Generic Drugs Market

Global Generic Drugs Market Size, Share & Trends Analysis Report, By Application (Cancer, CVD, Musculoskeletal Diseases, Infectious Diseases, Neurology, Diabetes, and Others), By Route of Administration (Oral, Topical, Injectable, and Inhaler) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global generic drugs market is estimated to grow at a CAGR of 6.5% during the forecast period. The market was valued at nearly $168 billion in 2019, which is estimated to reach nearly $261 billion in 2026. A generic drug is similar to its branded counterparts in terms of performance, administration, and dosage. Cost is the major benefit associated with the use of generic drugs. The cost of generic drugs can be up to 85% lower compared to the brand-name drug. Generic drug firms do not have to invest in high initial drug development costs which results in the low cost of these drugs compared to branded drugs. The low cost of generics is acting as a major factor accelerating market growth.

Other factors driving the market growth include a significant rise in the prevalence of chronic diseases and increasing launches of new potential generic drugs in the market. As per the estimation by the World Health Organization (WHO), nearly 19.3 million new cancer incidences will be reported globally in 2020. Generic drugs have been playing a vital role in cancer treatment. For instance, in everyday practice, patients with early-stage breast cancer, and children suffering from acute lymphoblastic leukemia are treated and cured with generics. In cancer care, generic drugs are also significantly used in supportive care beyond chemotherapy.

An instance of the generic drug is Carboplatin which is used for the treatment of breast cancer. The brand name for carboplatin is Paraplatin. Additionally, Mitoxantrone is a generic drug that is used for the treatment of Leukaemia. Novantrone is a brand name for Mitoxantrone. Generic drugs are available after the patent expiration on the branded drug name. When the patent expires, several manufacturers can apply to get permission from regulatory authorities to manufacture and sell generic versions of the drug. When several firms commence manufacturing and selling a product, the competition among these firms further brings the price down. Increasing patent expirations are expected to offer an opportunity for market growth.

Market Segmentation

The global generic drugs market is segmented based on application and route of administration. Based on application, the market is classified into cancer, CVD, musculoskeletal diseases, infectious diseases, neurology, diabetes, and others. Based on the route of administration, the market is segmented into oral, topical, injectable, and inhaler.

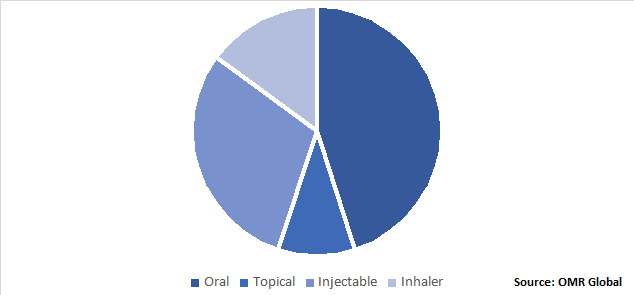

Oral Generic Drugs Held the Largest Share in the Market

In 2019, oral generic drugs held the largest share in the market as it is easy to administer and patient compliance with oral drugs is higher compared to the other routes of administration. Over the decade, the cost of oral generic drugs has reduced more rapidly which is driving its adoption for the treatment of several diseases. Increasing launches of oral generic drugs are also encouraging market growth. For instance, in August 2020, Mylan declared the introduction of the first US FDA approved generic of Biogen's multiple sclerosis therapy Tecfidera (dimethyl fumarate). Mylan’s dimethyl fumarate delayed-release capsules are available in the dosage forms of 120 mg and 240 mg doses and are intended for the treatment of relapsing forms of multiple sclerosis. It is the first generic of any multiple sclerosis therapy available in an oral solid dosage form in the US.

Global Generic Drugs Market Share by Route of Administration, 2019 (%)

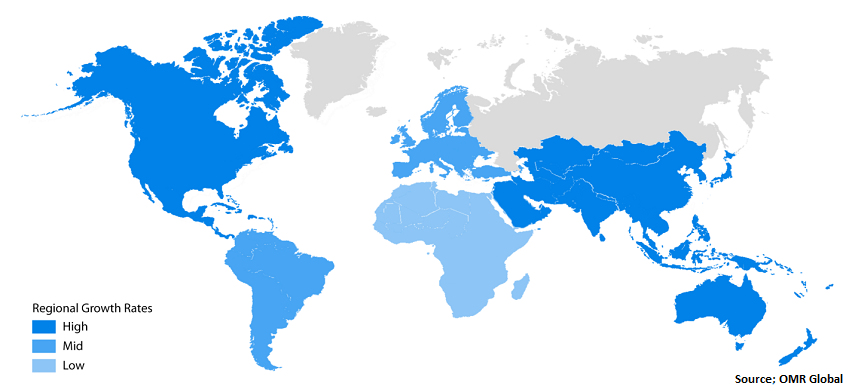

Regional Outlook

In 2019, North America held the largest share in the market, owing to the rising US FDA approvals for generic medicines and increasing prevalence of cancer, CVD, respiratory diseases, and diabetes in the region. In 2019, the generic drug program approved or tentatively approved 1,014 generic drug applications, referred to as Abbreviated New Drug Applications (ANDAs). These include Apixaban tablets, Fingolimod capsules, Fluticasone and Salmeterol inhalation powder, Lurasidone tablets, Mesalamine capsules, Micafungin injection, Pregabalin capsules, and more. Apixaban is intended for the prevention of systemic embolism (SE) and stroke. Pregabalin is intended to treat neuropathic pain, fibromyalgia, postherpetic neuralgia, and seizures.

Global Generic Drugs Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Mylan N.V., Teva Pharmaceutical Industries Ltd., Lupin Ltd., Novartis International AG, and Sun Pharmaceutical Industries Ltd. The market players are using some key strategies to increase their market share. For instance, in October 2020, Teva Pharmaceuticals USA, Inc. declared the availability of the first US FDA-approved generic versions of TRUVADA i and ATRIPLA i tablets. These products, along with over 10 HIV-related drugs are already on the WHO’s Essential Medicines List. By launching these new generic options for HIV treatment, Teva will further increase access to vital therapies and strengthen its position in the generic marketplace.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global generic drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Mylan N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Teva Pharmaceutical Industries Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Lupin Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Novartis International AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Sun Pharmaceutical Industries Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Generic Drugs Market by Application

5.1.1. Cancer

5.1.2. CVD

5.1.3. Musculoskeletal Diseases

5.1.4. Infectious Diseases

5.1.5. Neurology

5.1.6. Diabetes

5.1.7. Others

5.2. Global Generic Drugs Market by Route of Administration

5.2.1. Oral

5.2.2. Topical

5.2.3. Injectable

5.2.4. Inhaler

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Amneal Pharmaceuticals LLC

7.3. Aurobindo Pharma Ltd.

7.4. Baxter International Inc.

7.5. Cipla Ltd.

7.6. Dr. Reddy's Laboratories Ltd.

7.7. Eli Lilly and Co.

7.8. Fresenius SE & Co. KGaA

7.9. GlaxoSmithKline plc

7.10. Glenmark Pharmaceuticals Ltd.

7.11. Hikma Pharmaceuticals PLC

7.12. Lannett Co. Inc.

7.13. Lupin Ltd.

7.14. Merck & Co., Inc.

7.15. Mylan N.V.

7.16. Novartis International AG

7.17. Novo Nordisk A/S

7.18. Stada Arzneimittel AG

7.19. Sun Pharmaceutical Industries Ltd.

7.20. Teva Pharmaceutical Industries Ltd.

1. GLOBAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL GENERIC DRUGS IN CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GENERIC DRUGS IN CVD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GENERIC DRUGS IN MUSCULOSKELETAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL GENERIC DRUGS IN INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL GENERIC DRUGS IN NEUROLOGYMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL GENERIC DRUGS IN DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL GENERIC DRUGS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

10. GLOBAL ORAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL TOPICAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL INJECTABLE GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL INHALABLE GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. NORTH AMERICAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

18. EUROPEAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

1. GLOBAL GENERIC DRUGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL GENERIC DRUGS MARKET SHARE BY ROUTE OF ADMINISTRATION, 2019 VS 2026 (%)

3. GLOBAL GENERIC DRUGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD GENERIC DRUGS MARKET SIZE, 2019-2026 ($ MILLION)