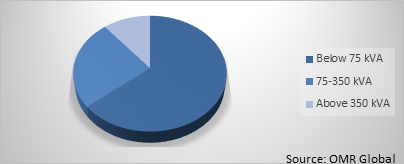

Global Generator Sets Market Share by Capacity, 2021 (%)

The Below 75 kVA Capacity Segment is Considered the Dominating Segment in the Global Generator Sets Market.

Among capacity, the below 75 kVA capacity is estimated as dominating segment during the forecast period. Less than or equal to 75 kVA generator sets are used in commercial complexes, small-scale industries, telecom sectors, and petrol stations. These kinds of small generators are typically based on price and need rather than efficiency, as they provide emergency backup power. Unreliable and restricted power access, particularly in rural regions, has been a primary driver of high demand for low-capacity generators. The market for 0-75 kVA diesel generators is predicted to increase tremendously since they are employed in the telecom sector for backup power in grid-connected locations and as the primary power source in off-grid areas. Therefore, based on the above-mentioned factors, below 75 kVA capacity generator sets are expected to have the largest market share during the forecast period.

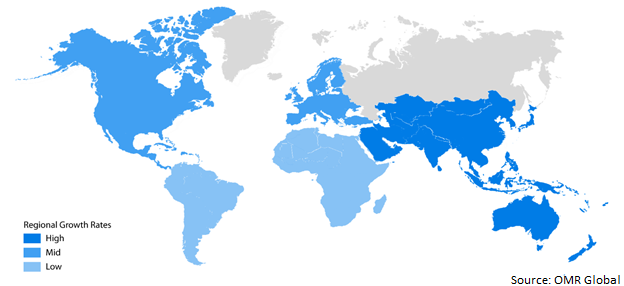

Regional Outlook

Geographically, the global generator sets market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is projected to have a significant CAGR in the generator sets market. Mexico's increasing commercial and industrial sector, as well as Canada's residential expansion, is projected to generate several opportunities for the North American generator set market. The US due to its largest population and increasing industrialization in the region is expected to dominate the North America generator sets market.

Global Generator Sets Market Growth, by Region 2022-2028

Asia-Pacific to Hold a Considerable Share in the Global Generator Sets Market

Geographically, Asia-Pacific is projected to hold a significant share global generator sets market. Among the region, China is the largest generator sets market due to escalating infrastructure projects, a widening power demand-supply gap, the growth of manufacturing facilities across the country, and rising commercial office spaces. The country also benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power backup devices. Increased power outages have affected Indonesia's manufacturing sector, prompting an increase in the country's use of generator sets to maintain a consistent and steady power supply. Due to the regular power outages in these areas, South Sumatra and Jakarta are the main contributors to the market's growth in Indonesia.

Market Players Outlook

The key players in the generator sets market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Cummins Inc, Generac Holdings Inc, Wartsila Corporation, Caterpillar Inc, Kohler Co. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In August 2020, Caterpillar Inc. announced that it has received Stationary Emergency Certification from the United States Environmental Protection Agency (EPA) for a natural gas-fueled generator set rated at 500 kW for 60 Hz markets. Caterpillar Inc. produces and builds a variety of engines and generators, including diesel and gas generators.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global generator sets market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Generator Sets Industry

• Recovery Scenario of Global Generator Sets Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Trade Analysis

2.2.3. Porter’s Analysis

2.2.4. Recommendations

2.2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Generator Sets Market, By Capacity

5.1.1. Below 75 kVA

5.1.2. 75-350 kVA

5.1.3. Above 350 kVA

5.2. Global Generator Sets Market, By Fuel Type

5.2.1. Gas

5.2.2. Diesel

5.2.3. Others

5.3. Global Generator Sets Market, By Application

5.3.1. Standby Backup Power

5.3.2. Prime/Continuous Power

5.3.3. Peak Shaving Power

5.3.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. Aggreko plc

7.2. AKSA Power Generation

7.3. Atlas Copco AB

7.4. Briggs & Stratton Corp

7.5. Caterpillar Inc.

7.6. Cooper Corp

7.7. Cummins Inc.

7.8. Doosan Corp

7.9. Endress Elektrogerätebau GmbH

7.10. Generac Power Systems Inc

7.11. Greaves Cotton Ltd.

7.12. Himoinsa S.L.

7.13. Honda India Power Products Ltd

7.14. Kirloskar Oil Engines Ltd.

7.15. Kohler Co.

7.16. Mahindra Powerol Ltd.

7.17. Mitsubishi Heavy Industries Ltd

7.18. MTU Onsite Energy

7.19. Multiquip Inc.

7.20. Wartsila Corp

1. GLOBAL GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2028 ($ MILLION)

2. GLOBAL GENERATOR SETS WITH BELOW 75 KVA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

3. GLOBAL GENERATOR SETS WITH 75-350 KVA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

4. GLOBAL GENERATOR SETS WITH ABOVE 350 KVA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

5. GLOBAL GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE , 2022-2028 ($ MILLION)

6. GLOBAL GAS FUEL GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

7. GLOBAL DIESEL FUEL GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

8. GLOBAL OTHERS FUEL TYPES GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

9. GLOBAL GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

10. GLOBAL GENERATOR SETS FOR STANDBY BACKUP POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

11. GLOBAL GENERATOR SETS FOR PRIME/CONTINUOUS POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

12. GLOBAL GENERATOR SETS FOR PEAK SHAVING POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

13. GLOBAL GENERATOR SETS FOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

14. NORTH AMERICAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

15. NORTH AMERICAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2028 ($ MILLION)

16. NORTH AMERICAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2022-2028 ($ MILLION)

17. NORTH AMERICAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

18. EUROPEAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

19. EUROPEAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2028 ($ MILLION)

20. EUROPEAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2022-2028 ($ MILLION)

21. EUROPEAN GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

22. ASIA-PACIFIC GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

23. ASIA-PACIFIC GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2028 ($ MILLION)

24. ASIA-PACIFIC GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2022-2028 ($ MILLION)

25. ASIA-PACIFIC GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

26. REST OF THE WORLD GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

27. REST OF THE WORLD GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2028 ($ MILLION)

28. REST OF THE WORLD GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2022-2028 ($ MILLION)

29. REST OF THE WORLD GENERATOR SETS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL GENERATOR SETS MARKET, 2022-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL GENERATOR SETS MARKET BY SEGMENT, 2022-2028 (% MILLION)

3. RECOVERY OF GLOBAL GENERATOR SETS MARKET, 2022-2028 (%)

4. GLOBAL GENERATOR SETS MARKET SHARE BY CAPACITY, 2021 VS 2028 (%)

5. GLOBAL GENERATOR SETS MARKET SHARE BY FUEL TYPE, 2021 VS 2028 (%)

6. GLOBAL GENERATOR SETS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL GENERATOR SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL GENERATOR SETS WITH BELOW 75 KVA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL GENERATOR SETS WITH 75-350 KVA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL GENERATOR SETS WITH ABOVE 350 KVA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL GAS FUEL GENERATOR SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL DIESEL FUEL GENERATOR SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL OTHERS FUEL TYPES GENERATOR SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL GENERATOR SETS IN STANDBY BACKUP POWER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL GENERATOR SETS IN PRIME/CONTINUOUS POWER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL GENERATOR SETS IN PEAK SHAVING POWER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

18. CANADA GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

19. UK GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

20. FRANCE GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

21. GERMANY GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

22. ITALY GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

23. SPAIN GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

24. REST OF EUROPE GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

25. INDIA GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

26. CHINA GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

27. JAPAN GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

28. SOUTH KOREA GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION)

30. REST OF THE WORLD GENERATOR SETS MARKET SIZE, 2022-2028 ($ MILLION